What are the Benefits of Buying Silver Bars?

12/12/2023Daniel Fisher

Free & fully insured UK Delivery. Learn more

Secure & flexible payments. Learn more

Buyback Guarantee Learn more

Investors often turn to silver when making an entry into the precious metals market. Silver trades around 85 times cheaper than gold, so the price point for a silver bar or some coins is far lower than that for gold. On a historical basis, this gold to silver price ratio is wider now by almost double when compared to the relationship over the past century. That suggests that silver is currently a bargain.

The tempting value of silver is further enhanced by its broad utility across electronics, medical applications and photovoltaics. Silver’s unique conductive and antibacterial properties continue driving industrial demand even as films fade from cameras.

Blending the appeal of owning a tangible asset as a safe-haven with its growing hi-tech efficacy, silver remains an alluring investment for both long-term, buy-and-hold savers and active traders seizing windows of speculative opportunity according to preference. This versatility helps ensure silver stays in vogue across financial eras.

A growing number of investors are choosing to buy silver bullion as an affordable portfolio diversification and inflation hedge with the lack of correlation to the volatile stock market. Silver coins and bars can be purchased from reputable dealers online at reasonable premium markups.

In the realm of silver investments, the choice between various forms of silver can be as crucial as the decision to invest itself. Each form of silver comes with its unique characteristics and appeals, catering to a spectrum of investor preferences. It’s very possible that a blend of the different silver investment options may be the best approach to create a balanced approach. But for others, the simplicity and raft of advantages of buying silver bullion bars may satisfy investment objectives.

Our exploration will unravel the unique benefits that silver bars bring to the table, from cost-effectiveness to ease of storage, liquidity, and beyond. By understanding why silver bars stand out in comparison to their counterparts, investors can make informed decisions that resonate with both financial prudence and the enduring appeal of precious metal investments.

Large silver bars provide better value for money

Here’s a quick look at the different forms of silver investments that we’ll evaluate. For the sake of this investigation, we’re only comparing forms of silver buying that gain direct exposure to the silver price. This omits the more complex nature of investing in silver mining shares, futures and options, which represent a different risk profile.:

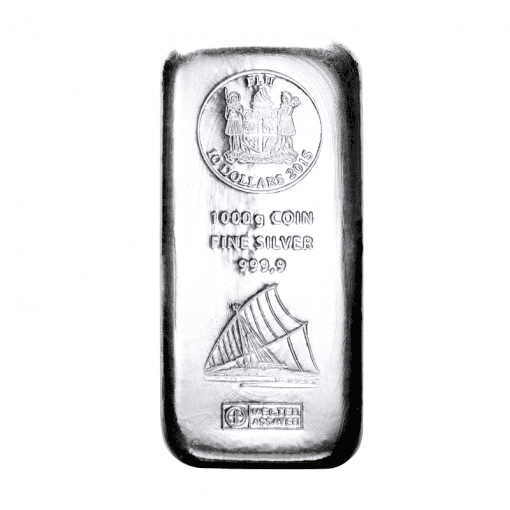

Silver Bars: Coveted for their tangible nature, silver bars offer cost-effective investment options with varying sizes and weights, providing flexibility for both seasoned and novice investors.

Silver Coins: Possessing historical charm, silver coins are not only an investment but also popular among collectors. They come in different designs and sizes, offering a fusion of aesthetic appeal and investment value.

Silver Rounds: These coin-like silver discs are known for their affordability and ease of acquisition. While they lack legal tender status, they are valued for their silver content and can be an accessible entry point for investors.

Silver ETFs (Exchange-Traded Funds): For those seeking a more indirect investment approach, silver ETFs offer exposure to silver prices without the physical possession. It’s a convenient option for investors who prefer a hands-off strategy.

As we navigate through the intricacies of silver investments, understanding these diverse forms empowers investors to tailor their portfolios according to individual preferences and financial goals.

The primary benefit of buying silver bars is the lower cost per gram when compared to smaller silver coins. Investors therefore take on less implicit costs relative to the raw market value of metal obtained. Silver bars can be bought in large sizes such as 5kg and 100oz, and yet still be affordable due to silver’s low price. When buying a bar, therefore, you can acquire a larger volume of silver for the money you invest, suiting the practical buyer on a budget.

The cost saving on silver’s premium is achieved in a few ways.

Fabrication costs are comparatively modest since bars involve basic minting rather than elaborate coin pressing with intricate designs demanding artistic skill. Specialised processes are required to create the high-tech anti-counterfeiting features becoming increasing popular and demanded on silver coins. In contrast, silver bullion simply needs to feature basic weight, purity, mint, and serial number details.

While silver bullion is widely available in small sizes like 1oz, it’s far more common for shrewd buyers to focus their investment on larger denominated bars. With around 32 ounces in a kilo, it makes sense than the cost of minting 32 x 1oz silver coins is higher than producing 1 x single 1 kilo silver bar. While they would both contain the same amount of silver, the overall time, manpower, and energy costs needed to manufacture many individual pieces of silver is greater.

Silver bars are mass-produced and abundantly available in the market, with common denominations being 1 kg and 5 kg. While their price fluctuates with the underlying silver spot price, premiums are generally consistent and predictable with supply steady.

