The Britannia is one of the most famous coins ever released in British coinage history. It is the pride and joy of the Royal Mint and also forms the backbone of any precious metal coin portfolio. The Britannia is available in both gold and silver and offers tremendous liquidity to the portfolio of an investor. Due to its reputation as one of the best-known coins in the world, it is easily saleable for cash.

The Britannia coin

The Britannia gold coin is a 1-ounce coin with a purity of 999.9 and a face value of 100 GBP that was launched by the Royal Mint in 1987. It is available in bullion and proof finishes, as well as fractional sizes. The Royal Mint also introduced a silver Britannia coin in 1997, which has a face value of 2 pounds. The silver Britannia contains one Troy ounce of fine silver. Both the gold and the silver coin feature a portrait of the reigning British monarch, Queen, Elizabeth II on the obverse of the coin. The reverse of the coin features the classic image of Britannia. The event featured on the coins issued from 1987, was designed by Philip Nathan. In 2018, the Royal Mint also released a Platinum version of the Britannia coin that contains one Troy ounce of Platinum and has a face value of £100.

The iconic image of Britannia above Somerset House in London

Who was Britannia?

In 43AD Britannia meant Roman Britain. This was an area to the south of what is known today as Scotland. In 197AD Roman Britain was divided into 4 provinces and 2 of these were Britannia Superior and Britannia Inferior. Britannia was the name given to this Island. In the 2nd Century, Roman Britannia was what is recognised today as the goddess armed with a trident and shield. Britannia was featured on all modern British coinage until being redesigned in 2008.

The Romans used the term ‘Britannicae’ to refer to the British Isles. The inhabitants of Britain were called ‘Britons’ at the time. Another name for the people of the British Isles used by the Romans was ‘Britanni’. Since the British Isles represented the furthest territory of the Roman Empire, it became symbolised with the goddess of warfare and water. Roman mythology portrays a goddess called Minerva, who is popularly known as the torchbearer of arts, commerce, strategy and wisdom. The image of Britannia was based on the icon of goddess Minerva and came to personify the British Isles over the years.

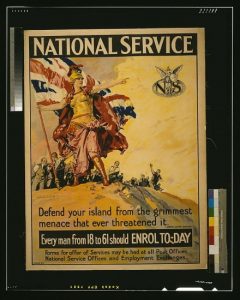

A World War 1 Poster depicting Britannia

Reinforcement of the Britannia image

After the invasion of England by the Anglo-Saxons, the ethnicity of the country changed drastically, with the exodus of the original Celtic Britons. However, years later, as Queen Elizabeth, I combined England, Scotland, Ireland. and Wales and significantly increased the nation’s naval power, the image of Britannia was restored as a representation of the nation’s power and the Queen. This was further reinforced during the reign of the great Queen Victoria when the British Empire became the most powerful empire in the world and Britannia ruled the waves. The iconic image of Britannia was then put firmly in place to represent the power of the British Empire, and its monarch.

Physical Gold can assist you in purchasing Britannia coins

Whether it’s gold Britannias or silver ones that you’re after, our coin experts at Physical Gold can advise you on how to get the best deals. Call us on (020) 7060 9992 or drop us an email and a member of our team will reach out to you at the earliest.

Image credits: Alastair Rae and Picryl

The silver Britannia has won its place in British coinage history as one of the most iconic UK coins to be ever released. The coin was introduced in 1997 and had a fineness of 95.8% in its original issue. The 1-ounce silver coin reflected the design elements of the original gold Britannia, which was introduced by the Royal Mint 10 years earlier. The popularity of the gold Britannia prompted the Royal Mint to start minting a similar coin using silver. Within two years of its release, the fineness of the silver Britannia had been increased to 99.9%. Needless to say, the 24-carat silver coin enjoyed immense popularity amongst collectors and investors alike.

