British Gold Coins – 10 of the Best in History

23/10/2024Daniel Fisher

Free & fully insured UK Delivery. Learn more

Secure & flexible payments. Learn more

Buyback Guarantee Learn more

British gold coins have long been a symbol of wealth, history, and power. Beyond their material value, they serve as tangible links to the past, representing pivotal moments in Britain’s royal and economic history. From their role in trade and diplomacy to their place in royal presentations, British gold coins are highly sought after by collectors, but also remain some of the best gold coins for investment. Whether minted during the reign of Henry VII or the modern era, these coins offer a unique combination of aesthetic beauty, historical significance, and financial security. With so many types of gold coins available, which ones do we think are worth your attention?

The gold sovereign is one of the most iconic coins in British history, first introduced by Henry VII in 1489. Known originally as the “double royal,” it was a large, prestigious coin, often too valuable for circulation. It wasn’t until the late 19th century, in 1871, that the sovereign was reintroduced, this time with a design that would endure for centuries—Benedetto Pistrucci’s St. George slaying the dragon.

The George V sovereign, issued from 1910 to 1936, stands out for its place in a world marked by immense change, from the First World War to the interwar period. With Bertram Mackennal’s portrait of the king on the obverse and Pistrucci’s timeless reverse, this coin remains a favourite among both investors and numismatists.

Today, George V sovereigns are valued not just for their gold content, but for their historical significance. They tend to be available in very good condition and are relatively plentiful, so don’t command huge premiums for what is a century-old coin. For that reason, they’re a popular investment choice for those wishing to pay modest prices for tax-free gold coins with a historical background.

Preceding George V, Edward VII’s reign marked the end of the Victorian era and the beginning of the Edwardian age, a brief but influential period in British history. Edward VII sovereigns were minted between 1902 and 1910 and feature an obverse designed by George William De Saulles, portraying the king with a dignified, regal countenance.

Edward VII sovereigns are particularly prized by collectors, as they represent a period of transition and modernization for Britain. These coins are not only valuable for their gold content but also as artifacts from the reign of a monarch who oversaw significant societal shifts.

Edward VII Sovereigns enjoy a strong interest from Asian and Middle Eastern buyers, perceiving them as rarer and more prestigious than their George V peers. For this reason, they can sometimes be a little pricier to buy and stocks may not always be available.

Few coins hold as much appeal as the sovereigns minted during Queen Victoria’s reign. Her long rule saw the issuance of three distinct sovereign designs, with the “young head” being particularly popular among collectors. This coin features the youthful Queen Victoria, portraying her in her prime with her hair in a bun—a symbol of Britain’s optimism and strength during the early years of her reign.

They’re the oldest of the modern-era Sovereign coins, so Victorian coin values reflect this 200 year history.

The young head sovereign is notable for its two reverse designs, with the St. George and dragon being the more common, while the rarer shield-back version commands a premium in the numismatic market. These coins remain sought after, especially those minted between 1871 and 1887, making them a cornerstone in any collection.

The Gold Britannia, first introduced by the Royal Mint in 1987, is one of the most recognized modern bullion coins in the world. The image of Britannia—a symbol of British strength, unity, and independence—has graced coins for centuries, and its re-emergence in the late 20th century reinforced its significance. The 1oz Gold Britannia is not just a symbol of heritage but also a strategic investment choice, especially for those seeking capital gains tax-free options.

The 2017 30th-anniversary edition is particularly special, marking three decades of the Britannia’s reign as a premier bullion coin. Its limited mintage and increasing popularity among investors make it a valuable addition to any collection. The coin is minted in 999.9 purity gold with the detail and precision the Royal Mint are renowned for. UK investors also benefit from the Britannia’s Capital Gains Tax-free status.

Free ultimate guide for keen precious metals investor

Half sovereigns have long been overshadowed by their full sovereign counterparts, but these smaller coins offer the same level of craftsmanship and beauty. First minted in the 16th century, half sovereigns were used for everyday transactions due to their smaller size, yet they carried the same rich designs. Their diminutive size holds the same divisibility appeal today for those fearing that bartering may return if fiat currencies crash.

Half sovereigns from the reigns of Queen Victoria, Edward VII, and George V are particularly prized for their historical significance. These coins are often seen as an affordable entry into the world of British gold coinage, with prices at less than £300. They are perfect for both budding collectors and seasoned investors. For those with larger budgets, the full-sized Sovereigns are a more cost-effective solution due to the half Sovereign’s inflated premiums. But it’s still wise to own some of these beauties to provide the flexibility of fractional denominations.

The Jubilee head sovereign was issued to commemorate Queen Victoria’s 50th year on the throne, marking a milestone in British history. These coins, minted between 1887 and 1893, feature a regal portrait of the Queen in her later years, designed by Sir Joseph Edgar Boehm.

The Jubilee head sovereigns were struck in London, Melbourne, and Sydney, and the different mint marks add a layer of collectability to these already rare coins.

Due to their limited minting period of just 7 years, Jubilee head sovereigns are among the more coveted Victorian coins, making them highly desirable for investors and collectors alike.

The English angel is a coin of immense historical and religious significance. Introduced by Edward IV in 1465, it quickly became one of the most iconic coins of its time. Its design, depicting Archangel Michael slaying a dragon, symbolized divine intervention and protection—a fitting image during a period of great upheaval in England. The reverse shows a ship with arms, with sun rays at the masthead

The angel coin was issued under several monarchs, including Henry VIII and Elizabeth I, each iteration reflecting the changes in value and design from 6 shillings to 11 shillings. Today, these coins are rare and highly valuable, with Elizabethan angels being especially prized by collectors. A gold angel from the reign of Elizabeth I is valued at £7,250 by Stanley Gibbons.

