The case for regular investments

Investors who are serious about building a strong financial portfolio usually invest regularly. It doesn’t matter what asset class you pick, the periodic churning of your portfolio is the only way to keep it optimised. Building a precious metals portfolio is, of course, no exception.

When you invest regularly, you end up buying at various price points. So, you don’t have to worry about timing the market because the market fluctuations average out over a long period of time. For example, if you were to buy mutual funds and you invested every two months, you would build a sizable investment portfolio over a period of time, without laying undue financial stress on your budget, while gaining the advantage of averaging the various price points in the market out. Eventually, if you stayed invested for say, 6 years, you would make money.

Download our FREE 7 step Cheat Sheet to Successful gold and silver investing here

Monthly gold plan

As precious metals brokers and investment advisors, we often advise investors to put together a regular investment plan. Our monthly saver gold bundle is an excellent investment option for investors who aren’t sure about the products they want to buy. The minimum monthly threshold starts at £350 and we set you up to buy tax-free gold coins.

Investors receive different varieties of sovereigns and half-sovereigns delivered to their door. They cannot choose the coins they receive. Given that the spot prices of gold vary, you would also buy the coins at different price points, spreading your risk. This is a great way to build the foundations of a strong portfolio of physical gold. Before you know it, you would have amassed a small fortune. You can simply get started by filling out the form on this page.

A regular monthly investment can help you build a quality gold portfolio over time

The director’s pick

If on the other hand, you wanted to kick-start your gold portfolio, we also have a ‘director’s pick’ option. You can choose to invest a couple of thousand pounds, going all the way up to 50k. The tax-free gold coins you will receive are handpicked by our director, Daniel Fisher and have great investable value. All of our products come with a certificate of authenticity and we also offer a guaranteed buyback scheme.

Silver monthly saver

While we don’t run the same auto-pay monthly saver for silver, it’s still possible to regularly save in silver coins. Silver investors need to make individual purchases of silver from our online portal every month. Once an account has been created, single orders are very quick to complete.

Talk to our precious metal experts for the best investment options

At Physical Gold, we take customer satisfaction to new heights. Just call our team of investment experts if you’re unsure which monthly saver package is best for you. Call 020 7060 9992 or drop us an email and a member of the team will be in touch with you shortly. We are a BNTA registered precious metals broker and we always ensure that every customer gets the best value for their money. Call now.

Image credits: Mark Herpel

What is Silver

Silver is one of the most popular precious metals in existence, not only as a material for producing jewellery and currency but also as a commodity to be traded. But what is silver exactly and can it be defined in an unambiguous way?

Silver bars

The etymology of ‘silver’

The modern word ‘silver’ is derived from Old English ‘seolfor’, which in turn has links to Germanic words including ‘silbar’ and ‘sidabras’. Throughout its history, the word has referred both to the metal itself and to the properties it exhibits; namely its bright, shining, almost ethereal quality.

Interested in buying silver? Download our FREE 7 step guide to Silver Investment here

Where is silver found?

Silver is mined in a number of key regions of the globe, in places as diverse and disparate as Poland, Australia, Peru and Mexico.

What explains the popularity of silver?

Silver shares many of the same properties as gold,

It is easy to work into different forms thanks to being a relatively soft metal, which is advantageous for producing jewellery and coinage. While it is more common than gold, it is rare enough to remain a precious commodity and eye-catching enough to have value for purely aesthetic reasons.

The history of silver trading

Silver was known to humanity before the written word was invented, so it is widely assumed that it was a vital element that acted as a bartering tool in the days before the concept of currency had been formalised.

Silver’s relative malleability meant that it was appreciated more for its pleasing appearance than its practical applications. It was also more widely available in some parts of the ancient world than others, which impacted its value. In Ancient Egypt, for example, silver was more precious than gold at some points.

Silver coins have been circulated since at least 600BC, with archaeological digs at sites in Turkey bringing truly ancient coins to light in recent years. Even at this early stage in the emergence of currency, a design was struck in the coin to make it recognisable, albeit only on a single side.

In Britain, silver has a long history as a store of value, as well as in coinage. Up until the 19th century it was still used to make pennies and has since grown in popularity as a bullion coin with the introduction of the Silver Britannia coin in 1997.

A display of silver coins

Interesting facts about silver

- Although silver is more conductive than other metals, including copper, it is too expensive to be widely used in electrical wiring.

- Silver is so reflective that it is the element of choice for use in the manufacture of everything from mirrors to microscopes. Interestingly its shiny surface is only effective at bouncing backlight in the visible part of the spectrum, while UV rays are absorbed in much higher proportions than you might expect.

- Like gold, silver naturally occurs in nuggets and so was found by prehistoric humans without the need for processing.

- Silver is edible and is used to make various foods from around the world more attractive. Don’t expect the presence of silver to have any impact on the taste of the food, however, as it doesn’t have any flavour and is purely decorative in a culinary context.

- Mexico produces more silver than any other country in the world, mining an impressive 5600 tonnes in 2017

- The largest silver nugget discovered by humans to date was hauled out of Smuggler Mine in the US state of Colorado way back in 1894. Estimates of its weight vary, but a figure of around 900kg is seen as plausible.

Silver as an investment

Silver is an appealing option for investors for a number of reasons, chief amongst which is its resilient reputation and historic low level of volatility. It has been bought and sold for thousands of years and will continue to be traded for thousands more.

Like investing in gold, the decision to buy silver can be spurred on by a desire to avoid the risks associated with other investments. Silver’s value is innate and fairly stable, unlike nebulous concepts of currency and other marketable commodities.

Of course, owning physical silver in the form of silver bars or coins will require that you also have somewhere safe to keep them. If you need help with silver storage, speak to us about our secure storage solutions.

Contact Physical Gold to invest in silver today

The team at Physical Gold should be your first point of contact for all of your silver investment needs. Call us on 020 7060 9992 or drop us an email to ask a question, learn more about our investment opportunities or get advice on precious metal trading.

