Investors have always turned to precious metals like gold and silver when building their investment portfolios, which is why we have created this “How to Buy Gold and Silver” guide. Gold has always remained a popular asset class for many investors, due to its reliability as a store of wealth. Gold has performed well over the last 20 years and the spot price of gold has risen steadily, providing great returns in the short term.

Additionally, the yellow metal has provided an avenue for investors to hedge their risks during times of economic turmoil. Last year, we witnessed the price of gold reaching its highest ever peak due to the economic crisis across the world, triggered by the global pandemic. Silver has also risen steadily over the years, due to high industrial demand. Many investors invest in silver with the expectation that the white metal will generate higher returns in the future.

Deciding your objectives

When deciding how to buy gold and silver, it’s important to understand that both gold and silver are available as bars and coins. The choice of precious metal depends on your investment horizon and objectives.

Investors who are looking for steady returns in both the short and long term are better off investing in gold. Silver, on the other hand, has a volatile market that is suited for speculative investments. The price of silver is quite low when compared to gold. Therefore, it provides an easy entry for investors into the precious metals market and allows them to book their purchases at current price points in the hope of making quick profits in future.

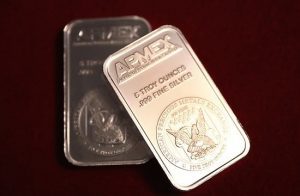

Always look for the refiner stamp on gold bars

The divisibility factor

Divisibility is an essential factor when it comes to investing in precious metals. The logic behind this is quite simple. Assuming that the price point is right, and it meets your objectives, you will want to make a sale.

Owning a large bar of gold (such as 1KG) and silver (1KG) will provide you that one chance and the sale is over. However, owning several gold and silver coins of different dimensions give you multiple opportunities to cash in at different price points in the market.

A question of balance

Divisibility and liquidity are, of course, important aspects of your portfolio. But we need to think ahead. Spreading your investments between gold and silver can provide much-needed balance to your portfolio. The current gold-silver ratio is 72:1, which simply means that silver is 72 times cheaper than gold. Therefore, you can buy large amounts of silver and wait for the price to rise in the future, providing your portfolio with balance and meeting your long-term investment objectives.

Ensuring the safety of your investments

You must be certain that the gold and silver products you are investing in are authentic, high-quality and carry the right price tag. Always buy your precious metals from a reputed online gold dealer. This is the only way that you can be sure about the authenticity and quality of your purchases. Moreover, an online gold dealer will normally ensure that your precious metals are sent to you through an insured delivery service.

Most reputed gold dealers will also provide you with an option for storage. If you select this option, your gold and silver purchases will be stored in a secure, LBMA approved vault. All of these are great reasons why you should buy your gold and silver from a reputed online dealer. Going down this route will also ensure that there is no risk of theft or robbery.

These one-kilo gold bars clearly display the purity number

Connecting with a reliable broker

Any investor who is serious about buying gold and silver needs to get connected with a reliable broker. But who is a reliable broker and how can you find one An online broker usually has a far greater variety of bars and coins for sale. But it’s important to ascertain that the business is legitimate and has a transparent and reliable track record.

You can check if the broker is registered with an industry body like the BNTA or LBMA. Also, find out if they offer a guaranteed buyback scheme and check their reputation online. Once you have identified the broker of your choice, the next obvious step would be to discuss your investment objectives with them and draw up a plan.

Gold and silver coins are popular investments in precious metals

Gold and silver can be sourced through online precious metals dealers, at auction or from areas specialising in precious metals. Hatton Garden in London features dozens of shops that sell gold and silver bars and coins. However, the choice of coins may be limited. The Jewellery Quarter in Birmingham offers similar services.

Know your gold and silver products

There are a few steps you can take to ensure that the gold and silver products you buy are genuine. Gold bars that contain investment-grade gold will always have a refinery stamp engraved on the face of the bar. It will also carry a number that denotes its purity. So, if the bar contains 24-carat gold with 99.9% purity, the bar will typically have a purity number of 999.9 on its face.

The refiner stamp will also denote the weight of the bar. Similarly, silver bars will also carry this information. When buying gold or silver coins, like the gold Sovereign or the silver Britannia, always ensure that you buy these from a reputed online dealer, who is registered and listed on the website of the British Numismatic Trade Association (BNTA).

