The Russian Central Bank plans to strike coins as well as print banknotes in order to commemorate the 2018 World Cup, being hosted in the Russian Federation. Of course, the move to issue the World Cup coin series would be pursuant to approvals being issued by FIFA. As a precursor to the gala event, the Russian Federation has already issued certain coins. For example, a series of coins have been launched by the city of Ekaterinburg, the fourth largest city in Russia, where the last Tsar and the Romanov family were executed by the Bolsheviks. The coins feature an image of the arena along with an inscription announcing the start of the construction. The coins were struck by the Ural mint ahead of the tournament that starts on June 14, 2018.

Earlier Russian sports themed coins

This isn’t the first time that Russia has issued coins to commemorate the FIFA World Cup. In 1997, the Central Bank issued 20,000 silver roubles to commemorate the 1998 World Cup, which was held in France. Similarly, Russia also minted 10,000 silver coins with a face value of three roubles each and 1,500 gold coins with a face value of 50 roubles, to herald the 2006 World Cup, which was hosted by Germany. In 1993, Russia started the tradition of issuing currency with themes based on major international sporting events. This has resulted in dozens of commemorative coins, as well as banknotes being issued by the Russian Central Bank over the last 25 years.

Download our FREE Ultimate Insider’s Guide to Gold and Silver Investment here

Russia has a long history of issuing coins commemorating sports events

In 2013, the World Summer Universiade was hosted

by Russia in Kazan, in the Tatarstan region of the country. To commemorate the event, Russia minted two different types of 10 rouble coins, as well as gold and silver coins with a mintage of up to 7,500 in number. As the Russian Federation was created only in 1991, earlier issues of sports-related coinage is attributed to the erstwhile Soviet Union. In fact, the Soviet Union also had a long tradition of minting commemorative coinage in order to mark major international sports events. Coins were issued to celebrate the Moscow Olympics in 1980. Copper and nickel one rouble coins were issued with mintage quantities of up to 9 million from 1977 to 1979. These coins featured images of famous Russian landmarks like the Mir space station and the Kremlin. Many coins were also minted by Russia for the Sochi games, including the country’s first ever 100 rouble banknote. Interestingly, days before the break-up of the Soviet Union, coins were minted to commemorate the Barcelona Olympic Games with a mintage volume of 250,000. However, these coins were never formally issued.

2014 World Cup coins

During the last World Cup in 2014, FIFA had launched a massive programme to officially issue coins and medals. The programme enjoyed participation from most football playing nations across the world. All of these countries minted commemorative coins, which were despatched to collectors in its official packaging. This featured a white case that had the embossed World Cup logo on the lid. The coins were packed in protective capsules to prevent damage.

Contact Physical Gold for the best advice on how to buy coins

Our numismatics experts can give you sound advice on how to buy coins made of precious metals. Call our team on 020 7060 9992 or get in touch via our website, and a member of our team will be in touch with you at the earliest.

Image credit: Wikimedia Commons

The Royal Mint launched a unique series of coins in 2016, known as the Queen’s Beasts. Statues of the Queen’s Beasts were present at the historic occasion of the coronation of Queen Elizabeth II, Britain’s current and longest-reigning monarch. The event took place on the 2nd of June, 1953 at Westminster Abbey in London. The coins were minted in silver and gold. There are 10 planned coins in the series, featuring stylised images of each of the Queen’s Beasts statues from the 1953 ceremony. The designs of the coins were developed by Jody Clark. The series is significant, as it is the first time that the UK has issued a two ounce silver coin, which forms part of this series. In this article, we will explore each coin in detail.

The Queen’s Beasts are a series of statues depicting mythical figures that form part of British pageantry

The Lion of England

The Lion is the first in the series that was inaugurated in March 2016. The issue was completely sold out on allocation. A further mintage was issued by mid-June 2016. The coins were delivered to investors packed in a protective plastic capsule. The obverse of the coin displays a portrait of the Queen, similar to the ones issued on other coins. The obverse also contains the inscription ‘Grace of God, Defender of the Faith’, written in Latin. This is displayed in an abbreviated form with the letters DG REG FD. The initials of the designer, Jody Clark are also inscribed. The reverse is the side that features the stylised version of the crowned Lion of England. The reverse also shows the name of the statue, the fineness of the coin, the year of issue and the signature of Jody Clark.

Interested in buying gold or silver coins? Download our FREE 7 step cheat sheet here first

The Griffin of Edward III

The Griffin was issued in November 2016 and is the second coin in the series. Once again, the obverse features a portrait of the Queen and the initials of the designer. The reverse has the stylised image of the statue of the Griffin, along with the inscription, ‘Griffin of Edward III’. The text also indicates the fineness, year of issue and the signature of the designer.

The Red Dragon of Wales

Riding on the success of the first two issues,

The Unicorn of Scotland

The fourth release of the series came in September 2017. In doing so, the Royal Mint skipped a release in March earlier in the same year. With the obverse, identical to the other coins in the series, the only difference was the finish. The earlier coins had a stucco style finishing for the obverse, however, this time the finish featured an arched pattern of several tiny diamonds.

The reverse of the coin features an image of the Unicorn of Scotland along with similar inscriptions and the initials of Jody Clark, the designer.

The Unicorn of Scotland is the fourth coin in the Queens Beasts series

The Black Bull of Clarence

The fifth in line of the Queen’s Beats series is the Black Bull of Clarence, which was issued in March 2018. The obverse is the same as the other coins and the reverse features an image of the black bull, with the other inscriptions similar to the earlier coins in the series.

