Understanding Gold Ore Grades

30/05/2024Daniel Fisher

Free & fully insured UK Delivery. Learn more

Secure & flexible payments. Learn more

Buyback Guarantee Learn more

Every industry has its own jargon which can confuse novices. To make matters more puzzling, it’s not uncommon for some terms to be used to refer to completely different things. Gold Grade is one of those expressions which participants use for various meanings.

The aim of this guide is to unravel the term Gold Grade as it represents the amount of gold present in the ore extracted from the earth. This is a critical concept in the mining sector, rather than for retail customers. It shouldn’t be confused with the secondary use of the term which is interchanged with the phrase Gold Purity. We explain the difference between the two concepts further down in this guide.

Gold grade refers to the concentration of gold within ore. It is a measure of how much gold can be extracted from a specific amount of mined material. It’s a crucial evaluation for mining companies gauging the viability of certain operations.

Gold grade is usually expressed in grams per tonne (g/t) or ounces per ton (oz/t). High-grade gold ore contains more raw gold, making it more valuable and economical to mine. Low grade gold may prove unviable to mine due to the lower gold yield versus mining and processing effort required.

It’s important to distinguish between gold grade and gold purity. Gold grade measures the amount of gold within ore before it’s processed, while gold purity refers to the percentage of gold in the final, refined product. Gold purity is either measured in fineness (the number of parts gold per 1,000 parts) or gold karats, where 24 karat gold is deemed pure.

Gold grade represents the proportion of raw gold which can be extracted from gold ore. Meanwhile gold purity is measured after the addition of alloys to the pure gold to create and mint the final product, whether it be gold bars, gold coins, or gold jewellery.

Confusingly the expression gold grade is also typically used interchangeably with purity to refer to the finished gold product’s purity. This particular use of ‘gold grade’ is important to understand the value of a specific gold coin or piece of jewellery.

The term ‘Investment Grade Gold’ is assigned to finished gold products which meet certain criteria. The two main requirements to be classified as investment grade gold is to be in the form of coins or bars and be of no less than 22 carats in purity. This is a critical classification as it qualifies the gold item as VAT-exempt, ensuring it’s a far more cost-effective investment.

To complete the trifecta of ambiguity, a third, similar expression is also common within the precious metal’s world. ‘Graded gold coins’ refer to minted coins which are then sent to third party grading services who study the coin and allocate a grade reflecting its condition. The coins are then encapsulated in plastic, along with a grade score, providing reassurance for owners and potential buyers.

A simple way to distinguish between the three expressions is understanding the production stage in which they’re utilised.

Gold (Ore) Grade The density of gold within gold ore, that is yet to be processed.

Gold Grade/Purity The proportion of gold versus alloys in a refined product.

Graded Gold Coins which are retrospectively sent to be assessed for condition.

Free ultimate guide for keen precious metals investor

Gold grade is measured to determine the concentration of gold in the ore extracted from a mine. This measurement helps assess the potential value of the mining operation.

Gold grade is typically measured in grams per tonne (g/t) or ounces per ton (oz/t). Grams per tonne is the metric system’s unit, while ounces per ton is used in the imperial system. Both units indicate the amount of gold found in a specific weight of ore.

While there’s no official gold ore density categorisations, the general consensus to gauge the density of gold or mined ore is;

