The Potential Risks Of Silver Investment And How To Avoid Them

21/09/2023Daniel Fisher

Free & fully insured UK Delivery. Learn more

Secure & flexible payments. Learn more

Buyback Guarantee Learn more

Silver investing seems tempting, but you need to be aware of the potential risks lurking beneath the shiny surface. Market volatility, economic downturns, storage headaches – silver investing needs to be navigated carefully to maximise chances of a good profit.

While we don’t want to discourage you from the investment, it’s best we equip you with an understanding of the potential risks that come with adding silver to your portfolio. When you do your homework and learn about all the aspects of the investment, you can harness silver’s strengths while minimising downsides through diversification and perspective.

Once you understand all the investment risks, you’ll have a clearer picture of whether silver is right for you. By considering the risks and rewards, you can construct resilient portfolios that properly allocate silver alongside other assets. Let’s confront all the hazards so you can ensure that your investments are wise and safe.

Silver has reemerged as an increasingly popular investment asset over the past decade. As a precious metal and tangible commodity, silver offers diversification and a hedge against inflation and economic uncertainty for investors’ portfolios. However, like any investment, risks should be fully understood before buying physical silver bullion or silver-based financial instruments.

The main appeal of silver as an investment is its physical nature. When you purchase silver bullion products such as bars, rounds or coins, you have a real tangible asset in your possession, unlike stocks or bonds that exist digitally. Silver is also a finite natural resource with limited supplies. These characteristics make physical silver attractive as a hedge against inflation, economic stress and currency devaluation.

Silver also has widespread industrial applications across technology, medical devices, solar panels and more. This dual role as an industrial metal and financial asset creates a base level of demand. With both industrial and investment demand, the spot price of silver tends to appreciate when economic conditions improve.

However, as a commodity, silver is still highly volatile. Silver prices fluctuate daily based on supply, demand and macroeconomic factors like interest rates and geopolitics. Just like any investment asset, there are inherent risks with silver that must be considered before adding it to an investment portfolio. The remainder of this article will examine the key risks silver investors face and strategies to mitigate them.

One of the primary risks of investing in physical silver bullion, silver futures contracts, silver mining stocks, and other silver assets is high volatility compared to stocks, bonds, and other investment classes. As a precious metal commodity, the spot price of silver can fluctuate wildly in both directions due to shifts in supply and demand dynamics.

Several factors contribute to silver’s market volatility. On the supply side, the amount of new silver production from mining in any given year can move silver prices higher if supply constricts or lower if it expands. Recycling of silver scrap also impacts the supply available.

Demand for silver is similarly variable and unpredictable. Investment demand tends to increase when economic uncertainty rises or inflation is expected to accelerate, yet investor interest can fade quickly, too. Industrial demand linked to silver’s use in electronics, solar panels, and other products is also vulnerable to global downturns.

This volatility means the current market price of silver can change rapidly over the course of weeks, days, or even within a single trading session. For investors, short-term drops in silver prices can mean portfolio losses if forced to sell silver holdings like futures contracts or mining stocks at inopportune times. However, silver’s long-term appreciation over decades can offset shorter-term volatility for patient investors executing a buy-and-hold strategy.

Another major risk factor for silver investors is that the price of silver tends to decline during economic recessions and periods of low growth.

When recessions hit or growth stagnates, industrial activity declines. With less demand from industrial uses, the price of silver tends to fall. This can be offset to some extent by increased investor demand from those wishing to own silver coins and bars as a hedge against currency depreciation during these periods.

Certainly this is becoming a more prominent influence as silver investment becomes more widespread among retail investors. An example of price pressure during downturns was apparent when silver prices dropped over 40% during the Great Recession of 2008-2009.

This was a period when stocks and industrial production crashed. However, resilient silver investors who bought during the bottom came out ahead when prices rebounded after the recession ended. The prices increased by a staggering 400% in the 3 years following the recession and then dropped by 70% during the next 4 years.

But how do silver prices hold up against inflation? Looking at the development over the course of the period between September 2022 and September 2023, the price has increased from £16.99 to £18.37 per ounce.