How to buy gold and silver in the UK

Turning to gold and silver has been a tried and tested vehicle for investors in the precious metals category. While gold has remained a popular and preferred asset class for most investors, silver has steadily risen in popularity in recent years. Most investors prefer to hold these precious metals in their physical form. So, let’s explore how to buy gold and silver UK-wide.

Once you’ve decided to put your money in the market, it’s important not to get swayed by irrelevant offers. You should always evaluate your purchases by calculating how they can contribute to the balance, liquidity, and divisibility of your portfolio.

Don’t ignore tax considerations, as this will ultimately impact your profits. Remember, if you’re seeking to buy gold and silver as an investment, then it’s best to stick to well-known UK silver and gold coins (such as Britannias). These have the advantage of being Capital Gains Tax free, but also offer flexibility to sell small parts of your holding.

Ensure you get good discounts from your broker and keep buying gold and silver coins and bars with low premiums. If you’re investing in a coin, make sure that it has a strong secondary market. The Britannia (such as Silver Britannias) and the Sovereign could be your top choices. If you are interested in buying numismatic coins, avoid buying obscure ones and ensure that there is scope to make profits in the long run.

Discuss your gold and silver investments with our experts

Physical Gold, one of the U.K.’s most reputed online gold dealers have an investment advisory team, who can assist you with learning how to buy gold and silver in the UK. Call us on (020) 7060 9992 or drop us an email by visiting our website.

Image credits: Hippopx and mlproject

Silver or gold?

One of the keys to great investment is timing and staying ahead of the pack. I receive many enquiries from keen investors asking about the prospects for silver. Everyone has seen how well gold has performed over the years and many commentators feel that silver has huge upside potential.

I always describe gold as ‘reducing the risk in your life’, while silver is about ‘taking risk’. Obviously with higher risk, comes higher potential reward. Nearly half our customers buy silver, compared to a minority of around 10% a decade ago. These customers feel silver has vast profit potential, so are willing to take the additional risk.

As a purely speculative punt, buying silver may be worth a bet but only as part of a well balanced portfolio. You’d certainly need nerves of steel to put significant funds into silver. However, dig a little deeper and silver may not live up to being the new gold investment at all.

Here are 7 reasons why buying physical gold is still the best precious metals investment;

- There is much less research and analysis available on the silver market as it’s less developed as an investment market. The more research available, the better chance you have of assessing an asset’s prospect

- If you buy gold there is no VAT to pay on the purchase. However, silver is not VAT exempt so you’re 20% down before you’ve even started

- The gold market has evolved into a highly competitive and efficient arena. So the bid/offer spread (or difference where a dealer will buy and sell a piece of gold) is relatively tight (perhaps 5-10%). However, with less competition silver spreads can be 3 or 4 times those of gold, so silver needs to rise significantly in price before you break even

- Silver is less ’precious’ than gold as there’s more of it in existence! The lack of supply and difficulty in extracting gold provides a huge support to its price. If you have an asset who’s supply could increase significantly, the price of that asset is always exposed to a sharp fall

- Due to silver’s lower price per kilo you will literally get more product for your money than with gold. This means that a £50k gold investment can be shipped cheaply and discreetly whereas the equivalent in silver would be heavy and expensive to deliver

- Storing silver is also more problematic to gold due to its cheapness. £50k of gold can fit into a tiny safe at home. But £50k of silver needs 70-80 times more space (that’s alot of silver coins!)

- With the global economy at its most unstable in history, and the expectation of inflation and a huge post-Covid recession – the Safe Haven tag of gold provides one of the most compelling reasons to buy gold. Silver quite simply is not known as the ultimate safe haven so is less relevant as a portfolio insurance in today’s climate.

So if you want exposure to the silver market it may be better seeking a more efficient method such as mining shares or ETCs. If you still seek the comfort of owning the physical metal itself, then buy gold coins or bullion.

The American Silver Eagle is one of the most prestigious coins to be minted in the US. The coin is a relatively new one, having been released in 1986. This makes the first edition of the coin only a year older than the gold Britannia. The US Mint released the silver Eagle with one Troy ounce of silver that has a purity of 999.9. The coin was released with a face value of one dollar.