Higher grade mining has a density of 8.0 to 10.0 g/t

Lower grade mining has a density of 1.0 to 4.0 g/t

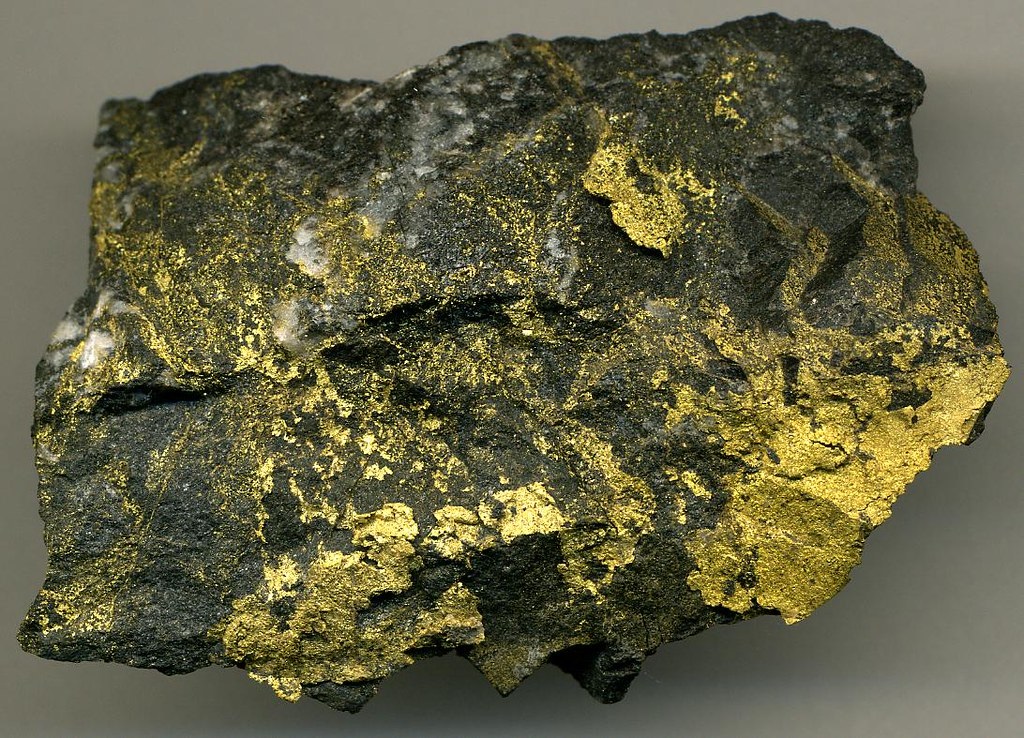

To accurately measure gold grade, miners use various sampling and analysis methods. To the eye, a sample may look like it contains lots of gold when in fact it’s mainly fool’s gold.

Sampling provides the information necessary for mining companies to make investment decisions.

Extracting cylindrical samples from rock to analyse the gold content.

Collecting large samples of ore to get a more representative estimate of the gold grade.

Laboratory analysis is then conducted on these samples using techniques like:

A traditional and highly accurate method where ore samples are melted to separate and measure gold content.

Atomic Absorption is a technique that measures the concentration of gold by detecting the absorption of light.

A highly sensitive method that can detect even trace amounts of gold in the ore.

Gold deposits form in different ways and in various geological areas. Classification is based on how and where the gold is found in nature and will determine how they’re extracted. Understanding these types helps in identifying the best mining methods and predicting potential yields as gold grade can vary between the deposit categories.

It can sometimes be more economically viable to remove lower grade gold from nearer the surface, than very high-grade gold ore which is deeper and more expensive to extract