Image Credits: Money Metals and Pixabay

A country’s monetary policy usually has some kind of knock-on effect on the prices of all stocks, bonds and commodities. Of course, although we view gold and silver as precious metals, they are essentially traded as commodities. So, all monetary policies will have certain effects on the gold and silver markets. Investors are often confused about what quantitative easing really is and how this move affects markets. Let’s dive in and find out.

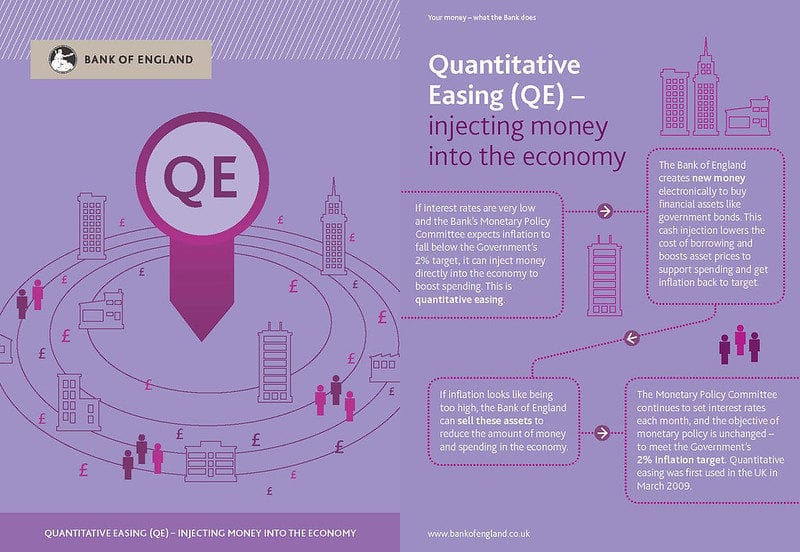

What is quantitative easing?

Firstly, quantitative easing is not a normal step taken by the central bank of a country. It is an extraordinary and somewhat unconventional move in which a country’s central bank basically increases the money supply. Many of you may think that’s inflation. But we must understand that quantitative easing does not involve the printing of extra banknotes. The central bank (in the UK it would be the Bank of England) simply buys government securities and other financial instruments from the market in a bid to lower interest rates and increase the money supply, thereby creating more liquidity.

An explanation of quantitative easing from the Bank of England

So, the assumption here is that lowering interest rates would add stimulus to the economy by encouraging industry to invest more. When companies invest and start new projects, more jobs are created and additionally, there is a positive ripple effect that kick starts smaller suppliers to also start providing services to the bigger players.

Gold is a safe haven for investors during times of uncertainty

What are the benefits of quantitative easing?

So, quantitative easing (QE) increases the supply of money and financial institutions benefit by increasing their capital base. This promotes lending and increases liquidity, ushering in a revival of the economy. Quantitative easing is usually a step taken when short-term interest rates have fallen to zero or are nearing zero levels. Going by past experience, we can say that if the central banks invest $600bn, the move typically triggers a fall in interest rates of 0.15 to 0.2%.

When did the UK first start exploring quantitative easing and what were the results?

At the height of the last financial crisis, in 2009, the interest rates were dropped to 0.5% for the first time in the history of the Bank of England. The UK economy badly needed a shot in the arm and the first QE programme for the UK was started with an infusion of £75 billion. This was eventually raised to £200 billion. The programme was rolled out on 5th March 2009. The Bank of England had been contemplating a drop in interest rates to 0.5% from 1.00% for a while. By November 2008, the financial pundits of the Gordon Brown government knew that the drop to 0.5% wasn’t going to be enough. It had to be backed by a parallel strategy that could save Britain from going into a long drawn economic depression.

Alistair Darling, the Chancellor of the Exchequer adopted a financial technique that had been used in Japan during the early 2000s. Interestingly, the same technique had also been adopted by Ben Bernanke, the chairperson of the American Federal Reserve, during the US chapter of the crisis, which triggered the fall of Lehman Bros. The radical macroeconomic technique was designed to put cash back into the hands of banks by buying out the government and corporate bonds they held.

These resources would have a two-pronged effect. Firstly, the new demand for these gilts would drive up their prices, triggering the required fall in the interest rates. Banks would now have money to pump back into the economy and things would be easier for businesses and individuals, as the cost of borrowing would be radically reduced. That was pretty much how the under-performing banks like RBS were saved back in the day. The government was able to bail them out via the QE programme.

Many homeowners also rejoiced at the time, since their mortgage repayments dropped to a negligible level. Many homeowners across Britain seized the opportunity to opt for capital repayment, ensuring that banks were able to recover their sub-prime housing loans, injecting more cash into their reserves. The move was hailed as having a double whammy effect for the sub-prime housing market in the UK. While the banks were able to claw back the money they had loaned, homeowners were able to reduce their debt exposure and free up equity in their homes.

However, many critics have been sceptical about the success of the U.K.’s QE programme. It has been 11 long years since the programme was rolled out. It had been purported as an emergency measure, designed to revive the economy and not a permanent fixture. Additionally, interest rates never recovered completely and remained near zero, as we plunge headlong into the next financial crisis. So, the verdict in the minds of many is that the program was a relief mechanism that did not have long-term success. However, in the backdrop of these criticisms, one must not forget that the UK has had the longest sustained quarterly growth record of any G-7 nation.

What quantitative easing was taken during the Coronavirus pandemic of 2020?

US response

On 15th March 2020, the US Fed announced its fourth round of quantitative easing. The Fed is purchasing $700 billion worth of mortgage-backed securities ($200 billion) and treasuries ($500 billion) with three main priorities:

- boosting liquidity within financial systems and

- increasing the aggregate demand by expanding the supply of money

- helping the US to avoid going into a recession

Part of the Fed announcement from 15th March said

“We haven’t set a gradual schedule for QE, quite deliberately. This crisis in UK financial markets demanded more. We will act in the markets promptly and rapidly as we see appropriate. The alternative was a run on sterling, a flight to the dollar and a complete breakdown of the UK financial system’s core.”