The key for long-term silver investors is maintaining perspective and not panic-selling during temporary downturns. To bring a bit more peace to your mind, it’s always worth it to keep an eye on the silver price forecast.

While economic recessions can negatively impact silver prices over the short term, silver has historically maintained its value over decades and remained uncorrelated to stocks and bonds. Building a balanced portfolio across asset classes can also help mitigate recession risks for silver investors.

During periods of high inflation, the purchasing power of currencies declines significantly. Hard assets like physical silver tend to hold their value much better than cash. This makes silver an effective inflation hedge. However, sudden inflation spikes can cause volatility.

On the other hand, deflation causes silver prices to decrease. Even though currencies gain purchasing power in deflation, the reduced economic activity depresses demand for silver, bringing prices down.

Investors should be aware of both scenarios. Having a balanced portfolio with stocks, bonds, and other assets in addition to silver can help smooth out inflation and deflation impacts. Holding silver for the long term also helps endure short-term price swings caused by inflation/deflation.

An increased number of concerned investors believe that the current global inflationary money system will lead to a complete demise in the use and trust of traditional currencies. As a precursor to this possibility, many are accumulating silver in case inflation gets to the point where fiat currency is worthless. Silver coins are the preferred option as they provide smaller values to more conveniently use as bartering for goods or services.

Global events and geopolitical factors can also impact silver prices, presenting another risk factor for investors to consider.

Supply disruptions at major silver mining facilities due to natural disasters, labour strikes, or political instability in producing nations can drive up silver prices by constraining supply.

Geopolitical conflicts and economic sanctions involving major industrial countries can depress global economic growth and industrial/investment demand for silver, causing declining prices.

Changes in monetary policies and interest rates by central banks in response to economic and geopolitical events also influence silver market volatility.

While geopolitical events are unpredictable, having a long-term perspective, a diversified portfolio, and avoidance of panic-selling can help mitigate the risks for silver investors. Staying cognizant of global supply and demand dynamics for silver is also key when geopolitical issues arise.