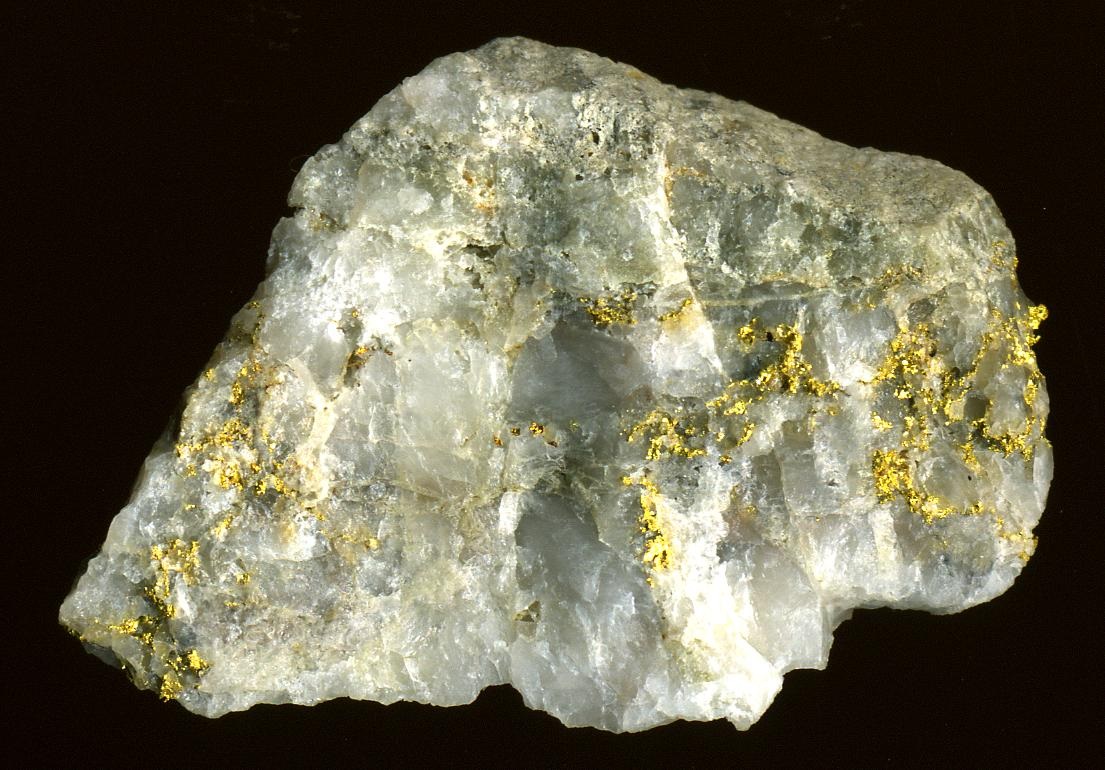

Lode deposits are primary gold deposits where gold is found in veins or rock formations. These deposits are usually deep underground and require mining techniques like tunnelling to extract the gold. Lode deposits often contain high-grade gold, making them highly valuable. Examples of lode deposits include the famous gold mines in South Africa and the United States.

Placer deposits are secondary deposits where gold has been eroded from its original source and deposited in riverbeds, beaches, or other sedimentary environments. These deposits are typically closer to the surface, making them easier to mine using methods like panning, sluicing, or dredging. Placer deposits can vary widely in gold grade, but they are generally easier and less expensive to extract than lode deposits.

The grade of gold in ore is influenced by several factors, including geological conditions and mining methods. Understanding these factors is essential for efficient gold extraction and maximizing profitability.

The geological setting where gold is found plays a significant role in determining the gold grade. Factors such as the type of rock, the presence of other minerals, and the geological processes that formed the deposit all impact the concentration of gold. Hydrothermal activity, for instance, can create high-grade gold veins, while sedimentary processes might lead to lower-grade placer deposits.

Different mining methods affect the recovery and grade of gold from ore. The choice of method depends on the depth and type of gold deposit.

This method is used for near-surface deposits and generally involves removing large amounts of overburden to access the ore. The average gold grade for open pit mines typically ranges from 1 to 4 grams per tonne (g/t). Lower-grade ores can be economically viable due to the large scale of operations.

Top 10 highest grade open-pit gold mines. Information supplied by Mining.com

Used for deeper, high-grade deposits, this method involves creating tunnels and shafts to access the ore. The average gold grade for underground mines is often higher, typically between 4 and 10 grams per tonne (g/t). Some high-grade underground mines can have grades exceeding 10 g/t.

Top 10 highest grade underground gold mines. Information supplied from Mining.com

Simply targeting high density gold ore won’t necessarily yield the mining company higher returns. As well as the depth of the ore (and its subsequent extraction cost), the varying composition of the rock also has a significant impact on the mining process and economic value of the extracted gold. Ores often contain various precious and base metals, which can provide additional benefits or challenges in the extraction process.

Ores frequently contain other valuable metals such as silver, copper, lead, and zinc. These metals can be recovered as by-products, enhancing the overall profitability of the mining operation. Mines that produce gold along with other valuable metals can sustain profitability even if the gold grade is lower. This diversification reduces the risk associated with fluctuating gold prices. For instance:

The composition of the ore also affects the difficulty of extracting gold. Different mineral compositions require different processing techniques:

Ores with fewer impurities and a higher concentration of free-milling gold can be processed using straightforward methods like gravity separation and cyanidation.

Ores containing sulphides or other complex minerals can trap gold, making extraction more challenging. These ores often require additional treatments such as roasting, pressure oxidation, or bio-oxidation to free the gold.

Check out what your gold is worth in our selling section

Gold grade is a critical factor in mining operations, influencing both the environmental impact and the economic viability of a project. Higher gold grades can lead to more efficient and profitable mining, while lower grades can pose significant challenges.

The gold grade directly affects the environmental footprint of mining activities. High-grade ores require less material to be processed to extract the same amount of gold, leading to:

Higher-grade mines generate less waste rock and tailings, minimizing the environmental disruption.