On March 23rd, 2020 the Federal Reserve announced:

“it would purchase an unlimited amount of Treasuries and mortgage-backed securities in order to support the financial market.”

UK response

On 19th March 2020 the Bank of England increased quantitative easing in the UK by £210 billion (from £435 billion to £645 billion) through the purchase of government bonds.

Andrew Bailey the new Governor of the Bank of England announcing the £210 billion quantitative easing said:

“We haven’t set a gradual schedule for QE, quite deliberately. This crisis in UK financial markets demanded more. We will act in the markets promptly and rapidly as we see appropriate. The alternative was a run on sterling, a flight to the dollar and a complete breakdown of the UK financial system’s core.”

On 18th June, 2020 the Bank of England raised quantitative easing by an additional £100 billion (from £645 billion to £745 billion) through an additional purchase of government bonds.

Andrew Bailey said after the additional easing

“As partial lifting of the measures takes place, we see signs of some activity returning. We don’t want to get too carried away by this. Let’s be clear, we’re still living in very unusual times.”

All quantitative easing to date by the central bank for quantitative easing purposes have been (click here for further details):

- November 2009 – £200 billion

- July 2012 – £175 billion and

- August 2016 – £60 billion

- March 2020 – £210 billion

- June 2020 – £100 billion

EU response

On 18th March, Christine Lagarde the President of the European Central Bank announced the €750 billion Pandemic Emergency Purchase Programme (PEPP). This was for the purchase of private and public sector securities to mitigate the economic risks caused by the COVID-19 pandemic. Purchases will be made up until the end of 2020 for all asset categories, which are eligible under their asset purchase programme.

On 4th June, the EU announced an additional €600 billion of quantitative easing with an aim of controlling inflation and stimulating vulnerable areas of the EU economy caused by the COVID-19 pandemic. This brings the total response to €1350 billion of quantitative easing when added to the €750 billion from March.

Relative comparisons of response – US, UK and EU

Although, this is a moving picture as at 22nd March the following amount of quantitative easing has been provided by the 3 different central banks:

- US – $700 billion – 3.3% of GDP initially, but this is unlimited

- UK – £310 billion – c14% of GDP and

- EU – €1350 billion – c13% of Eurozone GDP

The US response was the first and is now seen as a small intervention in the markets. Almost certainly there will be further rounds of quantitative easing from the 3 central banks.

How did the 2008 financial crisis affect QE?

The 2008 financial crisis triggered massive falls in interest rates in the UK. As the crisis broke out, interest rates were at 4.5% on 8th October 2008. By 5th March 2009, it had fallen to 0.5%. Unemployment rose as businesses failed due to their cash flows being affected by the bank’s refusal to lend. Overall consumer confidence plummeted and the entire economy entered a bearish phase. By March 2009, quantitative easing was introduced. The Bank of England put in an initial tranche of £75bn in new money, rising up to £375bn eventually.

If you want to know “How to sell gold for the most cash”, watch our YouTube video.

The Bank of England actually called it ‘asset purchase facility’ and bought assets from financial institutions like high street banks. Many of us remember the bailing out of Northern Rock at the time. The Bank of England formally started its QE program on 5th March 2009 after bailing out the high street banks. Initially, it was just long-term government bonds, but by the 25th of March, the program had been expanded to purchasing corporate bonds as well, in an effort to boost business confidence and increase lending to companies. In 2013, Japan announced a massive QE program going into trillions of dollars to boost its economy, in response to the global financial crisis.

The Bank of England introduced quantitative easing in 2009 as part of the monetary policy

In recent years, the ECB has announced a halt to its QE programme, in spite of a continuing slowdown in the European economy. The ECB is currently investing 30bn euros in buying bonds, although this program was slated to phase out by the end of 2018, Coronavirus and the world economy has caused a change in plan!

What are the effects of quantitative easing on gold and silver?

So, now that we know what quantitative easing is all about and how large industrialised economies used it during the global recession, let’s look at how it affects the gold and silver markets. Well, firstly quantitative easing is a step usually taken by central banks during economic turmoil. We already know that gold and silver act as safe havens during these times. So, if we look at price charts for gold during the period 2009 to 2011, we can see that gold prices skyrocketed during this period.

According to economist Marc Faber, quantitative easing hurts currencies and sends people rushing to buy gold. In 2016 he predicted that gold would continue to rise on the back of the fourth round of QE undertaken by the US federal reserve. On June 14th, 2018 when the ECB made the announcement to phase out QE by the end of 2018, they also announced that the European economy was still soft and interest rate hikes would not take place till March 2019. This news saw the gold market responding positively on that very day. Therefore, we can surmise that while QE is good news for the economy in terms of its GDP growth at a time of crisis, it’s not good for the stability of currencies. It’s both these reasons that spur the rise of gold prices at these times.

Call us to know more about gold investments

Our investment experts can guide you on the best times to invest in gold and silver and how to approach them. Call Physical Gold Limited on 020 7060 9992 or get in touch online and a member of our team will get in touch with you shortly to discuss your investment objectives and how precious metals can be an important part of your investment plan.

We sell a range of gold bars (sizes from 1oz, 100g to 1 kilo), gold coins (including gold Sovereigns and gold Britannias).

We also sell an excellent silver range, including silver bars (such as a 1 kilo silver bar) and silver coins (including silver Britannias).

Image credit: Wikipedia

When people buy and sell silver, they often use the terms sterling silver and silver interchangeably. The precious metal is much in demand, thanks to rising demand from the industry, as well as increased scarcity in recent years. Silver is, of course, a popular metal, as it is 75 times cheaper than buying gold. Basically, it would take around 75 troy ounces of silver to buy one troy ounce of gold, at the current gold-silver price ratio. As silver prices continue to escalate, there is increased interest in the white metal from customers all over the world.