The image of Britannia used in an earlier British coin

The iconic design

The silver Britannia, like its gold counterpart, features the classic image of Britannia on its reverse. The Britannia icon was possibly conceived as early as Roman times. It is the image of a goddess warrior, carrying a shield and a trident. This classic image is a testament to the spirit and bravery of the people of Britain. The design elements used in the silver Britannia coin was created by the famous designer, Jody Clark. The obverse of the coin features an image of our reigning Queen, Elizabeth II. Since its issue, the coin has seen some changes in design and mintage with different weights and dimensions.

Silver Britannias are the most popular silver investment coin in the UK. They represent very good value as they are mass-produced to bullion finish which keeps production costs low. They are legal tender, so any gains made are also tax-free.

Investors are keen to invest in silver coins, like this USA silver dollar bullion coin

The value of a silver Britannia for an investor

The value of the coin is dependent on the spot price of silver. As a thumb rule, the coin can fetch a sale value of approximately the 1-ounce silver spot price. Generally, the sale price would be just under the spot price of silver, unless the coin commands a premium due to a collector’s edition. The bullion version of the coin is mass-produced and attracts low premiums. In addition to this, bulk orders of the bullion coin can qualify for attractive discounts, when buying from a reputed dealer. The best part is that the silver Britannia offers investors an incredible opportunity to enter the precious metals market at a lower price point. On the other hand, the gold Britannia is a prohibitively expensive coin to buy.

The rising price of silver

One of the reasons that the coin has enjoyed popularity amongst investors is the expectation that silver prices will eventually rise in the future. The use of silver in industrial applications has grown over the years and will continue to rise in the coming years, as electronic cars, solar power solutions and other electronic products continue to dominate the marketplace.

However, the production of silver has dipped over the years. Market experts believe that a price rise is imminent for silver, and investors who purchase silver Britannia coins today can expect to book healthy profits once the price of silver reaches its peak.

The precious metal experts at Physical Gold can advise you on buying silver coins

Physical Gold is one of the country’s most reputed gold and silver dealers, who offer free advice to precious metal investors. Call us on (020) 7060 9992 or drop us an email by visiting our website, and a member of our team will be in touch with you to discuss your silver investments.

Image credits: Wikimedia Commons and Snappygoat.com

Silver Britannia coins have become a popular investment vehicle for investment in silver. Regularly we are asked questions about these coins, so have summarised some of the most popular questions and provided answers in this silver Britannia coins FAQs guide.

Are silver Britannia coins a good investment?

Click here https://www.physicalgold.com/insights/are-silver-britannia-coins-a-good-investment to read our detailed answer to this article.

How to buy Britannia silver coins

Visit https://www.physicalgold.com/insights/how-to-buy-silver-britannia-coins for a detailed answer to this question.

What are Britannia Silver coins?

Click here to read our detailed answer.

What is the value of Britannia silver coins?

We have created a comprehensive answer to this question. Click here for details.

Is there a limit on Britannia silver coins mintage?

Please click this link to read a detailed reply to this answer.

How do I sell silver Britannia coins?

As a popular investment coin, the easiest and safest way to sell them is to a reputable precious metals dealer. This enables you to agree on a competitive price with the dealer, send them your coins, and receive payment quickly. An alternative is to sell privately where collectors may pay a premium. However, this can be fraught with danger.

Buy and sell silver Britannia coins with Physical Gold Limited

Are Britannia silver coins legal tender?

Absolutely, they are legal tender within the UK. They possess the requirements of featuring the monarch’s bust and a face value, £2 in the case of the 1oz version. In theory, you could use it to buy goods up to the value of £2 in a UK shop, however, the silver content alone, makes the coin worth many times that. In practice, the legal tender status increases the coins’ appeal as an investment as this qualifies it as tax-free.

Silver Britannias vs American Eagle

Read our article – by clicking here for an answer to this question.

Any more questions? Speak to us at Physical Gold Limited

We always welcome enquiries, so if you have any further questions about silver coins, including Britannias then please do not hesitate to get in touch. Call Physical Gold Limited on 020 7060 9992 or complete our contact form to start discussions.