Extracting gold from high-grade ore typically requires less energy, reducing the carbon footprint of mining operations.

Higher-grade ore processing involves fewer chemicals, decreasing the potential for chemical spills and contamination.

Conversely, low-grade ores necessitate processing larger volumes of material, which can result in significant environmental degradation. This includes increased land disturbance, higher water usage, and greater risk of pollution. As awareness, social pressures, and legislation around the environmental impact of mining intensifies, so does the importance of assessing gold ore grade.

The gold grade is a key determinant of the economic feasibility of a mining project. Higher gold grades can lead to:

In contrast, low-grade gold mines face higher production costs and may struggle to remain economically viable, especially during periods of low gold prices. These operations often require advanced technologies and innovative approaches to extract gold efficiently, which can increase initial investment and operational costs. Sometimes walking away from a gold discovery can prove to be the best decision if the potential profit doesn’t justify the huge allocation of resources.

Understanding gold grade data is crucial for assessing the potential and profitability of a mining project. Accurate interpretation helps in planning, investment, and operational decisions.

Gold grade data is essential for estimating the resources and reserves of a mining project. These estimates are classified into three categories:

High confidence in the quantity and quality of gold, based on detailed sampling.

Reasonable confidence in the quantity and quality, with some areas requiring further exploration.

Lower confidence, based on limited sampling and requiring significant additional exploration.

Gold grade data plays a key role in feasibility studies, which assess the practicality and profitability of a mining project. These combine the various factors of grade, composition, extraction challenges, and by-products, to decide the viability of a project. High-quality grade data is essential for accurate feasibility studies, ensuring that projects are planned and executed with realistic expectations and sound financial backing. There are two main types of feasibility studies:

Preliminary Feasibility Study (PFS)

Provides an initial assessment of a project’s economic viability, including initial estimates of gold grades, costs, and potential revenue.

Definitive Feasibility Study (DFS)

Offers a comprehensive analysis, including detailed gold grade data, to make final investment decisions and plan the mining operation.

A gold ore grade measures the concentration of gold in the ore extracted from a mine. It is typically expressed in grams per tonne (g/t) or ounces per ton (oz/t). Higher grades mean more gold is present in the ore, making it more valuable.

The highest quality gold ore is found in high-grade lode deposits, which can contain gold concentrations exceeding 20 grams per tonne (g/t). Examples include the Fosterville Mine in Australia and the Macassa Mine in Canada, known for their exceptionally high gold grades.

Gold grade is crucial because it determines the economic viability of a mining operation. Higher-grade ores are more profitable to mine as they yield more gold per tonne of ore processed, reducing costs and increasing profitability.

Gold grade is measured through sampling and laboratory analysis. Common methods include core sampling, bulk sampling, and analysis techniques like fire assay, atomic absorption spectroscopy (AAS), and inductively coupled plasma mass spectrometry (ICP-MS).

Open pit mines usually have gold grades ranging from 1 to 4 grams per tonne (g/t), while underground mines often have higher grades, typically between 4 and 10 g/t. Some high-grade underground mines can have grades exceeding 10 g/t.

Factors affecting gold grade include geological conditions, the type of deposit (lode or placer), the presence of other metals, and the mining methods used. Geological formations and processes, such as hydrothermal activity, play a significant role in determining gold concentration.

Gold ore is categorized into two main types: lode deposits and placer deposits. Lode deposits are found in veins or rock formations, often deep underground. Placer deposits are formed by the erosion of gold from its original source and are found in riverbeds, beaches, or sedimentary environments, typically near the surface.

Image credits: Flickr, Wikimedia Commons, Wikimedia Commons

Live Gold Spot Price in Sterling. Gold is one of the densest of all metals. It is a good conductor of heat and electricity. It is also soft and the most malleable and ductile of the elements; an ounce (31.1 grams; gold is weighed in troy ounces) can be beaten out to 187 square feet (about 17 square metres) in extremely thin sheets called gold leaf.

Live Silver Spot Price in Sterling. Silver (Ag), chemical element, a white lustrous metal valued for its decorative beauty and electrical conductivity. Silver is located in Group 11 (Ib) and Period 5 of the periodic table, between copper (Period 4) and gold (Period 6), and its physical and chemical properties are intermediate between those two metals.