Silver Mining: The Complete Guide

01/02/2024Daniel Fisher

Free & fully insured UK Delivery. Learn more

Secure & flexible payments. Learn more

Buyback Guarantee Learn more

Beyond its aesthetic appeal, silver is in high demand from speculative and safe-haven investors, jewellers, electronic manufacturers, healthcare professionals, and a huge array of other industries seeking to harness its unique properties.

As the technological era gathers pace, demand for silver as a conductive element increases, so it’s important to also be aware of the dynamics of silver supply – a key determinant of its market price. The limited amount of silver in the world combines with fluctuating silver mining production and demand, subsequently affecting its market price.

Silver mining can be traced as far back as 3000 BCE in Anatolia (in today’s Turkey), with ancient civilizations such as the Greeks, Romans, and Egyptians extracting silver for use in currency, ornaments, and utensils. The metal’s malleability and conductivity made it invaluable in early technologies, from mirrors to the earliest forms of currency.

During the Middle Ages, the discovery of vast silver deposits in Europe, particularly in regions like Saxony and the Harz Mountains, fuelled economic growth and encourages technological investment. The influx of silver from the Americas, following the Spanish conquests, marked a turning point in global trade, with significant quantities of the metal flowing into Europe and Asia.

The 19th century saw the rise of silver mining in North America, spurred by the California Gold Rush and subsequent discoveries of silver deposits in states like Nevada and Colorado. This era also witnessed the introduction of more advanced mining techniques, including the use of dynamite and steam-powered machinery.

The 20th century brought further innovations, with the advent of open-pit mining and advanced extraction methods, significantly increasing the efficiency of silver production. However, it also posed environmental challenges that prompted the industry to adopt more sustainable practices.

Today, the silver mining landscape reflects a blend of ancient traditions and cutting-edge technologies. Mines span the globe, from the vast deposits of South America to the emerging operations in countries like China and Mexico. The industry continues to evolve, driven by a growing demand for silver in industries ranging from electronics to renewable energy.

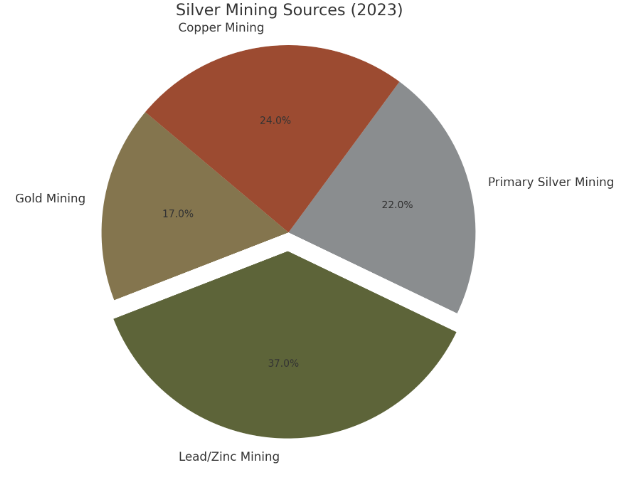

It’s only natural that the pursuit of one valuable metal often leads to the unexpected discovery of another. Afterall, the earth comprises a complex mix of metals and minerals so digging for one metal usually unearths others. Silver, in particular, is retrieved more than most other metals as a secondary yield.

Silver’s presence is particularly notable in mines primarily targeting metals like copper, zinc, lead, and gold. As geologists and miners delve into the earth, they often unearth silver deposits alongside their primary targets. This phenomenon occurs due to the geological association of silver with various other metals, creating a fortuitous by-product of the mining process.

Take, for instance, copper mining operations. While the focus may be on extracting copper for its widespread industrial applications, the by-product of this endeavour frequently includes significant amounts of silver. Similarly, gold mining often reveals unexpected silver deposits, adding an unforeseen dimension to the economic viability of such operations.

The economic implications of this secondary silver mining are noteworthy. It not only contributes to the global supply of silver but also offers a cost-effective avenue for obtaining this precious metal. Mining companies can leverage the added value of silver by-products, enhancing overall profitability. The unpredictable nature of extracting silver as a by-product means exact silver production quantities are both difficult to control and record.