What is sterling silver?

So, is sterling silver and silver the same thing after all? Actually, sterling silver is an alloy of silver. When we use term ‘fine silver’, we are in fact referring to silver with a purity of 99.9%. However, sterling silver has a purity of only 92.5%. The balance 7.5% consists of other metals, which we will discuss shortly. Like gold, silver is an amazing conductor of heat and energy. It is also a soft metal in its pure form. Due to this, 99.9% pure silver is not a good choice for making artefacts, jewellery, cutlery, etc. Sterling silver was therefore created by metallurgists in order to have a metal to work with, that was hard and durable enough to be able to hold the shape of an item.

Sterling silver is a popular choice for making kitchenware

The composition of sterling silver

Steel, which is an alloy itself is sometimes added to silver to make sterling silver. Other metals of choice include copper, nickel or zinc. So, when sterling silver is made, the balance 7.5% is made of these base metals. The addition of base metals may enhance the stability of the metal, but it also causes loss of lustre and the metal becomes tarnished over time. Tarnishing is a common feature of most alloys and if sterling silver is not polished regularly, the shine starts to fade. Basically, on exposure to air or water, sulphur compounds react with the sterling silver and a black sulphide layer is created on the surface, which fades the lustre from the surface. On the other hand, pure silver does not tarnish easily.

Interested in buying silver? Download our FREE Insiders Guide to silver investment first

Uses of sterling silver

Sterling silver is cheaper than pure silver and is often used in the making of kitchenware, particularly cutlery. These include spoons, knives, forks, etc. Prior to stainless steel cutlery being introduced, sterling silver was the material of choice for cutlery making and this cutlery needed to be polished every day. Utensils made out of sterling silver also need to be used every day, as lack of use causes reactions with the air and the items start to look tarnished.

Call our silver experts to know more

Our silver experts can help you identify the differences between sterling silver and fine silver. Since it is a popular choice, many items that are actually made of sterling silver are referred to as silver. It is important that our buyers are well aware of what they are buying. Call a member of our team on 020 7060 9992 or get in touch online via the contact page on our website. All the silver products sold by us carry a certificate of authenticity and a buyback offer. You can also get more information on our website about the various silver products that we do.

Image credit: Pixabay

Best Gold and Silver Research sites

François-Marie Arouet, the classical French philosopher and writer commonly known as Voltaire (1694-1778) once said: “Paper money eventually returns to its intrinsic value – zero.” One of the earliest uses of fiat currencies is recorded in China in the year 1000 AD. Since then, modern global economics has successfully managed to keep the solvency of fiat currencies alive. Its intrinsic value was kept alive by linking it to gold so that businesses and tradesmen would honour paper notes and coins made of base metals as having an accepted representative value. This was popularly known as the gold standard and the practice ended at the end of the two world wars, as gold reserves eventually thinned out.

Do your research to really unlock the potential of gold and silver

Rising inflation has been eating into the value of fiat currencies over the last 20 years, and global economic turmoil has left few options to generate good returns for investors. Therefore, anyone looking for a sustainable, stable store of value with strong fundamentals in order to hedge against currency debasement and market risks would seriously consider gold and silver. With the prices of precious metals slated to go up in the near future, it is important to conduct your own research into gold and silver. In this article, we’ll run through the best blogs for you to read.

Investor research is an essential step before investing in gold bars

1. The World Gold Council blog

The World Gold Council focuses on developing the gold industry by creating awareness among investors, ensuring a steady demand for gold and establishing themselves as a market authority for gold. Their blog provides insights into the gold market and helps investors understand the drivers for supply and demand in the market. The blog also provides market commentary and tracks price trends for precious metal. Through its members, the World Gold Council seeks to be a collective voice in the gold industry. Several articles on the blog are available for free download and provide investors with effective guidance on how to invest in gold.

Interested in gold and silver? Read our Ultimate Insider’s Guide to tax efficient investment here

2. The LBMA blog

The London Bullion Market Association (LBMA) is a regulatory body that sets standards for the precious metals market. The association has a footprint across 30 countries, with more than 140 members. The LBMA sets trading standards for the industry in a number of areas including purity and form. As a regulatory body, the organisation value adds to the industry by ensuring that service providers adhere to the highest standards at all times. Their blog is essentially a collection of news articles, press releases and publications relating to the precious metals industry.

3. Gold trading experts

Based in Birmingham, Gold Trading Experts is a gold industry training services provider for investors. They provide online tutorials, training materials and information designed to assist their users in understanding the dynamics of the gold market. Regular video overviews of the market are regularly uploaded on their website. In order to gain full access to their services, users need to purchase a paid subscription. The gold blog provides market updates and price trends.

Coin buyers use blogs to do their research before buying coins made out of precious metals

4. The Royal Mint bullion blog

The Royal Mint has a long history that dates back to 886 AD, during the time of Alfred the Great. Since then, the Royal Mint has been the official flag bearer for British coinage. After centuries of existence as a mint owned by the British government, it is now a limited company, wholly owned by Her Majesty’s Treasury. The mint is the official manufacturer tasked with creating the nation’s coinage. The bullion blog published by the Royal Mint is a great repository of information about the London bullion market, price information, coin reviews and articles about important coins in the history of British coinage.

5. Mint news blog

The Mint News Blog provides

6. PNG news and events blog

The Professional Numismatists Guild (PNG) is one of the best-known certification agencies in the world for gold and silver coins. Their website features a blog page under the title ‘news and events’, which serves as a library of information for investors who wish to buy gold and silver coins. Set up in 1955, PNG is an industry regulator of repute, whose coin grading service is trusted all over the world.

