Buying Gold in Bulk

17/11/2023Daniel Fisher

Free & fully insured UK Delivery. Learn more

Secure & flexible payments. Learn more

Buyback Guarantee Learn more

Investing in gold provides stability and growth potential during economic uncertainty. Purchasing large quantities of gold can maximise these benefits through substantial cost savings and greater investment value.

But how does bulk buying relate to the global spot prices set by the illustrious COMEX exchange in New York or, for the UK investors, the London Bullion Market, and why is it a good option for both individual investors and institutional giants?

Whether you’re a seasoned investor or a newcomer to the gold market, understanding the mechanics and benefits of bulk buying could be your stepping stone to building a stronger investment portfolio and making more economical and impactful investments.

It’s true that whether you buy large or small quantities of gold, you still need to buy it at a premium to the current spot price. However, there are significant advantages to buying anything in bulk.

The main incentive for buying gold in bulk is lower costs per ounce. This advantage comes from:

In addition to cost savings, purchasing gold in bulk maximises the investment growth potential.

Preservation of Wealth: Holding substantial amounts of gold provides stability against inflation, currency devaluation, and economic crises that can erode the value of paper assets.

Free ultimate guide for keen gold investors

In the same way, buying coins and bars in bulk allows the buyer to benefit from significant savings on factors such as admin fees, shipping costs, insurance costs, or packaging. These are costs that any buyer faces, even if they are buying smaller quantities.

However, when these costs are spread over larger volumes, they are much lower per ounce of gold. Insurance costs greatly reduce per ounce, while a bulk purchase may attract free shipping. This creates price advantages, and the buyer can enjoy greater savings on every shipment.

Bulk buying of gold can create advantages in pricing due to economies of scale

It’s important to go through the purchase process carefully to get the best prices and services when buying large amounts of gold.

Gold prices change all the time, and as a serious buyer of gold, especially if you are interested in buying in bulk, it’s important to be aware of the current metal prices. Once you have done your homework and identified the right wholesale bullion dealers you want to trade with, you should call them and discuss the spot price and talk about the best deal they can give you on different volumes.

All retailers and wholesalers worth their salt will always have a bullion expert you can speak with. If the company doesn’t have a number you can call and only wants you to get in touch online, there’s something fishy, and you should steer clear of such dealers. It’s equally important to research the subject of buying gold at your own end and find out the dos and don’ts.

Do not be tempted to buy unrefined gold from Africa or other ‘straight from mine’ solutions. Prices may be at a discount but it represents far greater risks in authenticity, valuation and liquidity. Buying gold less than 22 carats in purity can attract VAT and gold bars of less than 24 carats can be difficult to sell on.

Another great way to check if your dealer is legit is to look up their reviews and ratings online. If customers have been scammed earlier, they’re sure to report it on review sites and social media. If the dealer’s online reputation is mud, steer clear.

Choose secure payment methods like bank wire transfers to protect large transactions. Review all documentation, like invoices showing product details, serial numbers, weight, and fineness. Then, cross-check delivery receipts and chain of custody paperwork and obtain certificates of authenticity from mints and assayer’s reports from refiners.

To make sure that all your investments are in order, you should work closely with your dealer through each step:

Streamlining purchase and delivery while maximising oversight and price negotiation ensures your bulk gold acquisition is seamless and cost-effective.

For UK investors seeking large gold purchases, careful precious metal dealer selection and market timing are key to maximise value.

Acquiring high-qualityphysical gold bullion bars and coins in bulk locally requires finding reputable sellers that meet your pricing and service needs. Work only with established dealers with competitive bulk rates and discounts.

Compare commission structures across sellers and look for those sourcing inventory directly from major mints to avoid high importer margins.

Buy gold when prices are low or expected to rise, usually during times of inflation or economic uncertainty, to get the best value. Schedule large buys around events impacting currency and debt levels, which can spur investor demand.

Our automated portfolio builder will provide suggestions based on various investment objectives.

For suitable local sellers, consider reputable UK-based precious metals dealers or global suppliers that service the region. Evaluate import costs, delivery times, and convenience of buyback programs. Take advantage of bulk discounts from distributors shipping gold worldwide.