Interestingly, ever since the American silver Eagle has been released, the designs have never changed. Unlike the silver Britannia, the coin is presented in the same style, look and feel and the only difference from one coin to the other is the respective mint mark, which is found on the reverse of the proof coins. Well, the coin enjoys healthy interest from investors, and we want to find out whether the silver Eagle is worth its salt as an investable coin.

The American Silver Eagle coin known across the world as a liquid coin.

Divisibility and liquidity

In terms of divisibility, the silver Eagle does not offer much choice. As discussed above, the coin has always been available in the same size, shape, and design. However, there are some variations in its design that can add to the variety of an investor’s silver portfolio. The obverse of the coin features an image of Lady Liberty, created by the designer Adolph A. Weinman. Apart from the famous image of Lady Liberty, the obverse of the coin also features the American national motto – “In God we trust”.

Design options

The reverse of the coin carries the image of the Heraldic Eagle. Right above the head of the bald eagle, there is a cluster of 13 stars, each of which represents one of the original colonies of America, at the time of its founding. The only design change for the American Silver Eagle was in 2021. In the new 2021 design, the bald eagle on the reverse of the coin is featured flying back with its wings spread out. So, this is perhaps the only element of variety that an investor can hope for when investing in the American Eagle. The 2021 design commemorates the 35th anniversary of the coin, and the US Mint has taken this opportunity to refurbish the design of the coin.

Liquidity

The American Silver Eagle is a famous and well-known coin across the world. This ensures the liquidity of the coin and the coin can be easily cashed in at any point in time, bringing in cash as you need it. Previous editions may command a premium due to increased numismatic interest. American Eagle coins are available in uncirculated, proof, and burnished versions, giving a certain amount of choice to investors. Being a well-known coin, the coin has a good chance of being sold for its value in a short period.

The obverse of an American Silver Eagle – the year 2000

Silver Eagles can provide a good medium to long term investment and balance to other assets. The 1oz coins afford high flexibility to sell small parts of the silver holding compared to owning huge silver bars. The mass-produced coins are relatively cheap compared to collectors’ coins and their value can rise along with the underlying silver price and age of the coin. Many analysts feel the silver price is very undervalued, suggesting holding silver Eagles will benefit the investor in the long run.

Talk to the coin experts at Physical Gold

One of the country’s most reputed and well-known precious metal dealers is Physical Gold. Our advisors are always happy to discuss your silver coin purchases with you and can offer valuable advice. Get in touch with us on (020) 7060 9992 or simply drop us an email by visiting our website.

Image credits: Eric Golub and Wikimedia Commons

What is colloidal silver?

Although the name may lead people into thinking that colloidal silver is a certain type of physical silver, in reality, it is quite different from a silver bar or coin. When tiny silver particles are suspended in a liquid, the suspension is known as colloidal silver. The size of these particles is so minuscule that they cannot be removed from the liquid by standard laboratory filtration processes. Many of the particles are invisible to the human eye and could be classified as nano-particles. Colloidal silver has been popular as an alternative therapy for many common human ailments over the years.

Colloidal silver’s uses in medicine

Colloidal silver can be used to treat viral infections that antibiotics cannot such as bronchitis or pneumonia. It can relieve sufferers of airborne allergies when used as a nasal spray. Most commonly, it is used as an anti-inflammatory and antiviral, with it even helping fight the HIV and hepatitis viruses. Its antibacterial qualities help fight antibiotic-resistant superbugs.

Colloidal silver is a popular alternative therapy

How does it work?

Colloidal Silver can be ingested orally as a dietary supplement. Alternatively, it can also be applied to the skin. This remedy has been around for centuries, long before the discovery of antibiotics. Some doctors and scientists believe that colloidal silver is a placebo, and doesn’t really work as a remedy for any illness.

However, some research that has been conducted, appears to indicate that colloidal silver can attach itself to the proteins present on the cell walls of bacteria. This causes damage to the cell membrane of the bacteria, allowing the silver ions to enter the cell and destabilise the bacteria’s metabolic processes, and destroy it. More silver ions are released through suspensions that have a larger number of small particles.

