How Does Inflation Impact The Price Of Gold? Expert Insight.

30/11/2023Daniel Fisher

Free & fully insured UK Delivery. Learn more

Secure & flexible payments. Learn more

Buyback Guarantee Learn more

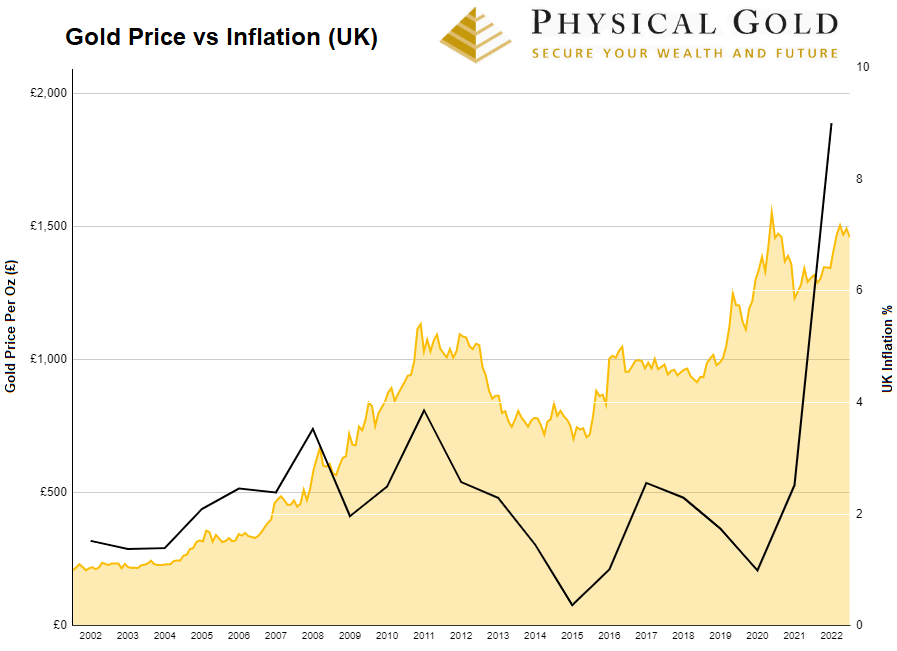

Historically, gold prices often rise substantially during periods of high inflation. The precious metal has long been perceived as a hedge against inflation and a stable store of value when currencies depreciate. This is driven by economic factors like decreased trust in fiat money and increased demand for hard assets like gold when inflation accelerates.

However, the connection between inflation and gold is nuanced, with the precious metal sometimes underperforming expectations. This makes a deeper look at gold’s track record during inflationary regimes valuable for investors considering precious metals as part of their strategy today. While not a perfect solution, allocating part of a diversified portfolio to gold may provide some protection if high inflation persists.

Let’s explore the link between inflation and gold prices and what steps you can take to build a strong investment portfolio.

Inflation is the ongoing increase in prices across an entire economy over time, representing the declining purchase power of a currency. For example, 5% annual inflation means £100 purchases less goods and services than it would have the prior year. The common metric used to gauge inflation in the UK is the Consumer Price Index (CPI). The CPI tracks the changing prices households pay for expenses like food, housing, transport, medical care, and more. Sustained CPI rises over multiple periods indicate accelerating inflation.

Inflation is primarily caused by increased production and labour costs (cost-push inflation) or increased consumer demand without matching supply growth (demand-pull inflation). The impact of inflation on households and the economies includes eroding purchasing value of income and savings, increased price volatility making financial planning challenging, higher costs of living requiring faster wage growth to compensate, and decreased consumer and business confidence, which may slow economic activity.

Inflation risks sparking a vicious spiral, requiring leaders to control rising prices before they weaken economic stability and growth. Understanding inflation’s complex drivers and effects helps inform decisions in inflationary conditions.

Gold has long been perceived as a hedge against inflation, with its value tending to rise when inflation is high. Historical data supports this relationship, as gold prices have often increased substantially during periods of high inflation.

In a study analysing 50 years of data, the World Gold Council found that gold returned 15% per year on average during periods when inflation exceeded 3%. In contrast, gold returned just 6% annually when inflation was under 3%. This demonstrates gold’s tendency to outperform when inflation is elevated.

Several theories explain the economic link between gold and inflation. Rising inflation typically corresponds with decreasing trust in fiat currencies and increased demand for hard assets. Inflation erodes the purchasing power of currency, so investors look to gold as a stable store of value. Central banks may also increase gold reserves to diversify from devalued currencies. These dynamics drive up gold demand and prices when inflation rises.

While historically associated with inflation hedging, gold’s performance is complex and dependent on investor behaviours and economic conditions.

Owner & Founder, Physical Gold

The term ‘Hedge against inflation’ refers to the ability of an asset to maintain relative value – known as their Purchasing Power. For this to be achieved, the assets need to increase in value at the same rate (or higher), than the rate of inflation. Gold has demonstrated its inflation-hedging abilities during several prominent economic downturns accompanied by high inflation. During these crisis events, gold reliably retains or increases its value while other assets decline.