7. The artisanal gold council blog

The artisanal gold council caters to the mining industry and champions the sustainable development of small-scale gold mining companies. The artisanal gold council blog publishes information, articles and news related to the gold mining industry and can be an interesting read for investors who wish to know about the sources of the gold they’re buying.

8. The silver institute blog

The Silver Institute is a non-profit organisation that acts as an industry body for the global silver industry. The institute’s website is essentially a blog aimed at educating silver investors across the world. It features industry news, the uses of silver, silver price charts and links to other online resources about silver investing.

Call the precious metals team at Physical Gold to know more

As a reputed online broker of precious metals, Physical Gold has a team that provides expert advice to investors. Call us on 020 7060 9992 or get in touch online to connect with a member of our team to know more about making the right investment decisions in precious metals.

Image credits: Wikimedia Commons and Pixabay

The price of any commodity is dependent on rising and falling demand. When demand becomes higher and the supply of the same commodity dwindles, it impacts the price significantly. Silver is both a precious metal, as well as a commodity. If we are to go by what the experts are saying, 2018 could possibly be the year for silver.

How is the silver price determined..

The spot prices of silver are decided by the COMEX exchange in New York. The spot prices are dependent on a number of factors. Investors like precious metals like gold and silver as they provide stability and balance to a person’s wealth portfolio. They also provide a hedge for investors to park their funds during periods of turmoil in the global capital markets. Of course, macro-economic forces, as well as political pressures have an impact on the prices of silver. But, more importantly, the forces of supply and demand have a significant impact on these prices.

Fall in supplies of silver

The current spot price of silver is approximately $16.45 per troy ounce. There is a market expectation that the price of silver could soon touch $20. Over the years, the supplies of silver have been depleted as several million tonnes have been mined in response to the increased industrial demand. Some of the leading silver mining countries across the world include China, Russia, and Peru.

Download our FREE 7 step cheat sheet to successful silver investing here

Recently, the government of Peru announced that there had been a sharp drop in silver production, in the Cajamarca region. Cajamarca is a region in Peru which is famous for its silver deposits. The 2017 report, released in February stated that silver production was down to 323.1 metric tonnes, from to 367.4mt during the corresponding period the earlier year. This was a significant drop of 12%, largely due to silver resources being exhausted in the country.

Silver bars can be a great investment while prices remain low

In a similar vein, Chile, the world’s fifth largest producer of silver reported a large drop of 32% in silver production by May 2017. When we go back in time, we realise that, not so long ago, in 2014, Chile had produced a record high of 54 million ounces of silver. This supply fell to 4.6mn ounces in 2016 and then further down to 3.1mn ounces in 2017, an appalling reduction in supplies.

That’s not all….

Moreover, as the world continues to wade its way through the longest economic crisis in modern times, nations and markets worldwide continue to buckle under the pressure of debt. This is adversely impacting commodity prices worldwide. Due to the cascading effect of these dark economic forces, production of base metals has also shrunk globally. The bad news is that this is likely to impact the production of silver as well, since a large amount of the precious metal is really produced as a by-product of lead, zinc and copper mining.

Infact, the World Silver Survey reckons that 34% of global silver is produced as a result of zinc and copper production, while another 22% comes our way due to copper mining. When we do the math, we realise that is actually a whopping 56% of global silver production, which is in jeopardy. Knee-jerk reactions by governments across the world haven’t helped at all. For example, India, which is a large consumer of silver saw its demand drop due to the Indian government’s introduction of demonetisation measures in the country to control the illegal black money.

The electronics industry uses silver heavily in wires and electrical contacts

Rising demand

While the supply scenario seems to be mostly doom and gloom, things are much rosier on the demand side. Electric cars, solar panel manufacturers and the electronic components industry all use silver heavily, so industrial demand for silver has risen steadily over the years. Solar panels use photovoltaic cells that generate energy from the rays of the sun. Due to its incredible conductivity properties of both heat and electricity, a silver paste is used in every solar panel. Solar panel installations have gone up by 24% in 2017 alone.

This could be even bigger….

The electric car industry is another industry

Impact on prices

Silver prices are expected to skyrocket on the back of this increased industrial demand. Remember, we have not taken into account the bullion bars, coins and the mintage industry at all, which would add to the impetus. With gold-silver parity in prices at around 75:1, silver is an affordable investment. Many experts, therefore believe that it’s a good idea to invest in physical silver for the long term, and get in now while the prices haven’t gone through the roof. There are market experts who believe that silver prices could even go up as much as $130 per ounce in the future.

Talk to our silver investment team to know more

At Physical Gold, our team of expert investment advisors includes silver experts who can guide you in the right direction, if you decide to invest in silver. Browse our website and you will find that there are plenty of investment options from silver bars to silver coins. Call our team today on 020 7060 9992 or contact us by filling out the contact form on our website, and a member of the team will soon be in touch with you to discuss your requirements.

Image credits: Tookapic and Steve Johnson

Putting together an investment strategy isn’t easy. A shrewd investment strategy requires astute asset allocation that keeps your financial goals in line with your risk tolerance. A smart investment strategy is not about timing the markets and moving from one asset class to another in order to maximise your gain.

Important considerations prior to asset allocation

There are two important aspects to understand:

- The first one is that you cannot win every time. There are boom and bust cycles in every market and you must ride them. In order to do that, a long-term view is essential. A long-term view is typically more than 10 years, during which time, your portfolio will have matured having gone through these cycles.

- The second one is that your asset allocation can only be done in line with your risk appetite. In that sense, this step is unique for every individual. Each person’s risk appetite depends on that person’s income, age, family situation, the number of dependents, ownership of property, debts owed, assets owned, etc. It’s pretty much like a balance sheet of that person’s life. Making money is about taking more risks to gain more. Therefore, an aggressive asset allocation that includes volatile asset classes is great for someone who is younger, earns well and has the propensity to take more risk. However, a middle-aged man who may retire within the next five years is risk-averse and may require a more conservative approach, in terms of his asset allocation.

