Gold Bars FAQs (Frequently Asked Questions)

17/07/2021alanhorton

Free & fully insured UK Delivery. Learn more

Secure & flexible payments. Learn more

Buyback Guarantee Learn more

We receive a lot of questions about buying gold bars. For convenience, we have summarised some of the most popular questions we receive in this handy gold bars FAQs with answers guide, which we hope helps with your investment questions.

Bars of gold are a good long term investment to provide balance and protection from economic downturns. The value tends to rise during times of political and economic instability and has averaged more than the inflation rate over time. Large bars offer better value than smaller ones, although divisibility should be a consideration. To be Capital Gains Tax-free, buying UK gold coins offers an alternative.

Owning bars of gold is completely legal. The question arises due to a period in US history just after the great depression in 1933 when the US Government issued a decree making it illegal to hold gold in the form of gold bullion without a unique warrant. Any gold owned privately could be confiscated in an attempt to stabilise the floundering economy. This lasted until 1974, and all restrictions have been rescinded since 1 Jan 1975.

Unlike financial securities such as equities and bonds, there is no requirement to formally register gold bar ownership. Electronic gold ownership such as ETFs would be more easily traceable as an ownership register exists which is why so many investors prefer the physical, tangible nature of bars of gold.

Generally, all bars sold by gold dealers will be 24 carats in purity. However, not all sold globally are 24 carats. The term ‘bar’ really only refers to the format of the physical gold. You should not assume that purity is automatically 24 carats. Many mined on the African continent are only 22 carats, which make them difficult to sell outside of Africa. Often these bars are melted down and used for jewellery.

Gold 24 carat bars are not taxable when purchased in the UK. They benefit from a VAT exemption on investment gold (gold in the form of a coin or bar with a minimum of 995/1000 parts gold). Therefore, sub-grade 22-carat versions would be taxable. When bars are sold, any gains should be declared and are applicable for Capital Gains Tax if the annual allowance is breached.

The production of bars of gold is registered with the relevant assayer, and a serial number recorded. However, there does not need to be a register of private buyers. Gold dealers will need to invoice buyers and keep records, but these are not publicly available.

They are hard to the touch. But due to their high purity (24 carats), they are relatively soft in metal terms. Pure gold is malleable, so have a major possibility of scratching due to this. This is the reason why Sovereigns coins are produced in 22 carat format, which is deemed a more robust alloy.

They are VAT free if they are 24 carats in purity due to the VAT exemption on investment-grade gold. There is no income tax when holding them, and Capital Gains tax will only be applied on any gains in value upon sale that surpass your annual allowance. Investors should sell bars strategically that have increased in value, i.e., some either side of tax year end will deem the bars tax free.

They are worth buying if you seek a tangible asset with no counterparty risk. Physical ownership is beneficial to provide balance to a portfolio consisting of mainly paper assets. The value can go up and down and is related to the underlying gold price. The gold price generally moves up in times of uncertainty so is desirable for those seeking a hedge against unstable markets.

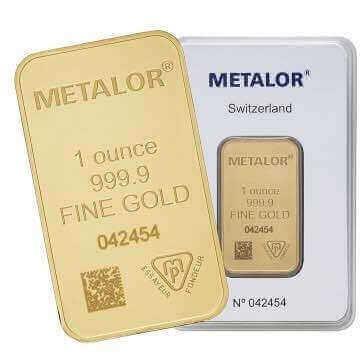

Most bars are 24 carat gold which is the highest carat possible. Some bars on the African continent are a lower purity of 22 carats. The 24 carat bars are referred to as pure gold, but technically they are not 100% pure. Purity can be anywhere from 995 parts per 1,000 upwards, but most reputable bar producers make bars of 999.9 purity.

This 1oz bar from Metalor is clearly marked as 999.9 purity and is available to buy from Physical Gold Limited

The terms gold bullion and bars are somewhat interchangeable. Both generally refer to 24 carat gold in the form of a rectangular bar. However, bullion is also a term used to describe the ‘investment finish’ of certain coins. Bullion coins are minted for value purposes as opposed to proof finish coins which are more expensive collector’s items.

It is easier for fraudsters to fake or add non-gold substances to bars than coins. This is because the design of a coin is far more complex and difficult to copy. The best place to buy is from a trusted gold dealer, where they tightly control their supply network. All genuine bars should also come with serial numbers and many with a certificate from the mint.

This all depends on the size of the gold bar. Due to its high value, most people are surprised by quite how small and light a bar £1,000 will buy you. However, as a dense metal, the larger buys can be very heavy. For instance, the largest is 400 ounces or 12.5kg but are smaller than a standard brick which weighs a mere 3.5kg.

Gold coins are generally deemed to be a better investment than gold bars, as long as you buy the right ones. Buying gold coins offers more divisibility than bars, benefit from quantity discounts, can be easier to sell, and be Capital Gains Tax-free. Of course, the investment objectives and investment amount will also determine which is best.

