The Top 5 UK Gold Investments For 2024

30/08/2023Daniel Fisher

Free & fully insured UK Delivery. Learn more

Secure & flexible payments. Learn more

Buyback Guarantee Learn more

In 2023, global tensions and high inflation have led many investors to turn towards gold. But how and where should you invest?

In this article, we’ll share our top 5 gold investments to consider right now. These options cater to both first-time and experienced gold investors.

Owning physical gold provides comfort through its tangible nature and intrinsic value. But gold mining stocks, ETFs, and gold IRAs can also diversify your holdings and maximise upside potential when prices rise.

Your personal risk tolerance, time horizon, and financial goals are key in deciding the best gold investments for your needs. You can craft the ideal portfolio by understanding these factors and working with reputable precious metals companies.

Let’s get into Physical Gold’s top 5 picks for gold investments in 2024.

Gold’s enduring role as a store of value is well-documented throughout history. As we navigate today’s global complexities, investing in gold remains a reasonable choice for a multitude of compelling reasons:

Supply Constraints: The finite annual yield of mined gold introduces an element of scarcity. As demand intensifies, notably from central banks, this scarcity tends to increase gold prices.

As you venture into the world of gold investment, it’s crucial to understand your various options.

From large kilogram bars to smaller, more accessible units, each form of gold investment comes with its own set of advantages and considerations. Here five types of gold investment you should consider.

For high-net-worth individuals or institutional investors with substantial assets to allocate, 1 kilogram gold bars offer an efficient way to store significant tangible value in physical gold bullion. 1 kilo gold bars provide the lowest cost per gram option for investors.

Leading gold refineries across the globe, from PAMP Suisse or Metalor in Switzerland to the Perth Mint in Australia, manufacture these large wholesale one-kilo bars. Each bar contains a full 32.15 troy ounces of pure 24-karat gold at a minimum of .9999 fineness.

While the upfront investment required is sizable, so is the amount of gold. 1kg gold bars provide major investors with an asset that can offer financial security in times of economic turbulence. The bars also come sealed with a serial number and hallmarks from the prestigious refinery, supporting authentication and maintaining their future liquidity.

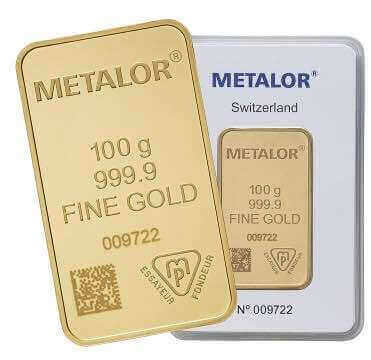

For investors seeking a middle-ground option between lower-tier coins and larger kilogram bars, 100-gram gold bars occupy an appealing product sweet spot. Their 3.215 troy-ounce size offers more substantial gold weight and value than popular one-ounce coins while remaining reasonably priced compared to bigger kilobar options.

Switzerland’s Metalor Technologies, one of the world’s most prestigious and respected gold refiners, produces these gold bars to exacting .9999 purity standards. Each bar’s mark and serial number provide assurance that it contains highly pure 24-karat gold sourced directly from a leading global precious metals refiner.

100-gram gold bars offer investors looking to allocate more funds to physical gold an obtainable piece sized proportionally between common coins and larger kilogram alternatives. Investors may choose to buy several 100g gold bars instead of one larger bar to benefit from the flexibility of being able to sell part of their holding in the future. Their accessibility and Metalor’s trusted reputation make these gold bars popular among investors who appreciate the metric sizing.

One-ounce gold bars from reputable global mints and refineries provide investors with a basic pure gold ownership experience. Top gold bar manufacturers like PAMP Suisse, Perth Mint, and Metalor utilise .9999 fine gold to fabricate these bars, guaranteeing their weight and gold content.

While more substantial bar options exist, a one-ounce gold bar strikes an appealing balance between affordability and tangible value. Their smaller size and lower price point make them more accessible to investors who want to hold pure physical gold. They tend to be priced at a slight discount to typical one-ounce gold coins and appeal to those who seek the comfort of owning certified gold.

One-ounce bars remain highly liquid, as most dealers readily accept them for buy-back or exchange. For many first-time gold buyers, these bars represent an ideal starting point to begin accumulating physical precious metals wealth.