Investment in silver bars can be a clever way to balance your investment portfolio

A diverse approach

The old maxim, ‘Don’t put all your eggs in one basket’ holds true in this case. A diversified approach taken by the investment advisor will typically include a number of asset classes that may include real estate, stocks, bonds, equity growth schemes, fixed income products, cash deposits, ISAs and of course precious metals. The premise here is that investments across a range of asset classes will lead to stability in the event a particular asset class underperforms. Performance is monitored closely and money moved from one asset class to another depending on market conditions. Diversification protects the investor against unexpected market shocks. Rebalancing, on the other hand, is all about risk assessment and ensuring that overexposure to areas of risks is avoided.

What is balancing a portfolio?

Let us suppose you started your portfolio with a traditional asset allocation of 60-40 across equities and bonds. At the end of three years, you find stocks have outperformed. Now, your portfolio has grown, but you may have too much in equities due to a boom in capital markets. Then, you need to book profits and re-allocate, so that once again the 60-40 ratio can be maintained.

Rebalancing is not about reacting to short-term market conditions. When events like Brexit hit the market, don’t panic and start selling off a particular asset class in order to re-adjust. Patience is required to stick to the plan and reap rewards in time. Rebalancing should be done every year or two.

Another factor that needs to be considered when rebalancing is changes in a person’s personal circumstances that impacts the risk appetite. A person may get older and this would affect the risk appetite. A person could also lose his/her job. All these changes in personal circumstances need to be taken into consideration.

Diversification of your portfolio across asset classes is the key to mitigating risk

The role of silver in balancing

The role of precious metals like silver in an investment portfolio

serves more than one purpose. The first one is hedging. Hedging is a strategy that offsets risks associated with investments, more importantly, future risks. So, if the portfolio is overweight by 10% in equities and we move that 10% to silver, we have not only balanced the portfolio but also hedged against future risk of losses that we may have incurred by remaining invested in stocks and bonds. We need to bear in mind that our portfolio is also impacted by the forces of inflation, which means that the real value of the money we make today will be a lot lower in 20 years. By investing in silver we also hedge effectively against inflation. Many investment experts agree that 7-15% is a healthy allocation for precious metals in any portfolio. At the silver price per troy ounce at $16.58, it’s an affordable addition to your portfolio.

To know more about silver investing, call us

If you have any questions about how much silver to include in your portfolio, talk to our experts. Our team of investment experts are just the right people to guide you on investing in silver and other precious metals. Call us on 020 7060 9992 or send us an email and an investment advisor will get back to you.

Image credits: Wikimedia Commons and CCO Public Domain

It’s said that if you cross a gypsy fortune teller’s palm with silver, she will happily tell you your future. Well, these days with all the financial analysts around, we don’t need fortune telling to predict the global market for silver. As you may know, silver is not just a commodity, but a precious metal that has been desirable to mankind over centuries. Of course, gold has always been the preferred choice for many investors, but given the gold-silver price parity, which is approximately 75:1 currently, silver is clearly a more affordable investment. Let’s look at where the market is in 2018 and where it’s headed.

Demand and supply of silver in 2018

The silver price curve has always tracked the gold curve, which means that silver has historically mirrored the price movements of the gold market. However, the mirroring effect ended in March 2011, when gold broke free and rose quickly as investors parked their money in gold in order to escape exposure to the troubled international capital markets.

From $800 an ounce in 2009, gold broke all records by racing to $1900 an ounce in 2011.

Silver also enjoyed some of the action, rising to a price of $49.80 in April 2011. However, silver fell back against gold in the years after that, and the current spot price is approximately $16.58 per troy ounce. However, we are now witnessing an interesting phenomenon.

Silver bars could be a great investment in 2018

The supply of silver has fallen significantly. The leading silver producing countries of the world, which includes Russia, Mexico, China and Peru have all registered drops in mining volumes. There’s no particular reason, just depletion of the resource. Peru, in particular, reported a 12% drop in production volumes in 2017. Yet another leading producer, Chile – the fifth largest producer in the world, also reported a significant drop in production volumes. From a high of 54mn ounces in 2014, Chile’s production dropped to an appalling 3.1mn ounces in 2017.

Of course, scarcity of resource is just one of the factors that are affecting the silver market in 2018. The other is rising demand. The electronics industry is silver hungry and as of 2017, consumed 249.9mn ounces in 2017. This, in itself, is a significant 41.5% of the entire global industrial demand for silver, which was reportedly 599mn ounces in 2017. Other industries are silver hunger too. The demand for silver in the solar panels industry rose by 34% to 76.6mn ounces in 2016.

Impact on prices

Needless to say, the pull of relentless demand for silver

Call our investment experts for silver market advice

At Physical Gold, our investment experts track the silver industry on a day to day basis. So, we don’t need a fortune teller to tell us which way the market is headed. We love speaking to investors just like you, so if you’re thinking of investing in silver, give us a call. You can call us on 020 7060 9992 or message us via the contact form on our website. A member of our team will soon be in touch with you.

Image credit: Money Metals

It all started with a discovery

The actual event of the discovery of silver has been lost in time. However, modern-day archaeologists surmise that silver was already in use among humans around 3000 BC.

Ancient civilisations like the Incas, Greeks and the Egyptians held silver in high esteem and used it for the creation of a number of artefacts from religious idols, jewels, and coins. Infact, the three metals, all of which are elements, known to ancient humans were silver, copper, and gold. The ancient Egyptians were able to separate silver and gold by heating the metals with salt. Later humans started separating silver directly from its ore. This technique was prevalent in Europe as well as in ancient India, China, and Japan.