However, the environmental impact of secondary silver mining must also be considered. The extraction processes employed in primary metal mining may inadvertently result in ecological consequences. Thus, finding a balance between maximizing silver extraction and minimizing environmental impact becomes a critical aspect of responsible mining practices.

Direct silver mining aims to extract silver from ore deposits by focussing on areas of natural silver occurrence. Excavating involves a spectrum of methods that have evolved over time, driven by the type of silver ore, extent of the deposit, reduced environmental impact, technological advancements, and the quest for efficiency. These methods range from traditional practices deeply rooted in history to cutting-edge technologies that define modern mining.

In the early days of silver mining, manual labour and simple tools were the driving forces. This is the classic image of miners employing pickaxes, shovels, and hand-held drills to extract silver ore from the earth. This labour-intensive process often took place in underground mines, where miners navigated through narrow tunnels, extracting ore by hand.

The 20th century witnessed a significant shift with the advent of open-pit mining. This method is perhaps the one which springs to mind when thinking about large-scale mining. It involves the excavation of substantial, open pits in the earth’s surface to extract silver deposits. It allows for the efficient removal of substantial quantities of ore, streamlining the mining process. Open-pit mining is particularly common in regions with extensive silver deposits, offering both economic and logistical advantages.

Heap leaching is a contemporary method employed to remove silver from low-grade ores. In this process, ore is crushed into fine particles and stacked in heaps. A solution containing chemicals is then applied to the heaps, facilitating the leaching of silver from the ore. This method is cost-effective and environmentally friendly, making it a preferred choice for certain types of silver deposits.

Modern silver mining often involves hydrometallurgical processes, wherein chemical solutions are employed to extract silver from ores. Techniques such as cyanidation and chlorination are commonly used. These methods offer precision and efficiency in extracting silver, minimizing environmental impact compared to traditional approaches.

Froth flotation is another contemporary method employed in silver mining. It involves the separation of minerals based on their surface properties. In this process, chemicals and air are introduced into a mixture of finely ground ore and water, creating froth that selectively binds with silver particles, separating them from other minerals.

The process typically begins with the extraction of the primary metal, and during this extraction, silver is also recovered as a secondary benefit. The ore containing both the primary metal and silver is processed through either flotation, gravity separation, or magnetic isolation, depending on the minerals involved. Smelting is then deployed, utilising high temperatures to further separate the silver from impurities before a final stage of chemical processes or electrolysis.

Free ultimate guide for keen precious metals investors

As of mid-2023 Global Data estimated there to be 743 silver mines currently in operation globally. Here are the top 10 largest silver mines in the world, based on total annual 2022 production. Figures can vary significantly depending on the data source due to the convoluted nature of silver mining. Some notable omissions from our data are Sindesar Khurd (India) Saucito (Mexico), Uchucchacua (Peru), San Cristobal (Bolivia), Lucky Friday (USA), and Pirquitas (Argentina).