White Horse of Hanover

The White Horse Beast celebrates the rule of King George I, the first monarch from Hanover to rule Britain in 1714. His ascension to the throne came as he was the closest living Protestant relative to Queen Anne. He was the grandson of Elizabeth Stuart, sister of Charles I, and in fact ruled the whole of Britain, France and Ireland. The Haus Hanover lineage stemmed from the House of Brunswick-Luneburg, rulers of the pre-republic Duchy of Brunswick.

Falcon of the Plantagenets

The reverse of the coin features the impressive Falcon of Plantagenets design, The falcon perches on a shield depicting another falcon sat on a fetterlock. Representing the House of Plantagenets, the falcon has long been a heraldic symbol of not on this famous royal house but also houses of York, Lancaster and Tudor.

Yale of Beaufort

Like many of the 10 heraldic beasts, the Yale of Beaufort is a mystical beast with a number of slightly varying interpretations of the fable. The generally accepted parameters are that the Yale is a goat-like creature which boasts incredible powerful horns which can pivot in any direction for combat. It also possesses a set of boar-like tusks. The back of this 1oz coin features the legendary Yale of Beaufort, proudly astride a shield with crown and chained portcullis. The wonderfully detailed main image pops out even more as it sits on a dimpled background, adding depth. Around the edge of the image is the wording ‘YALE OF BEAUFORT’, coins weight ‘1oz’, ‘FINE GOLD’, purity ‘999.9’ and finally the year of issuance.

White Lion of Mortimer

Not to be confused with the Lion of England emblem, also celebrated in the Queen’s Beasts coin range, the Lion of Mortimer features no crown and its tongue and claws are blue rather than red. Originally inherited from his grandmother, heiress of the Mortimers, it was Edward IV (1461-1483) who first used the Lion of Mortimer in the Royal Arms. Representing his House of York, the Lion design holds a blue shield with white rose on a golden sun. The symbol has since been favoured by King George VI, Queen Elizabeth’s father.

See the 1oz Gold Lion of Mortimer here.

White Greyhound of Richmond

The White Greyhound is associated with the Tudor era, in particular Henry VII and his father Edmund Tudor. The Greyhound symbolised the Honour of Richmond, which Edmund used as Earl of Richmond.

Completer coin

The coin celebrates the success of the 10 beast series by featuring each of the previous beasts surrounding and protecting Queen Elizabeth, as the original statues were designed to do.

As with the core 10 beasts, the Completer coin is issued in the 1oz Gold version and the 2oz Silver bullion coin.

Call us to know more about investing in precious metal coins

Our investment experts include numismatics specialists who can guide you on the right ways to buy gold and silver coins. Bullion coins can be an excellent investment, whether you’re an investor or a keen numismatist. Queen’s Beasts coins are available at Physical Gold and come with a certificate of authenticity. Dial 020 7060 9992 to talk to a member of our team, or email us to avail of the right advice in buying gold and silver coins.

Image credits: Money Metals and Wikimedia Commons

Numismatists and their passion for collectables

The practice of collecting coins, paper notes, tokens, etc. is called numismatics. Numismatists can be found all over the world, from every walk of life, and they are passionate about finding and collecting. There is an inherent thrill about digging up remnants of the past and finding a piece of history and holding it in your hand.

Owning a piece of history

Of course, many such collectors also get involved in the history of the coins they find and conduct their own research. That can be an absorbing experience in itself. For many, it’s also about the value that the particular coins command. So, just for clarity, numismatists do not necessarily collect only gold and silver coins. For example, this coin from one Mughal emperor in India dates back to 1538 and is highly collectable, but made of the base metal, copper and not silver or gold.

The Birch Cent is an important piece of American coinage history and very valuable today

Again, many numismatists as well as people who aren’t numismatists also collect gold and silver coins for their value. Some collect coins as bullion, as an investment in precious metals. Others purchase historic or collectable coins that are greater in value than their just their price in gold or silver, This is due to the fact that these collectable coins enjoy great demand from collectors and their market value is decided by the price that collectors are willing to pay for them. In this article, we’ll look at 20 highly collectable coins that are not just collectable, but also a great investment.

Download our FREE Insiders Guide to successful gold investment here

1) The flowing hair dollar, USA, 1794

This was the first dollar ever issued by the US federal government as a coin, post the war of independence. The coins were originally minted in 1794 and 1795 and made of silver. The silver dollar from 1794 is one of the rarest and most valued. The coin fetched $10.01mn at an auction in 2013.

2) The gold double eagle, USA, 1933

The double eagle is a 20 dollar coin, which is otherwise known as the St. Gauden’s Double Eagle. These were minted in 1933, just before World War II. However, they were never released and ordered to be melted down. Interestingly, 20 survived and were eventually picked up by collectors, however, the US government spared no effort in recovering them and nine were taken back and melted. Most of the remaining ones are held by the US government and only one is privately held, which was purchased in 2002 for $7.59mn.

Only 20 double eagles survived out of which there is only one in a private collection

3) Brasher doubloon, USA, 1787

The Brasher Doubloon is a 22 karat gold coin minted by Ephraim Brasher in 1787. It was a coin he minted privately along with other gold coins and copper ones when he petitioned the State of New York to mint copper coins and was denied. The doubloon that survived weighs 26.6g and was sold at an auction in 2018 for $5mn.

4) $10 proof eagle, USA, 1804

The $10 eagle was issued by the US mint up to 1933. The Mint issued the first eagle in 1792. It was the largest of all the coin denominations, the others being the cent, the dime and the dollar. In October 2007, a $10 gold eagle sold for $5mn.

5) Liberty head nickel, USA, 1913

The liberty head nickel, a 5 cent coin, was produced in very small quantities, which was unauthorized by the US mint at the time. This makes it one of the most coveted coins for numismatists. Only 5 of these exist now and in 2010, one of them fetched $3.7mn at an auction.

