What is the Cheapest Way to Buy Silver?

03/10/2023Daniel Fisher

Free & fully insured UK Delivery. Learn more

Secure & flexible payments. Learn more

Buyback Guarantee Learn more

Globally, silver is sold at significant premiums over its spot prices. But, can UK investors buy it any cheaper?

Well, the only way to do that is to make informed decisions, purchase the silver online and in bulk, and buy junk silver coins. These coins are often sold below the silver spot price and so can be considered one of the cheapest silver buys on the market.

Although the percentage of silver in these coins often varies, investors do buy these as a form of speculation. It’s just like buying junk bonds. In this case, speculators get more silver for their money.

Silver has long captivated investors as a precious metal with compelling value. Many search for the most cost-effective ways to invest in this commodity in an uncertain economic climate. But with a diversity of silver products on the market, it can be challenging to identify the cheapest options for buying silver.

Here’s how to find a silver investment that will boost your portfolio and meet your investment goals without breaking the bank.

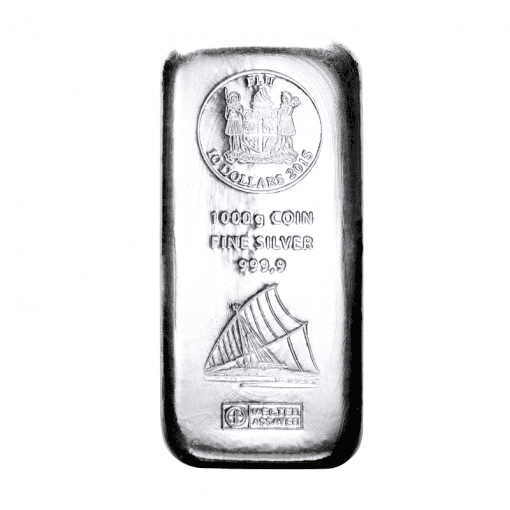

When it comes to finding the most affordable investment silver, one of the first decisions is whether to buy silver bars or silver coins. At first glance, silver bars seem to provide more silver for your money. Large bars like 5 kg carry lower premiums per ounce compared to coins, which can lead to significant savings on bulk purchases.

However, silver coins have advantages that make them competitive, if not cheaper, in some cases:

To determine the most cost-effective option, consider your budget, total ounces desired, investment objectives, storage situation, and anticipated usage. Both silver bars and coins have a role in a diversified silver portfolio. But for many retail investors, silver coins often provide the best value for maximising affordability while meeting your practical investment needs.

Junk silver coins are world coins with absolutely no numismatic value. Therefore, the only value it could possibly have is the value of the amount of silver content.

The most popular coins in this category are American silver coins that were minted before 1965. The US government minted several coins during this period using silver alloys. However, the purity of silver in these coins varied from 35 to 90%. So, these coins command a market value based on what is known as their ‘melt value’. Many of these coins are very attractive to investors as they present a way for them to buy silver at low prices.

Bullion coins such as the American Silver Eagle command a 25-30% premium over the spot price. However, junk silver coins can be bought at only 1-3% over the spot. So, it’s important to identify specific junk silver coins that have no value to numismatists and trade at low prices – just over the spot or sometimes even below.

If you spend your money buying junk silver coins, you’d better get a decent amount of silver from it. You don’t want to spend your money buying large amounts of base metals, which are worthless. It would be better in these cases to go with the tried and tested, and buy tried and tested coins, like those below:

So, the rule of thumb is to avoid coins that have 35 or 40% silver only. Many of these are around, so it’s important to do your research well.

There are US half dollars with the head of JFK, and there are wartime nickels that are simply called Jefferson war nickels. These have no value.

Bags of junk silver coins need sorting to pull out 80% silver coins

In today’s digital era, online precious metals platforms offer investors convenient ways to buy silver coins, bars and other products. But is buying silver online the most budget-friendly option for investors? Here are some key pros and cons to consider:

Overall, buying silver online provides a flexible and affordable option for many investors to access an extensive range of silver bullion products. Performing due diligence is key to making sure that you are working with a reputable online precious metals dealer and reviewing prices across multiple platforms.

Buying in bulk is one of the most effective ways to get the lowest premiums when investing in physical silver. This lets you take advantage of volume pricing discounts from precious metals dealers.

However, keep in mind that you’d need to make a substantial investment to complete the trade, which is why most private investors avoid such deals.

On the other hand, it could be a great option for those with the capital and looking to invest a larger sum of money.

