How to Buy Silver Britannia Coins?

10/04/2025Daniel Fisher

Free & fully insured UK Delivery. Learn more

Secure & flexible payments. Learn more

Buyback Guarantee Learn more

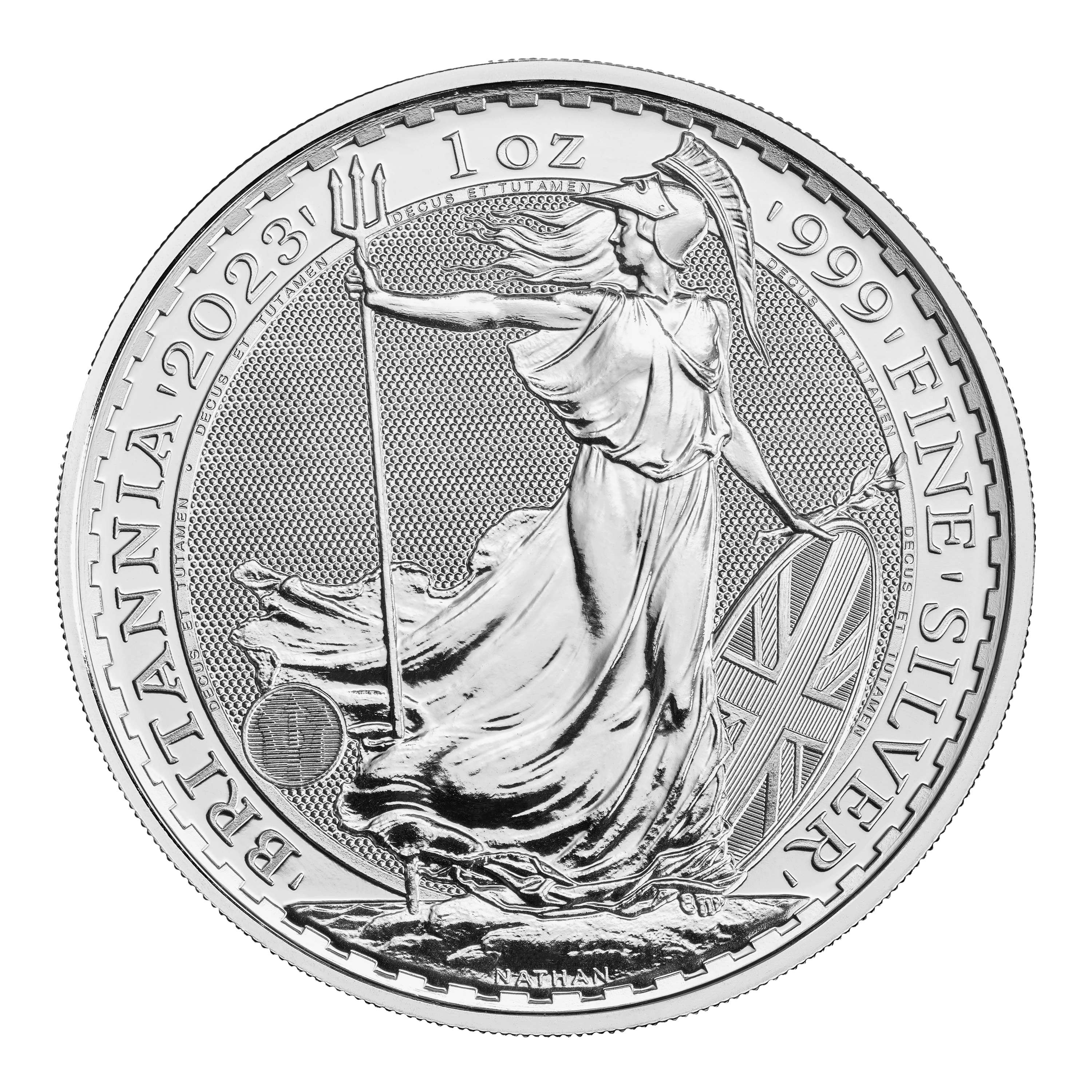

Silver Britannia coins are the UK’s flagship silver bullion coins, first introduced by the Royal Mint in 1997. Struck in .999 fine silver and carrying a face value of £2, they feature the iconic image of Britannia—symbolising strength and national pride.

They are hands down, the most popular choice for UK investors wishing to obtain silver. As legal tender in the UK, they’re exempt from Capital Gains Tax, are highly liquid, provide handy 1oz divisibility, and can be obtained at competitive prices.

Whether you’re a first-time investor or adding to your stack, knowing where to buy Silver Britannias safely and at a fair price is key. The constantly moving silver price makes it more difficult to compare prices between sellers, enabling divergence in premiums. Picking the most suitable place to buy your coins will not only impact the price you pay, but also the possible ability to sell the coins and their authenticity.

Many investors choose to buy Silver Britannias from well-established bullion dealers. These platforms typically offer a wide selection, competitive pricing, bulk discounts, and secure, insured delivery.