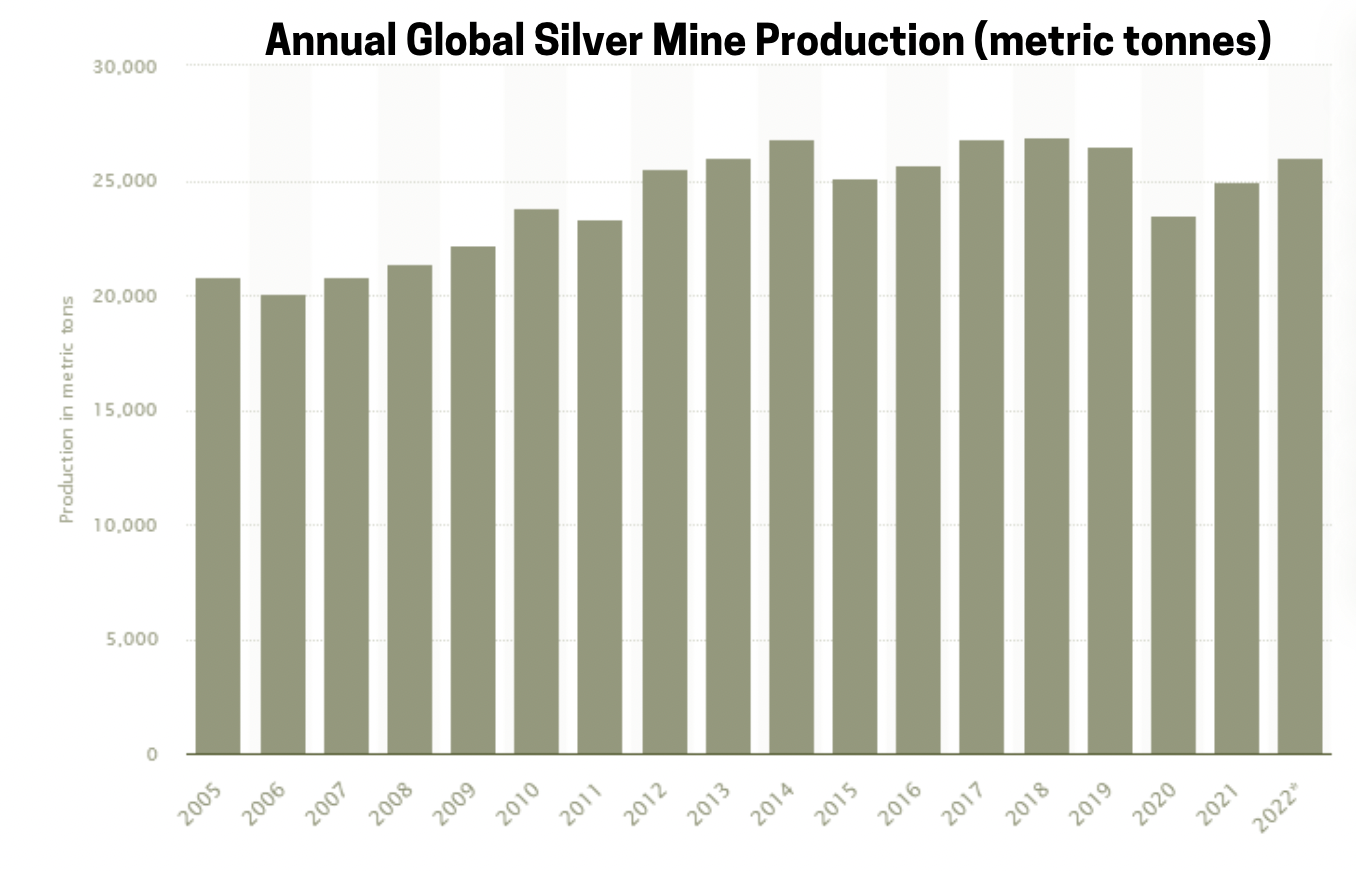

The historical trajectory of global silver production unveils a compelling narrative of highs and lows. Over the years, silver extraction has been influenced by economic conditions, technological advancements, and shifts in industrial demand. Over the past 10 years, silver supply from mining has hovered around the 25,000 metric tonnes mark. This is up around 25% from levels the previous decade.

In recent years, the demand for silver has evolved along with technology, ranging from industrial processes and electronics to investments and jewellery. Tracking Silver demand is crucial for assessing the global production landscape with mining companies aiming to produce the optimum amount of silver to meet demand – but no more. As industries increasingly rely on silver’s unique properties, the balance between supply and demand continues to shape production trends.

The rise of emerging markets and their expanding industrial sectors play a pivotal role in driving global silver production trends. As countries embrace technological advancements and infrastructure development, the demand for silver intensifies. The geographical shifts in both production and consumption allows for a nuanced analysis of the impact of countries like India and China on silver mining levels.

It will be no surprise that society’s increasing environmental concerns have led to a growing emphasis on sustainable mining practices within the silver industry. Mining companies are adopting eco-friendly technologies and responsible extraction methods, contributing to a more sustainable future. This trend not only addresses environmental impacts but also shapes the overall perception of the silver mining sector.

Advancements in mining technologies have significantly impacted silver production efficiency. From automated machinery to data analytics, technological innovations are streamlining extraction processes and enhancing safety standards. It’s common sense that the most accessible silver deposits are mined first. This means that as silver reserves become increasingly difficult to extract, more sophisticated approaches are required.

