How Much are Gold Sovereign Coins Worth?

17/07/2020Daniel Fisher

Free & fully insured UK Delivery. Learn more

Secure & flexible payments. Learn more

Buyback Guarantee Learn more

Gold sovereign prices fluctuate with the gold spot price, but below is the latest information on the value of a gold sovereign today. These are guide prices for selling standard Sovereigns.

As a general rule of thumb for gold sovereign prices, you can take the current price per gram, found on our live spot price page. You then simply multiply this price by the pure gold content of your coin, as seen in the table above. If you’re looking to sell, then dealers will likely pay a small discount to this price.

However, these prices are not the same ones that you’ll find on each of our pages if you are looking to buy full sovereign coins, half sovereign coins or quarter sovereign coins.When you purchase any gold coin or bar, you’ll be charged a premium over this ‘spot value’ which reflects costs such as production and delivery and the quantity you’re buying.

The value of a Gold Sovereign also depends on several other variables. The age and condition of the coin will also impact the worth, with Victorian gold Sovereigns being valued higher than newer coins for example. This is called numismatic value, which can lead to large increases in price for certain coins. Finally, private coin collectors may pay higher for a particular Sovereign than a jeweller for instance.

The prices you see above are an indication of what you’ll receive when you sell gold sovereign coins to us. Live prices if you’re looking to buy Sovereign coins can be found here Full gold sovereign coins or half sovereign coins.

A gold sovereign is a British gold coin first minted in 1489 under King Henry VII. The coin has a rich history and holds a special place in the hearts of coin collectors and investors. Today, gold sovereigns are popular for their gold content, historical significance, and tax advantages.

Gold sovereigns are made from 22-carat gold, weighing 7.98 grams and measuring 22.05 mm in diameter and 1.52 mm in thickness. The pure gold content of a sovereign is 7.32 grams. See our guide for more detail on a gold sovereigns size.

Gold sovereigns were initially introduced in 1489 by King Henry VII and were used as currency across the British Empire. They gained popularity because of their gold content, intricate designs, and the significance they held in British coinage. Over the centuries, the designs on gold sovereigns have evolved, with the most famous design featuring Saint George slaying a dragon by Benedetto Pistrucci. For more information on the history of gold sovereigns, you can visit: The Royal Mint – History of the Gold Sovereign.

Comprehensive guidance on gold and silver investment

Gold sovereigns are highly sought-after British coins known for their intricate design, resilience and historical significance. These coins have been minted since 1817, with various designs used over the years. This section will explore some of the most common designs and features found on gold sovereigns, focusing on aspects that would help collectors and investors identify and appreciate their coins.

The face value of a gold sovereign coin is £1. However, this does not necessarily mean the coin is worth only £1, as its gold content and market conditions significantly influence its actual value.

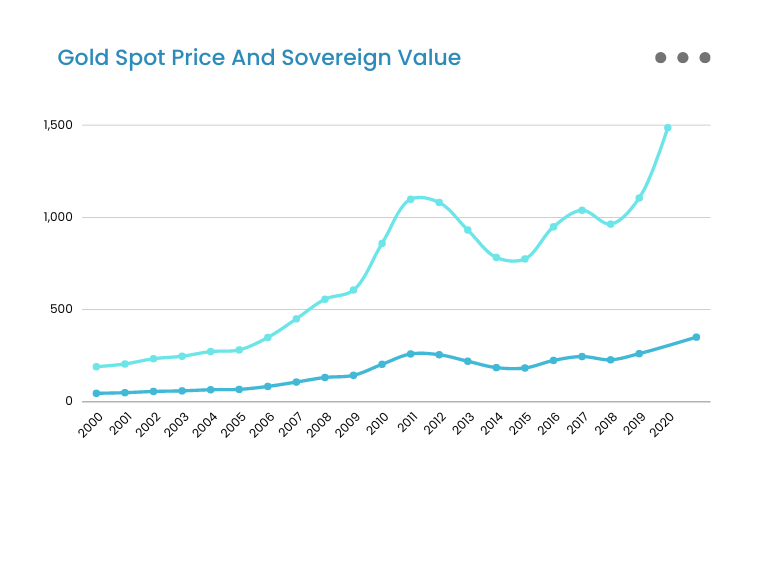

Below is a table detailing the average gold price per troy ounce in British Pounds (GBP) for each year from 2000 to 2020, along with the corresponding gold sovereign value based on the gold content only. The pure gold content of a gold sovereign is 7.32 grams, which is equivalent to 0.2354 troy ounces. Additional premiums on particular Sovereigns and during various timeframes will vary. Gold Spot Price (Light blue), Sovereign Price (Darker blue).

