Gold Buying Terms For Beginners | Understand The Terminology Today

20/11/2023Daniel Fisher

Free & fully insured UK Delivery. Learn more

Secure & flexible payments. Learn more

Buyback Guarantee Learn more

Physical gold is a much sought-after asset class that is coveted by investors all over the world.

But how do you buy and sell gold if you’re a complete newbie to the gold business? If you’re going to build a gold portfolio, you’re going to need a substantial sum of money to make it happen. So, how do you avoid the common pitfalls that scores of investors fall for?

Well, a great start is to discover all the gold trade terminology that is in vogue, so you don’t get caught on the wrong foot.

Allocated gold refers to specific gold bars or coins that are assigned and stored uniquely for the account holder. When you own allocated gold, your name is directly connected to verifiable gold bars with a purity, weight, and serial number. These are held in a secure vault and ensure you maintain outright ownership of the physical metal. Allocated gold is the most direct way to own gold bars and provides full transparency and control.

A gold alloy is a mixture of gold and other metals, most commonly silver, copper, and zinc. Alloys are used to make gold coins and jewellery harder and more durable for everyday use. A 22 karat gold alloy contains 22 parts gold and 2 parts alloy metal(s). Harder alloys with less pure gold content can help jewellery hold up over time but come with a lower value.

Arbitrage refers to simultaneously buying and selling gold in different markets or forms to profit from price differences. For example, an arbitrage opportunity exists if gold coins sell for a lower premium than gold bars, after accounting for relative fabrication costs. Arbitrage enables investors to capitalise on gold price discrepancies.

Assaying involves analysing the chemical composition of gold products to verify their purity level and metal content. Reputable mints and dealers assay gold coins and bars through advanced testing processes. Assay reports provide detailed information on gold weight, purity percentage, and authenticity. Investors can request to view these reports for

A bull market is characterised by a sustained rise in gold prices, reflecting positive investor sentiment and demand.

Bull markets see gold values increase substantially, such as by 20% or greater from low points. Bull markets can last many years and are the optimal times for gold investors to maximise returns.

Gold bullion refers to refined gold formed into bars, rounds, or ingots. It is produced by mints and refineries to meet a minimum purity standard, most often .999 fine or 24 karat. Gold bullion provides a convenient way for investors to purchase large quantities of gold at lower premiums. Popular bullion sizes are 1 ounce, 100 grams, and 1 kilogram (32 ounces).

Bullion coins are coins made predominantly from gold or other precious metals, manufactured specifically for investment purposes. While bullion coins have legal tender face values, their intrinsic gold value is much higher. Leading examples include the Gold Eagle, Gold Maple Leaf, Gold Krugerrand, and Gold Britannia.

The purity of gold is measured in karats.

It is a measure of the fineness or purity of gold for 24 parts, which is considered to be 100%. The standard has been long adopted by the US federal law. 24 karat gold is very difficult to obtain and the label is allowed only for 99.95% purity of gold.

Normally 22 karat signifies a purity of 91.66% – 95.83%. Gold jewellery is normally made out of 14k gold which indicates a purity of 58.33%, or 18k (75%).

A central bank is a national financial institution that provides banking services and oversees monetary policy for its jurisdiction. Many central banks hold substantial gold reserves to support their currencies, provide assets, and signal economic strength. The European Central Bank, U.S. Federal Reserve, and Bank of England are leading examples.

Commemorative coins celebrate special events, anniversaries, or accomplishments. While made of gold, they are produced for collectibility rather than bullion investment purposes. Commemoratives have unique designs and generally have much higher premiums over the value of their gold content.

Deflation is the opposite of inflation and happens when prices fall. In deflationary periods,cash increases in purchasing power over time. Gold can still thrive in deflation by providing an asset that holds value.

A gold ETF (exchange-traded fund) is an investment vehicle that offers direct exposure to physical gold. Gold ETF shares can be easily bought and sold like stocks on exchanges. Each share represents fractional ownership in the underlying physical gold held by the ETF.

The face value, or legal tender value, is the monetary value assigned to a gold coin by its issuing nation. For example, a Gold Eagle has a face value of $50, and a Gold Maple Leaf $50 CAD. However, their intrinsic gold value is much higher and drives their market pricing. The face value allows legal tender status.

Fiat money refers to a government-issued currency that is not backed by a physical commodity like gold. Since abandoning the gold standard, most world currencies, including the British Pound, are considered fiat money. Fiat money derives its value from government regulation and public faith rather than tangible assets.

Fiscal policy refers to government spending and taxation decisions that affect the economy. For example, higher taxes or increased spending are contractionary fiscal policies, while tax cuts or spending cuts are expansionary. Fiscal policies can impact inflation and currency values, both key drivers of gold prices.

Free ultimate guide for keen gold investors

Gold futures contracts allow investors to buy or sell gold at a predetermined price for future delivery. Futures trade on exchanges and represent a contractual obligation for fulfilment. Futures help gold producers and consumers hedge against price movements but also allow for speculation.

Gold nuggets are naturally occurring pieces of native gold found in alluvial deposits. While valued by collectors, nuggets are less pure than refined gold. Large nuggets are exceptionally rare, most ranging from a few millimetres to a few ounces in size. Nuggets are assessed by size, shape, and purity.

The premium is the markup paid when buying gold over the prevailing spot price. Premiums compensate dealers for manufacturing, certification, storage, shipping, and processing costs plus profits. Coin premiums range 2-15%, bars 5-20%. Higher demand, smaller sizes, and collectibility raise premiums.

Under the gold standard, paper currency is directly convertible into physical gold, linking a nation’s money supply to its gold reserves. The United States was on a gold standard from 1879 until 1933, when it was abandoned. No country operates on a full gold standard today, but some tie their currencies to gold.

