Gold Prices Surge to 7 Year Highs Due to Coronavirus Pandemic Fears

25/02/2020Daniel Fisher

Free & fully insured UK Delivery. Learn more

Secure & flexible payments. Learn more

Buyback Guarantee Learn more

February 24th, 2020 saw gold prices surge to a 7 year high. Concerns about a COVID-19 coronavirus global pandemic upset the markets, we investigate reasons for recent events in this latest article.

The expression “coronavirus” is actually a term used to describe a large family of viruses, which cause a range of conditions ranging from the common cold to more serious illnesses such as MERS and SARS. The virus outbreak in 2020 called the “coronavirus” is actually COVID-19, a new strain of the coronavirus family, which had previously not been known to have infected humans.

Signs to look for with COVID-19 are breathing problems, cough, fever, respiratory problems and shortness of breath. In most cases, the virus is fairly innocuous and only creates mild conditions in the sufferer. More severe complications can lead to acute conditions such as kidney failure, pneumonia, respiratory syndrome and worst-case scenario even death.

Mortality rates are not yet fully known, although the World Health Organisation estimates that between 1-2% of people infected with the virus will die. There is as of the time of writing (25th February 2020) no known vaccine, although research to create a vaccine is being undertaken rapidly around the world.

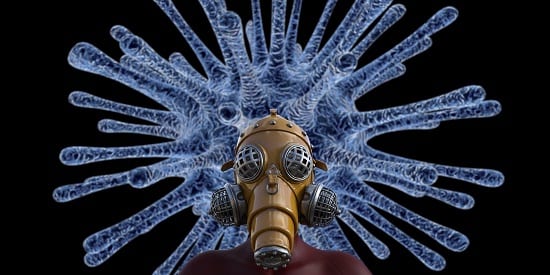

The COVID-19 coronavirus is causing concerns about a global pandemic

As I write the World Health Organisation says: “The World must prepare for a COVID-19 pandemic”. This doesn’t necessarily mean a pandemic will occur, but the world needs at least to be prepared.

According to the Merriam Webster Dictionary a definition for a pandemic is:

“An outbreak of a disease that occurs over a wide geographic area and affects an exceptionally high proportion of the population. A pandemic outbreak of a disease.”

Currently, there have been 77,000 cases in China and 1,200 other cases around the world, which are spread over 30 countries. According to the NHS, COVID-19 is a High Consequence Infectious Disease. Although, seen as a lower-mortality rate than SARS and previous viruses it is the infectiousness of COVID-19 that makes a pandemic likely. The virus spreads itself mainly through the air but also can spread through bodily contact.

Now what you may be wondering will the impact of COVID-19 have upon gold and other precious metal prices? We summarise some of the main impacts below:

On February 24th, the Dow Jones Index fell 3.5%, the UK FTSE fell 3.3% and the Milan stock market fell 6% (mainly because Italy had a large outbreak). These wiped out an entire year’s worth of index gain on the Dow Jones in just one day. Companies with high exposure to China (Disney, Nike and Apple) and travel companies were most affected with EasyJet falling 16.7% in one day and British Airways falling in price.

Events such as the coronavirus COVID-19 outbreak cause investors to seek safe haven investments

As shares are sold, generally investors will look for an alternative asset-class to invest their funds into (typically safe havens). Conversely to shares, gold prices hit a 7-year high on February 24th 2020. The reasons for this price rise are multi-faceted (as changes in gold price always are) but undoubtedly an underlying tension about the possible global economic impact of COVID-19 is the main factor.

Most Analysts believe that gold prices will continue to rise, particularly in the short to medium-term. Investors are currently moving out of stocks/shares and currencies and investing in safe haven assets such as gold and silver.

It proves once again that investors value the tangibility of gold and at times of economic uncertainty, investors value investments they can “feel and touch”, especially ones which can be used as a highly liquid alternative form of currency to traditional cash.

The team at Physical Gold have vast experience in precious metals trading. Check our About Us page to view our accreditations and trade memberships.

Call us today on 020 7060 9992 or email us to contact the team. We can speak about your current circumstances and suggest the best gold/silver investment strategies to meet your needs.

Image Credits: The Digital Artist and Ben Taylor 55

Live Gold Spot Price in Sterling. Gold is one of the densest of all metals. It is a good conductor of heat and electricity. It is also soft and the most malleable and ductile of the elements; an ounce (31.1 grams; gold is weighed in troy ounces) can be beaten out to 187 square feet (about 17 square metres) in extremely thin sheets called gold leaf.

Live Silver Spot Price in Sterling. Silver (Ag), chemical element, a white lustrous metal valued for its decorative beauty and electrical conductivity. Silver is located in Group 11 (Ib) and Period 5 of the periodic table, between copper (Period 4) and gold (Period 6), and its physical and chemical properties are intermediate between those two metals.