Always check for clear and live pricing, customer reviews, and transparent terms before buying. Choosing a reputable dealer such as Physical Gold, with membership of leading trade associations such as the BNTA, provides peace of mind that coins are genuine and in top condition.

Their expertise can be beneficial in obtaining guidance with timing, strategy and types of coin. Most dealers will provide competitive buyback terms and professional vaulting services.

Buying directly from the Royal Mint ensures authenticity and peace of mind. While prices may be slightly higher due to premiums, you’re purchasing straight from the source. The Mint will no doubt have supply of Britannias even in the most frantic silver bull markets.

With higher prices also comes a far less personal service than from an independent bullion dealer. If you’re seeking to build a relationship to get special offers, guidance, and a voice at the end of the phone, then Royal Mint will struggle to fulfil this. Buyback prices will likely be lower than those of bullion dealers, and the mint focus on selling new Britannias only, excluding pre-owned versions.

Silver Britannias can also be found on platforms like eBay or in private auctions. While deals might be tempting, this route comes with more risk. Always verify seller ratings, look for proof of authenticity, and understand the platform’s buyer protection policies before purchasing.

This route may provide opportunities for finding a specific year or edition of Britannia if you’re a collector. But beware that sellers can inflate guide prices to suit their agenda.

But if you’re a silver investor, then you’re unlikely to be able to buy Britannias in sufficient quantities and the additional risks of dealing with the unknown public are far too high.

The number one way to buy silver Britannia coins is online from bullion dealers. Usability of websites will differ across the various dealers, with some websites being intuitive and clear, while others can be clunky and confusing. Regardless of which dealer you choose, the steps to purchase Silver Britannia’s online will be similar across the board.

It may seem odd to focus on payment as the first step, but in today’s financial landscape, it will save you time and hassle to do this first. Most dealers will accept credit cards, debit cards, or bank transfer. Check if dealer-imposed limits vary between each method so that you line up the appropriate approach. At Physical Gold, credit cards are accepted on orders up to £10k in value, debit cards up to £30k, and bank transfers for any amount.

You’ll then need to contact your issuing bank BEFORE placing your online order. Let them know your intention to make a purchase to ensure they will clear payment. Most banks now block payments to buy precious metals as a default and will need to be persuaded that you’ve done your research and know what you’re doing. This obstacle has become worse since UK banks became liable for customer losses up to £85k from October 2024.

With payment lined up, you’re ready to place your order. Ensure you’re on the correct product page as there are likely to be various versions of Silver Britannia, from new to pre-owned, collectible, to generic, from single coins to boxes of 500! Add the quantity of Britannias to your basket and you’re ready to go.

The next choice is between taking delivery or electing for specialist storage. We talk about the pros and cons or each further down in this blog. Most dealers will offer free insured delivery to your door but there will be a charge for storing your metals for you. If you prefer to pick up your order in person after placing your order, then check the best way to achieve this with the dealer.

Once you’ve completed your order and made payment, you may be asked to complete some ID checks, depending on your order size and payment method. Ensure that the dealer doesn’t share your details with any 3rd parties. At Physical Gold, our ID software takes 2 minutes to complete and sensitive documents like passports don’t need to be emailed.

Free ultimate guide for keen precious metals investor

Buying Silver Britannia coins may seem straightforward, but a few smart strategies can help you get more value for your money and avoid common mistakes.

Premiums on silver coins are significantly higher than those for their gold counterparts, a factor has a serious impact on the time it takes to be in profit when investing. But this initial price spread is vastly reduced if you’re able to buy second hand silver coins. Pre-owned silver coins bought privately may be prone to poor quality, but buying from a bullion dealer should ensure quality, with many older Britannias never leaving their official Royal Mint tubes. This is one of the cheapest ways to buy silver Britannias.

Physical Gold sell pre-owned silver Britannia coins under the banner ‘Best Value Silver Britannias” at almost 15% less than brand new editions. Crucially you’ll obtain the same price when offloading your best value Britannias in the future as selling back previously new coins. Always look for availability of pre-owned silver Britannias as they’re only in stock when other customers sell – which is rare with silver! Engaging with the ‘Notify me when back in stock” function will enable you to be first in the queue.

Buying in bulk—typically in tubes of 25 or monster boxes of 500—can significantly reduce the premium per coin. If you’re ready to invest more, these bulk options offer better value and are easier to store and stack.

Some websites will offer different product pages to buy individual silver Britannias, tubes of 25 coins, and monster boxes (containing 20 tubes of 25 coins). If you’re seeking to buy 500 Britannias for example, it’s wise to see if there’s a price difference in buying them between each of these three product pages (ie 500 x individual coins vs 20 x tubes versus 1 x monster box).

The 1oz Silver Britannia is the most liquid and widely traded format. While fractional sizes or larger bars might seem appealing, sticking to the standard 1oz coin offers the best balance of flexibility, recognisability, and resale value.