Premiums on coins are already higher due to inflated production costs but can also vary considerably with demand. Limited issue silver coins or those minted to commemorate events command even higher premiums due to their appeal to the collector’s market.

While a cost saving is inevitable when buying silver bars, not all bars are equal when it comes to value. A huge number of different silver bar brands, types and sizes are available. The general rules of thumb on price when buying silver bars are;

Free ultimate guide for keen precious metals investors

Being able to sell your silver exactly when you want and at an optimum price, is just as impactful on your investment as paying low prices when choosing which form of silver to buy. Gains are only ever realised when your silver is sold at a profit as owning silver doesn’t pay any interest. If difficulty in selling is experienced for one reason or another, market opportunities to maximise returns can be missed.

Silver bars check the boxes investors and bullion dealers seek in easily verifiable precious metals ideally suited to appeal to the widest possible buyer pool. These attributes combine to enhance market depth when aiming to liquidate metal holdings.

Here are the main reasons why silver bars offer strong liquidity when selling:

Silver bars stand out for their undeniable appeal and the satisfaction of owning a large slab of silver. Their tangible nature allows investors to physically hold and possess their wealth as opposed to the digital ownership of a silver ETF or mining share.

While buying silver coins or rounds also ticks the box for investors desiring a tangible connection to their investment, their diminutive size is less satisfying. While the design and detail of silver coins holds its own appeal, the familiarity of holding coins as part of everyday currency means they feel less special.

Silver bars come in various sizes and weights, enabling buyers to own substantial denominations of silver bullion. The unique reassurance and gratification of their weight separates the tangible appeal of silver bars from other forms of silver.

One of the biggest risks when buying precious metals in their physical form is ensuring you’re purchasing authentic products which meet the stated purity and weight. Anything less will not only impact the asset’s value but also the ability to resell the silver. In this respect, buying silver bars, especially from a reputable dealer, provides peace of mind when compared to sourcing silver coins or rounds.

Reputable mints and dealers often imprint hallmarks on silver bars, serving as a quality assurance stamp. These hallmarks not only validate the authenticity of the silver but also provide essential information about its purity and origin. By choosing silver bars from established sources, investors significantly mitigate the risk of falling prey to counterfeit schemes, ensuring the integrity of their precious metal holdings.

Undoubtedly, the ease and convenience of buying silver through digital means presents its own appeal. There’s no cost or need to arrange storage of your electronic silver ETF! However, when comparing ease and flexibility of storage between the various physical silver forms, silver bars hold a distinct advantage.

One of the significant advantages of choosing silver bars as an investment is the simplicity of storage, especially in a home setting. Silver bars, with their compact and stackable nature, allow investors to store substantial value in a relatively small space. This convenience is particularly appealing for those who prefer having direct access to their physical assets. Whether kept in a secure home safe or a designated storage area, the manageable size and weight of silver bars make them an excellent option for those prioritizing accessibility.

For investors seeking an extra layer of security or dealing with larger quantities of silver bars, professional vault storage is a viable solution. Many reputable vault services offer secure and insured storage options, providing peace of mind to investors concerned about the safety of their precious metal holdings. This alternative not only ensures the physical well-being of the silver bars but also addresses concerns related to theft or damage, making it a practical choice for those who prioritize the highest level of security for their investments.

Whether at home or in a professional vault, the easy storage and portability of silver bars cater to the diverse preferences of investors, offering flexibility and convenience in managing their tangible assets.

If you’ve enjoyed the simplicity and cost-effectiveness of silver bars, then why not share your experiences in the comments.

Physical Gold is a highly reputed precious metals broker with a team of silver experts. You can call physical gold on (020) 7060 9992 to discuss the most appropriate buying opportunities in silver bars. Likewise, you can also contact the team online and discuss everything related to your silver purchases and build a strong and robust portfolio.

Silver bars offer cost-effective investment options due to lower premiums, easy storage, and high liquidity. Their tangible nature makes them a preferred choice for those seeking a physical asset with flexibility.

To verify authenticity, look for reputable hallmarks on the bars. Use trusted dealers and consider testing methods like the magnet test or specific gravity test. Purchasing from established sources minimizes the risk of counterfeit bars.

In the UK, investment gold bars are exempt from Value Added Tax (VAT). However, capital gains tax may apply when selling. It’s advisable to stay informed about tax regulations and consult with a financial advisor for personalized advice.

Yes, silver bars are highly liquid, and selling is typically straightforward. Reputable dealers, online platforms, and auctions are common channels. Keep an eye on market trends for optimal selling opportunities.

Secure storage is crucial. Options include professional vaults, safe deposit boxes, or secure home storage. Ensure proper insurance coverage and follow recommended security practices to safeguard your investment.

Live Gold Spot Price in Sterling. Gold is one of the densest of all metals. It is a good conductor of heat and electricity. It is also soft and the most malleable and ductile of the elements; an ounce (31.1 grams; gold is weighed in troy ounces) can be beaten out to 187 square feet (about 17 square metres) in extremely thin sheets called gold leaf.

Live Silver Spot Price in Sterling. Silver (Ag), chemical element, a white lustrous metal valued for its decorative beauty and electrical conductivity. Silver is located in Group 11 (Ib) and Period 5 of the periodic table, between copper (Period 4) and gold (Period 6), and its physical and chemical properties are intermediate between those two metals.