The early history of silver in global commerce

It is now believed that it was from these ancient times that silver was used as a form of money. An interesting fact is that silver was dearer than gold in Egypt well up to the 15th century BC. We can only speculate that perhaps that’s where silver investing started. The Greeks were mining around 30 tonnes annually by the 7th century BC. The economic stability of the Roman Empire was heavily dependent on silver bullion, which came from conquered territories like Spain.

Learn how to successfully invest in silver with our FREE 7 step cheat sheet here

Believe it or not, the Romans hit a peak production of 200 tonnes annually, and 10,000 tonnes of silver was already in use within the Roman occupied territories by the second century AD. Needless to say, this was an unprecedented event, and it’s hard to understand how the Romans hit those volumes with the technology that they may have had in that era. Clearly, those are volumes that we would hit using the modern machinery of our times. By the time the Roman Empire was finished, tens of thousands of tonnes of silver had already been mined and used up. As only a finite amount of silver exists on the planet, supplies had already started being depleted.

Silver is easy to melt into bars from coins

The growing popularity of silver

By the 18th century AD, much of the silver extraction action had shifted to another continent – South America. The Spanish stepped up mining operations and some of the countries like Argentina were named after Argentum, another name for silver. Silver’s foray into coinage started around 600BC in Lydia, a kingdom from Asia Minor. Coins minted in silver include the Drachma, from Greece, The Roman Denarius, The Dirham and the Indian ‘Mohur’ from the Mughal Empire.

Presumably, the culture of silver investing took off around this time. Governments had always observed that the price of silver tracks gold, so a gold-silver parity was set. This ratio was set at 12.5: 1 in the Roman Empire. The US set this ratio to 15:1 in 1792. France actually set this ratio to 15.5:1 in 1803. Meanwhile, silver was being used widely across the world for coinage and in the 1400 -1500s several countries across the world were using the precious metal for coinage. People, therefore, started investing in silver coins for its value. Spanish silver coins were being transported to Asia by sea. These coins were traded for porcelain, silks, spices and other desirable goods from Asia. So, now we can see where the perception of value relating to silver started building up.

The demand for silver also rose during the Renaissance, as it was used for fine craftsmanship. It was around this time that the European nations used a lot of silver to mint coins. As a result of this new demand for coinage, there was a huge influx of silver into Europe, which ultimately led to inflation.

The Roman Denarius was an early silver coin

Why was silver a popular metal for coinage?

Let’s look at the reasons why silver was a great choice for coinage.

- Firstly, silver and gold are dense metals. Having a high value to weight ratio is an advantage, as high value coins don’t need to be huge and bulky.

- It is easy to divide silver into smaller parts, without eroding its value. You can make coins straight out of a bar or melt coins back into bars.

- The density and high value-weight ratio make silver products convenient to transport.

- The purity of silver can be easily established. Very pure silver is denoted as having a purity of 999.9.

- Since it has a universally accepted price, the metal is fungible. ‘Fungibility’ means that one piece of silver can be traded unequivocally for another. A 1oz coin is exactly the same value as another.

- It does not decay and is considered to be highly durable. This makes it a great choice of metal for coinage. Since it has lesser value than gold, it is great for small transactions.

Historically, silver coins were always popular among investors

Silver investor rallies

However, it wasn’t until 1979 that really serious silver investors emerged. The Hunt Brothers, Nelson, William and Lamar, sons of the millionaire Texan oil tycoon, H.L. Hunt tried to corner the silver market by amassing 100 million troy ounces of the precious metal and drove the spot price of silver up from $11 in September 1979 to $50 in January 1980. Eventually, intervention by the US government stopped the bull-run.

The next rally for silver investors came in 2011, on

the back of the US debt ceiling crisis. Standard & Poor, the global rating agency based in the US released a negative outlook on the “AAA” rating of the United States economy on April 18, 2011. By the 25th, silver traded at $49.80 on the COMEX, as investors scrambled to pull their money out of the US economy, and turned to precious metals in order to hedge.

Call us to discuss your silver investment goals

Physical Gold is a reputed online silver broker and precious metals investment advisory firm. Our investment advisory team has precious metals experts who rely on their years of experience and expertise, when it comes to giving sound advice to investors, just like yourselves. Call us now on 020 7060 9992 or get in touch with us online to discuss your silver investment goals.

Image credits: Money Metals, Wikimedia Commons and Wikimedia Commons

Investing in silver is new to many. Even established gold investors may not have bought silver before. But that’s now changing, as we’re seeing just as many enquiries in silver as gold. So why are more and more people investing in silver?

Gold isn’t the only precious metal – Why you should invest in silver too

Why invest in silver, when gold is the ‘go to’ precious metal?

If you currently invest in a precious metal then it’s likely to be gold and with good reason. As the most popular of the precious metals, gold is recognised as a valuable commodity and is available in a range of formats and weights, which are easily tradable. Gold has historically been a reliable way to both protect and grow your wealth.

Silver’s the new kid on the block

But gold is not the only precious metal investment. Experienced investors know that, as with all types of investment, having all your eggs in one basket isn’t a good idea. It’s unlikely that all the shares in your portfolio are in one company, so why not consider diversifying your holdings in precious metals too? In fact, it’s not only us who are excited about the potential of silver. 5 years ago, 95% of our enquiries were for gold. Roll on to today, and our sales are now split 50/50 between the two precious metals. Metal diversification is a sound strategy for many reasons:

Silver’s historical position

Silver, like gold, has been considered a precious metal for hundreds of years and has been utilised as money throughout history. Its value is intrinsic, meaning that like gold, there’s never a shortage of buyers. As such, silver is a great vehicle for securing your wealth against threats such as volatility and for growing your portfolio.

Much of silver’s use can be roughly split three ways; between ‘silverware and jewellery’, ‘photographic’ and other ‘industrial’ uses. These are the key drivers of the worth of silver and why it has become such an attractive investment.