6) The bust dollar, USA, 1804

Another name for this dollar dated 1804, which was struck post-1830 is the Bowed Liberty Dollar. There are only 15 in existence, and it is a very sought after coin. One of these coins sold for $4.1mn in 1999.

7) The birch cent, USA, 1792

The 1792 cent is an important part of US history. In 2015, this coin sold for $2.5mn at an auction. An engraving of liberty is visible on the front of the coin.

Download the 10 secrets to selling your coins at the highest price. Free pdf here

8) The quarter eagle, USA, 1808

The quarter eagle was born during the coinage act of 1792 in the US. Its value was 250 cents or two and a half dollars. Few were struck and the ones from the early 1800s are quite rare. In 2015 a quarter eagle sold for $2.35mn.

9) The rolled edge eagle, USA, 1907

The rolled edge 10 dollar American eagle weighs 16.70 grams and is made of pure gold. Only 42 were minted and in 2011, one was auctioned at $2.1mn.

10) Polish 100 ducats, Polish-Lithuanian Commonwealth, 1621

The 100 ducat coins were minted by the then ruler of the Polish-Lithuanian Commonwealth to commemorate his victory over the Turkish Ottoman invasion at the battle of Chocim. On the obverse is the head of the king in full regalia. It is the most expensive Polish coin ever minted and recently in 2018, it fetched a price of $2.1mn.

Polish-Lithuanian monarch Sigismund III released gold ducats. The image above shows the 40 ducat coin. The 100 ducat is worth 2 million dollars.

11) Barber dime, USA, 1894

The Barber Dime gets its name from the Barber coinage where it was produced. Only 24 were made and 9 have survived till date. It is one of the rarest US coins for numismatists and in 2016, one sold for $1.9mn.

12) Ummayad Dinar, Ummayad Caliphate, 723 A.D.

The Ummayad Dinar is a coin issued by the Ummayad Caliphate, to commemorate the occasion of the Caliph leading a pilgrimage to Mecca. It is a very rare Islamic coin and in April 2011 one was sold at $6.02mn.

13) Edward III Florin, Great Britain, 1343

The English king, Edward III attempted to establish

a coinage for Europe in the 1300s and coined a gold coin. The continental florin weighed only 3.5g of pure gold and was rejected by merchants and subsequently withdrawn. In 2006, a buyer paid $680,000 for one of the three surviving coins.

14) Pattern Disme, USA, 1792

The 1792 Half Disme pattern coin is thought to be the first coin struck by the US Mint. Around 200 of these survive to date. In 2014, one of the coins commanded a price of $528,750.

15) Gold 2000 Yuan, China, 1992

The China mint struck pairs of 1 kg pure gold coins, one with a seismograph design and the other a compass. The coins have been certified by NGC. Only 10 were minted and in 2011 one was sold at a record $1.29mn.

16) Confederate half dollar, USA, 1861

There are only four Confederate Half Dollars struck at the New Orleans Mint during the civil war. An NGC certified half dollar recently realised a price of $960,000 at an auction in 2017.

17) Five dollars small eagle, USA, 1795

The small eagle five dollar coin was the first gold coin introduced in 1795. The coin weighs 8.75 grams in pure gold and fetched a price of $586,500 in 2008.

18) Eagle on globe quarter dollar, USA, 1792

The eagle on globe quarter dollar was struck in copper by the US mint, and not with precious metals. However, the coin, which dates back to 1792, is an important part of American coinage history. In 2015, a job lot of a dozen coins sold for $2.2mn.

19) Lavriller pattern penny, Great Britain, 1933

By far the most expensive copper coin in the world, only four of these George V pennies were coined in 1933. In 2016, one of these coins sold for £72,000 at an auction by A.H. Baldwin and Sons.

20) Edward VIII gold proof sovereign, Great Britain, 1937

The Edward VIII gold sovereign is the most expensive coin to be coined by the Royal Mint. Due to the abdication of the King in under a year, the coin was never introduced for circulation. In 2014, the sovereign sold for a record £516,000.

Call us to know more about the best coin investments

At Physical Gold, our numismatics experts can impart valuable advice on investing in coins that are worth more than their weight in gold or silver. Call us on 020 7060 9992 or contact us via email to get in touch and find out more.

Image credits: Wikimedia commons, Wikimedia Commons and Wikimedia Commons

Essential rules to maximize your selling price

Selling your gold coins is the point at which you crystallize your profits. After all, holding gold coins doesn’t pay you a dividend. The idea is that the value of the coins rises during the time you own them. When you eventually sell them, a handsome profit awaits. Simple! Or is it?

Perfect timing and luck needn’t be relied upon. If you follow our proven step-by-step commandments, it’ll ensure you squeeze every last penny out of your investment.

Commandment 1: Thou shalt not buy obscure coins in the first place

This may sound like a lot of forward-thinking but if you want to obtain the best possible prices for your gold, then you need to consider this even before you buy coins. That’s because not all gold is created equal. In a similar way to buying and selling property, some gold coins are deemed very liquid and others are far more obscure and may prove difficult to sell. It’s comparable to buying a 2 bedroom flat, close to a main station in the UK, rather than a quirky property in the middle of nowhere, that only a small handful of people will like.

Remember, the larger the buyer market for your particular coins, the easier it is to sell, and the better value you’ll receive. Play outside of these guidelines and you’re playing with fire. It may well be that you buy a strange and wonderful gold coin which was either ‘going cheap’ or had a fantastic design, but when you try to sell, no one wants it.