Where is colloidal silver used?

Due to its ability to destroy a wide range of bacteria, colloidal silver was an antibacterial remedy in vogue long before the discovery of antibiotics in western medicine. Today, it is used in several medicinal products like dressings and creams for wounds. However, there are certain risks associated with the ingestion of colloidal silver. Due to this, pharmaceutical companies do not include colloidal silver as an ingredient in oral medications.

The silver particles in Colloidal Silver are invisible to the human eye

What are the risks of consuming colloidal silver?

Human beings are usually exposed to minute amounts of silver daily through drinking water and the environment. However, continuous exposure to silver can be hazardous to human health. Medical scientists have ascertained that the most common risk associated with frequent exposure to colloidal silver is a condition known as Argyria. The silver particles found in colloidal silver can deposit themselves in our vital organs and skin. These deposits can turn the pallor of human skin into a greyish blue colour. The condition is often developed by people who are frequently exposed to large amounts of silver, either through their job or through the ingestion of certain dietary supplements. So, colloidal silver needs to be used judiciously for external use.

Talk to the silver experts at Physical Gold

At Physical Gold, our silver experts are always ready to answer your questions about any kind of silver. We have a wide range of precious metal investment options. Our team is best placed to discuss your silver requirements and advise you on the best products to buy. Call us today on (020) 7060 9992, or get in touch with us online via our website.

Image credits: Wikimedia Commons and luvqs

Silver and gold are both precious metals that are attractive to most investors. Many investors are keen to strike a balance between the two precious metals in their portfolio. To do that, one must understand the differences in the way these precious metals behave.

Setting your objectives

The initial step in deciding whether to buy silver or gold depends upon your investment objectives. Gold has always been perceived as a repository of value. Gold investments can offset the investment risks that your portfolio is exposed to. So, if your investment objectives are to build wealth and remove risk, gold can be the right choice for you. However, silver investments are more volatile, but the profit potential is great. So, if your objective is to make significant profits in the long run, silver is an excellent choice for you as an investor.

Silver investments can be lucrative over a long-term horizon

Profit potential

Over the last year, as the global pandemic engulfed the world, investors rapidly moved their money to gold. This was an expected development since gold is generally perceived as a safe haven for most investors. As a result of the large demand for gold, the price of the precious metal shot up to its highest levels. Currently, the spot price of gold is US$1,736 per ounce. However, in August 2020, gold prices breached the US$2,000 mark to reach its highest ever level of US$2,067 on 7th August 2020. Investors who had invested their money in gold with a five-year horizon had the opportunity to make great returns when selling.

A year in turmoil

2020 was an interesting year for other precious metals as well. Due to the high demand for gold, the gold-silver price ratio widened to an all-time high above 150:1 in March 2020, when gold reached its peak. However, the ratio has now fallen to 66:1. The current spot price of silver is US$26 per ounce. This is a significant rise from March 2019, when silver was trading at USD $15 per ounce. However, the industrial demand for silver continues to rise, in the face of dwindling supplies. This has led to speculation amongst investors that eventually the price of silver is likely to skyrocket, providing an excellent opportunity for profits.

Divisibility

Silver has in recent times between around 75 times cheaper than gold so is ideal for those with modest investment funds. Silver Britannia coins cost around £20 each so a silver portfolio can comprise of many coins offering increased divisibility over gold where you may only have one item. Due to its low price and vast uses in technology, there are numerous advantages of silver when compared to gold.

Gold has always been a great repository of value

Affordability

Silver offers investors the opportunity to enter the precious metals market at a low price point. However, the production costs of silver bars and coins are proportionally higher when compared to gold. If you consider the value of a gold bar, its production price becomes negligible. This is not the case with a silver bar. But, due to lower prices, silver offers investors a great chance to lock in prices and reap profits in the long run.

Tax efficiency

All investment-grade gold is VAT free and Capital Gains Tax exempt in the UK. Therefore, gold can be a better investment from a tax standpoint. Buying physical silver will add 20% to the overall price of the purchase due to VAT. Despite this, many investors find Silver attractive, due to the lower capital investment.