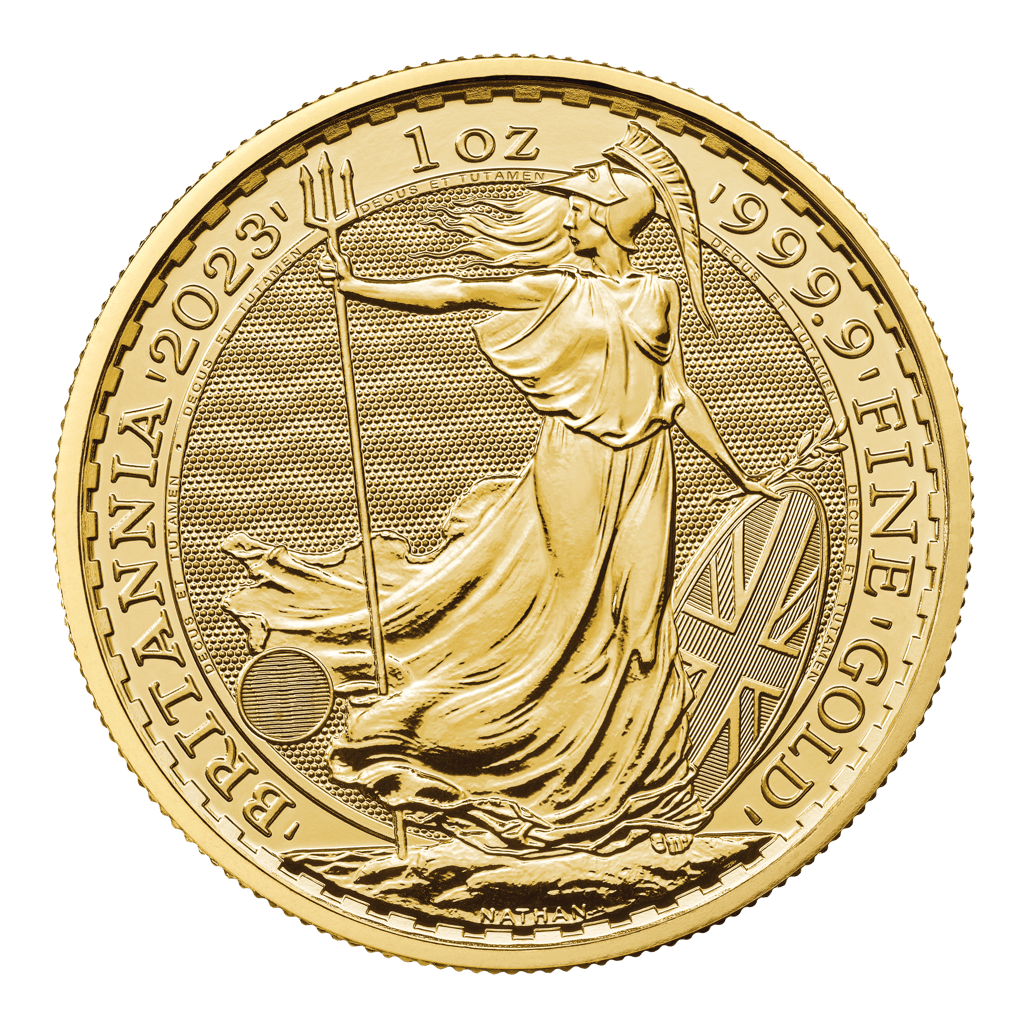

First minted by the Royal Mint in 1987, the 1oz Gold Britannia coin is important in British numismatic history. As the official gold bullion coin of the United Kingdom, the Britannia’s design featuring a figure depicting the personification of Britain makes it one of the world’s most iconic and recognisable gold coins.

With a face value of 100 British pounds, these coins contain one full troy ounce of pure 24-carat gold. The Royal Mint uses only the highest .9999 fineness gold to strike these coins. Advanced security features include micro text around the rim and a latent image that is visible under magnification, protecting against counterfeiting.

Gold Britannias also enjoy Capital Gains Tax-exempt status for UK residents, making them highly appealing to British investors seeking an affordable gold coin option that can provide tax relief. As mass-produced bullion coins, premiums tend to be relatively low compared to limited issue coins. Discounts are available when buying Britannias in various quantities.

With a rich history spanning over 200 years, Gold Sovereign coins hold a special collector appeal unmatched by newer bullion options. These iconic 22-karat gold coins were first minted in Great Britain in 1817 and have been continuously produced since then. They remain a core product of the Royal Mint to this day.

