The Effect of Government Quantitative Easing on Gold and Silver

12/07/2018Daniel Fisher

Free & fully insured UK Delivery. Learn more

Secure & flexible payments. Learn more

Buyback Guarantee Learn more

A country’s monetary policy usually has some kind of knock-on effect on the prices of all stocks, bonds and commodities. Of course, although we view gold and silver as precious metals, they are essentially traded as commodities. So, all monetary policies will have certain effects on the gold and silver markets. Investors are often confused about what quantitative easing really is and how this move affects markets. Let’s dive in and find out.

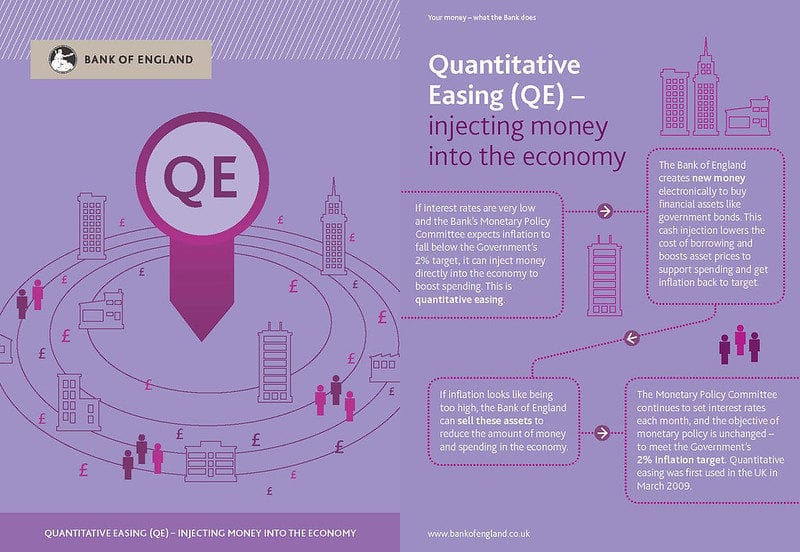

Firstly, quantitative easing is not a normal step taken by the central bank of a country. It is an extraordinary and somewhat unconventional move in which a country’s central bank basically increases the money supply. Many of you may think that’s inflation. But we must understand that quantitative easing does not involve the printing of extra banknotes. The central bank (in the UK it would be the Bank of England) simply buys government securities and other financial instruments from the market in a bid to lower interest rates and increase the money supply, thereby creating more liquidity.

An explanation of quantitative easing from the Bank of England

So, the assumption here is that lowering interest rates would add stimulus to the economy by encouraging industry to invest more. When companies invest and start new projects, more jobs are created and additionally, there is a positive ripple effect that kick starts smaller suppliers to also start providing services to the bigger players.

Gold is a safe haven for investors during times of uncertainty

So, quantitative easing (QE) increases the supply of money and financial institutions benefit by increasing their capital base. This promotes lending and increases liquidity, ushering in a revival of the economy. Quantitative easing is usually a step taken when short-term interest rates have fallen to zero or are nearing zero levels. Going by past experience, we can say that if the central banks invest $600bn, the move typically triggers a fall in interest rates of 0.15 to 0.2%.

At the height of the last financial crisis, in 2009, the interest rates were dropped to 0.5% for the first time in the history of the Bank of England. The UK economy badly needed a shot in the arm and the first QE programme for the UK was started with an infusion of £75 billion. This was eventually raised to £200 billion. The programme was rolled out on 5th March 2009. The Bank of England had been contemplating a drop in interest rates to 0.5% from 1.00% for a while. By November 2008, the financial pundits of the Gordon Brown government knew that the drop to 0.5% wasn’t going to be enough. It had to be backed by a parallel strategy that could save Britain from going into a long drawn economic depression.

Alistair Darling, the Chancellor of the Exchequer adopted a financial technique that had been used in Japan during the early 2000s. Interestingly, the same technique had also been adopted by Ben Bernanke, the chairperson of the American Federal Reserve, during the US chapter of the crisis, which triggered the fall of Lehman Bros. The radical macroeconomic technique was designed to put cash back into the hands of banks by buying out the government and corporate bonds they held.

These resources would have a two-pronged effect. Firstly, the new demand for these gilts would drive up their prices, triggering the required fall in the interest rates. Banks would now have money to pump back into the economy and things would be easier for businesses and individuals, as the cost of borrowing would be radically reduced. That was pretty much how the under-performing banks like RBS were saved back in the day. The government was able to bail them out via the QE programme.

Many homeowners also rejoiced at the time, since their mortgage repayments dropped to a negligible level. Many homeowners across Britain seized the opportunity to opt for capital repayment, ensuring that banks were able to recover their sub-prime housing loans, injecting more cash into their reserves. The move was hailed as having a double whammy effect for the sub-prime housing market in the UK. While the banks were able to claw back the money they had loaned, homeowners were able to reduce their debt exposure and free up equity in their homes.

However, many critics have been sceptical about the success of the U.K.’s QE programme. It has been 11 long years since the programme was rolled out. It had been purported as an emergency measure, designed to revive the economy and not a permanent fixture. Additionally, interest rates never recovered completely and remained near zero, as we plunge headlong into the next financial crisis. So, the verdict in the minds of many is that the program was a relief mechanism that did not have long-term success. However, in the backdrop of these criticisms, one must not forget that the UK has had the longest sustained quarterly growth record of any G-7 nation.

On 15th March 2020, the US Fed announced its fourth round of quantitative easing. The Fed is purchasing $700 billion worth of mortgage-backed securities ($200 billion) and treasuries ($500 billion) with three main priorities:

Part of the Fed announcement from 15th March said

“We haven’t set a gradual schedule for QE, quite deliberately. This crisis in UK financial markets demanded more. We will act in the markets promptly and rapidly as we see appropriate. The alternative was a run on sterling, a flight to the dollar and a complete breakdown of the UK financial system’s core.”

