Free & fully insured UK Delivery. Learn more

Secure & flexible payments. Learn more

Buyback Guarantee Learn more

Specifications

Best Value Gold Krugerrand Coin

The 1oz Gold Krugerrand is arguably the world’s most popular bullion coin. While buying Britannias or Sovereigns may be the most common gold purchase for UK investors, the Krugerrand enjoys the most consistent recognition and demand worldwide. Certainly, it dominates gold investment demand in Europe. The Krugerrand already represents great value for the avid gold investor, it’s a mass-produced bullion coin designed for investment purposes, so premiums are low reflecting its abundance. The Best Value Krugerrand offers you the chance to buy Krugerrands at even lower rates. Rather than receiving the latest version of the coin, you’ll receive Krugerrands of mixed years, of our choice, depending on stock levels. This enables us to offer the Krugers at even lower premiums. This coin is a fantastic choice if your main motivation is value and you wish to receive as much gold for your money, without compromising liquidity or divisibility. All our Best Value Krugerrands undergo a strict checking process to ensure all are of very good condition.

Krugerrand Gold Coin Design

The Krugerrand is a 22-carat world gold coin containing exactly 1oz or 31.103g of pure gold. Like the Gold Sovereign, the exact alloy mix can vary from year, changing annual colour slightly. However, the metal combination provides great resistance to bangs and scratches, meaning pre-owned Krugerrands are amongst the best condition second-hand coins in the market.

The obverse, designed by Otto Shultz, features the four-term former South Africa President Paul Kruger. Meanwhile, the reverse displays one of South Africa’s national animals the Springbok antelope, along with the inscription ‘Krugerrand’, the year of mintage and confirmation of the pure gold content.

The design of the gold coin doesn’t change from year to year which offers a comforting familiarity and feeling of longevity, while also keeping prices low due to no redesign costs.

Krugerrand History & Mintage

2017 represented a milestone for the famous Gold Krugerrand. It marks 50 years since its launch in 1967, reflecting its success in the gold investment market. No other coin has really come close to matching its accomplishment. The idea behind its original launch was to capitalise on South Africa’s abundant gold mining industry by providing the perfect gold investment vehicle. While the British Sovereign had established itself for well over a century, its obscure gold weight (0.2354oz) meant the average person found it difficult to track its value. The Krugerrand was the first mass-produced bullion coin to contain exactly 1oz of pure gold, and the market loved it. So much so, that it accounted for 90% of the global coin market by 1980. Always ready to capitalise on opportunities, the South African Mint launched smaller denominations of the coin that year while its demand was at a peak. Variations include half, quarter and tenth-ounce versions. This was despite many Western countries banning the import of old Krugerrands during the 1970s and 80s due to South Africa’s problems with apartheid.

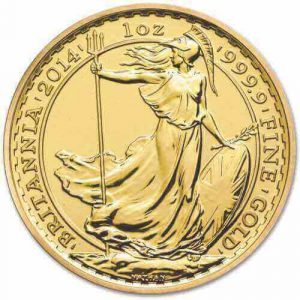

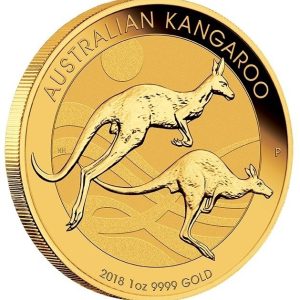

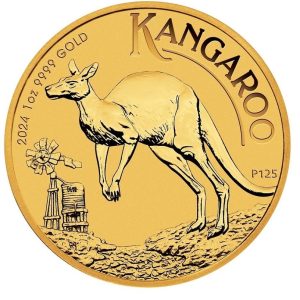

The unparalleled success of the Krugerrand has spawned many copycat coin launches. It proved to be the inspiration of other eminent gold bullion coins such as the Canadian Maple Leaf, the Australian Nugget, Chinese Gold Panda, American Eagle, and finally, after 20 years of Krugerrand circulation, our very own gold Britannia coin.

Mintage figures vary hugely from year to year. Early annual production varied between 40,000 and 200,000, while peak years in the mid-1970s saw mintage reach a heady 6 million in 1978. For that reason, the most common period for pre-owned Krugerrands is the mid-1970s. Production pulled back dramatically during the international apartheid sanctions, falling to around 25,000 due to crushed overseas demand. However, figures have recovered since sanctions have been dropped, albeit not to their peak levels.

Our Expert Opinion

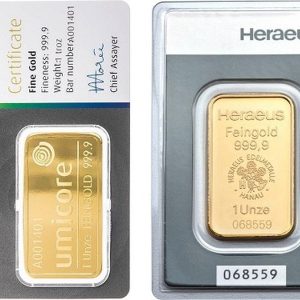

The Beast Value Krugerrand is highly recommended by Physical Gold Limited for anyone seeking super-low premiums and liquidity. It provides far more flexibility than buying large gold bars (such as 1KG) but offers similar value. Smaller gold bars such as 1oz bars and 100g bars are more affordable but don’t offer the same discounts as larger bars.

There are few coins with the sheer depth in its second-hand market, so you’ll always be able to sell Krugerrands easily, quickly and achieve a good price. We would always buy these pre-owned coins over the latest year of issue, as we don’t see the point in paying extra when the older Krugerrands maintain their integrity so well. While the Krugerrands may not hold huge gold collectors appeal, due to their abundance and lack of design change, they are one of the top choices for gold investing.

If you’re buying substantial quantities of coins or intend to build a holding over a number of years, you may want to consider the UK coins such as the gold Britannia or the Best Value Sovereign coin. Both have the added advantage of being Capital Gains Tax free for UK investors. Owning these coins also represents great value and liquidity but selling a large quantity at any time will prove more tax efficient. Obviously, selling your Krugerrands strategically, in tranches, will prevent breaching the annual CGT allowance which currently stands at over £11,00 per person.

Orders are delivered free of charge within the UK only.

Delivery is in non-branded tamper proof packaging by Royal Mail Special Delivery and is fully insured. Delivery usually takes place before 1pm on the day following despatch, but some areas may run over this timeframe.

Maximum value per parcel is £50,000, so larger orders will be sent in multiple installments.

When placing your order, the delivery address needs to match the registered address of the buyer.

You’ll receive a despatch email with a tracking link once the goods are sent so you can see the status of the delivery and location of the parcel.

In the event that no-one is in to receive the delivery, you’ll be left a red card confirming attempted delivery, with confirmation on the Royal Mail tracking page. You then have the choice of arranging redelivery or picking up the parcel from your nearest sorting office.

For more details please see section 4 of our Terms & Conditions and our Delivery & Storage page.

If you request storage for your order, your goods will be sent free of charge to the storage vaults.

All gold & silver orders are stored at Loomis International in the UK and held on a fully allocated and segregated basis.

Storage fees are 1%+VAT/year for gold and 1.5%+VAT/year for silver, subject to minimum charges.

Please see further details of storage fees and minimum charges on our Storage & Delivery page.

Storage is charged at point of purchase by selecting ‘Buy with Storage’ to the next semi-annual pay date. Semi-annual storage dates are 15 March and 15 September each year and are subject to minimum charges for the period.

A recurring storage fee will be taken from your card at each semi-annual storage date.

You can opt to have your goods delivered at any time, subject to delivery charges of £25 +0.25% of the metal value.