Investing in obscure gold coins is a huge mistake

Infact, the three key things that you need to focus on when building your gold portfolio are liquidity, variety and value. Focusing on liquidity gives you the opportunity to rake in your capital at the time when you need it most. By buying obscure coins, you are defeating the very purpose of your investments. In order to capitalise on liquidity, your coins need to have a strong secondary market. Some of the most liquid coins in the world are the Britannia, the Krugerrand and the Sovereign. Invest in these and you can’t go wrong.

Of course, variety should be in another point of focus. As you continue to build your portfolio, you need to invest in gold and silver coins of different weights and dimensions. This ensures that you can sell off small portions of your holding at different price points in the market, rather than being forced to sell a large piece of gold at one price. Selling at different price points help you take advantage of rises in the spot price of gold. Value is yet another consideration.

You will probably find that you make end up paying hefty premiums for rare obscure coins. These types of coins are mostly purchased by amateur investors who end up believing that the coin they are buying is indeed something of great value. Sadly, at the time of selling, they are unable to recover the premium they paid. The best strategy to build value is to buy coins that have low premiums so that your capital outlay is minimal. Once the price of gold rises, you can sell off your investments at a decent profit margin.

Avoid buying obscure coins as they’ll be hard to sell

Commandment 2: Thou shalt consider Capital Gains Tax

When you buy gold coins, focus on the best-known investment bullion coins. In the UK, that means focusing on coins issued by The Royal Mint; like various Sovereigns and Britannias. One way to maximise your selling price is to avoid paying any Capital Gains Tax (CGT) on your profits. This can easily be achieved by sticking to UK coins. These coins boast their own face value, qualifying them as CGT free. This way you get to keep all your profits rather than pay the taxman.

Can I avoid CGT even with non-UK coins?

If you have non-UK coins to sell, then offloading a large quantity all at once may incur capital gains tax on your profit. To maximise your profit, sell some before the Apr 5th tax year end, and the rest afterwards. Spreading the sale over two tax years could save you thousands in tax.

Discover other useful tips in our FREE Insiders Guide. Download Now

How about well-known non-UK coins?

Some of the non-UK bullion coins are also very liquid;

Commandment 3: Thou shalt give your dealer some notice when selling

Wishing to sell your gold coins immediately is one thing. But giving a dealer a few weeks means they can hook your sale up with a keen buyer. A really good gold broker will be able to work with you to achieve higher prices for your coins. They’ll have a large number of buyers and sellers on their books, so pairing buyers and sellers together can improve value for both parties rather than simply selling your coins back into the wholesale market.

Communicate your wishes early

Give them time to find a buyer (or buyers) who wants your coins. So, rather than calling your dealer on the day you wish to sell, call them a few weeks before you need the money. Let them know you’re keen on selling over the coming weeks and perhaps set a deadline. Any dealer worth their salt, will share this with their team and actively find buyers so they can improve your selling price. It may only improve the price by a percent or two, but this can add up to a lot in Sterling terms if you’re selling a large number of gold coins.

Commandment 4: Thou shalt not buy proof coins in flashy boxes

Proof coins are beautiful to look at.

Trying to sell proof coins can be difficult

They tend to have a matt finish foreground detail with a shiny background. This makes the coin designs look more like Ultra HD TV than the Standard definition-like bullion finish coins. However, if you want to maximise the price you get when selling coins (and therefore boost your profit), then proof coins don’t represent good value. Most will be accompanied by expensive wooden presentation boxes when bought and include a certificate detailing the coin and its limited issue number. Like for like prices for a proof coin versus its bullion counterpart can be as much as 30% higher, for the same amount of gold.

But surely I’ll get more for a proof gold coin when I sell?

In all likelihood, a gold broker would pay you the same for a proof or bullion coin, or at most a few percent more. Almost always, you won’t receive back 30% more than you would a bullion coin. If you want to maximise your selling price (certainly in relation to your buying price), then stick to bullion coins. They’re cheaper to produce and buy, and far better value when you come to sell.

Commandment 5: Thou shalt plan ahead when thinking of selling gold coins

If you’re willing to plan ahead rather than leave your sale to the last minute, you can sell when the market spikes. While the gold price rises over the medium to long-term, it can be notoriously volatile in the short term. In any short-term window, the underlying price can vary considerably, and that’s the first reference point for the value of your gold coins. Preparing your sale ahead of time enables you to have everything in place to quickly close the sale when you see a daily spike in the price.

Commandment 6: Thou shalt love and cherish your coins

This is a simple one. Just like maintaining your property, gold coins are physical assets, so your price will be affected by their condition. Keep your coins safe and handle with care. This is especially necessary with 24 carat coins which can scratch, and then impact your sale price. Wash in warm soapy water if dirty. Plastic coin capsules can be purchased from dealers to house the coins, so you can still handle and enjoy them, without actually touching them.

Look after your coins to ensure they fetch the best price

Commandment 7: Thou shalt invest in a variety of gold coins

Did someone say that variety is the spice of life? Well, the same applies to gold coin portfolios. If you own all of the same coins, then you obviously only have one type of coin, and one price, when it comes to selling. This isn’t a major issue, especially if you stuck to some of our other commandments and bought UK gold coins.

But! We’re in the business of squeezing out every last penny of profit possible for you. And that may mean owning a variety of UK coins. Ideally, owning British tax-free coins of various sizes will add to your portfolio balance. So, depending on the number of coins you buy, that may be some half Sovereigns, full Sovereigns, Quarter and Half Britannias, £2 coins, 1oz Britannias, Lunars and Queens Beast coins, and perhaps some nice chunky £5 gold coins. Owning various age coins adds another dimension again. So, mixing brand new, nearly new and semi-historical coins can actually enhance your chances of maximising profits. Read our Do’s and Don’ts of buying gold.

How does owning various size and age UK coins help me?