Quarter and tenth ounce silver Britannias were launched by Royal Mint in the past couple of years, but premiums are vastly higher than those imposed on the full 1oz versions. If investing, the 1oz coins provide by far the lowest price per gram way to buy silver Britannias. The fractional coins may be useful to add in small quantities for divisibility if you feel that you may use silver to buy goods in a future world devoid of fiat currency.

Developing a relationship with a reliable dealer can open the door to better service, early access to new releases, and even occasional discounts. Choose dealers with strong reputations, clear pricing, and responsive customer support.

The best example of benefiting from a relationship is obtaining pre-owned Britannias before they’re even added to the website. In addition, sound dialogue and planning with a dealer can obtain better selling prices when you’re looking to exit your position.

While special editions or limited-run Britannias might be tempting, they usually carry higher premiums and appeal more to collectors than investors. Unless you’re building a numismatic collection, it’s usually best to focus on standard bullion versions for maximum liquidity and value.

See latest indicative sale prices

Ensuring your Silver Britannia coins are genuine is essential—especially when buying from private sellers or marketplaces. Fortunately, there are several simple ways to verify authenticity, whether you’re checking a newly delivered order or evaluating a coin before purchase.

Modern Silver Britannias (from 2021 onward) include advanced security features like:

A genuine 1oz Silver Britannia should:

The best way to avoid counterfeits is to buy from reputable dealers or the Royal Mint. These sources guarantee authenticity and usually offer a return policy or buyback program.

Once you’ve built up a stack of Silver Britannias, proper storage becomes essential. Good storage keeps your investment secure, protects the coins from damage, and makes it easier to sell or access them when needed.

Storing your coins at home is a cost-effective and convenient option, especially if you like having direct access to your silver.

For peace of mind, invest in a solid safe and avoid advertising your holdings.

Vaulting services, often offered by bullion dealers or specialist providers, offer high-security storage with insurance and flexible selling options.

Vaulting is ideal for larger investments or anyone wanting maximum security with minimal hassle. Physical Gold charge 0.75%+VAT semi-annually for their UK-based silver vaulting service.

Timing your silver purchases can make a noticeable difference to your overall returns, especially if you’re buying regularly or in bulk. Silver prices are more volatile than gold, creating bigger swings in value and therefore buying opportunities. While no one can predict the market perfectly, there are a few smart strategies and patterns that can help guide your buying decisions.

Silver prices tend to move with global economic trends, particularly industrial demand. Since silver is used heavily in electronics, solar panels, and manufacturing, prices can slump when industrial activity slows—often creating buying opportunities for investors. Keep an eye on global economic indicators, central bank policies, and the gold-to-silver ratio for potential entry points. And remember, you need to be ahead of the curve. Reacting after a bullish economic event will mean the price has already increased. Trying to predict upcoming trends is the key.

Historically, silver prices often dip in the summer months (June–August) and rally towards the end of the year. While not guaranteed, these seasonal patterns can offer helpful clues, especially if you’re planning a larger purchase. Be aware of increased demand during economic uncertainty, which can drive prices and premiums higher. Black swan events such as Covid can turn seasonal patterns on their head.

If you’re unsure about timing—or want to reduce risk—dollar-cost averaging (DCA) is a smart approach. By investing a fixed amount at regular intervals (e.g. monthly), you buy more when prices are low and less when they’re high. Over time, this strategy can smooth out price fluctuations and reduce the impact of short-term volatility.

Don’t forget that silver investment should be for the long term. Even perfect timing won’t convert the significant trading spreads associated with silver into profits in the short term. Timing should be seen as a way of boosting your investment but shouldn’t be the be all and end all if you believe in silver fundamentally as an asset.

Silver Britannia coins are a strong investment, especially for UK buyers, seeking to take some risk but wanting a tangible asset. They’re Capital Gains Tax–exempt, widely recognised, and easy to sell, making them ideal for both beginners and experienced investors.

The best places to buy Silver Britannias are reputable bullion dealers. These sources offer verified coins, transparent pricing, buyback guarantees and secure delivery. Many can offer prices below the Royal Mint.

Pre-owned Britannias are often cheaper and just as valuable as new ones. New coins come in pristine condition but usually carry a significantly higher premium. Crucially, you’ll receive the same price when selling.

Yes, you can buy Silver Britannias in tubes of 25 or monster boxes of 500. Bulk buying usually lowers the cost per coin and is ideal for long-term investment.

Genuine Silver Britannias have advanced security features like a latent image and micro-text. Check weight & size, and buy from trusted dealers to ensure authenticity.

Live Gold Spot Price in Sterling. Gold is one of the densest of all metals. It is a good conductor of heat and electricity. It is also soft and the most malleable and ductile of the elements; an ounce (31.1 grams; gold is weighed in troy ounces) can be beaten out to 187 square feet (about 17 square metres) in extremely thin sheets called gold leaf.

Live Silver Spot Price in Sterling. Silver (Ag), chemical element, a white lustrous metal valued for its decorative beauty and electrical conductivity. Silver is located in Group 11 (Ib) and Period 5 of the periodic table, between copper (Period 4) and gold (Period 6), and its physical and chemical properties are intermediate between those two metals.