Take us for example, for bulk buyers we offer:

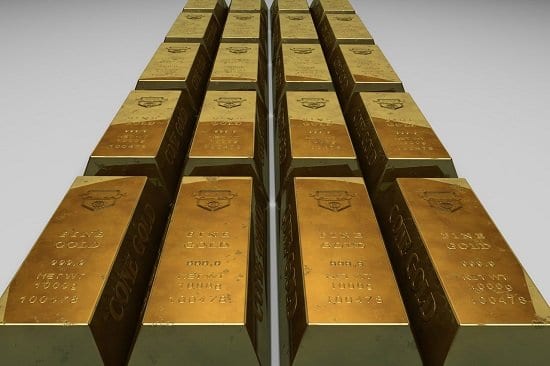

Physical Gold, our online store, offers certain products in bulk and even offers bulk discounts on them. For example, our Metalor 100g VAT-free gold bars with a fineness of 999.9 is available for bulk purchases. At the current gold prices, one bar would cost you £5,180, but if you buy in excess of a hundred, the price drops to £5,154. That’s a saving of £26 per bar. So if you were to buy, let’s say, 150 bars, you would save £4,200. You may also like to view our 1 oz gold bars and 1 kg gold bar. Similarly, you can order physical bullion gold coins like Sovereigns, Britannias, Gold American Eagle coin, or Canadian Maple Leafs in quantities of above 500 and avail of discounts.

On our website, you can even set an alert to buy at a certain price. All you need to do is to head over to our gold price chart and fill in the information you’d like to track. Once the price of gold falls to that level, an automatic notification will be generated, and you can complete your purchase.

When buying physical gold in bulk in the UK, investors must navigate legal reporting rules and tax implications. To make sure that your investments are safe and legal:

For private investors, gold bullion bars are liable for UK Capital Gains Tax if you profit more than the annual allowance of £6,000 when you sell. To remain tax-free on large profits, stick to UK legal tender coins such as Gold Britannias and Sovereigns. They are exempt from Capital Gains Tax without any upper limit at all.

If you still want to focus on buying gold bars in bulk, then buying them through a Self Invested Pension Plan can grow your holdings tax-free until retirement. Consider using an ISA wrapper account to shield gains from tax during accumulation.

Stay up-to-date on reporting rules, transport laws, and tax codes for bulk gold transactions. Thorough record-keeping and compliance help avoid penalties and liquidity issues when mobilising large holdings.

Buying gold in bulk offers a range of benefits, from substantial cost savings to inflation-hedging qualities that stabilise portfolios during economic turbulence. While the advantages are clear, seizing this opportunity requires focus and discipline.

Carefully hand-selecting dealers, scrutinising pricing models, and negotiating terms takes time. Monitoring market conditions to time purchases demands research and active engagement. Once purchased, ongoing storage, security, and liquidity planning is essential.

Yet, for investors willing to take a strategic approach, allocating to bulk physical gold can provide an anchor of value and enduring protection, unlike any other asset. It is a legacy for the future borne out of prudence in the present.

As economic uncertainties persist, it pays to be proactive. By taking the right precautions and partnerships today, your bulk gold investment can deliver lasting returns and peace of mind for years to come.

Our team of reputable online gold dealers and bullion experts are always happy to help, and we’re just a phone call away. Call us on 020 7060 9992 and speak with our experts. You can also drop us an email, and we’ll call you right back.

With the right advice, you can make an informed decision about buying gold or buying silver in bulk or via an ETF would be more suitable and hopefully, your investments will bear fruit in the years to come.

Yes, buying gold in large quantities can maximise cost savings and investment growth potential through lower premiums, bulk pricing discounts, and economies of scale. Purchasing all at once reduces fees.

There are no set limits. Purchase amounts depend on your budget and the dealer’s capacity. Many allow bulk orders up to hundreds of ounces in bars/coins for individuals or even thousands of ounces for institutions.

Buying gold bars in large bulk orders is generally the most cost-effective approach. Bars have lower fabrication costs than coins, and bulk purchases minimise premiums and unlock discount pricing from dealers.

In the UK, gold purchases do not need to be reported. However, purchases over £10,000 will require ID checks to meet anti-money laundering requirements. The transaction still remains private and unreported.

Live Gold Spot Price in Sterling. Gold is one of the densest of all metals. It is a good conductor of heat and electricity. It is also soft and the most malleable and ductile of the elements; an ounce (31.1 grams; gold is weighed in troy ounces) can be beaten out to 187 square feet (about 17 square metres) in extremely thin sheets called gold leaf.

Live Silver Spot Price in Sterling. Silver (Ag), chemical element, a white lustrous metal valued for its decorative beauty and electrical conductivity. Silver is located in Group 11 (Ib) and Period 5 of the periodic table, between copper (Period 4) and gold (Period 6), and its physical and chemical properties are intermediate between those two metals.