Discuss your silver and gold investments with the experts at Physical Gold

Our precious metal experts offer you free advice on investing your money into gold or silver. Our in-depth research of the precious metal markets enables us to offer you the right advice when it comes to making investments. Call us today on (020) 7060 9992 or reach out to us online through our website.

Image credits: kschneider2991 and Pxhere

Gold and silver are often referred to as the ‘go-to’ precious metals for any investor. The yellow metal is revered around the world for its value and has many different uses. Gold has historically been one of the precious metals of choice for minting coins. Of course, it has numerous other industrial uses. Have you ever wondered why gold is used widely? Gold has certain properties that ensure its usefulness across industries. In this article, we will briefly overview some of these properties, and also focus on gold density.

Useful properties of gold

Gold is a highly malleable and ductile metal. The yellow metal is so malleable that 1 ounce can be pressed and spread over an area of 300 square feet. As a ductile metal, it can also be pulled out into wires. Gold has another property that makes it ideal for several industrial uses. It is a very good conductor of heat, as well, as electricity. This combination of ductility and conductivity make it invaluable in the electronics industry. Another great property of gold is that it does not corrode easily. Gold remains unaffected when exposed to air, or most other reagents.

Gold is one of the densest metals on Earth

The density of gold

Although gold is a malleable metal, the density is fairly high. Gold density is 19.3 g/cm³. When we refer to a metal density chart, we realise that the density of gold is much higher than most base metals. For example, lead has a density of only 11.3 g/cm³. Similarly, this number stands at 7.87 for iron, 8.90 for nickel and 7.7 for bronze. When compared to other precious metals, the density of gold is still higher than metals like rhodium or ruthenium, which are 12.4 and 12.1, respectively. However, platinum is higher than gold density and stands at 21.5. Similarly, the density of iridium is also higher than the density of gold at 22.5. Silver, on the other hand, is nearly half the density of gold at only 10.5.

So, we can see from the above comparisons that gold density is generally higher than most other metals. Despite this, it enjoys the properties of malleability and ductility, which is unique.

The density of silver is approximately half that of gold

How can we calculate the density of gold?

Well, the classical definition of the density of an object. Is the ratio of its mass to its volume. This is the reason why density is represented by grams per cubic centimetre – unit mass per unit volume. Now, mass is pretty much the same concept as weight. So, all we have to do is to weigh a bar of gold and divide this number by its volume. Therefore, one cubic centimetre of gold will weigh 19.3 g. Similarly, a cubic centimetre of silver will weigh 10.5 g

If the density of gold is higher than other metals, why is it softer?

The softness of a metal is its ability to easily change shape when pressure or stress is applied. The key to our answer lies deep in physics, where we analyse the structure of gold. Like all other metals, gold has a crystalline structure. This structure is essentially an arrangement of different planes of crystals. Metals which have a higher density like gold are more likely to have defects within these planes. These are called slip planes, and they allow the metal to bend easily. Gold and silver have more of these planes, making them extremely malleable. On the other hand, base metals like iron are more rigid and cannot be bent easily.

Find out more about gold from our experts at Physical Gold

When you call Physical Gold, your queries need not necessarily be about investments. We pride ourselves on being recognised as one of the most reputed precious metal dealers in the country. Our experts are extremely knowledgeable about gold and can answer all your questions related to the yellow metal. Call us on (020) 7060 9992. You can also visit our website and get in touch with us online and a member of our team will revert to you at the earliest regarding your queries.

Image credits: Wikimedia Commons and Wikimedia Commons

Most valuable precious metals

Investors are always keen to build a portfolio of precious metals. Throughout history, this is typically meant the acquisition of gold and silver. Traditionally accepted as precious metals all over the world, these metals enjoy great liquidity – irrespective of whether they are available in bars or coins.

Gold and silver also enjoy vibrant global markets, due to the internationally regulated exchanges that they are traded in. This creates transparency and dependability for investors, making these precious metals a popular choice for commodity investments.

Of course, gold and silver are also used in the making of jewellery and are greatly valued as ornaments across different cultures. Many countries in Asia have the tradition of gifting gold at the time of a child’s christening ceremony or marriage. In many countries around the world, the purchase of gold is also considered to be auspicious and gold is often bought during times of religious events in the year. However, are we restricted to only gold and silver when it comes to precious metals investing? Which is the most expensive metal? How do we know which is the most valuable metal?