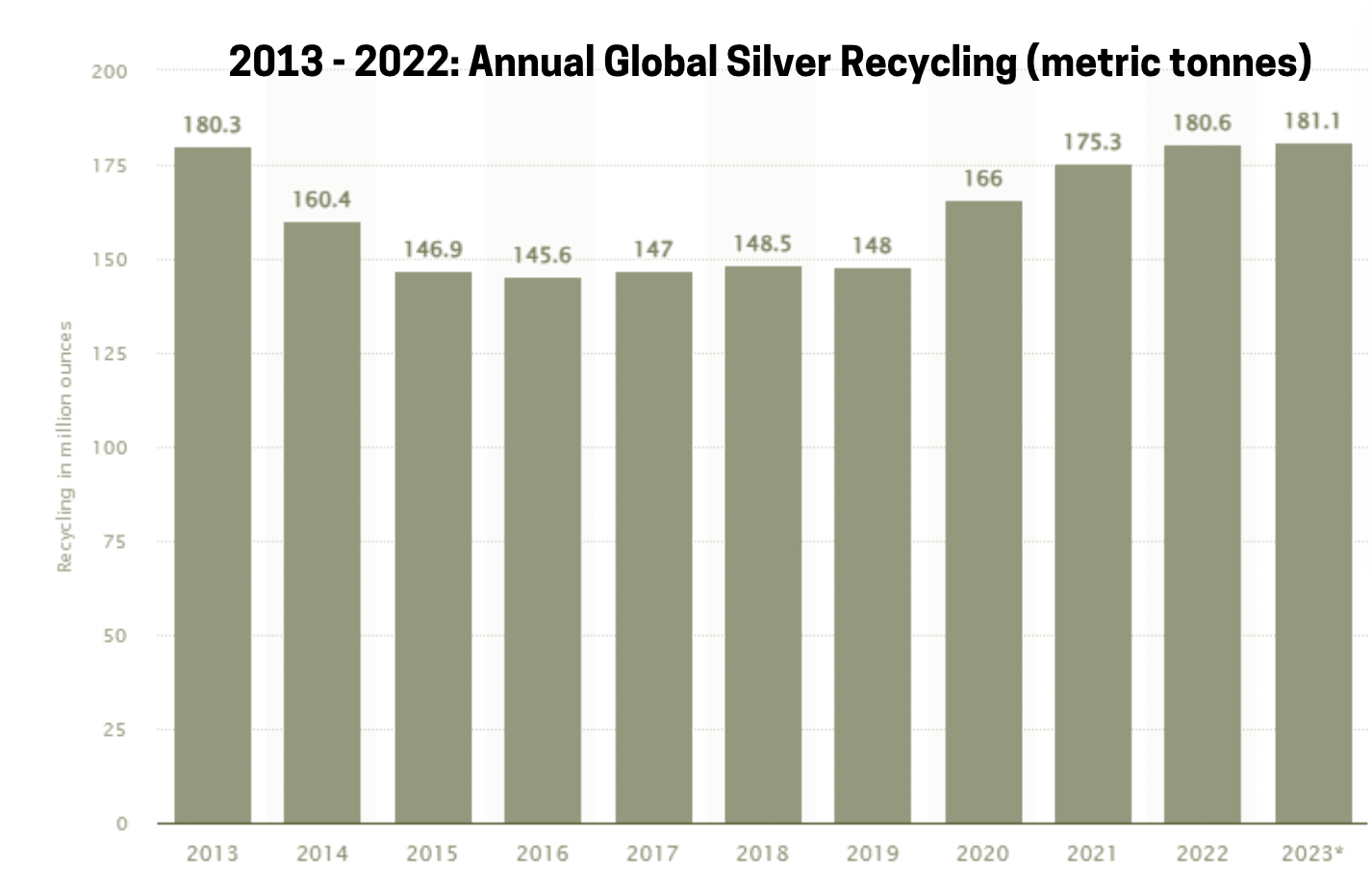

An increasingly influential factor in global silver production is the growing role of silver recycling. As environmental consciousness rises, the recycling of silver from end-of-life products gains prominence. This not only reduces the environmental footprint of silver extraction but also affects the overall supply dynamics. Recycling in general has grown as the cost-of-living crisis has forced many people to seek cost-effective approaches to updating their possessions.