First of all, some of the older coins can increase in value quicker than newer ones, depending on scarcity and demand at the time you buy and sell. The same can be said of £2 and £5 gold coins which usually include a commemorative element. For this reason, these coins can obtain better selling prices than new ones.

The key is owning a variety, as the supply/demand dynamic for each type of coin is fluid. In other words, at the point you come to sell, it may be that Edward VIII Sovereigns (for example) are trading at a premium due to a relative supply drought in the market. Alternatively, Victorian coins may be trading cheap due to a spike in secondary market supply. Or even Elizabeth coins may be sought after if our cherished queen has passed away. By possessing the different size and period coins, your gold dealer should be able to match selling your coins with the optimum time.

Premiums can vary up to 5% for regular coins and 20% for limited issue coins, so timing shouldn’t be underestimated.

Commandment 8: Thou shalt shop around when selling gold coins

The price one dealer pays may not be the same as another. At the end of the day, they run a business with stock. So, it may be that one dealer will pay less for coins if they already have a huge stock than another who could benefit from the additional stock.

You may also find that certain gold brokers simply pay more for certain coins than others. We tend to pay market leading rates for UK tax free coins such as Sovereigns and Britannias; as investment coins are our niche. We probably pay less for some more extravagant coins.

Commandment 9: Thou shalt use a reputable dealer

Using a trusted gold dealer means you’ll receive gold

of the finest quality and which is protected. Your gold should be supplied with a Certificate of Authenticity, meaning you have authentic paperwork when you come to sell. The dealer you purchase from is the one you should approach first about selling your gold, as a reputable dealer should have a ‘Buy Back Guarantee’.

How about selling privately?

Certainly, if you have older coins, taking the time to find a private buyer or a specialist dealer may increase your sale value.

While a dealer needs to consider selling your coins on, whether to other customers or into wholesale, private buyers will simply pay a price depending on their desire.

Especially if you own limited issue coins, coins that are part of a collection, or gold coins of 100 years in age or more, then finding a private buyer may unlock further profits. Clearly, there are additional risks when dealing with individuals, and it will undoubtedly take far more time and effort to sell coins off piecemeal. For these reasons, you’ll need to weigh up your priorities and sell accordingly.

Commandment 10: Thou shalt think long term

Many investors (usually failed ones!) think that timing and luck play a huge role in investing. This is driven by laziness, greed and impatience. The appeal of buying gold coins at the very bottom of the market and selling them a week later at a huge profit is sometimes what drives many to bad decision making.

Enjoy our YouTube video – “Gold coins – collecting as a hobby and for profit”.

The fact is that the price of gold and the subsequent value of gold coins fluctuates. Over the short term, there’s a fair chance that the market will be lower than when you bought. That’s because there’s a vast array of elements that can impact the gold price on the macro-economic level. In other words, over the short term, the performance is unpredictable. Not only that but there’s a difference in price between where you can buy a gold coin and sell it. This is known as the bid-offer spread. In practice, trying to buy gold coins and sell for a profit in a very short time period, won’t give the market long enough to overcome the buy/sell margin.

Planning and long term investing will maximize returns

So how can we use this knowledge to increase my profits?

There are two strategies to surmount this challenge. Firstly, try to buy the gold coins in bulk. Gold dealers generally offer discounts with quantity orders. If you plan to buy 100 gold coins, try to do this in one purchase. Then you’ll achieve a larger discount than if you buy 25 coins on four separate occasions. This tactic essentially reduces the buy/sell spread, furthering your profit margin and reducing the amount of time needed to be in profit.

Secondly, and more crucially, you need to buy and hold over the medium to long term. This timeframe irons out any short term volatility and negates the chances of bad luck and timing. Just looking at the last decade, while gold returned north of 30% in 2010 and 2016 for example, it lost 27% in 2013. Buying gold coins and selling them within a year could have been very profitable but also could have been very painful, all depending on which year you chose! However, when we average the returns over the entire 10 year period, price increases are more than 10% per annum. Compound that over the decade, and profits are very handsome indeed.

Winning approach

Not only that, but studies show that this buy

Buy and sell your gold coins with Physical Gold Limited

Whether you’re seeking to buy or sell gold coins and bars, the Physical Gold team of dedicated specialists are here to help. We’re able to share our expertise and network to ensure you maximize your precious metals profits.

Our team can be reached by calling 020 7060 9992 or emailing info@www.physicalgold.com

All collectors, irrespective of whether they’re philatelists, sigillographers or numismatists, require certain accessories to store or display their collections. While investing in bullion is not the same as numismatics, investors who have purchased gold coins require protection for their assets. A range of accessories is available to store your gold coins safely, as well as ensure that the coins do not get damaged in any way, thereby reducing their value. www.physicalgold.com understands the requirements of gold and silver coin investors and have a range of useful and stylish accessories that you can choose from.

Coins need to always be stored in capsules to prevent damage

Coin capsules

Acrylic coin capsules are a great way to store your valuable

Storage accessories

Storing your gold at home can always be a risky business. Homes usually do not have the failsafe security devices that can be found in a bank or a secure storage vault facility. Your home is always vulnerable to a break-in by burglars. In the event of such a calamity, your precious metals are always at risk. In order to safely conceal them in your own home, it’s important to invest in innovative storage solutions for your home that can store your precious metals safely away from being discovered by criminals. An excellent solution is the secret stash wall clock. It looks just like an ordinary wall clock but opens up and has a storage compartment inside to store your gold coins, bars and jewellery.

So discrete, it looks like part of the wall!