When you decide to buy silver in bulk, you need to find dealers like Physical Gold, who will be able to sell the precious metal in large quantities.

Buying silver in volume takes some planning and coordination but offers huge savings in the long run. Strike a balance between bulk and steady accumulation buying to optimise affordability.

UK investors aim to maximise after-tax returns on their precious metals holdings. That’s why many look to tax-advantaged silver products issued by sovereign mints. The best option is:

Taking time to research tax-free silver bullion coins and bullion allows UK investors to enhance their purchasing power and long-term gains. A balanced portfolio intelligently incorporates physical products structured for optimal tax efficiency.

Finding the most cost-effective silver to add to your investment portfolio takes savvy shopping techniques. Here are insider tips on ensuring you don’t overpay:

The cheapest silver isn’t always the best option if it means compromising on product quality or dealer trustworthiness. However, arming yourself with insider buying tips can help every investor stretch their budget further.

Use our automated portfolio builder to get suggestions based on various investment objectives, including tax efficiency.

When seeking affordable silver investments, it’s just as important to avoid potential pitfalls as it is to find the best deals. Here are some key mistakes that can lead investors to overpay:

Avoiding these common missteps takes diligence, patience, and discipline. However, learning to spot and sidestep potential pitfalls will help every precious metals investor maximise their purchasing power when buying silver.

The total cost of investing in physical silver bullion or silver-backed assets goes beyond the changing daily spot price. Understanding the key variables below will help buyers determine fair pricing:

Gaining literacy on these contributing expenses empowers investors to compare pricing across silver products and purchasing channels accurately. A wise investor focuses on maximising the amount of metal acquired over time while minimising unnecessary fees.

Silver is an attractive precious metal for investors for several reasons. It has inherent value and many industrial uses, driving steady demand. But the main draw is silver’s demonstrated ability to preserve wealth over time. Of course, its affordability compared to gold also makes it appealing.

When investing in silver, there are many forms to choose from – coins, bars, jewellery, mining stocks, ETFs (Exchange-Traded Funds), and more. However, physical silver coins and bars tend to be the most popular options for individual investors aiming to build precious metals portfolios.

The price of silver is influenced by various factors, including supply and demand, inflation levels, geopolitics, industrial activity, and investor sentiment. This leads to volatility in daily spot prices, requiring discipline and patience from investors.

Unlike gold, silver is prone to more significant price swings over time. But its continued role as a store of value remains constant. Those who buy silver during price dips and hold for the long term are often rewarded.

Grasping these silver investing basics primes investors to make smart decisions when buying physical silver or related assets cost-effectively. Affordable silver is only valuable if acquired as part of an intelligent overall strategy.

What does the future hold for silver prices, demand, and the overall investment landscape? Here are some projections:

By staying ahead of market projections, silver investors can make strategic near-term purchases while accounting for future trends. Maintaining core long-term holdings offers stability amidst silver’s coming volatility and upside.

Buying silver is most profitable when you can maximise your purchasing power by getting the most metal for your money. This involves buying in bulk when possible, comparing dealer premiums, and looking for discounted limited-time offerings.

Avoiding all fees when buying silver is extremely difficult, if not impossible. However, you can minimise fees by purchasing directly from mints during promotions, buying bars over coins, and shopping around for online dealers that offer free shipping and price matching.

Silver spot prices fluctuate daily based on market forces. One cost-saving strategy is to place limit orders that auto-execute when silver reaches a desired price on a downward dip. This allows buying at the lowest premiums over days or weeks rather than on one particular day.

For UK investors, the most cost-effective way to buy silver is likely through an online bullion dealer like Physical Gold that offers competitive pricing on coins and bars with secure, insured delivery.

Investing in physical silver coins and bars allow direct ownership with tax benefits, purchased through reputable dealers online. A lower premium option is Silver ETFs which track spot prices and don’t incur storage fees, though lack physical redemption. Equity stakes in miners provide an increased risk profile with potential for higher returns.

Live Gold Spot Price in Sterling. Gold is one of the densest of all metals. It is a good conductor of heat and electricity. It is also soft and the most malleable and ductile of the elements; an ounce (31.1 grams; gold is weighed in troy ounces) can be beaten out to 187 square feet (about 17 square metres) in extremely thin sheets called gold leaf.

Live Silver Spot Price in Sterling. Silver (Ag), chemical element, a white lustrous metal valued for its decorative beauty and electrical conductivity. Silver is located in Group 11 (Ib) and Period 5 of the periodic table, between copper (Period 4) and gold (Period 6), and its physical and chemical properties are intermediate between those two metals.