Anticipating the future of global silver production involves considering potential challenges and opportunities. Factors such as geopolitical shifts, economic uncertainties, and developments in alternative technologies can impact the silver market. It’s likely that the industry’s sustainable evolution will continue, which may inhibit mass production methods or excavation of particularly stubborn deposits.

4 simple steps to sell your silver coins

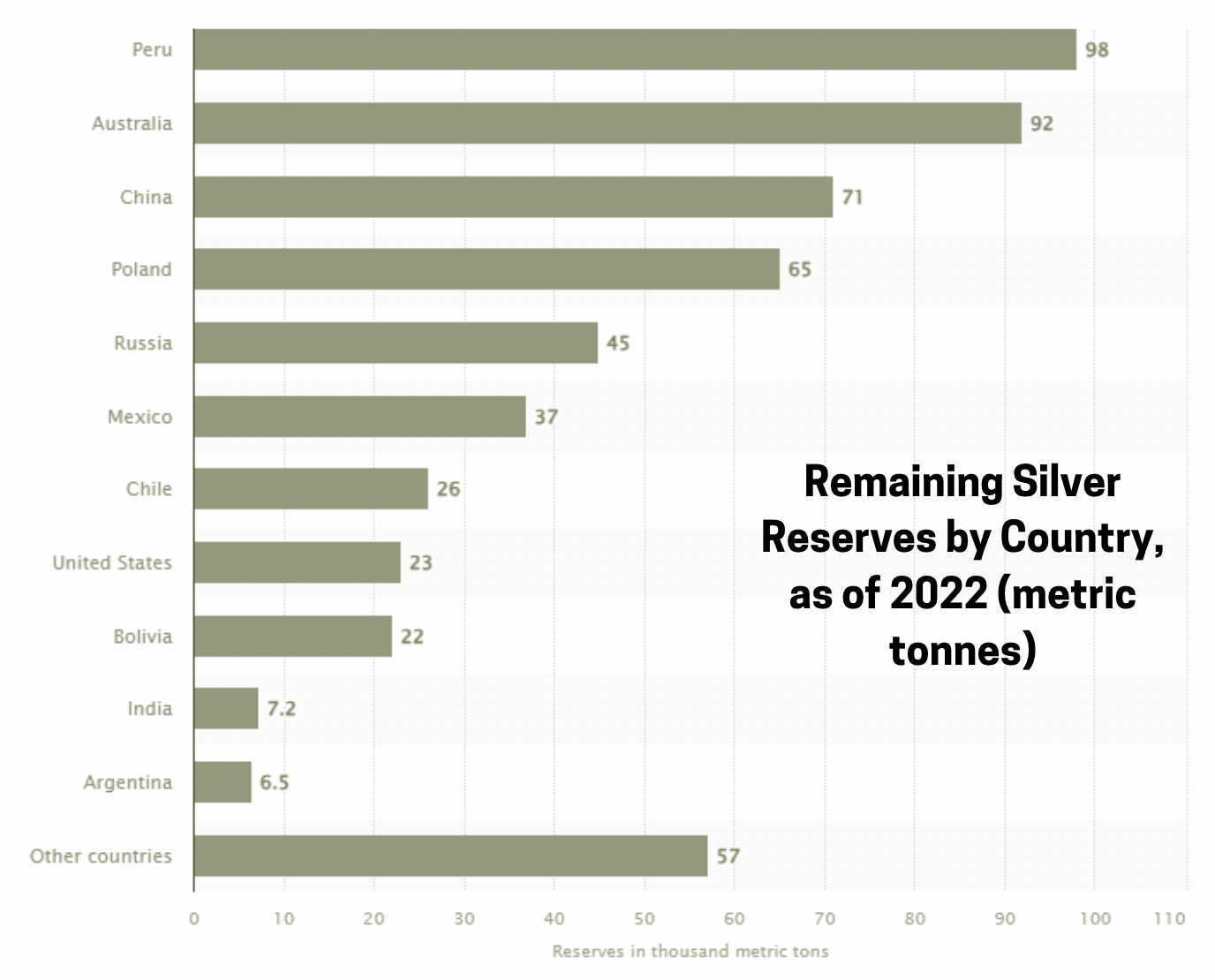

Estimating and tracking unmined silver reserves helps predict expected mining levels and possible trends. The diminishing amount of remaining silver in the ground will clearly play a role in silver supply and ultimately the silver price. The distribution of silver reserves across the globe isn’t uniform, with certain countries standing out as key custodians of this natural resource. Geo-political, geological, and economic variances between these locations will impact the potential influence these nations hold in shaping the dynamics of the silver market.

While these countries currently hold prominent positions in terms of silver reserves, ongoing exploration efforts worldwide continually unveil new opportunities. The global dynamics of silver reserves are subject to changes influenced by technological advancements, geopolitical factors, and shifts in mining priorities. Here are some of the countries currently sitting on significant silver deposits.