The 2008 global financial crisis triggered aggressive monetary policies, with the Bank of England slashing interest rates and engaging in quantitative easing. This stoked fears of inflation, causing investors to flock to “safe haven” assets like gold. From 2006 to 2011, annual inflation reached over 5% multiple times. Correspondingly, gold prices climbed from under £500 to over £1,000 per ounce.

Similar dynamics occurred during the COVID-19 pandemic, where massive stimulus packages raised inflation concerns, and annual UK inflation peaked at 5.4% in 2021. During recessions and crises, gold provides stability as fiat currencies weaken.

And most recently, we have witnessed how the conflict in Ukraine made inflation rates and gold prices soar once more.

Several factors drive gold’s strength in inflationary periods. Geopolitical risks increase demand for gold’s “safe haven” status. Declining real interest rates boost gold’s appeal versus bonds and cash. Currency devaluation spurs investment in assets like commodities and precious metals. Ultimately, gold’s limited supply and role as a long-term store of value underpin its ability to hedge inflation.

There are several key economic dynamics that explain why gold tends to function as an inflation hedge.

In essence, gold’s role as a stable long-term store of value underpins its ability to provide inflation protection. Gold has traditionally competed with the US Dollar as a store of wealth and value, most famously during the gold standard. So it’s no surprise to see gold appreciate when the Dollar’s value is undermined by inflationary pressures. Though not perfect, gold has historically rewarded investors during inflationary periods.

Free ultimate guide for keen gold investors

For investors looking to hedge inflation risks, gold can be a strategic addition to portfolios during inflationary environments. There are several key factors to consider when investing in gold:

With prudent allocation, portfolio balance, and risk management, gold can provide an effective buffer for wealth preservation should high inflation rear its head. Consult investment advisors to craft the optimal gold strategy.

While gold is often lauded as an inflation hedge, how does it compare to other assets also considered inflation-protective for UK investors? Analysing historical data reveals gold’s pros and cons versus real estate, commodities, bonds, and other common hedges.

Real estate is commonly viewed as an inflation hedge, with UK property values typically rising during inflationary periods. However, housing also comes with maintenance costs, taxes, high barriers to entry, and low liquidity.

Broad commodities indices can beat inflation, but individual commodities exhibit high volatility. Gold’s physical nature and cultural cachet give it an advantage over commodities dependent on economic growth.

Index-linked gilts directly hedge inflation by linking bond principal to the Retail Price Index. However, they offer low returns compared to gold, which has a greater potential for capital appreciation during high inflation.

In general, gold’s strength as an inflation hedge depends on the specific drivers of inflation, investor behaviour, and accompanying economic conditions in Britain. Its mixed performance in low-moderate inflation environments demonstrates gold’s limitations. As with any asset, gold has risks and downsides to consider.

According to the Bank of England, UK inflation remains high, though expected to continue slowing down and return to around 2% by the end of 2025.

However, their projections indicate inflation will likely stay elevated through 2023 amid lingering economic impacts from events like the pandemic and geopolitical tensions. Not all prices move at the same pace, either.

Monetary policymakers cite interest rates as the primary mechanism to control inflation by reducing spending and slowing price hikes. But risks like recession could alter forecasts, so uncertainties exist around inflation’s path.

Given the potential for lingering high inflation near-term, conditions may remain favourable for gold to retain value as a hedge, especially if elevated inflation persists. However, concrete predictions are difficult.

Following monetary policy shifts and UK economic developments can help ascertain gold’s inflation-hedging outlook. Possessing some gold seems prudent currently, given inflation and recession risks. But agility is required to respond to a fluid environment.

With UK inflation still running hot, the current environment seems ripe for allocating part of your portfolio to gold. History shows that the yellow metal can provide rewards when high inflation lingers. So fortifying your investments now could help weather the storm brewing on the horizon.

Over our more than 15 years of experience, we’ve been guiding investors on including gold in their wealth plans. Our range of gold coins and bars offers flexible options to suit different portfolios. And our experts can help identify the right gold solutions to match your personal investment goals and appetite for risk.

For newcomers, we lay out clear, practical steps to start investing in gold. For seasoned investors, we provide tips to build on existing holdings. Our website spotlights strategic gold products to consider in inflationary times like these.

We also encourage connecting with our team for personalised guidance on fitting gold into a well-diversified portfolio aligned with your specific financial aims. Our specialists can tailor premium gold strategies to help realise your investment vision.

Browse our website for guides, insights and real-time gold pricing. Or call 020 7060 9992 or email info@physicalgold.com to tap into our expertise. With inflation still a threat, now could be the moment to explore gold’s potential.

Given today’s inflation outlook, contact us to learn more about harnessing gold’s potential. Our experienced team is ready to help investors navigate the complexities of gold investing during these uncertain times.

Live Gold Spot Price in Sterling. Gold is one of the densest of all metals. It is a good conductor of heat and electricity. It is also soft and the most malleable and ductile of the elements; an ounce (31.1 grams; gold is weighed in troy ounces) can be beaten out to 187 square feet (about 17 square metres) in extremely thin sheets called gold leaf.

Live Silver Spot Price in Sterling. Silver (Ag), chemical element, a white lustrous metal valued for its decorative beauty and electrical conductivity. Silver is located in Group 11 (Ib) and Period 5 of the periodic table, between copper (Period 4) and gold (Period 6), and its physical and chemical properties are intermediate between those two metals.