Yet another innovative hidden storage solution is the wall socket hidden storage. It looks exactly like a standard UK electrical plug socket on the wall but opens up to reveal a deep cavity in which your bullion can be safely hidden away. These practical, yet clever storage accessories are unique and great as they conceal your precious metals right under the very nose of the burglars. So, while they’re searching for drawers, cupboards, walls and floorboards, they don’t realise that your valuables are in a very visible place. Lastly, there’s the lockable cash box, which is a great storage solution, although it isn’t a concealed one. Once you’ve put your precious metals in the box, you have to find a safe place to hide it.

Luxury presentation cases

At www.physicalgold.com, we have quality presentation cases that come along with acrylic coin capsules. The cases are primarily for storing full or half gold sovereigns and can accommodate 10 coins in each case.

Call us to find out more about coin accessories

Our team consists of coin experts who can advise you on the best way to store your coins so that it stays in mint condition for years to come. Please call us on 020 7060 9992 or get in touch online to speak with a member of our team.

Image credits: Pixabay

Gold coins hold a great attraction for many of us from the time we are children. The very mention of gold coins conjures images of hidden treasure and old wooden chests full of coins in our heads. For more serious buyers of collectable gold coins, numismatics is more than just a hobby. It is an investment, which they hope will reap rich rewards in the years to come. Yet another class of investors choose to buy gold bullion as an investment and not as a collectable. Many of these investors prefer to buy their gold bullion in the form of coins.

Why coins?

Coins are easy to store and come neatly wrapped in their own packaging or stacks loaded in cases. They can also be sold or liquidated in smaller quantities, as opposed to gold bars (especially 1KG bars), although smaller bars such as 100g and 1oz can be bought.

Gold coins are also preferred by many for their aesthetic value, in addition to their convenience, when it comes to storage and disposal. Several investors see these investments as an integral part of their portfolio expansion strategy and hedging of risks.

If you’re an investor, looking to invest in gold coins, here are a few things you should know. Also, check out our beginners guide to gold terms here.

Thinking of buying gold coins for investment? Get the FREE cheat sheet first

The authenticity of gold coins

If you’re unsure whether the gold coins you just received are real are not, the best way is to take them down to a gold expert to ascertain their authenticity. However, there are several things you can do at home to check whether the coins are real. We must remember that precious metals are incredibly dense. This means if the weight of the coins you bought is right, the size would be too large. In the same way, if the coins are forged using a base metal and the diameter and thickness are accurate, the coins would be too light.

So, simply measuring the diameter, thickness and weight of the coin and confirming that it’s accurate could be one way of making sure that the coins are genuine. This test can be done at home with a set of inexpensive tools, such as a set of Vernier callipers and a jeweller’s scale. Another home test involves using a magnet. Since gold coins (such as Sovereigns and gold Britannias) are not magnetic, the magnet should drop off instantly.

Establishing authenticity when purchasing gold coins is really important

If you’re a more serious investor, you could also use a device called a Fisch Tester to test your coins. The device measures 4 parameters, namely the thickness, diameter, weight and shape of the gold coin to ascertain its authenticity. While the tool is effective, you might have to purchase different testers for each different coin that you buy. Each tester and its parameters are designed to fit different coins like the Krugerrand, American Eagle or the Canadian Maple Leaf. Buying so many of these machines is likely to set you back a bit, and is only worth the investment if you’re an avid buyer of gold coins.

Smart apps to test your gold

There’s an app for everything these days, and sure enough, there’s one to test the authenticity of your gold coins as well. These apps work on the ‘ping’ test and can detect whether or not your gold coin is genuine, simply by the sound it makes. The first of these apps is called Coin Trust and you can test your coin by selecting the specific coin you want to test from a drop-down menu within the app. Next, spin your coin on a hard surface and just have your smartphone microphone nearby. Yet another one that works on the same principle is called the Bullion Test app, and you need to balance the coin on your fingers and hit it to produce a sound.

Certified gold coins with very high purity is a great addition to an investment portfolio

Buy from a reputed gold coin dealer

A reputed gold coin dealer will usually provide you with a 10 commandments certificate of authenticity from a bona fide coin certification agency like the PCGS or NGC. Once you are satisfied with your purchase, do not open the original packaging or the slab that the coin came in. If the packaging is removed, it could cast doubts on the purity or authenticity of the coin when you plan to resell it. When buying in bulk, aim for a discount!

Call us to discuss your gold coin investments

The Physical Gold Limited team of gold coin experts can guide you on how to buy gold and make the right coin purchases, as well as ascertain the authenticity of your purchases. Call us on 020 7060 9992 or email us to connect with our team. The right advice can help ensure you buy the right gold coins and help you get great returns on your investment in the long run.

We can also advise on silver investments too, such as silver bars (e.g. 1 kilo) and silver coins (e.g. silver Britannias).

Image credits: Money Metals and Motoyen

If you’re a numismatist, the British Gold Sovereign is an absolute must-have for your collection. But, before you actually put down your money and buy these beautiful collectable gold coins, it’s important to know more about them, how to buy them and what to look for. In this article, we take you through all that you need to know about buying a Sovereign. Also, be sure to read our beginners guide to buying gold.

The gold sovereign

The Sovereign is a 22-carat gold coin that is the flagship product of the Royal Mint, which also manufactures the gold Britannia. It measures 22.05 mm across and has a thickness of 1.52 mm. The coin weighs 7.98 grams, with a fineness of 916.7. Over centuries, the Sovereign has remained an integral part of the coinage of Britain and has never lost its unmistakable charm.