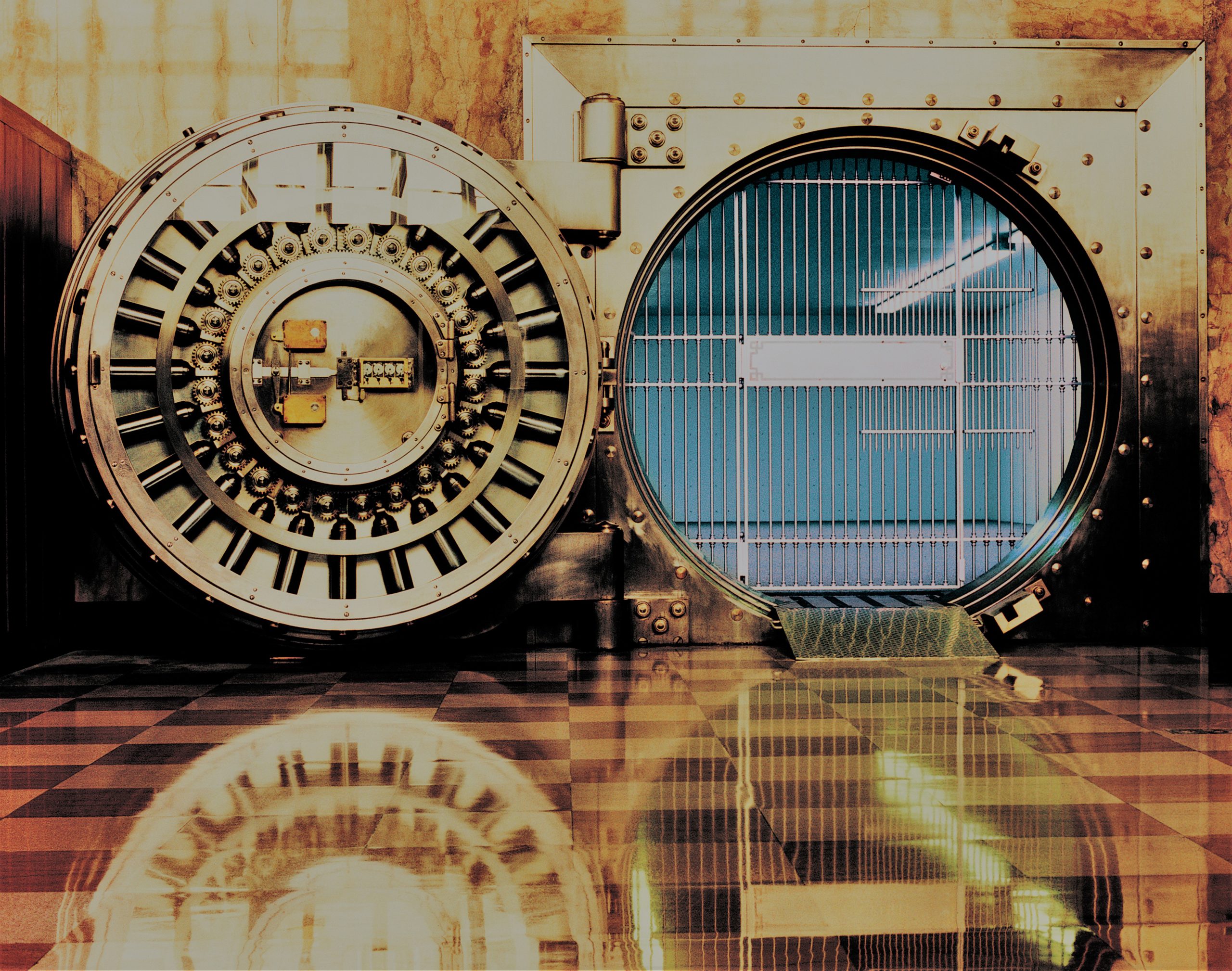

Storing physical assets like silver bullion bars, rounds or silver coins securely at home can be risky due to the potential for theft or damage. Safes and home security systems can help, but come with added costs. Also, homeowners or renters insurance typically only covers a small portion of precious metals holdings.

Using a safe deposit box at a bank vault can enhance security if stored out of the home. However, contents are still not insured, and accessibility is limited to bank hours. Storing silver at a specialised precious metals storage facility can provide high security and insurance against the risk of theft and damage but involves storage fees.

Finding the right storage methods that provide security as well as appropriate accessibility and affordability requires careful consideration by investors owning physical silver. Using diversified storage locations, being discreet about holdings, and only working with reputable storage providers can help mitigate risks.

Changes in tax policies, laws, and financial regulations pose significant risks that should be top-of-mind for silver investors.

Increased capital gains taxes, decreased tax-free allowance, new reporting requirements, and tighter import/export restrictions on precious metals could all diminish the investment upside of physical silver bullion and silver-based financial assets.

While no major legal or regulatory changes impacting silver investing have occurred recently, it remains a key risk factor to monitor closely.

To mitigate regulatory risks, prudent silver investors pay close attention to any proposed legislative or policy shifts from government entities that could negatively impact owning silver and transacting in precious metals markets.

Connecting with financial advisors and industry groups provides guidance on remaining compliant in the face of new regulations.

Ultimately, keeping a finger on the pulse of the political climate gives silver investors the best chance to protect their holdings over the long term in the event of less favourable changes to the investment landscape.

Liquidity refers to how quickly an investment can be converted into cash without substantial loss of value. Liquidity risks are higher for physical silver compared to financial assets.

Selling silver in the physical form of bullion bars or coins back to a dealer often involves receiving a slight discount to the spot silver prices, especially for smaller retail investors. Larger silver holders have more bargaining power. Geographic location can also impact the liquidity of physical silver, with more remote areas having fewer dealers.

Silver futures contracts and exchange-traded funds have higher liquidity than physical bullion. But trading costs and bid-ask spreads can still eat into returns compared to stocks or forex. Physical silver spreads are far larger than those for gold, which means the price of silver has to increase significantly to turn a profit. Liquidity risks also rise during market volatility when finding an immediate buyer is harder.