The Silver Britannia

The Royal Mint released the silver Britannia in 1997 as the silver counterpart of its flagship coin, the gold Britannia. The initial edition of the silver Britannia contained 1 ounce of silver with a fineness of 95.8%. All the design elements of the original gold Britannia were replicated in the silver version. By 1999, the silver Britannia had a fineness of silver content upgraded to 99.9%, or 999.9. This move by the Royal Mint made the coin attractive to investors and the demand for the silver Britannia soared.

The launch of the silver Britannia was an important event for the Royal Mint and the award-winning designer, Jody Clark was brought in to design the coin. She ensured that the reverse of the coin displayed the iconic image of Britannia, a testament to the bravery and spirit of the inhabitants of the British Isles during Roman times. It is this unmistakable image, coupled with the portrait of our Queen, Elizabeth II on the obverse of the coin, that makes the silver Britannia, a highly collectable and valuable coin for investors.

The silver Britannia is a highly collectable coin

The American Eagle

The American Eagle is a silver bullion coin minted by the United States Mint and is now considered to be the official silver bullion coin of the country. The coin was first minted in 1986, which is a year earlier than the release of the gold Britannia by the Royal Mint. Like the silver Britannia, the American Eagle is a 1-ounce silver coin, containing one Troy ounce of silver and a face value of a dollar.

Silver content

The content, weight and purity are certified by the United States Mint and the coin is minted with 24-carat silver, having a purity of 99.9%. Apart from the bullion version, the US Mint also produces a proof version of the coin and an uncirculated version, which is aimed at numismatists and collectors. When we speak about the United States Mint, it does not imply that there is only one manufacturing location, in reality, the American Eagle is usually struck at the Philadelphia Mint, the San Francisco Mint and the Westpoint Mint.

The American Eagle silver coin is available as a bullion coin

Design

The obverse of the American Eagle features a motif called ‘The Walking Liberty’. This theme had been used in previous coins produced by the United States Mint. It also contains the phrase, “In God we trust”, which is visible in many American coins. The reverse of the coin was originally designed by John Mercanti. The reverse portrays an image of a Heraldic Eagle, behind a shield, holding an olive branch. The Great Seal of the United States is also visible above the Eagle, along with 13, five-pointed stars, which represents the colonies.

Comparison of the two coins

Both coins are world-renowned and produced to a number of finishes. The Britannia can be bought slightly cheaper in the UK and has an increased fineness of 999.9 versus the Eagle’s 999.0. Both can be easily sold anywhere in the world. The Britannia is preferred within the UK due to its Capital Gains Tax-free status, whereas the silver Eagle is more popular in the US and Canada.

Talk to Physical Gold for all your silver coin purchases

Physical Gold is one of the country’s most reputed coin dealers and gold and silver merchants. We are registered with the BNTA and our advisors can help you make the right decisions when purchasing silver coins. Call us today on (020) 7060 9992 or drop us an email by visiting the contact page on our website.

Image Credits: Eric Golub and Public Domain Pictures

The silver Britannia is an iconic British coin introduced by the Royal Mint. These are 1oz coins minted by The Royal Mint to a purity of 999.9 silver. They were first issued in 1997, 10 years after the gold 1oz Britannia, and have become a very popular choice for physical silver investors. They can be bought at relatively low prices as they’re minted to bullion standard and large numbers. They have a face value of £2 which means they’re legal tender and therefore any rise in value is free from Capital Gains Tax.

In 1987, the Royal Mint introduced the gold Britannia coin. The coin enjoyed popularity amongst investors and the silver Britannia was introduced into the market to replicate the success of its gold counterpart. Although the coin was upgraded to 24-carat silver with a fineness of 99.9% in 2013, the original issue had a fineness of 95.8%. The Royal Mint wanted to create a replica of the gold Britannia in silver.