Early days…

The sovereign was first introduced in 1817 and had a nominal value of a pound. The coin was earlier in circulation but has now been accepted as a bullion coin. The 1817 edition features the iconic design of St. George and the dragon on the reverse. The design was created by world-famous designer, Benedetto Pistrucci, as part of the great re-coinage and the coin has his initials on it as well. The sovereign was taken off circulation in 1914 at the start of World War I. It was never reintroduced after the war, but the circulation of the already issued editions continued in other parts of the world, including the Middle East. Due to rising demand across the world, the Royal Mint struck new sovereigns in 1957. One of the reasons behind the popularity of the sovereign across the world was the fact that it was a reputed and trusted coin, containing an amount of gold that was known and could be easily verified.

Read our Insider’s Guide to buying Gold Sovereigns here

The sovereign is an iconic landmark of British coinage

Buying gold sovereigns

When you buy gold sovereign coins, you are investing in gold bullion. This is a very stable and secure asset class and is classified as a Capital Gains Tax (CGT) free investment in the UK. Gold sovereigns are more divisible than gold bars, with a 1 kilo gold bar being out of the reach of many investors.

However, when investing in gold, it’s important to find a reliable and trusted dealer. Buying gold sovereigns from Physical Gold is very easy. We provide you with a certificate of authenticity and all the sovereigns we sell are vetted by numismatists. We are also able to offer you storage facilities, along with insurance that protects your purchase and underwrites any risks.

Should I buy new or old Sovereigns?

With their long and illustrious history,

But that’s not the full story…

Older Sovereign coins can be classed as semi-numismatic. In other words, their value now consists not only of its gold content and production values but also possesses an element of scarcity and history. Coins may be less shiny than brand new Sovereigns, but due to their optimum 22-carat alloy mix, they’re far more resilient than 24-carat coins which can mark more easily. Prices are generally higher than for new Sovereigns due to these elements, however, their resale value is also higher, and there’s a greater chance that the older coins will appreciate in value quicker than new ones, especially if supply becomes particularly tight in the secondary market.

How about buying Halves, Fulls, or Double Sovereigns?

Another choice you need to consider when buying Sovereigns is which size to buy. For many years now, the UK Sovereign has been produced in four sizes. The smallest is the half Sovereign, next up is the classic full Sovereign coin, then the Double Sovereign (also known as £2 gold coin), and finally the largest is the Quintuple Sovereign (or £5 gold coin). All have their merits, with the half Sovereigns providing extra divisibility, and the £5 coins offering unparalleled satisfaction due to their impressive size. Generally, the smaller coins are more expensive per gram to buy, due to their relatively higher production cost. However, some £2 and £5 coins are also commemorative coins, so can trade at far higher values than simply their multiple of the full Sovereign.

How can I best use this info?

Depending on how much you wish to invest in gold Sovereigns, and your particular objectives and timeframe, we always recommend buying a mix of Sovereign sizes and ages. The newer and larger coins can help bring down the overall cost of your portfolio. The smaller coins can provide flexibility to sell small quantities in the future. Older coins and collector’s editions can help achieve quick possible price rises if the coins become scarce. As with investments in general, a mixed portfolio will always be preferable to owning all of the same assets.

Call us to buy sovereigns

You can order gold sovereigns online via Physical Gold. Our online process can provide you with great value for money. We have a membership of the British Trade Numismatic Association (BNTA), allowing you to buy with confidence. The buying process is very simple, however, if you would first like to speak with a member of our team of experts, call us on 020 7060 9992.

In our video, we answer the question – “Gold Britannias or Gold Sovereigns – which is the best investment?”

We endeavour to provide the best customer service and can offer you great deals on gold sovereigns, particularly for bulk purchases. Since we do not deal with any form of online or paper gold, you can rest assured that the gold you buy from us is physical gold of the highest quality, which can be a prized investment in your portfolio for years to come.

We also sell silver in the form of silver coins (like silver Britannias) and silver bars (such as a 1 kilo silver bar).

Image Credit: Money metals

Mintmarks are small indentations that have been stamped onto a coin to show from which mint it has been produced. They were originally introduced so that if there was a problem with a coin – i.e it was underweight or contained less metal than specified, then the owner could tell exactly which mint was responsible. In other words, a mintmark is a guarantee or mark of authenticity to prove that a coin has been produced exactly as has been specified.

Mintmarks throughout history

The first mintmarks were produced by the ancient Greeks and were known as Magistrate marks. At the time Magistrates were among the top-ranking government officers in Ancient Greece and were responsible for the production of coins. The magistrate mark symbolised the name of the magistrate who had overseen the production of that particular coin.

Proof of origin

The ancient Romans also used marks to determine from where a coin was produced, and mint marks were a regular feature of Roman coinage. Often these marks could be found at the bottom of the reverse side of a coin and contained three parts. The name and location of the mint and the workshop contained within the mint.

An example of a Soho mintmark on an old British Cartwheel Twopence

The importance of mintmarks for coin collectors

Certain collectors who display an interest in numismatic coins take particular interest in mintmarks. Sometimes it can make a huge difference in the value of a coin and knowing what makes certain mintmarks more collectable and where to locate them is part of what makes a coin collecting such an exciting pastime. A rare mintmark mark can add thousands to the value of a coin.

British Mintmarks

The Royal Mint has been responsible for minting coins

What’s the story with modern coins?

One defining factor of the Royal Mint is that it doesn’t often use a mintmark for British coins. For example, gold Sovereigns that are minted in the UK feature no mintmark at all whereas sovereigns that have been minted in branch mints overseas all feature their own unique lettering to represent where they have been produced. For example, sovereigns minted in Sydney feature the letter S, Melbourne M, Perth P, Ottawa C and so forth.

Purchasing gold and silver coins through Physical gold

Physical Gold is one of the leading dealers of gold and silver in the UK. We offer investors the chance to invest in a wide range of gold and silver coins including our huge selection of gold Sovereigns. For more information or any additional advice on how to invest in gold and silver, please give us a call on 020 7060 9992.