Mexico proudly asserts itself as a global silver powerhouse, boasting abundant reserves in regions like Zacatecas and Fresnillo. The nation’s rich mining history, coupled with ongoing exploration efforts, underscores its prominence in the silver industry. Mexico’s substantial silver reserves contribute significantly to the global supply, influencing market dynamics and prices.

Nestled in the Andes Mountains, Peru is renowned for its extensive silver reserves, particularly in regions like Puno and Huancavelica. The country’s geological wealth has positioned it among the top silver-producing nations globally. The mining activities in Peru play a crucial role in meeting both domestic and international demand for silver.

China, a stalwart in global mining, holds substantial silver reserves in provinces such as Inner Mongolia and Yunnan. With a strategic focus on mining development and technology, China not only contributes significantly to silver production but also maintains considerable reserves, shaping its role in the global silver market.

Russia, known for its vast mineral wealth, encompasses significant silver reserves in regions like Siberia and the Far East. The country’s mining endeavours contribute to its position as a silver resource giant, and the extraction activities align with both domestic and international demands for this precious metal.

Nestled in the heart of the Andes, Bolivia possesses substantial silver reserves, particularly in the historic Cerro Rico mine. The country’s mining legacy and ongoing exploration efforts underscore Bolivia’s importance in the global silver landscape. The Andean nation continues to play a pivotal role in meeting global silver demand.