Download our FREE 7 step cheat sheet to investing silver here

The use of silver, particularly in the photographic and technology fields, has been key to its rising value over time. In photographic materials, the silver can only be used once, meaning the volume of the available silver present on the planet is reducing every day. The technological uses for silver are naturally increasing, as more and more advances in technology are made every day – relying on silver for component parts.

Silver’s pivotal role in solar panels

In the manufacture of solar panels, silver plays a pivotal role. 90% of the structure of crystalline photovoltaic cells, which are widely used in the solar panels industry is made of a silver paste. When sunlight is received by the cells, a stream of electrons are generated. Silver is a metal with one of the highest conductivity ratios of both electrical and thermal energy. Therefore, silver is used to conduct the power out of the panels.

The solar industry alone uses 52.4mn ounces of silver, with each solar panel using around two-thirds of an ounce of silver, which is approximately 20gms. As the industry grows, with more and more townships across the world becoming more energy efficient and turning to green energy, the demand for silver will increase, as will its price. However, a reverse effect would also take place, as the rising price of silver is dissuading solar panel manufacturers from using too much of it in their operations.

Electronics is where silver really comes into its own

Then, of course, another silver hungry industry is the electronics industry, where silver is used in contact switches industry-wide. The electronics industry uses silver that has a fineness of 999.9, meaning silver with absolute purity. With the convergence of electronics with the automobile industry, most cars are now computer controlled and use several contact switches, gadgets like GPS, etc. Due to this, the demand for silver has increased hugely across the industry, particularly with the advent of smart cars. Silver is also widely used in brazing and soldering of metal joints, where operations are conducted at temperatures above 600 degrees centigrade. These joints are often used in applications like heating systems, air conditioning, and plumbing. As silver has strong anti-bacterial properties, it is ideal for use in these applications, especially where pipes may be used to deliver potable drinking water to homes.

The solar panels industry is a major user of silver

The use of silver, and its value, has changed over time but one thing is certain – the demand is growing and the stock of available silver on the planet is steadily decreasing. An increase in demand and a slowly diminishing supply, usually means one thing for prices..!

Many Uses

Silver, unlike gold, isn’t merely desired but essential for industry and commerce and its necessity has put considerable strain on silver’s supply thereby increasing demand for silver investments. Historically gold and silver used to trade at a ratio of 12:1 which meant it took 12 ounces of silver to buy 1 ounce of gold. Today – the ratio has widened and it takes 60 ounces of silver to buy 1 ounce of gold. Most commentators and analysts believe that as a result, silver bullion is massively undervalued with many predicting it could reach $100 an ounce in the next five years.

Supply shortages

As silver’s use in industry increases many financial analysts, investing experts, and even geologists believe that a silver shortage is upon us. Infact the Silver Institute predicts that silver demand for industrial purposes will increase by 36% by 2016.

The demand for industrial silver went up a lot more, rising to 599mn ounces in 2017. A large portion of this increased demand came from the solar industry, as there was a 24% increase in global solar panel installations in 2017. Solar photovoltaic cells use a silver paste, thanks to the incredible electrical and thermal conductive properties of silver. Silver is also an essential ingredient for the manufacture of electronics, including electronics used in the automotive industry. The industrial demand for silver from the electronics industry alone consumed around 249.9mn ounces.

Here’s the best bit….

Silver-zinc batteries are increasingly being used by the

Silver is undervalued

The historical ratio between gold and silver is currently out of sync. Throughout history, silver has, on average, been around 10-15 times cheaper than gold. Right now this gap has widened so that 1 ounce of gold, for example, will buy an astounding 75 ounces of silver. Many experts have identified this significant undervaluing as a huge opportunity to purchase silver.

Silver bullion is a very popular and stable investment

Why invest in silver coins or bars?

In addition, silver has many other strengths, making it a very worthwhile choice to strengthen your portfolio. People that ask themselves, “Why consider investing in gold?” end up considering silver investment. Consider the following benefits of investing in silver:

- Low entry point– because of silver’s relatively low price (when compared to gold), it’s an attractive precious metal when either first investing in metals or when adding to an existing portfolio. As silver is much cheaper than gold it only takes a small price change to effect a large percentage increase in growth. It’s fair to say that consequentially – silver is more speculative than gold but together they provide a good balance within your precious metals portfolio.

- Good ‘hedge’ against other investments– Silver is typically not linked to falls in the stock market or interest rates, so when stock markets fall or interest rates are low for example, your silver investment still has the potential to rise.

- Likely to yield higher returns than cash deposits– with interest rates low, your returns may well be better than cash investments such as ISAs or bank savings. Like a bank though, your investment can be securely held by us, so there’s no need to hide your silver bars under your mattress!

Contacting Physical Gold to discuss silver investments

If you’re interested in investing in silver or would like to add to an existing gold investment, then simply contact Physical Gold here. As a leading precious metals dealer, we’re able to offer competitive prices on gold and silver and organise secure holding or ship your silver directly to you. Whether you’re interested in purchasing silver bars, simply for investment, or you prefer silver bullion, our experts can guide you on how to buy silver and where to get the best silver deals in the UK. You can also buy silver online from a reputed online silver broker. When you buy silver products from Physical Gold, be it silver bars or bullion, you can rest assured that every product comes with a certificate of authenticity, as well as a buyback guarantee.

If you are investing in bullion coins or numismatic coins, we also have some great coin accessories that would help store your collection safely, without damage, in the event you decide to take delivery of your investment at your preferred location. In terms of delivery and storage, we have some excellent options, where you can choose not to take delivery of your purchases and opt to have them stored at our LBMA approved secure storage vaults, and simply receive the paperwork that entitles you to access them at any time you want.

The first step in buying your silver from Physical Gold is to simply open a free account online, select your purchases and put them in the online shopping cart. From there onwards, you need to select your delivery options, complete any further steps, pay for them and sit back and relax. Call our investment team now on 020 7060 9992 and speak to a consultant.

Our consultants can also talk through your requirements, to ensure you make the best investment for your personal situation.