The beautiful Silver Britannia, designed by Jody Clark

The design of the silver Britannia

The silver coin was expected to mirror its gold counterpart in terms of look and feel. So, the well-known coin designer, Jody Clark was commissioned to do the job. The design of the silver Britannia features the image of Britannia, holding her shield and trident. It is now thought that this image originated during Roman times and depicted the spirit and bravery of the British people. The coin portrays the warrior goddess on its reverse and features an image of Queen Elizabeth the second, the longest-reigning British monarch on the coin’s obverse. The upgrade of the fineness of the coin in 2013, increased the demand for the silver Britannia. Importantly, the coin offered investors an avenue to get into the precious metals market at a lower price point than purchasing gold coins.

Advantages of buying the silver Britannia

The bullion version of the coin carries low premiums since the coin was introduced recently. However, commemorative issues and collectable editions of the coin can attract higher premiums. Availability and affordability are the two pillars that have contributed to the popularity of the silver Britannia. In March 2020, the gold-silver ratio touched an astonishing 125:1. Since then, there have been changes to this ratio, but the price difference between the purchase of the gold Britannia and the silver Britannia has encouraged investors to buy this coin.

The image of Britannia has been used earlier in British coinage, like this Edward VII Florin

Tax efficiency

In addition to the advantages offered by the low price of silver, when compared to gold, the silver Britannia is a legal tender coin. In the UK, this means investors can book profits on the sale of this coin, without having to pay Capital Gains Tax (CGT). This exemption can ensure tax-free profits within a single tax year for many investors. The silver Britannia is an excellent coin to purchase, due to its advantages as a tax haven.

Download the 7 Crucial Considerations before you buy Silver and Gold. Click here.

Divisibility and liquidity

The silver Britannia is an extremely popular and liquid coin across the world. This ensures that investors can book profits by selling the coins at any given point in time. The coin is also available in different weights and sizes. So, an investor can benefit from the variety and divisibility that the silver Britannia has to offer.

Contact Physical Gold for the best deals on silver Britannia coins

We are one of the best gold and silver dealers in the UK, with an impeccable reputation. Our investment advisory team are always happy to answer your questions on buying silver coins. Please call us on (020) 7060 9992. Alternatively, you can also get in touch with us online by visiting our website and sending our team an email.

Image Credits: Eric Golub and Smabs Sputzer

Investors have shown a healthy interest in purchasing silver coins over the last few years. One of the factors for investors who opt to invest in silver is simply the gold-silver ratio. Silver is a lot cheaper than gold, allowing investors who are starting to enter the precious metals market and buy the white metal.

Investors can also expect capital appreciation on silver investments, due to the rising demand and falling supplies of the white metal. Of course, buying physical silver, like any other precious metal is devoid of counterparty risks, as the owner holds the asset in its physical form. Silver coins are a better investment for many investors, as their legal tender status in the country circumvents the need to pay Capital Gains Tax (CGT). Of all the silver coins in the market, possibly the best investment option is the silver Britannia.

A close-up of the intricate design elements of the Silver Britannia

History of the coin

The coin was introduced in 1997, ten years later than its gold counterpart – the gold Britannia. Since its release, the coin has been minted in different dimensions and has enjoyed immense popularity amongst investors. Although the silver market is fairly volatile, it is lucrative for investors to purchase this coin at current prices, and book profits in later years, once the spot price of silver rises. The low price of silver, when compared to gold is only one of the factors that have spurred investors to buy the silver Britannia. The intricate design of the coin is very attractive and features the iconic image of Britannia, with the shield and trident on the coin. The other side of the coin features the image of our reigning Queen, Elizabeth II.

How to buy the silver Britannia?

They are best purchased through a professional precious metals broker. Reputable dealers can be found on bnta.net. Most will offer discounts for quantity purchases, so it’s best to buy in one go to achieve the best discounts, rather than little and often. Certain online portals are structured to deliver them without the need to charge VAT, saving a further 20%.