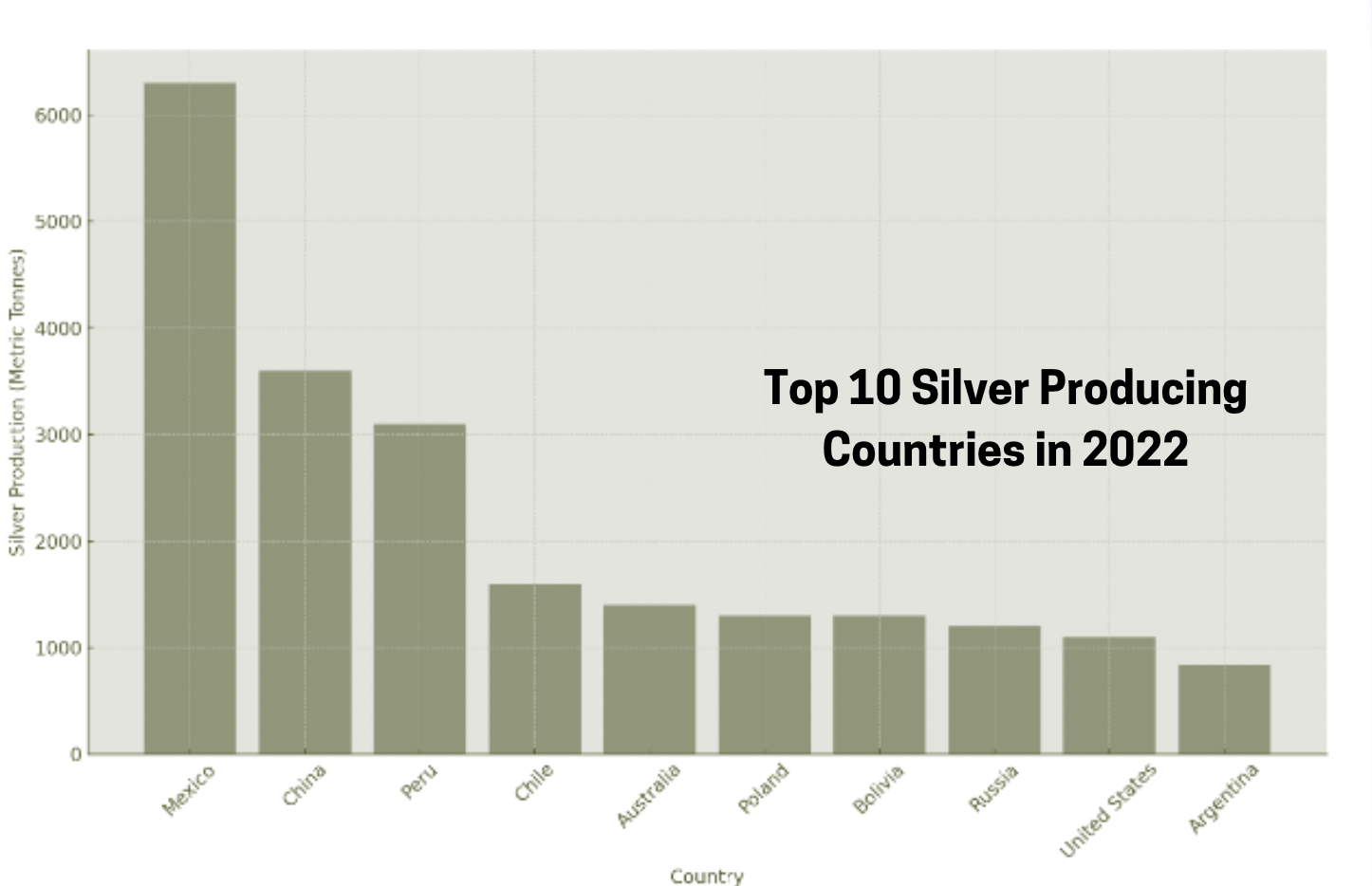

When it comes to silver production, Mexico takes centre stage as the world’s leading producer, mining over 6,000 metric tonnes, double the quantity of its nearest rivals in 2022. Renowned for its prolific mining districts, including Fresnillo and Zacatecas, Mexico consistently outshines other nations in silver extraction.

The country’s geological richness, coupled with a deep-rooted mining tradition, positions it as an unrivalled contributor to the global silver supply. With strategic investments in technology and ongoing exploration efforts, Mexico’s silver production remains a linchpin in meeting the diverse demands of industries worldwide, solidifying its status as the foremost player in the silver production arena.

China and Peru came in second and third respectively, both produced around 3,000 metric tonnes of silver in 2022. The remaining global top 10 miners formed a distinct third tier, extracting between 1,000 and 1,5000 metric tonnes each.

As the silver mining industry looks ahead, it faces a number of challenges and opportunities that likely impact the industry significantly. One key challenge lies in the need for sustainable practices, with environmental considerations pushing the industry towards cleaner and more responsible mining methods. Striking a balance between meeting global silver demand and minimizing ecological impact remains a complex but necessary effort.

On the flip side, the increasing demand for silver in emerging technologies such as solar panels, electric vehicles, and 5G infrastructure presents a substantial opportunity. Silver’s unique properties, particularly its conductivity and reflectivity, position it as an indispensable component in cutting-edge industries. Mining companies that can adapt to these technological shifts and invest in innovative extraction methods stand to capitalize on the growing demand for silver in the evolving landscape of modern technologies.

Geopolitical dynamics and economic fluctuations also pose challenges to the stability of silver markets. However, they also create opportunities for mining companies to diversify their operations and explore untapped regions with significant silver deposits. As the market evolves, the likely winners will be the silver miners with a strategic approach who demonstrate adaptability to technological innovation, and a commitment to sustainable practises.

Silver’s dual role as a precious metal and industrial commodity drives its investment appeal. There are various ways to invest into silver, with each method differing in risk profile, likely return and cost. Investing in silver mining shares is a way of gaining exposure to silver’s growing supply/demand squeeze, but also to have a stake in a company who could outperform the market.