To mitigate liquidity risks, silver investors should aim to only allocate funds they won’t need in cash in the short to medium term. Maintaining a cash buffer for emergencies and diversifying across physical silver and paper silver assets can also help.

Constructing a diversified investment portfolio beyond just silver holdings is vital to mitigate risks for investors. Silver’s volatility can inflict serious damage without proper diversification.

Maintaining 100% or even a majority of capital in silver bullion, mining stocks, silver futures, and other silver assets is incredibly risky. A market crash could wipe out years of portfolio gains in such an undiversified scenario.

Financial wisdom says don’t put all your eggs in one basket. Most advisors recommend limiting portfolio exposure to silver and other precious metals to under 10% of total investable assets. Some even suggest that 5% or less is prudent. The ideal allocation varies based on an investor’s risk tolerance and time horizon.

Spreading investment dollars across stocks, bonds, real estate, cash, commodities like silver, and other alternatives ensures no single asset type craters a portfolio. Periodic rebalancing maintains target allocations as different assets fluctuate.

The bottom line – avoiding overexposure and constructing a truly diversified, multi-asset portfolio helps buffer silver investors against market volatility, economic declines, inflation surprises and the many other risks inherent to silver.

Silver investing entails risks – there’s no skirting around it. Volatility, storage headaches, regulatory changes – prudent investors need to go in with eyes wide open.

But while substantial, the risks are not reasons to avoid silver altogether. Instead, risks call for education and planning. Constructing a diversified portfolio, maintaining perspective, and avoiding panic are key mitigation strategies.

Silver remains an attractive asset class for investors who weigh its risks and rewards objectively. This guide aims to provide an unbiased assessment of the hazards and opportunities.

Though not for the faint of heart, silver has a place in portfolios as an inflation hedge and economic stabiliser. The investors who will benefit most are those willing to embrace silver volatility. With knowledge, discipline and measured allocation, silver can enhance your portfolio returns over the long term and remains an investment worth considering.

Our investment team at Physical Gold have silver experts who can guide you through every step of the way. They can advise you about the risks associated with investing in silver and other precious metals. Call 020 7060 9992 to speak to a member of our team, or you can get in touch online through our website, and a member of our team will call you right back.

To conclude this in-depth guide on silver investment risks, here are answers to some frequently asked questions on navigating the challenges and opportunities of investing in silver.

While silver does carry more risk than assets like stocks or bonds, it should not necessarily be considered a high-risk investment within the commodity class when allocated wisely in a diversified portfolio.

The biggest negatives are high volatility in prices, storage and security concerns for physical silver holdings, and liquidity challenges in converting silver assets to cash quickly. Silver also tends to decline during economic recessions.

Yes, silver remains a worthwhile investment in the UK to hedge against inflation risks and provide uncorrelated exposure from stocks and bonds. The keys to a safe investment are buying from reputable dealers with fair premiums and proper storage.

Absolutely, silver prices can experience sharp declines over the short term during periods of economic recession, stock market crashes, or rising real interest rates that boost the dollar. Maintaining a long-term perspective mitigates this risk.

Pros include inflation hedging, protection during crises, and portfolio diversification. Cons are volatility, storage/security of physical silver, liquidity challenges, and declines during recessions.

Live Gold Spot Price in Sterling. Gold is one of the densest of all metals. It is a good conductor of heat and electricity. It is also soft and the most malleable and ductile of the elements; an ounce (31.1 grams; gold is weighed in troy ounces) can be beaten out to 187 square feet (about 17 square metres) in extremely thin sheets called gold leaf.

Live Silver Spot Price in Sterling. Silver (Ag), chemical element, a white lustrous metal valued for its decorative beauty and electrical conductivity. Silver is located in Group 11 (Ib) and Period 5 of the periodic table, between copper (Period 4) and gold (Period 6), and its physical and chemical properties are intermediate between those two metals.