The iconic image of Britannia depicted here in a statue

When identifying a reputed dealer, it is important to assess the company’s market reputation and the years in business. The best precious metal dealers in the country have a formidable track record of being in business for many years and will display good customer testimonials. All of this can be verified online. Most reputed dealers are registered with the British Numismatic Trade Association (BNTA). If you visit their website, you can access a full list of registered dealers in the UK. From here on, the best strategy is to build a relationship with the dealer. If you let the dealer know that you are keen to invest in silver Britannia coins, their team can advise you on the best deals available in the market. Discussing your investment objectives with the dealer can also be helpful, as they can guide you to the best deals available.

Tax considerations

The silver Britannia is considered to be legal tender in the UK. This means the coin has a face value and it qualifies for Capital Gains Tax exemption. So, the silver Britannia can be an excellent addition to your precious metals portfolio.

Get in touch with us for all your silver investments

Physical Gold is one of the U.K.’s most reputed precious metals dealers and is registered with the BNTA. We have a great team of investment advisors who can guide you, and help you acquire the best deals on silver Britannia coins. Call us today on (020) 7060 9992 or drop us a line, so we can get in touch with you and discuss your investment plans.

Image credits: Eric Golub and Glamhag

Benefits of purchasing Silver Britannias

In 1987, the Royal Mint released the gold Britannia coin. These coins were an instant hit and won popularity among collectors and investors. So, to replicate the success of its gold counterpart, the silver Britannia was launched in 1997. At the time of its original issue, the coin had a fineness of 95.8%. In terms of look and feel, the silver Britannia was very similar to its sister coin – the gold Britannia. It featured the Britannia icon, which made the coin instantly recognisable on its reverse.

The coin depicted Britannia as a warrior goddess carrying her trident and shield. The design for the silver Britannia was conceptualised by the well-known designer – Jody Clark. By 2013, the coin was upgraded to 24 carat silver with a fineness of 99.9%. By this time, silver investment had started gaining popularity and the demand for the coin rose significantly.

The silver Britannia is a timeless classic

Affordability vs value

Silver Britannias are affordable to buy and store, as they can be bought in tubes of 25 and monster boxes of 500 coins. Since the coin had been released as a bullion coin, they were easily available at very low premiums. Buyers can contact reputed dealers and avail of bulk discounts on their purchases. So, availability and affordability are clearly two benefits that contribute to the popularity of this coin. On the other hand, silver has always been cheaper than gold. It was 85 times cheaper than the yellow metal not too long ago and now, with the global financial crisis deepening, the gap has widened further. Currently, silver is 113 times cheaper than gold, with the ratio touching as high as 125:1 in March 2020. So, this allows investors to have easy access to the precious metals market at a cheaper price point than gold. The silver Britannia coin has made huge gains on the back of this sentiment.

Tax efficiency

As a legal tender coin, any value increases are completely free from Capital Gains Tax. So, UK investors can save a substantial amount in taxes by investing in this coin. Tax awareness is an essential consideration for any investor building a portfolio. The silver Britannia is a clear winner in this case, as the coin offers an opportunity to build a highly tax-efficient silver portfolio.

Liquidity

The silver Britannia is an instantly recognisable, popular coin across the world. Being issued by The Royal Mint, the coins are very liquid and easy to sell worldwide. This is a huge advantage for buyers since the coin can be sold instantly at any point in time, without losing out on market value. The liquidity factor enhances the demand for this coin as for investors who are keen to hold liquid investments that can be converted into cash when the need arises.

Understand the 7 Crucial Considerations before buying Silver Britannias. Click here

Divisibility

The silver Britannia is also available in different weights and sizes. There are special anniversary editions as well. This contributes to variety and divisibility – two more important benefits of owning the silver Britannia. Variety adds to the value of the coin, while divisibility allows investors to plan their sales and sell off small portions of their silver investments at a desirable market price.

Get in touch with us for guidance regarding your silver investments

At Physical Gold, we have a team of silver experts who can assist you in making the right purchasing decisions, when it comes to buying silver coins, as well as gold coins. Call us today on (020) 7060 9992 or get in touch with our team online to get the best deals on silver Britannias.