Thinking of buying gold or silver? Find out the most important buying factors here.

We ask and answer the question – “What are 8 of the World’s Most Expensive Metals?”

Rhodium produces white polished rings

1) Platinum

Close on the heels of gold and silver comes Platinum, a popular precious metal, partially due to its durability and versatility. Platinum enjoys demand from consumers and several companies manufacture jewellery and ornaments using the precious metal. Platinum is unique in the fact that its weight is close to double that of a gold carat.

This means that in terms of its density and weight, it is the heaviest in the list of precious metals. Apart from the jewellery industry, Platinum is in great demand in many other industrial fields such as aeronautics and dental implements. The metals name is derived from Platino, a word in the Spanish-language, meaning ‘little silver’.

2) Rhodium

Interestingly, Rhodium is as rare as it is expensive. In fact, it is considered to be the most expensive metal in the world. Deposits of rhodium are scarce, adding to its rarity. The metal has a very high melting point and does not corrode easily. This is why it is greatly in demand across several industries. Of late, a popular precious metal is known as white gold. This is an alloy that uses rhodium, the most expensive metal as a plating medium to achieve the white colour and create a non-corrosive, scratch-resistant, reflective surface. Rhodium is scarce in supply however, countries like South Africa, Canada and Russia are well-known for its manufacture.

Gold has always been used to make jewellery, even as early as 200 AD

1) Gold

Of course, gold is a time-tested precious metal, well-known as a repository of value. It is considered to be the classic precious metal across all countries in the world. Throughout history, gold has considered to be the most expensive metal. It is commonly used for a variety of uses, of which the most popular ones that we know of are jewellery making, coinage and investment. However, gold is also considered the most valuable metal across several industries as well, due to its unique properties of malleability and conductivity. For example, the audio industry uses gold frequently in the manufacture of cables and audio contact terminals.

2) Ruthenium

The precious metal enjoys high demand from the industry, particularly in the manufacture of electronic goods. This is primarily due to its property of extreme hardness and it is often used to reinforce other metals. It is well-known across the world as one of the most valuable metals within the Platinum category. It is possible to use the metal for the manufacture of jewellery, however, the incidence of this use is rare.

3) Silver

The white metal has always been a close runner-up to gold. However, like gold, silver is also in great demand across the world for a variety of uses. Historically, it has been used for coinage, manufacture of utensils and jewellery. Due to its high industrial demand, silver is much sought after today. Therefore, silver investments have risen substantially, and investors often invest in silver bars and coins.

4) Iridium

It is a rare metal to find, which makes it feature on the list of most expensive metals. Like Rhodium, it also has an extremely high melting point and does not corrode easily. Its use is primarily industrial, ranging from the electronics industry to its use in the automobile industry, particularly electric cars. Iridium has also been used widely as one of the most valuable metals for the manufacture of watches and South Africa remains the largest producer of this metal.

5) Osmium

It is a bluish, silver metal that also has a super high melting point. However, it does not enjoy the other properties, found in most precious metals. Unlike gold and silver, which are extremely malleable, Osmium is hard and brittle. It is primarily used in the industry for the manufacture of electrical components and electric bulb filaments.

6) Palladium

This precious metal is greyish white and also enjoys the properties of malleability and stability. It is rare, one of the most valuable metals, and has the unique property of being able to absorb large amounts of hydrogen, even at room temperature. The jewellery industry also uses this metal to create their alloys of white gold, while it is popular in the automobile industry as an emission reduction agent. Recently, there has been a fall in both supply and demand for this precious metal.

Call us for advice on your precious metal purchases

Physical Gold is one of the country’s most reputable precious metal dealers. Our team can advise you on the purchase of the most valuable metal products. Call us today on (020) 7060 9992 or get in touch with us by email.