Weighing in at just under one-quarter ounce, Gold Sovereigns contain 7.315 grams of gold in a compact size. The smaller gold content gives investors more divisibility than one-ounce coins when transacting. The coins’ high liquidity and tax-exempt status for UK residents add to their popularity.

Gold Sovereigns represent a tangible connection to British history and culture for collectors and investors alike. The coins continue to demand premiums, especially historical vintages from earlier centuries that can fetch manifold increases over their original bullion value.

Before investing in gold, it is critical to understand your personal risk tolerance. Key factors to consider include:

Use our automated portfolio builder to get suggestions based on various investment objectives.

Owning physical gold allows you to hold a tangible asset with intrinsic value. While buying gold bullion and coins has its benefits, proper storage is also key. Let’s explore the process of purchasing physical gold and best practices for keeping it secure.

When buying physical gold, focus on legal tender coins like the Gold Britannia and Gold Sovereign to receive tax breaks if you’re a UK investor. Reputable dealers like us at Physical Gold offer competitive rates on popular gold coins and bars ranging from 5g up to 1kg.

Gold bars from Metalor are a cost-effective option while PAMP Suisse bars offer a premium option with beautiful engraved designs. Gold coins exempt you from certain UK capital gains taxes. Be sure to research dealers thoroughly and buy only from established, accredited sources.

Storing physical gold securely is critical. For home storage, invest in a high-quality safe or hidden storage. However, it’s essential to keep the details of your home storage confidential to minimise risks.

On the other hand, using a safe deposit box at a reputable bank offers enhanced security and the benefit of anonymity. While this option may come with a rental fee, its peace of mind can be invaluable, but availability is becoming scarce.

Safeguarding your gold at a professional vaulting service is a popular choice for those seeking insured options where their gold is handled and kept in a controlled manner. Gold dealers are usually able to arrange such services. Regardless of your storage choice, insuring your gold is a must to safeguard against any form of loss, be it theft or damage.

Gold’s unique properties provideadvantages to investors at all experience levels when held in physical form. By understanding the specific benefits physical gold offers, both first-time and veteran investors can determine optimal allocation strategies to meet their needs.

For new investors, physical gold provides smaller denomination options for easy entry, compact storage, and recognisable assets from major sovereign mints. Experienced investors can utilise physical gold’s tax-exempt status in certain countries and its lack of counterparty risk for true portfolio diversification.

Regardless of current experience level, physical gold’s enduring benefits make it a valuable portfolio addition. This section explores the ideal physical gold options for novice and expert investors seeking to capitalise on tangible precious metals:

At Physical Gold, we take pride in being London’s premier gold coins and bullion specialist. Our expertise and commitment to service are what set us apart.

Located at the heart of Hatton Garden, we have served British and international clients since 2008. Our team of precious metals experts provides tailored guidance, drawing on decades of combined experience.

We hold ourselves to the industry’s highest standards by focussing on London Bullion Market Association-approved gold bars and being proud members of the British Numismatic Trade Association (BNTA) . Customers consistently rate us 5 stars for our pricing, knowledge, and professionalism.

Choose Physical Gold if you are an individual or institution looking to buy physical gold. Our London location makes purchase and inspection convenient. And our passion for all things gold means we’re the ideal partner for building your gold investment portfolio.

Get in touch with our specialists today to discuss your needs. We look forward to helping you reap the benefits of physical gold ownership.

The best type of gold to buy depends on your investment goals. For long-term wealth preservation, 24-karat gold bars or coins are ideal. Consider legal tender coins like the Gold Britannia for tax benefits if you’re a UK resident.

The ideal size for gold investment varies based on your budget and storage capabilities. For large investors, 1kg bars offer efficiency and cost-effectiveness. For those on a budget, 1oz bars or coins provide a more accessible entry point.

Given the current economic conditions of high inflation and global uncertainty, investing in gold for wealth preservation and portfolio diversification is prudent.

Live Gold Spot Price in Sterling. Gold is one of the densest of all metals. It is a good conductor of heat and electricity. It is also soft and the most malleable and ductile of the elements; an ounce (31.1 grams; gold is weighed in troy ounces) can be beaten out to 187 square feet (about 17 square metres) in extremely thin sheets called gold leaf.

Live Silver Spot Price in Sterling. Silver (Ag), chemical element, a white lustrous metal valued for its decorative beauty and electrical conductivity. Silver is located in Group 11 (Ib) and Period 5 of the periodic table, between copper (Period 4) and gold (Period 6), and its physical and chemical properties are intermediate between those two metals.