Where to Buy Silver in the UK

30/11/2023Daniel Fisher

Free & fully insured UK Delivery. Learn more

Secure & flexible payments. Learn more

Buyback Guarantee Learn more

With the economy looking shaky these days, many people are turning to silver as a safe haven for their money. But where to buy silver coins and bars? In our experience, your best bets are sticking with well-known online dealers like Physical Gold or turning to established sources like the Royal Mint.

We’ve been in the precious metals game for some time now, so we’ve gotten a feel for what separates the prime places to procure silver from the shady operators out there. Let us share some hard-won wisdom to help you avoid mistakes and find a trustworthy seller to ensure you buy the best silver at the best prices.

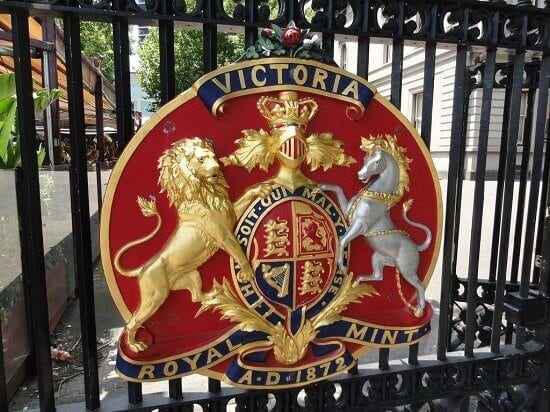

With over 1,000 years under its belt, the Royal Mint is a true veteran when it comes to churning out coins and precious metals. For silver seekers, this British institution is probably best known for minting the iconic Silver Britannia bullion coin. Each contains a full troy ounce of .999 pure silver, making the Britannia a darling for anyone looking to diversify their portfolio with a liquid investment exempt from Capital Gains Tax.

On top of their flagship silver coin, the Royal Mint also produces a limited variety of silver bars ranging from modest 1oz wafers, the most popular to 1-kilogram variety, right up to the huge 100oz size. You can bet their exacting standards ensure top-notch quality and security. Those rippled surfaces on their bars make counterfeits a no-go.

Online shoppers can score Royal Mint silver directly from the source, with free insured shipping on purchases that hit the minimum. Now, their products do come with higher premiums compared to some dealers. But for many investors, that extra cost buys peace of mind, knowing you’re getting the real McCoy, crafted to last.

The Royal Mint is a trusted and premier dealer of silver in the UK

For ages, the go-to places to score precious metals, rare coins, and other glittery collectables have been the high street dealers clustered in loci like London’s Hatton Garden. But today, many of those once physical-only coin shops now also sell their wares online.

This hybrid model gives you the best of both worlds – browse online, then visit the store to clinch the deal and eyeball your silver in person before forking over your hard-earned cash. With pre-purchase peeks at the merchandise, you can rest assured your silver is legit. Brick-and-mortar stores may even buy back what they sold you, a service you won’t get from web-only retailers.

Online bazaars like eBay and Gumtree connect buyers and sellers peddling physical silver – bars, rounds, you name it. The selection runs wide, and you can often score pieces with lower premiums than speciality dealers charge. But we’ve got to warn you, these digital marketplaces come with risks that leave rookie investors vulnerable.

Shady sellers may hawk silver-plated fakes or drive up your final price with hidden fees for shipping and insurance. Do your homework thoroughly vetting seller ratings and reviews before ponying up funds. Unexpected costs like eBay listing charges and PayPal transaction fees can also gnaw away at any potential savings.

If you’re a grizzled silver fox, online auctions may be worth the risks. But for newbies, we’d steer clear – there are safer places to purchase silver. Find a reputable dealer you can trust, and you’ll sleep easier knowing your hard-earned money bought the real deal.

As an official partner of the Royal Mint, some Post Office branches let you buy Royal Mint silver coins and bars right at the counter. For investors who value grabbing their silver easily without leaving town, the Post Office isn’t a bad choice.

But we have to give you a heads up – their Royal Mint selection usually comes with higher premiums than buying directly from the source. The Post Office tends to stock collectable commemorative issues rather than generic silver rounds and bars with lower premiums.

So, if you’re looking to make a bulk investment in silver with maximum savings, you may want to shop elsewhere. But if you appreciate the convenience of buying reputable Royal Mint silver at your neighbourhood post, a slightly higher premium could be worth it.

The Post Office won’t give you the cheapest silver around, but they do offer respectable options with the assurances of an iconic British institution. For some folks, that peace of mind balances out the additional cost.

Physical Gold has always been a reliable and trusted dealer of precious metals in the UK.

Buying your silver online from us is very simple, with discounts applied for bulk purchases. All you need to do is create an online account and select the silver you wish to buy. We offer a wide range of both silver coins and bars. Primarily we focus on obtaining silver coins for our customers at the lowest prices which are ideal for investment. Many of these are Royal Mint silver coins but at discounts to the prices if you bought directly from them. Likewise we only sell silver bars which offer the very best investment potential, rather than a collectible premium.

Buy silver from the site, and every product is guaranteed to be 100% genuine. There is a 3D authentication system in place to ensure that your financial information is not at risk when you complete your transaction. We always provide certification for bars and relevant papers to each and every customer. Moreover, we ensure that orders are sent to your registered address by an insured courier, or sent to our secure storage facility if you’d prefer us to safeguard your silver.

A quick check on the company’s reputation online would surely assure you that we are a highly reputed and reliable dealer of silver and other precious metals. So, instead of taking a chance with high street retailers, you are advised to consider buying your silver from Physical Gold for a hassle-free, smooth transaction.

