Free & fully insured UK Delivery. Learn more

Secure & flexible payments. Learn more

Buyback Guarantee Learn more

Specifications

2024 The Lion and the Eagle 1oz Silver Coin

This is a brand new 999 fineness 24 carat silver bullion coin from Royal Mint, celebrating the unique relationship between the US and UK. Crafted to The Royal Mint’s exacting bullion standard, this range offers a unique opportunity to invest in a historic collaboration between two numismatic giants.

The British Lion and American Eagle – two beasts representing the pride, might and spirit of their nations now immortalized together in .999 silver bullion.

Designer John M. Mercanti, the US Mint’s former Chief Engraver, has envisioned these iconic creatures steadfast side-by-side. The Lion’s flowing English mane complements the Eagle’s fierce beak and piercing stare toward a shared horizon.

Struck for the first time, the 2024 Lion and Eagle silver coins capture two kindred cultures meeting as friends with strength and liberty. The Royal Mint’s exacting engravers masterfully translated Mercanti’s symbolism honouring bonds between countries and people into precious tangible tokens.

For those drawn to designs merging heritage, craftsmanship and possibility, the Lion and Eagle bullion stands out as 1 oz tribute to forging understanding.

Key Features:

- Unprecedented collaboration between The Royal Mint and the United States Mint

- Stunning reverse design featuring the British Lion and the American Eagle in equal prominence

- Struck to The Royal Mint’s bullion standard for unparalleled quality

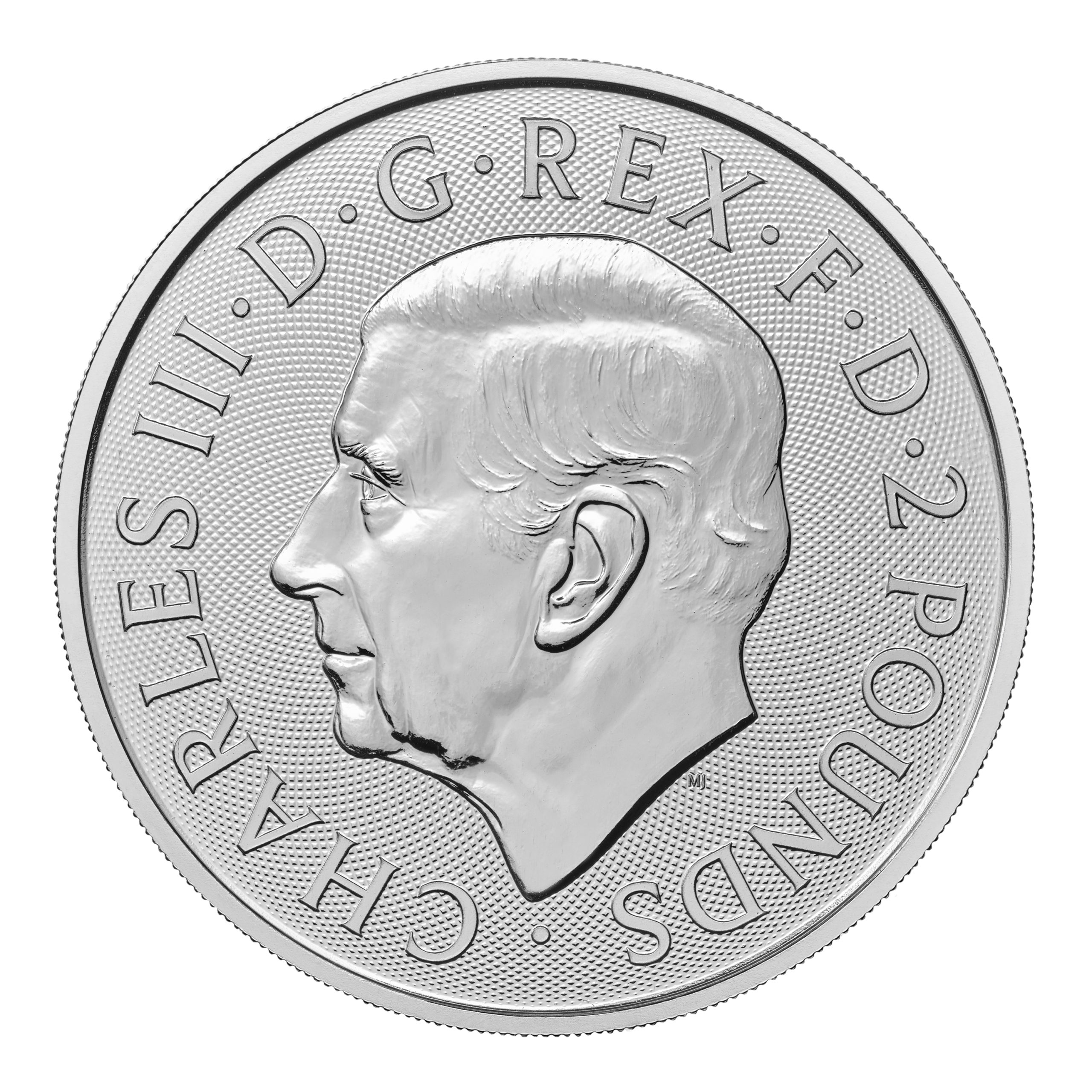

The obverse of the coin features the new portrait of King Charles III as depicted by designer Martin Jennings.

The minimum order quantity is 25 coins, with multiples of 25 coming in Royal Mint tubes, and quantities of 500 packaged into monster boxes, consisting of 20 tubes. These boxes provide an excellent storage solution for stacking larger investments.

As with all UK currency silver coins, the Gold Britannia is CGT exempt.

Orders are delivered free of charge within the UK only.

Delivery is in non-branded tamper proof packaging by Royal Mail Special Delivery and is fully insured. Delivery usually takes place before 1pm on the day following despatch, but some areas may run over this timeframe.

Maximum value per parcel is £50,000, so larger orders will be sent in multiple installments.

When placing your order, the delivery address needs to match the registered address of the buyer.

You’ll receive a despatch email with a tracking link once the goods are sent so you can see the status of the delivery and location of the parcel.

In the event that no-one is in to receive the delivery, you’ll be left a red card confirming attempted delivery, with confirmation on the Royal Mail tracking page. You then have the choice of arranging redelivery or picking up the parcel from your nearest sorting office.

For more details please see section 4 of our Terms & Conditions and our Delivery & Storage page.

If you request storage for your order, your goods will be sent free of charge to the storage vaults.

All gold & silver orders are stored at Loomis International in the UK and held on a fully allocated and segregated basis.

Storage fees are 1%+VAT/year for gold and 1.5%+VAT/year for silver, subject to minimum charges.

Please see further details of storage fees and minimum charges on our Storage & Delivery page.

Storage is charged at point of purchase by selecting ‘Buy with Storage’ to the next semi-annual pay date. Semi-annual storage dates are 15 March and 15 September each year and are subject to minimum charges for the period.

A recurring storage fee will be taken from your card at each semi-annual storage date.

You can opt to have your goods delivered at any time, subject to delivery charges of £25 +0.25% of the metal value.