On March 23rd, 2020 the Federal Reserve announced:

“it would purchase an unlimited amount of Treasuries and mortgage-backed securities in order to support the financial market.”

On 19th March 2020 the Bank of England increased quantitative easing in the UK by £210 billion (from £435 billion to £645 billion) through the purchase of government bonds.

Andrew Bailey the new Governor of the Bank of England announcing the £210 billion quantitative easing said:

“We haven’t set a gradual schedule for QE, quite deliberately. This crisis in UK financial markets demanded more. We will act in the markets promptly and rapidly as we see appropriate. The alternative was a run on sterling, a flight to the dollar and a complete breakdown of the UK financial system’s core.”

On 18th June, 2020 the Bank of England raised quantitative easing by an additional £100 billion (from £645 billion to £745 billion) through an additional purchase of government bonds.

Andrew Bailey said after the additional easing

“As partial lifting of the measures takes place, we see signs of some activity returning. We don’t want to get too carried away by this. Let’s be clear, we’re still living in very unusual times.”

All quantitative easing to date by the central bank for quantitative easing purposes have been (click here for further details):

On 18th March, Christine Lagarde the President of the European Central Bank announced the €750 billion Pandemic Emergency Purchase Programme (PEPP). This was for the purchase of private and public sector securities to mitigate the economic risks caused by the COVID-19 pandemic. Purchases will be made up until the end of 2020 for all asset categories, which are eligible under their asset purchase programme.

On 4th June, the EU announced an additional €600 billion of quantitative easing with an aim of controlling inflation and stimulating vulnerable areas of the EU economy caused by the COVID-19 pandemic. This brings the total response to €1350 billion of quantitative easing when added to the €750 billion from March.

Although, this is a moving picture as at 22nd March the following amount of quantitative easing has been provided by the 3 different central banks:

The US response was the first and is now seen as a small intervention in the markets. Almost certainly there will be further rounds of quantitative easing from the 3 central banks.

The 2008 financial crisis triggered massive falls in interest rates in the UK. As the crisis broke out, interest rates were at 4.5% on 8th October 2008. By 5th March 2009, it had fallen to 0.5%. Unemployment rose as businesses failed due to their cash flows being affected by the bank’s refusal to lend. Overall consumer confidence plummeted and the entire economy entered a bearish phase. By March 2009, quantitative easing was introduced. The Bank of England put in an initial tranche of £75bn in new money, rising up to £375bn eventually.

If you want to know “How to sell gold for the most cash”, watch our YouTube video.

The Bank of England actually called it ‘asset purchase facility’ and bought assets from financial institutions like high street banks. Many of us remember the bailing out of Northern Rock at the time. The Bank of England formally started its QE program on 5th March 2009 after bailing out the high street banks. Initially, it was just long-term government bonds, but by the 25th of March, the program had been expanded to purchasing corporate bonds as well, in an effort to boost business confidence and increase lending to companies. In 2013, Japan announced a massive QE program going into trillions of dollars to boost its economy, in response to the global financial crisis.

The Bank of England introduced quantitative easing in 2009 as part of the monetary policy

In recent years, the ECB has announced a halt to its QE programme, in spite of a continuing slowdown in the European economy. The ECB is currently investing 30bn euros in buying bonds, although this program was slated to phase out by the end of 2018, Coronavirus and the world economy has caused a change in plan!

So, now that we know what quantitative easing is all about and how large industrialised economies used it during the global recession, let’s look at how it affects the gold and silver markets. Well, firstly quantitative easing is a step usually taken by central banks during economic turmoil. We already know that gold and silver act as safe havens during these times. So, if we look at price charts for gold during the period 2009 to 2011, we can see that gold prices skyrocketed during this period.

According to economist Marc Faber, quantitative easing hurts currencies and sends people rushing to buy gold. In 2016 he predicted that gold would continue to rise on the back of the fourth round of QE undertaken by the US federal reserve. On June 14th, 2018 when the ECB made the announcement to phase out QE by the end of 2018, they also announced that the European economy was still soft and interest rate hikes would not take place till March 2019. This news saw the gold market responding positively on that very day. Therefore, we can surmise that while QE is good news for the economy in terms of its GDP growth at a time of crisis, it’s not good for the stability of currencies. It’s both these reasons that spur the rise of gold prices at these times.

Our investment experts can guide you on the best times to invest in gold and silver and how to approach them. Call Physical Gold Limited on 020 7060 9992 or get in touch online and a member of our team will get in touch with you shortly to discuss your investment objectives and how precious metals can be an important part of your investment plan.

We sell a range of gold bars (sizes from 1oz, 100g to 1 kilo), gold coins (including gold Sovereigns and gold Britannias).

We also sell an excellent silver range, including silver bars (such as a 1 kilo silver bar) and silver coins (including silver Britannias).

Image credit: Wikipedia

Live Gold Spot Price in Sterling. Gold is one of the densest of all metals. It is a good conductor of heat and electricity. It is also soft and the most malleable and ductile of the elements; an ounce (31.1 grams; gold is weighed in troy ounces) can be beaten out to 187 square feet (about 17 square metres) in extremely thin sheets called gold leaf.

Live Silver Spot Price in Sterling. Silver (Ag), chemical element, a white lustrous metal valued for its decorative beauty and electrical conductivity. Silver is located in Group 11 (Ib) and Period 5 of the periodic table, between copper (Period 4) and gold (Period 6), and its physical and chemical properties are intermediate between those two metals.