Image Sources: Wikipedia

This year marks the 50th anniversary of the 1968 gold sovereign. The last gold sovereign to portray a young Queen Elizabeth II and the last sovereign to be issued before decimalisation (in 1971).

The obverse of 1968 UK Gold Sovereign

Elizabeth II young head sovereigns were issued between 1957 and 1968 and are considered highly collectable due to the fact they were the last sovereign to depict a younger-looking Queen Elizabeth II. Although gold sovereigns were no longer issued for circulation after 1932, the production of gold sovereigns has continued in order to meet the growing demand for gold coins. There were no proofs minted of the 1968 gold sovereign and a total of 4,203,000 sovereigns were produced that year.

Want to learn how to profit from Gold Sovereigns? Download the 10 Commandments now

A history of the gold sovereign

The first gold sovereign was minted in 1489 on the orders of King Henry VII. The idea was to make a statement in order to symbolise the countries strength and unity after years of civil war and turmoil. At the time it was the largest gold coin ever minted in Britain.

Following the King Henry VII sovereign, succeeding monarchs each chose to strike a new version of the gold sovereign as a way of displaying their own power and strength, however, this practice died out after the reign of Elizabeth I. It wasn’t until George III decided to replace the guinea with a new gold sovereign 214 years later that the coin was reintroduced into circulation. Since then the sovereign has gone on to become one of the UK’s most prized, most sought-after coins and it is still highly valued by many coin collectors today.

The reverse of 1968 UK Gold Sovereign

Why gold sovereigns make great investments

Gold sovereigns are one of Britain’s most striking and beautiful coins,

Due to the fact that gold sovereigns are classed as semi-numismatics, (coins whose value is based on their numismatic value as well their bullion value) they often trade above the gold value, making them attractive investments for collectors. Gold sovereigns are also fairly liquid should you need to raise funds quickly and investors from all over the world are interested in purchasing them which means that you won’t have any trouble finding a buyer.

To learn more watch our related video – “5 Reasons to buy gold sovereigns”

Purchase gold sovereigns through physical gold

We stock a huge selection of gold sovereigns including those produced from 1957-1968. Click here to browse our complete collection. Whatever your requirements, whether you’re looking for single investment opportunities or help to select a mixed portfolio of gold bullion coins, we can assist. Why not give us a call on 020 7060 9992?

Opportunity for gold bars and coins in China

China is one of the largest buyers of gold bars and coins in the world. A global report

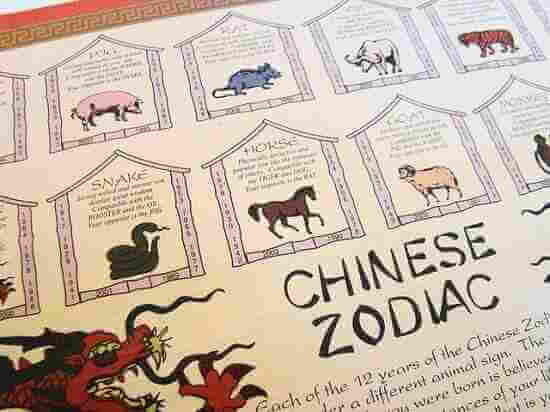

The year of the dog 2018

The Chinese zodiac plays an important role in investment decisions made by gold investors in the country. 2018 is the year of the dog and there are lucky days like the 7th and 28th of every Chinese lunar month. Lucky numbers included combinations of the integers 3, 4 and 9. Lucky months were the 6th, 10th and 12th month of the Chinese lunar calendar. Studies found that people born in the year of the dog along with the gold element made them attractive to members of the opposite sex. According to Chinese astrology, the yellow metal has influences on people born in the year of the dog. When gold is worn by these people, it is said to make them firm in their convictions, with high principles, noble and charitable. Previous years of the dog since the 1970s were 1970, 1982, 1994 and 2006.

The Chinese zodiac is a powerful influence on gold buyers in China

Year of the dog gold coin issues

The Australian Gold Lunar Series 2 Year of the Dog coins are available in 1oz, 1/4 oz. and 1/10 oz. These are a great series of coins issued by the Perth Mint with 99.9% pure gold. The 2016 Year of the Monkey gold 1oz. coins enjoyed immense popularity and are currently priced at £1,035. The Australian issue for 2018 also features a one-kilo coin made of 99.9% pure gold, the largest and heaviest coin in the series. The coins feature a portrait of Queen Elizabeth II on the obverse and a lovely Labrador retriever dog on the reverse. The coins were designed by Ing Ing Jong at the Perth Mint and are legal tender across Australia.

Discover the 10 rules to ensuring you always get the best price for your gold coins

Not to be left behind in the race to commemorate the Year of the Dog from the Chinese Zodiac, the UKs Royal Mint has also issued their design of the 1oz. gold bullion coin. The coins are VAT free for investors across Europe, as well as CGT (Capital Gains Tax) exempt in the UK. The Royal Mint has created a series called the Shengxiao Collection and this coin is the fifth lunar design to feature in that collection.

The Canadian Mint has also issued a limited edition gold coin to commemorate the Chinese Year of the Dog. The coins have a face value of 150 CAD, made with 18-carat gold and weighs 11.84g. The edition is limited to 1500 coins worldwide. It is the 9th coin in the lunar series issued by the Canadian Mint.

Call us to invest in Chinese Zodiac gold coins

Our team of experts at Physical Gold are always available to advise you on buying gold bullion. Call us on 020 7060 9992 or get in touch via email before investing in gold coins. We deal in collectible gold coins and may be able to procure specific gold coins for your collection. One of our advisors can guide you through the process of investing in gold and help you make an informed decision before you invest your hard-earned money.

Image Credit: Flickr