Buying silver mining stocks is easy to do with online access to equity trading platforms and there’s no need to physically store any silver. Returns can be super-charged if you pick the best performing stocks, but the risk of loss is far greater than holding physical silver. Here are some key considerations.

Thoroughly assess mining companies before investing, considering financial health, operational efficiency, and commitment to sustainability. Evaluate geological potential and proximity to existing infrastructure.

Silver mining stocks come with inherent risks and market volatility. Employ risk management strategies, diversify portfolios into several different miners, and stay informed about global economic trends.

Monitor long-term themes and industry innovations. Silver’s role in technology and green energy indicates potential sustained demand. Invest in companies adapting to industry shifts as these are the most likely to thrive in a rapidly evolving industry. Prioritizing mining companies committed to sustainable practices will provide longevity to their income opportunities. Environmental, social, and governance (ESG) considerations are crucial for risk mitigation and ethical investing.

As of the beginning of 2024, these are the biggest silver mining stocks based on market capitalisation. This doesn’t mean they’re the best stocks to select as you’ll be buying at a price based on current market cap and success will be based on future performance rather than previous returns.

Silver mining in the UK has a historical presence, with notable occurrences in regions like Cornwall, Cumbria, and Scotland. Cornwall, in particular, was historically renowned for its silver production, often extracted as a by-product of mining for tin and other metals. While silver mining in the UK has diminished over the years, remnants of its rich mining heritage can still be traced in these regions.

Silver is considered less abundant than gold above the Earth’s surface. While estimates may vary, it’s widely recognized that silver is rarer above ground compared to gold, with gold being approximately 5-7 times more abundant. Below the surface, silver is roughly 19 times more abundant than gold. This scarcity contributes to silver’s value and significance in various industries, making it a precious and sought-after metal.

Silver is found deep in the Earth’s crust, occurring naturally in various forms, often in combination with other minerals like lead, zinc, and copper. Silver deposits can be found in both surface and underground mining operations, with some of the richest deposits located deep within the Earth.

Silver mining involves extracting silver from the Earth’s crust. Various methods, such as traditional mining, open-pit mining, and hydrometallurgical processes, are used to extract silver from ore deposits.

Mexico is the leading global producer of silver, contributing significantly to the world’s silver supply. The country’s rich mining history and abundant silver reserves position it as a key player in the silver market.

Silver recycling plays a crucial role in the overall silver supply. Recycling from end-of-life products reduces the environmental impact of mining and affects the total amount of silver mined, promoting sustainability in the industry.

Some of the largest silver mines include Fresnillo Mine in Mexico, Cannington Mine in Australia, and Polkowice-Sieroszowice Mine in Poland. These mines contribute significantly to global silver production.

Future challenges in silver mining include the need for sustainable practices and navigating market volatility. Opportunities arise from increasing demand in emerging technologies. Investing in companies with a commitment to sustainability and adaptability to industry shifts is key to capitalizing on future trends.

Generally, gold mining can be more challenging due to deeper deposits and more complex extraction processes. However, both gold and silver mining present unique challenges, and the level of difficulty varies from one mining operation to another. Factors such as technological advancements and mining infrastructure also influence the ease of extracting these precious metals.

The largest silver mine in Australia is the Cannington Mine. Located in Queensland, it is renowned for its massive lead-zinc-silver ore body. Operated by South32, Cannington is a key contributor to both the national and global silver production, emphasizing Australia’s significance in the silver mining industry.

Live Gold Spot Price in Sterling. Gold is one of the densest of all metals. It is a good conductor of heat and electricity. It is also soft and the most malleable and ductile of the elements; an ounce (31.1 grams; gold is weighed in troy ounces) can be beaten out to 187 square feet (about 17 square metres) in extremely thin sheets called gold leaf.

Live Silver Spot Price in Sterling. Silver (Ag), chemical element, a white lustrous metal valued for its decorative beauty and electrical conductivity. Silver is located in Group 11 (Ib) and Period 5 of the periodic table, between copper (Period 4) and gold (Period 6), and its physical and chemical properties are intermediate between those two metals.