The weight of gold is not measured in troy ounces across the world. Different geographical regions have different ways of measuring gold. While the troy ounce is the accepted unit of measure for gold in the West, parts of South East Asia, including India – the second largest consumer of gold in the world, measure gold differently. Grams or Tolas are the preferred unit of measure in South East Asia. When compared, 1 Tola equals 11.33 grams, while 1 troy ounce = 31.1 grams.

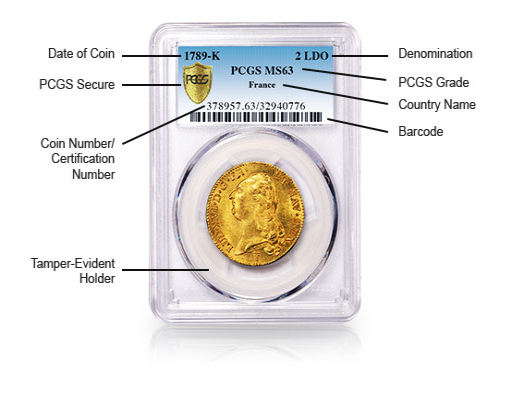

Graded coins are assigned a numeric score by an independent grading service like NGC or PCGS, certifying the coin’s condition.

They are then sealed in protective cases. Higher grades indicate better condition and can dramatically raise collectable coin values. Proof and uncirculated coins also receive grades.

A hedge is an investment made specifically to offset potential losses in another investment. Gold often acts as a hedge against stocks, inflation, currency devaluation, and systemic risks. Investors may buy gold or gold derivatives to hedge portions of their portfolio against various macroeconomic outcomes.

Inflation refers to the sustained rising cost of living represented by the prices of goods and services. It is measured by the Consumer Price Index. Gold can act as an inflation hedge because its supply cannot expand rapidly. During high inflation, the relative value and purchasing power of gold tend to rise.

The intrinsic value of a gold coin or bar is determined by its gold content and purity level. This represents the baseline minimum value of precious metals. Additional value can come from collectibility, scarcity, or historical significance, which contributes to higher market prices.

The London Bullion Market Association (LBMA) oversees the world’s largest over-the-counter bullion market, setting quality standards and facilitating trading. The globally trusted LBMA Good Delivery List contains approved refiners of gold and silver bars along with specifications for weight and purity.

Legal tender is any official medium of payment recognised by law. Many modern gold coins have legal tender status, meaning they can be used for business transactions and financial obligations. However, the face value is typically symbolic compared to their intrinsic gold value.

Liquidity refers to the ease with which an asset, like gold, can be quickly bought or sold without meaningfully impacting its market price. Physical gold is highly liquid worldwide, especially in larger bars and well-known coins. High liquidity helps gold investors execute transactions and rebalance portfolios.

Some dealers allow locking in the price of gold and securing a purchase in advance. This hedges against future price movements. Locking in a price provides certainty and can be smart when prices look favourable.

The lustre describes how light reflects and interacts with the surface of a gold coin or bar. Gold has a distinctive bright yellow glow and metallic shine. Ample lustre is an indicator of quality and appeals to collectors. Luster can diminish from abrasions or environmental damage.

Melt value is the total worth of the raw gold content at current spot prices, disregarding numismatic or collectable value.

The melt value, also called scrap or bullion value, sets a baseline for the metal value in a particular coin, bar, or jewellery item.

A mint is an official manufacturing facility that produces gold bullion coins, bars, and other precious metal products. Government mints and private mints must meet stringent quality standards for their gold products. Leading global mints include the Royal Mint, the United States Mint, Royal Canadian Mint, and PAMP Suisse.

Monetary policy refers to central bank actions aimed at controlling money supply, interest rates, and credit conditions. Expansionary monetary policies like quantitative easing tend to benefit gold prices by devaluing currencies. Tighter policies raising rates can hamper gold in the short term but restore confidence.

Numismatics is the study and collection of coins, paper currency, and metals. A coin’s age, rarity, condition, mintage, historical significance, and design contribute to its collectable numismatic value, which can greatly exceed its gold content. Numismatic coins appeal to collectors more than bullion investors.

The spot price is the current real-time market trading price of one troy ounce of gold. Continuously updated based on trading activity, the spot price serves as a benchmark for the purchase and sale of physical gold worldwide. Changes reflect immediate supply, demand, and sentiment.

The spot prices of gold, as determined by the New York based COMEX exchange, sets the price of gold in USD per troy ounce. This simple measure indicates the weight of gold and has nothing to do with the purity. The price of gold is quoted in U.S. dollars per troy ounce, which equals 31.1 grams. This measure of weight is used worldwide for precious metals trading.

With unallocated gold, you own a general pool of gold. You don’t own specific coins or bars, just the quantity of gold specified in your account. Unallocated gold typically comes with lower storage fees but less direct ownership.

Investing in gold can be a daunting experience if you’re just starting out. However, you can benefit from speaking to our team of experts who can guide you on the best way to invest in gold bulk purchases. Please call us on 020 7060 9992 or get in touch with us online. We are always willing to help.

Images: Wikimedia and Michael Steinberg

Live Gold Spot Price in Sterling. Gold is one of the densest of all metals. It is a good conductor of heat and electricity. It is also soft and the most malleable and ductile of the elements; an ounce (31.1 grams; gold is weighed in troy ounces) can be beaten out to 187 square feet (about 17 square metres) in extremely thin sheets called gold leaf.

Live Silver Spot Price in Sterling. Silver (Ag), chemical element, a white lustrous metal valued for its decorative beauty and electrical conductivity. Silver is located in Group 11 (Ib) and Period 5 of the periodic table, between copper (Period 4) and gold (Period 6), and its physical and chemical properties are intermediate between those two metals.