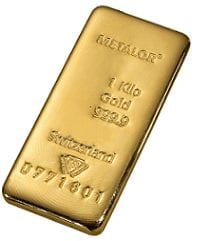

They can be made in 2 distinct ways. Generally smaller bars tend to be minted, whereby a sheet of gold is stamped and cut into the required size, shape, and weights. These minted bars tend to be exceptionally clean looking with a smooth precise finish. For larger bars, a second method is used to create what is known as cast bars. Molten gold is poured into set size moulds to produce ingots. The finish of these tends to be more natural and rougher.

It is best to buy directly from a precious metals dealer. Prices will be transparent and based on the live market. Usually, discounts are offered for purchasing bars in quantity. You benefit from the peace of mind knowing your investment is genuine and high quality and you will have a place to sell the bars when the time comes.

It is best to sell bars through a reputable gold dealer. In the UK, stick to a gold broker who is a member of the British Numismatic Trade Association (BNTA). Try to ensure you have the bar certificate if it is loose. It is possible to take bars into jewellers, but they will likely pay a lower price as they will simply melt down the bar.

Both Gold ETFs and bars have their value linked to the underlying gold price, so they both provide a degree of balance to mainstream assets. Bars benefit from having no counterparty risk whereas gold ETFs can be leveraged and there are additional risks associated with the provider. Buy/sell margins are tighter with ETFs due to their electronic efficiency. Fees may exist with both investments, ETF management fees, and gold bar storage costs.

The value of a gold bar depends on the underlying gold price and the weight of the bar. The approximate value of the bar can be calculated by multiplying the current gold price in grams by the weight in grams in the bar. As most bars are 24 carats, pure gold), no other sums are needed. The actual price will likely be slightly lower by a couple of percent depending on supply and demand in the market.

We would recommend that all bars of gold should have an accompanying certificate. This certificate will come from the refiner and will prove that strict quality control standards set by the LBMA have been met. The certificate will provide a serial number, proof of authenticity and will have the place of origin on it.

Unless buying a substantial quantity of gold, choosing the right gold coins can be a better investment than bars. Bars can command lower premiums when large in size, but coins benefit from being more divisible. UK coins have the added advantage of being free from Capital Gains Tax for UK residents, and older coins provide more historical interest than bars.

As an investment, buy bars when the gold price is low to enjoy capital appreciation when the gold price rises. Prices tend to rise during times of Dollar weakness and general economic instability. So, do not wait for the economy to slump as the gold price would already have risen. Buying gold in good times and selling in bad times will reap the biggest profits.

It is best to sell bars in the middle of an economic crisis as the price will likely be the highest. Gold is sought as a safe haven in these times, so demand goes up and the price of gold follows. This directly impacts the price you can fetch for your gold bar.

Bars of gold can be cheaper per gram to buy than Krugerrands if bought in a large size like 1kg. However, Krugerrands are a good value coin, so the gain is minimal. An advantage of Krugerrands is that you can sell one coin or a handful whenever you need to. Owning one large gold bar does not allow this. Buying lots of smaller bars is expensive.

Buy a 1kg Metalor gold bar from Physical Gold Limited

If you are seeking investment, then try to buy the cheapest 24 carat bar possible. Premiums are paid for certain brands, especially from Switzerland, or enhanced packaging, but these premiums may not be recouped upon sale. Pre-owned gold bars can be bought cheaply, just ensure they have a certificate and buy from a reputable gold dealer.

In the UK, bars can only be confiscated if they are linked to money laundering or crime. In the US, under current federal laws, gold bullion can technically be confiscated in times of crisis, but rare coins do not fall into the confiscation category. All privately-held bullion could be confiscated during the Executive order 6102 after 1933, but that expired by 1975.

Very few banks sell gold these days as they have many other revenue streams and gold is deemed to be a specialist area. To purchase bars, it would probably be best to go to a reputable gold dealer to benefit from extensive choice, guidance, and general good advice about the timing of purchasing and selling.

All bars over 250g should have a serial number on them. This serial number helps an assay office authenticate the gold bullion. Generally, this serial number will be on your invoice, so it can be traced back to your dealer.

Silver bars are clearly far more affordable than bars of gold due to the price differential of around 80:1. This means that buying a bar for £3,000 can be underwhelming for those expecting a large brick-like bar. In contrast, a huge 5kg silver bar cost less than £2,500. Due to the low silver price, the relative production cost is higher than for gold, so bid/offer spreads are wider. Both bars can be held as safe havens, but the value of silver can also go up with industrial demand.

5kg bars like this Umicore bar are available from Physical Gold Limited

If you have any further questions we are only a phone call away when you call us on 020 7060 9992. We can also be contacted via webform, so please contact us and we will do our best to help with all your gold bar-related enquiries.

Live Gold Spot Price in Sterling. Gold is one of the densest of all metals. It is a good conductor of heat and electricity. It is also soft and the most malleable and ductile of the elements; an ounce (31.1 grams; gold is weighed in troy ounces) can be beaten out to 187 square feet (about 17 square metres) in extremely thin sheets called gold leaf.

Live Silver Spot Price in Sterling. Silver (Ag), chemical element, a white lustrous metal valued for its decorative beauty and electrical conductivity. Silver is located in Group 11 (Ib) and Period 5 of the periodic table, between copper (Period 4) and gold (Period 6), and its physical and chemical properties are intermediate between those two metals.