Image Credit: Eric Golub

Silver Britannia value

The silver Britannia has been around since 1997. The coin had a fineness of 95.8% during its original issue. It was a 1-ounce silver coin that mirrored the design and elements of the original gold Britannia, which was launched 10 years earlier. Due to the popularity of the gold Britannia, the Royal Mint decided to start minting the same coin in silver. By 2013, the purity of the silver Britannia had been increased to 99.9%. This was basically 24 carats fine silver with a purity of 999.9. Needless to say, the coin became extremely popular. It was easily available and its sales skyrocketed.

Design elements

The silver Britannia features the classic image of the Britannia icon on its reverse. This is a classic British icon, which may have originally been conceived as early as Roman times. Britannia is shown as a goddess warrior carrying a shield and a trident. The image represents the spirit and bravery of the people of Britain. The design of the silver Britannia was created by Jody Clark. The coin features an image of our reigning Queen, Elizabeth II on its obverse.

There have been changes in design across different issues of the coin, in different weights and dimensions. In some issues, we can see the warrior riding a chariot, or sitting with a lion. Some coins feature close-ups and other design elements. The Royal Mint has also minted numerous special editions of the coin, including one which features an oriental border and the 30th-anniversary edition in 2017. All of these are popular with investors and collectors alike.

This silver Britannia coin from 2008 shows the Britannia icon with a shield

The value of the coin

The value of this coin is primarily based on the underlying silver price. Unless the coin is a collector’s edition, the Britannia coins can be sold for around or just under the 1oz silver spot price. The silver spot price can rise and fall daily and is linked to 30th-anniversary variables which affect the supply, demand and ultimately price of silver. Since the coin is mass-produced and available easily, premiums are extremely low. In addition to this, good discounts are available from many dealers on bulk purchases. This allows investors entry into the precious metals market at a low price point.

Moreover, there are predictions that the price of silver may go up in future. The demand for silver is rising due to several industrial applications. At the same time, the production of silver has fallen over the years. These factors lead experts to believe that a price rise is imminent. If this happens, investors who have purchased silver Britannia coins today could make a windfall gain.

A tax-efficient investment

Another factor that adds to the value of silver Britannias is its tax efficiency. As the coin is legal tender in the UK, they are capital gains tax exempt. This means that substantial tax savings can be generated when booking profits during the sale of your investment. Clearly, it increases the value of the coin.

Call our silver experts to receive guidance when buying these coins

The silver Britannia presents an excellent investment opportunity to acquire 1 ounce of pure silver at a great price point. There are many other versions with a variety of that dimensions, including fractional issues that can be purchased. Call our silver experts at Physical Gold Limited today on (020) 7060 9992 or drop us an email if you’re interested in investing in silver Britannia coins.

Image Credit: Eric Golub

Buying Britannia coins

The Britannia is considered by many to be the flagship British coin to include in their portfolio. Originally minted in gold, it was introduced in 1987 by the Royal Mint. The current editions also include a silver version since 1997. The gold coins are a great investment, as they contain one Troy ounce of gold with a face value of hundred pounds. The silver version also contains one Troy ounce of silver with a face value of 2 pounds. Since 2013, the Royal Mint has been minting the gold Britannia with 24 carat gold and purity of 999.9. The Royal Mint also sells gold Sovereign coins, which are another popular range.

The coin features an image of Queen Elizabeth II on the obverse and the iconic Britannia image on the reverse. The coin enjoys immense liquidity and is available in a variety of editions. There are definitive tax advantages to investing in these coins. The coin is legal tender in the UK, and therefore attracts no capital gains tax. But the question is – should we be buying older or newer versions of these coins? What is likely to generate better value?

The silver Britannia was first issued in 1997

Buying older Britannia coins

The Britannia does not command a rarity value or historical premium. Most editions of the coin are easily available. Most of the time, the current year of issuance will also be the cheapest due to plentiful supply. Buying particular year Britannia’s from the past may well command a premium due to scarcity. However, you may find that the older coins can also rise in value quicker than the new ones in the context of the time you intend to hold onto the coins.