Image credits: Wikimedia Commons and Wikimedia Commons

Investing in silver coins

Silver coins are a great investment choice if you’re seeking potential capital growth and also want a hedge against falling stock markets and banks. The value of coins tends to rise over time, especially when there’s political and economic instability. Silver coins are also exempt from Capital Gains tax. The modest price of the coins enable accessibility to the market for many compared to gold coins (such as Sovereigns and Britannias), and divisibility to sell part of your holding. The silver price can also rise when demand for industrial silver rises, with its predominant use in electronics.

The industrial demand for silver is rising

The white metal is used extensively in the electronics industry, IT, solar panel manufacturing and a host of other industrial processes. On the other hand, the production of silver from mines has greatly reduced over the years. Rising demand and dwindling supplies have fuelled speculations that there may be a huge price in the spot price of silver in the years to come. Many investors have started buying up silver early with an expectation of making profits, once the prices go up.

Coins like the silver Dollar do not enjoy tax free status in the UK

Silver to gold price ratio looks enticing

Today, silver is almost a hundred times cheaper than gold. Therefore, it provides investors with easy access to the precious metals market. If you are planning to invest in silver, there could be no better time than the present to take a calculated risk and purchase the white metal. Silver bars and coins can provide you with good investment options if you plan to get in early and wait for the long term to generate good returns. While silver bars allow you to acquire more silver at a cheaper price per gram, silver coins have several distinct advantages.

Variety and purity

Firstly, they are available in a wide variety of sizes. 1-ounce coins are quite common, but now there are larger silver coins of 10 ounces and even up to 1KG. These large coins also offer you the same advantages as buying a silver bar. Secondly, purity is an important consideration. Silver coins with a purity of 95.8% are easily available. However, better options can be found like the Canadian Silver Maple Leaf, which is a coin with 99.9% purity.

A vibrant secondary market

Liquidity is also an important consideration when building a precious metals portfolio. Always buy silver coins that are popular and enjoy a strong secondary market. Obscure and rare coins can be difficult to sell later on. Well-known coins with a vibrant resale market include 1-ounce silver coins like the Krugerrand and the silver Britannia.

The silver Britannia is one of the finest silver coins to invest in

Tax efficiency

Any investment portfolio needs to be tax-friendly. While coins like the Canadian Maple Leaf are a great buy, the profits you make from their sale are taxable. UK silver coins like the silver Britannia, on the other hand, are CGT free, due to their status as legal tender in the country. The silver Britannia, in particular, is a bullion coin and is available in plenty. Therefore, premiums are low, they are CGT exempt and available with good discounts on bulk orders from reputed silver dealers.

Get in touch with Physical Gold to plan your silver portfolio

Physical Gold is one of the most reputed gold and silver dealers in the UK. Our investment experts can help you identify the right silver coins to buy. Give us a call on (020) 7060 9992 or drop us an email and a member of our team will get in touch with you right away.

Image credits: Pikist and Wikimedia Commons

Buying Gold and Silver Bullion

Gold and silver bullion commonly refer to bars rather than bullion finish coins. Precious metals merchants generally buy and sell both metals so it’s possible to buy gold and silver from the same place. There are certain distinct advantages to buying bullion. The most important advantage is the elimination of counterparty risk and taking control of one’s wealth. Counterparty risk refers to the risk associated with the promise of delivery from a third party. If you invest in gold company stocks, paper gold or other gold instruments, you open yourself up to these risks. Therefore, buying gold and silver bullion can be an excellent strategy to minimise risks and maximise returns.

Click here to download the FREE Insider’s Guide to Buying Gold and Silver Bullion

Knowing the spot price of gold and silver

The first step in purchasing gold and silver bullion is to know the spot price and how it works. Nowadays, it’s very easy to find out the prevailing spot prices of these precious metals. Most reputed online dealers and regulatory bodies like the LBMA display the spot price on their website. Since the spot price is a dynamically changing number, it will be displayed as a ticker. It’s important to understand that you will never buy gold or silver bullion at the exact spot price. When buying, you would likely pay a small premium, over and above the spot price. Similarly, when selling, the price you achieve will be slightly below the spot price. Researching the spot prices and knowing about the market is an essential first step to buy gold and silver bullion.