Gold sovereigns are considered a good investment for several reasons, making them an attractive option for investors looking to diversify their portfolios. These British coins offer not only the pure gold value inherent in bullion coins but also come with a historical and numismatic significance. Let’s delve deeper into the factors that make gold sovereign coins an excellent long-term investment:

The value of a gold sovereign is influenced by several market conditions, which can significantly impact its worth. Here is an in-depth look at these factors:

Gold prices fluctuate daily due to various factors, such as currency values, interest rates, inflation, and economic and political events. These fluctuations directly affect the value of gold sovereigns since their worth is primarily based on their gold content. Monitoring global gold prices can help investors identify trends and make informed decisions when buying or selling gold sovereigns.

The market demand for gold sovereigns and their availability also play a crucial role in determining their value. Higher demand for these coins, coupled with limited supply, often results in higher prices. On the other hand, if the market is saturated with gold sovereigns, their value might decline. Rarity, mintage, and historical significance can also affect demand and, consequently, the value of gold sovereigns.

Global economic and political events can influence the value of gold sovereigns. During times of economic uncertainty or political instability, investors often turn to gold as a safe-haven investment, which can increase demand for gold sovereigns and, in turn, their value. Additionally, government policies and regulations concerning gold ownership and taxation can impact gold sovereign prices.

Identifying the right time to buy gold sovereigns can help investors maximise their returns. Here are some strategies to consider:

To ensure your gold sovereign is genuine, pay attention to the following indicators:

For more information on gold sovereign hallmarks, visit our guide on the hallmarking of coins.

If you’re looking to sell your gold sovereigns, it’s essential that you work with a reputable dealer to ensure you receive a fair price for your coins.

Physical Gold Limited, a registered member of the BNTA, has a long track record of providing excellent service. To get in touch with their investment team, call (020) 7060 9992.

For a more detailed guide on selling your gold sovereigns, check out our insights on how to sell gold sovereign coins.

Gold sovereigns minted in 1604 or before are highly desirable due to their scarcity and rarity value. Bigger and heavier than today’s sovereign and made from purer 23-carat gold, their prices are not affected by the market price of gold and they can fetch thousands.

Gold Sovereigns are British coins made from 7.98 grams of 22-carat gold.

To sell your gold sovereign, work with a reputable gold dealer to ensure you receive a fair price reflecting the gold content and numismatic value of the coin.

A gold sovereign coin is minted in 22ct gold, which means it is made up of 91.67% fine gold. Each sovereign contains 7.32 grams of fine gold. The bullion value of your sovereign is determined by multiplying the fine gold content by the spot price at the time.

The value of a 1912 gold sovereign depends on its condition, rarity, and current gold price. To determine its worth, consider both the gold content and any numismatic value the coin may possess.

All sovereigns have a fineness of 916.7, which means that out of 1,000 parts, 916.7 parts are pure gold, equating to a purity of 91.67%. This has been the purity and weight of gold sovereigns since their reintroduction in 1817, making them 22-carat gold coins.

The weight of a gold sovereign is 7.98 grams, with a pure gold content of 7.32 grams. They measure 22.05 mm across and are 1.52 mm thick.

Live Gold Spot Price in Sterling. Gold is one of the densest of all metals. It is a good conductor of heat and electricity. It is also soft and the most malleable and ductile of the elements; an ounce (31.1 grams; gold is weighed in troy ounces) can be beaten out to 187 square feet (about 17 square metres) in extremely thin sheets called gold leaf.

Live Silver Spot Price in Sterling. Silver (Ag), chemical element, a white lustrous metal valued for its decorative beauty and electrical conductivity. Silver is located in Group 11 (Ib) and Period 5 of the periodic table, between copper (Period 4) and gold (Period 6), and its physical and chemical properties are intermediate between those two metals.