Our automated portfolio builder will provide suggestions based on various investment objectives

Queen Elizabeth, I had a substantial gold coinage, although much underrated by numismatists. Gold crowns issued during the reign of Elizabeth I are a collector’s dream, not just for their beauty but for their association with the Elizabethan Golden Age. Minted in 1601 and 1602, these coins were circulated in limited quantities and feature the regal portrait of the Queen on the obverse and the royal coat of arms on the reverse.

Elizabethan crowns are not only rare but also significant as symbols of England’s rise to global prominence during the age of exploration. Owning one of these coins is like holding a piece of Renaissance history in your hands.

The gold crown from the Elizabethan era is a valuable collectors item today

Introduced by the Royal Mint in 2016, the Queen’s Beasts series has quickly become a favourite among collectors and investors. Each of the ten coins in the series represents a heraldic beast that stood guard during Queen Elizabeth II’s coronation, symbolizing the monarchy’s long lineage and power. The intricate designs and high gold content make these coins valuable both for their bullion and collectible value. As legal tender, they also qualify as CGT-exempt.

The Queen’s Beasts series is still relatively recent, but its impact on the market has been profound, with each release eagerly awaited by collectors. Their success and popularity are indicated by the Royal Mint’s decision to produce an eleventh ‘Completer’ gold coin summarising all ten beasts.

For investors, the subsequent Tudor Beasts spin-off series may be a savvy collection of coins to target as coins are available are reasonable premiums while they’re still being produced. If values rise in a similar way to the original series, then investors will be quids in.

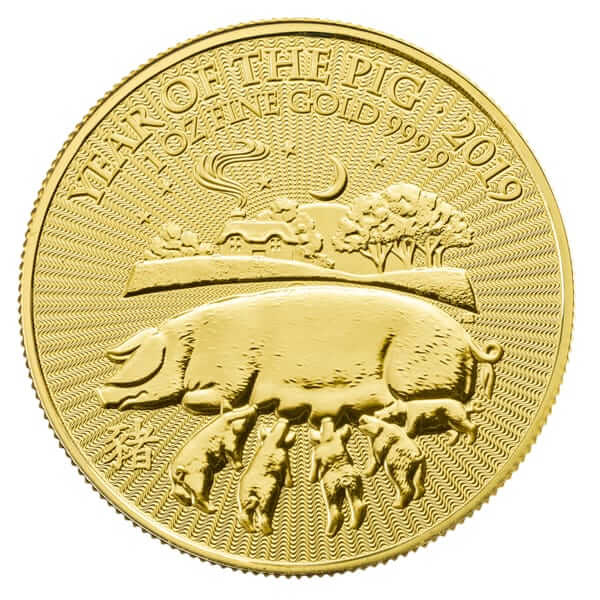

The Royal Mint’s Lunar series, launched in 2014, celebrates the Chinese zodiac with a new design each year. These coins have become particularly popular among collectors looking for something different from traditional British coinage. Each coin in the 12-coin series features an animal from the Chinese zodiac, and the 2014 lunar horse marked the start of the series.

A rarity occurred in 2014 when 38,000 coins were mistakenly struck with the obverse intended for the Britannia, making these error coins especially valuable. Collectors have since snapped up these unique pieces, driving up their value.

British gold coins are more than just currency; they are a testament to the nation’s history, culture, and artistic heritage. Each coin tells a story, whether it’s the enduring image of St. George on a sovereign or the proud Britannia standing firm through centuries of change. For coin collectors and investors alike, these coins offer a tangible link to the past and a secure investment for the future.

Whether you’re a seasoned numismatist or a first-time investor, British gold coins provide an unparalleled combination of beauty, history, and value. At Physical Gold, our team of experts is here to help guide you through the process of selecting the right coins for your portfolio or collection.

Call us now on 020 7060 9992 or contact us via our website for guidance on buying gold coins.

The rarest English gold coins include the 1933 George V Sovereign, the 1643 Charles I Oxford Mint Triple Unite, and Elizabeth I’s gold “Ship” Ryal. These coins are prized for their historical significance, limited mintages, and rarity in the market, making them highly sought after by collectors and investors alike.

British gold coins like the Sovereign and Britannia are excellent investments due to their intrinsic gold value, historical significance, and exemption from capital gains tax. They tend to retain or increase in value over time, offering both stability and growth potential, making them a secure choice for long-term investors.

Sovereigns are ideal for flexibility and smaller investments, while Britannias offer more gold per coin and often have a lower premium per gram. Both are capital gains tax-free, but Britannias may be more cost-effective for larger purchases, whereas Sovereigns allow for easier liquidity and incremental investing.

The Edward VIII Sovereign is the most valuable British coin, with one sold for £1 million. Its rarity stems from Edward VIII’s brief reign, making coins featuring his likeness highly sought after. Other valuable coins include the 1933 George V Penny and the 1643 Charles I Triple Unite.

Image credits: Wikimedia Commons, Public Resource.org and Wikimedia Commons

Live Gold Spot Price in Sterling. Gold is one of the densest of all metals. It is a good conductor of heat and electricity. It is also soft and the most malleable and ductile of the elements; an ounce (31.1 grams; gold is weighed in troy ounces) can be beaten out to 187 square feet (about 17 square metres) in extremely thin sheets called gold leaf.

Live Silver Spot Price in Sterling. Silver (Ag), chemical element, a white lustrous metal valued for its decorative beauty and electrical conductivity. Silver is located in Group 11 (Ib) and Period 5 of the periodic table, between copper (Period 4) and gold (Period 6), and its physical and chemical properties are intermediate between those two metals.