If you are a regular investor, we also have structured monthly plans that help you invest regularly in silver and build up a robust portfolio that will stand the test of time and deliver great returns on your investment in the years to come.

Free ultimate guide for keen silver investors

When it comes to acquiring silver bullion, investors have to pick a side – online or offline dealers. Each route has its own pros and cons.

Going through online sellers like Physical Gold gives you 24/7 access to browse and buy coins, bars, rounds and more. Top sites provide ace pricing, detailed product photos and descriptions, tax-efficient deals, insured shipping, and advice from market vets. The only downside – not inspecting goods before you click buy. Many dealers like Physical Gold will allow you to purchase the silver anytime online and then collect from their dispatch centre if preferred.

Offline dealers like brick-and-mortar shops allow you to verify your silver is legit face-to-face before parting with your cash. But that in-person experience means potential travel time and limited hours.

The bottom line? Online buys offer convenience and potential savings, while offline lets you physically vet products. You’ve got to weigh what matters most – snagging the best price or the peace of mind of seeing silver before you seal the deal.

For many investors, the ease and cost benefits of top-rated online sellers like Physical Gold outweigh the inability to fondle coins in person. But if seeing is believing for you, old-school offline dealers may be worth the trip.

Most major banks do not offer physical silver bullion, such as bars and coins, directly to retail investors and account holders. While some banks may provide certificates or accounts that track the price of silver, these do not represent ownership of the physical metal itself.

For investors seeking actual silver in hand, banks are generally not the best source. The limited silver products they do offer, such as commemorative coins, come with high premiums and substantial delivery delays compared to reputable bullion dealers.

Additionally, banks charge higher overhead costs that are passed onto the customer in their silver pricing. Without dedicated precious metals experts on staff, banks also cannot provide the same level of market guidance and education as specialised silver bullion dealers.

For the widest selection of physical silver bullion at the most competitive prices, investors are better served shopping with leading online dealers like Physical Gold. Their silver bar and coin products come with lower premiums, quicker fulfilment, and support from knowledgeable precious metals specialists.

Reliability and safety are key factors to consider when buying silver from a UK trader. Obviously, you don’t want to be scammed or compromise the security of your bank details when conducting a transaction. There are other important factors to consider, like ascertaining the authenticity of your purchase and, of course, transportation, delivery and storage.

Stay away from online marketplaces like eBay, when buying precious metals like silver or gold. Checking the purity and quality of your silver could be a huge problem, and you could easily become a victim of fraud. Another issue to consider is that the price you pay for your silver is likely to be a lot more, thanks to hidden costs like PayPal fees, delivery and insurance charges.

A reliable and trusted source of buying silver in the UK is, of course, the Royal Mint. The Royal Mint is a reputed producer of silver coins historically, for coins such as the Britannia, and you can rest assured about the quality and purity. The mint provides free delivery of your coins and silver bars on purchases above £45. An important point to note, however, is that the mint does not buy back your silver, so if you plan to resell, you’ll need to go to a reputed 3rd party dealer.

In order to identify reliable silver dealers in the UK, you can always use the BNTA register. The British Numismatic Trade Association (BNTA) ensures that all dealers registered with them adhere to a code of ethics and abide by certain industry rules and regulations set by the association. Remember, all good dealers will provide you with transparent pricing & paperwork and will always be willing to speak to you over the phone to answer all your queries and provide guidance on your purchase.

Finding a trusted dealer is the key first step to making a smart silver investment.

For an exceptional buying experience, reputable online dealers like Physical Gold stand above the competition. Our team of experts inspect all products while providing market guidance and secure storage solutions tailored to your needs.

Visit the Physical Gold website today to browse our selection of silver bars, coins, and rounds. Investing in silver has never been easier when you have a knowledgeable partner like Physical Gold to offer advice and service every step of the way.

Reach out now to get started building your precious metals portfolio in a financially savvy yet secure manner. With Physical Gold, experience the difference that expert support and guidance can provide when buying silver bullion online.

The most common risks are volatility in silver spot prices, security issues with storage, and challenges selling large-sized bars. Market fluctuations mean silver may lose value after purchase.

Silver is currently far cheaper versus gold than it has been historically, suggesting significant room to appreciate. Overall investment demand, industrial use, and supply factors all influence silver’s future outlook. Speaking with financial and silver experts is advised before buying.

Investors should consider their budget, goals, and personal preferences. Coins have higher premiums but are easier to liquidate. Large bars have lower per-ounce costs but are harder to sell. A reputable dealer can provide guidance.

Purchases of silver coins and bars are subject to 20% VAT in the UK, regardless of price. Silver bullion is not VAT-exempt like gold bullion currently is. Capital Gains Tax may apply if sale profits exceed the annual exemption threshold of £6,000. Checking current tax laws is recommended.

Live Gold Spot Price in Sterling. Gold is one of the densest of all metals. It is a good conductor of heat and electricity. It is also soft and the most malleable and ductile of the elements; an ounce (31.1 grams; gold is weighed in troy ounces) can be beaten out to 187 square feet (about 17 square metres) in extremely thin sheets called gold leaf.

Live Silver Spot Price in Sterling. Silver (Ag), chemical element, a white lustrous metal valued for its decorative beauty and electrical conductivity. Silver is located in Group 11 (Ib) and Period 5 of the periodic table, between copper (Period 4) and gold (Period 6), and its physical and chemical properties are intermediate between those two metals.