Download the FREE Insider’s Guide to Tax Efficient Gold & Silver Investment here

Commemorative and special issues

The Britannia has also been released

Needless to say, these types of special issues attract a lot of interest as a collectable coin. Therefore, they command high premiums in the secondary market once supplies run out. But, investing in these special issues would require a higher capital outlay.

Buying newer coins

The current editions are a great buy if you consider their value in gold and silver. As these coins are available in plentiful, premiums are very low. It’s also a great idea to order these coins in bulk from your dealer.

Buying current years of an issue would result in a lower price commitment at the buying stage. This would mean that your profit margins could be a lot higher when you sell off your gold in the years to come.

Contact Physical Gold to buy Britannia coins

A proven and hassle-free way to acquire Britannia coins were your collection is to simply give us a call. Our precious metal experts are best placed to advise you about buying the right gold and silver coins. They can let you know when older versions of the Britannia become available at the price you want. Similarly, you can also benefit from sound advice and assistance in buying newer coins. Call us on (020) 7060 9992 or get in touch online through our website, which has a wealth of information about Britannia coins.

Image Credit: Eric Golub

Silver Britannia supply

The silver Britannia is an iconic British coin. The coin was released in 1997, due to the popularity of its gold counterpart. The silver Britannia offers investors and easy entry point into the world of precious metals, as the spot price of silver is currently 85 times cheaper than gold.

The coin adds divisibility and stability to any precious metal’s portfolio. Being legal tender in the UK offers investors the added advantage of acquiring the coin CGT free. We will now explore the current and historical limits on the mintage of this iconic piece of British coinage.

Early limits on mintage

In 1997, when the coin was first released into the market, the coin was available with the fineness of .958, indicating 95.8% pure silver. The coin is released in three ways; as proof, uncirculated bullion, and as part of proof sets. Mintage numbers have varied from year to year for each of these categories, but have settled on 2,500 for both proof types, and 100,000 for the bullion coins since 2008.

Click here to Download our FREE cheat sheet to buying tax free silver Britannias

The initial limit imposed on the 1-ounce proof orders in 1997 was 16,005. In the same year, the limit for proof sets was set at 11,832. By 1998, the uncirculated bullion mintage reached 88,909. The Royal Mint was responding to its increased demand as a silver bullion coin. However, in the same year, the 1-ounce proof edition of the coin was reduced to 3044. Proof sets orders were also limited to 3044, down from 11,832 in the first year of issue.

The silver Britannia coin

Variable mintage quantities over the next seven years

By 1999, uncirculated bullion amounts of reduced to 69,394 and proof coins were discontinued in both the 1-ounce proof and the sets categories. The next few years saw limited numbers of uncirculated bullion coins being released in the market, ranging from 81,301 in 2000 to 100,000 in 2004. During these years, extremely limited quantities of proof sets and the 1-ounce proof coins were released. The Royal Mint was releasing the coins year-on-year, according to expected demand.

Further changes to the silver Britannia

Steady streams of 100,000 uncirculated bullion coins were released from 2004 to 2009. An interesting fact to note is that in 2006, a silhouette collection of proof sets was released, which had five styles where the purity of silver was increased to 99.9%, along with gold gilts around the coin. By 2013, the purity of the coin was raised to 999.9 or 99.9%. The popularity of the coin had been greatly enhanced by this time. Mintage has become unlimited since 2013, in an attempt to meet the rising investment demand. The coin is therefore produced according to the volume of the order book.

An interesting anomaly

In 2014, around 17,000 silver Britannia coins were struck at the Royal Mint with a wrong image on the obverse. There had been a mix-up with the Royal Mint’s lunar series – the year of the horse. These coins are commonly known as the ‘Mule Britannia’ and carry substantial premiums at auctions, due to demand from numismatists.

Get in touch with Physical Gold for silver Britannia investments

The silver Britannia is a flagship silver coin for investors and can generate good returns in the long-term. Call our investment team on (020) 7060 9992 to find out how this iconic British coin can be added to your portfolio.

Image credit: Eric Golub