Free & fully insured UK Delivery. Learn more

Secure & flexible payments. Learn more

Buyback Guarantee Learn more

Specifications

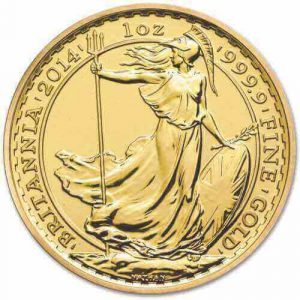

2021 Britannia Gold Coin

This is a pre-owned 2021 Britannia gold coin. Struck in 999.9 fineness 24 carat gold, this Royal Mint coin is the first in a new era of ultra-high secure coins. The coins will come in a Royal Mint tube if bought in quantities of ten. Smaller orders will come loose, but the Britannia coin capsules can be ordered to protect them.

The Britannia image on this coin (facing left, standing in front of the sun, standing tall against a gale with her shield, Corinthian helmet and olive branch), designed by Philip Nathan, remains the same as last year’s. However, the rest of the coin’s reverse is all change. The 2021 Britannia features some exciting and stunning new hi-tech features, designed to take the coin’s anti-forgery status to the next level.

The four brand new features created with Royal Mint’s cutting edge lasers are;

- Animated Waves A micro detailed wave background to the Britannia image on the back of the coin. Now Britannia really does rule the waves, as the background waves seem to move when the coin is angled

- Hologram effect Another first-time feature is a small circular image on the coin’s reverse. At first glance, the image is of the familiar naval trident, but when the coin is pivoted, the trident evolves into a padlock. Clearly, the Mint want to be direct by boasting of the coin’s new security features!

- Micro Text An additional inner ring sits within the coins main reverse text. This ultra-fine detail includes the words ‘DECUS ET TUTAMEN‘, which means ‘An ornament and a safeguard’

- Shield detailing More laser work is displayed on Britannia’s shield, which now boasts additional line detailing, depicting pattern and colour

This all adds up to not only the most secure gold coin in history but also the most visually impressive and stunning coin on the market.

The outer ring, around the design of Britannia, is the legend ‘BRITANNIA 2021 999.9 FINE GOLD’

As with all UK currency gold coins, the Gold Britannia is CGT exempt and VAT free in the UK and European Union.

Britannia’s background history

The Britannia was originally launched to compete with the Krugerrand. The South African coin was the first bullion coin to hold exactly 1oz of gold and after its launch in 1967, it managed to dominate the ever-growing gold investment market. The Royal Mint eventually produced its flagship 1oz gold coin 20 years after the Krugerrand, in 1987.

The Britannia’s popularity soon took off and appealed domestically to UK investors looking to buy gold in denominations of 1oz at low cost and achieve CGT-free status. Initially produced in 91.6% purity gold, the original Britannia was alloyed with copper. This mix was changed to combine gold with a silver alloy in 1990 to produce a more familiar yellow gold, from the more reddish previous version.

The Royal Mint realised the coin’s potential to appeal to the global market by updating the purity of the coin to 999.9 (24 carats) in 2013. This purity of gold appeals more to the ever-growing Asian market.

We often get asked “Gold Britannias or Gold Sovereigns – which is the best investment?”, so learn more in our YouTube video.

Variety of Britannia coins

With growing demand and recognition for the 1oz gold Britannia, the Mint has since produced the coin in fractional versions, special editions and in other metals. The gold version is available in Half, Quarter and tenth ounce sizes, to complement the larger 1oz coin. These can be bought in bullion finish or in proof sets which command a premium due to finish and presentation. The smaller coins can appeal both to collectors and modest investors who seek smaller, more affordable individual coins.

Special editions

In recent years we’ve also witnessed beautiful special edition 1oz iterations. Last year witnessed the 30th-anniversary limited edition of the coin which commanded a premium over the mass-produced version. This year, in very limited quantity, the Royal Mint has launched a version with an oriental style border, no doubt to further appeal to the Asian market.

And now in silver

A decade after the Gold Britannia launch came the 1oz Silver Britannia. In a similar fashion to its older gold cousin, the 1oz silver coin has become the go-to coin for those investing in silver. The coin is mass-produced to reduce cost and provide great value for money. As a legal tender coin, it also attracts no Capital Gains Tax.

Our expert opinion

The newest version of the Britannia 1oz gold coin is always one of our best sellers. Quite simply, it ticks all the boxes. For investors, the 1oz size reduces production costs when compared to smaller coins. It’s mass-produced at the Mint and finished to bullion standard, lending itself to be a valuable investment. For UK investors, the £100 face value can be a huge cost saving when it comes to selling. That’s because the face value qualifies the coin as legal tender and therefore the Treasury can’t tax you on any Capital Gains made when selling the coins. Quantity discounts run deep too, so you’re rewarded with reductions as you increase the amount you buy. Buy 2021 gold Britannias with confidence as when selling, the Britannia gold coins also pay well.

The best bit.

Of all the 1oz coins, the Britannia tends to have the fewest churners. In other words, most people buy and hold, and look to pass them down the generations. So, there is very rarely a glut of pre-owned coins coming onto the market. This provides great support for the second-hand price. With the coins now being 24 carats (since 2013), there is also a strong bid from China, further enhancing demand and growth potential.

The Britannia doesn’t neglect to tap into the collector’s coin market either. The symbol of Britannia is creatively updated every few years so that the various issues remain distinct and appealing. The special edition versions like the oriental edge and 30th-anniversary edition, further attract buyers.

Buying 2021 Gold Britannias was never easier

It’s easy to buy 2021 gold Britannias, simply contact us today and we can fulfil your order. If you need help or friendly advice, Physical Gold are on hand to assist with your investment.

We can be contacted on 020 7060 9992 or via e-mail.

Orders are delivered free of charge within the UK only.

Delivery is in non-branded tamper proof packaging by Royal Mail Special Delivery and is fully insured. Delivery usually takes place before 1pm on the day following despatch, but some areas may run over this timeframe.

Maximum value per parcel is £50,000, so larger orders will be sent in multiple installments.

When placing your order, the delivery address needs to match the registered address of the buyer.

You’ll receive a despatch email with a tracking link once the goods are sent so you can see the status of the delivery and location of the parcel.

In the event that no-one is in to receive the delivery, you’ll be left a red card confirming attempted delivery, with confirmation on the Royal Mail tracking page. You then have the choice of arranging redelivery or picking up the parcel from your nearest sorting office.

For more details please see section 4 of our Terms & Conditions and our Delivery & Storage page.

If you request storage for your order, your goods will be sent free of charge to the storage vaults.

All gold & silver orders are stored at Loomis International in the UK and held on a fully allocated and segregated basis.

Storage fees are 1%+VAT/year for gold and 1.5%+VAT/year for silver, subject to minimum charges.

Please see further details of storage fees and minimum charges on our Storage & Delivery page.

Storage is charged at point of purchase by selecting ‘Buy with Storage’ to the next semi-annual pay date. Semi-annual storage dates are 15 March and 15 September each year and are subject to minimum charges for the period.

A recurring storage fee will be taken from your card at each semi-annual storage date.

You can opt to have your goods delivered at any time, subject to delivery charges of £25 +0.25% of the metal value.