Buying bullion coins can generate healthy returns

Getting to know a reputed dealer

Another important step in making the right investments in gold and silver is to go through a reputed dealer. Firstly, a high-street gold seller will not have a wide choice of products available to purchase. Secondly, making high-value purchases on the high street is usually a risky business. Check out the company’s track record and reviews before placing an order online. It may be worth calling them first to check their customer service. Larger bullion will be better value, but divisibility should also be a consideration.

Gold bullion bars carry lower production costs

At Physical Gold, every product we sell comes with a buyback guarantee. This assures customers that the gold bullion they buy from us is certified and genuine. This also makes a difference to buyers, as they can sell off their investments easily through the same dealer. It’s important to do your own research when selecting a dealer so that you can pick the right one.

Dangers of buying from Mints

Another way to buy gold and silver coins is to buy it directly from the Royal Mint. If you choose to buy non-UK bullion, there are other reputed mints in the world, like the Perth Mint in Australia, from where you may be able to purchase your bullion online through their websites. However, you may end up paying more for packaging and processing costs. Many reputed mints will also try to sell you proof coins. These are more polished and better looking and attract higher prices due to their finish. However, you must bear in mind that the gold and silver content remains the same. So, you are unlikely to receive a higher price at the time of selling, simply because they are proof coins. If your objective is to maximise your gains, you may be better off picking the right bargains from the secondary market through a dealer.

Get in touch with us to plan your gold and silver bullion investments

The economic crisis of the post-pandemic era has already started unfolding through the first half of 2020. Many investors are moving to precious metals in order to hedge their risks. If you are thinking of buying bullion, call us directly on (020) 7060 9992, to discuss your investments. We are certain you can benefit from the right advice. You may also reach our investment team through our website.

Image Credits: Tony Media and Pxfuel

Proof silver coins as an investment

Investing in silver coins

Silver coins are a popular choice for collectors and investors alike. As many silver coins are legal tender in the UK, they provide an opportunity to invest, without having to carry the burden of Capital Gains Tax (CGT). However, when investing in silver coins, one needs to make the right choice. Silver coins are available as proof sets, bullion coins and rare/ collectable coins.

These US Mint proof coins in silver are great for collectors

What are silver proof coins?

Proof coins were originally produced before the actual issue of a coin. They were used for securing approvals from the Ministry of Finance and the administration of the mint. Checking the proof coins is also a method used for verification of the dies used during the production process. Finally, they were retained for archival. Proof coins are usually produced by polishing the dies. This results in a high-quality finish, with a polished look and feel and sharp edges and design. The polished areas of the coin take on an almost mirror-like finish, especially in silver coins. Additionally, the dies used for production are often chemically treated to create a frosty appearance in some areas of the coin.

FREE Guide. Click here to download The Insiders Guide to Gold & Silver Investment

The rising popularity of proof coins

Due to their high-quality finish and attractiveness, silver proof coins have become extremely popular over the years and enjoys healthy demand from the general public. As a result of this, the Royal Mint has been issuing limited edition sets of proof coins. Of course, these coins can be bought at hefty premiums and are usually purchased by numismatists.

Silver proof coins as an investment

If an investment is a primary focus, then buying bullion coins is a better bet. Bullion coins finished to brilliant uncirculated finish are cheaper per gram than a silver proof coin. Most silver dealers will not pay you the same premium when you come to sell the proof silver coin. Proof coins are better suited to collectors or as presents.

The premiums you would pay for buying a proof coin set is more or less the same as that of a commemorative issue. One needs to bear in mind that the higher price being charged for a proof coin is simply on account of production costs and limited availability. This does not change the price of the silver contained within the coin. Bullion coins, on the other hand, are freely available with low premiums. As an investor, you can secure great deals from dealers on bulk purchases of bullion coins. So, if you are buying silver coins as an investment, steer clear of buying silver proof coin sets. Buy current issues of silver bullion coins like the silver Britannia and you can land yourself a much better deal.

Call our silver investment team to discuss your silver coin purchases

Our investment experts offer you free and impartial advice on buying silver coins and bars (such as this 1KG bar). By connecting with the Physical Gold team, you can stay abreast of the latest deals and find out everything you need to know about buying silver coins. Call us today on (020) 7060 9992 or contact us online to speak to a member of the team.

Image Credit: Wikimedia Commons