Gold Investment Vs Property Investment: Which One Is Best For You?

18/09/2023Daniel Fisher

Free & fully insured UK Delivery. Learn more

Secure & flexible payments. Learn more

Buyback Guarantee Learn more

When choosing between gold and property as an investment, there is no one-size-fits-all answer. Both have their merits and drawbacks. Gold offers higher liquidity and lower entry costs, making it accessible to everyone.

On the other hand, property provides the potential for both capital appreciation and rental income but comes with higher initial costs and ongoing maintenance.

With all the benefits and disadvantages of both investments, it might be difficult to find the right one for your portfolio. But don’t worry – we’ll review all the facts and stats you need to make an informed decision to start your successful investment journey.

Let’s start by comparing the performance of these two asset classes in the UK over the past 3 years.

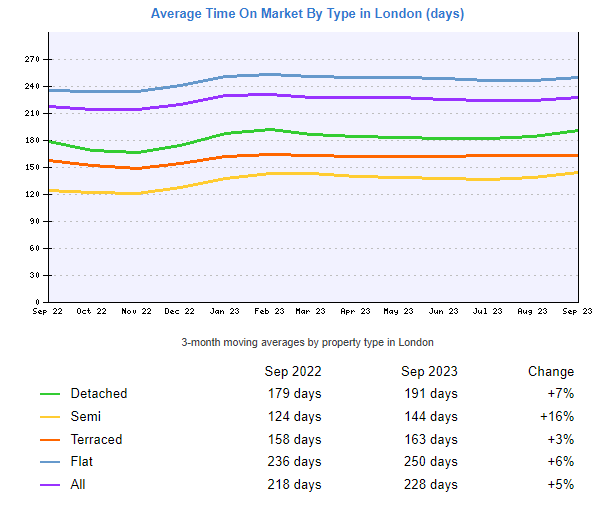

UK house prices have seen annual growth of 1.7% over the past year. Key areas like London are seeing monthly price declines as housing inventory takes longer to sell, indicating a broader shift in momentum. This softening in property markets contrasts sharply with gold’s stellar performance.

The below chart from www.home.co.uk demonstrates the fact that housing inventory is lingering on estate agents’ books for around 7% longer than a year ago.

In comparison, gold prices have surged at around 8% per year over the past decade, significantly outpacing gains made in the property market.

With such strong and steady appreciation year after year, gold has clearly been the top-performing asset class versus housing in recent times.

Gold provides exceptional benefits as an effective inflation hedge and a store of value during periods of economic uncertainty.

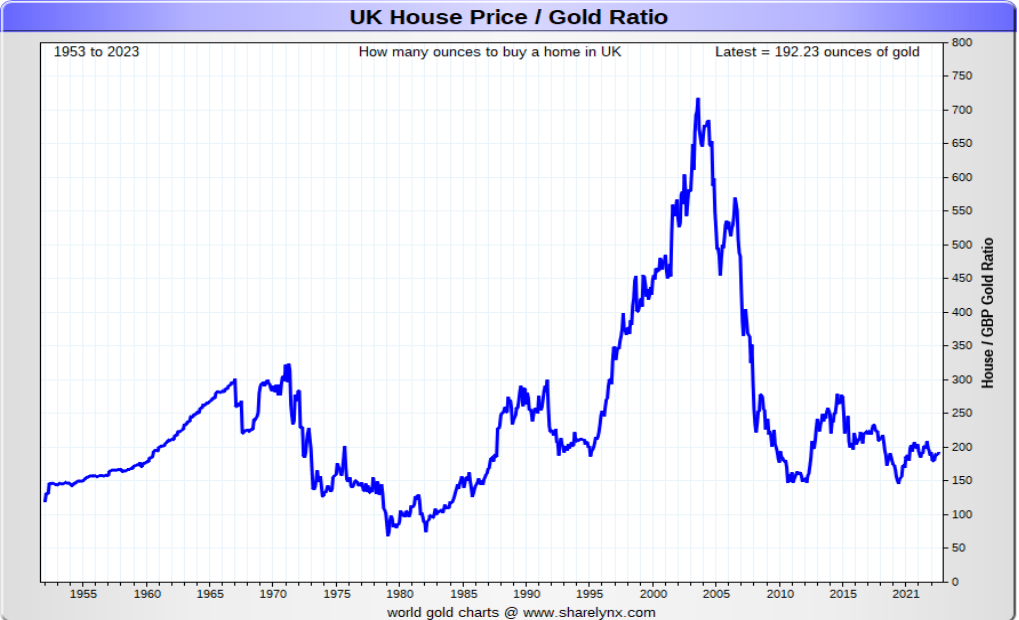

The Gold to Property Ratio is a straightforward measure that compares the value of gold to the value of real estate. It’s a ratio calculated by dividing the price of one ounce of gold by the average price of a square foot or square metre of property.

Being able to determine the relative cost of each asset class provides context to their respective current price. Tracking the gold to real-estate ratio enables prospective investors to identify when gold or the property market is over or under-priced, relative to each other.

With both gold and the house market seen as sound long term tangible investments, it can be useful to identify buying and selling opportunities of each, based on their price relationship.

From the chart below we can see that the average ratio over the past 70 years is around the 250 mark. In other words, 250 ounces of gold would cost the same as an average UK house. The ratio peaked at around 700 in 2005, marking a period of soaring house values while gold floundered towards the back end of a long bear market.

With the average house price in the UK standing at around £285,000 at the beginning of 2024, and the gold price hovering around £1,600/oz, it would take a mere 178 ounces of gold to afford an typical property. This reflects the dynamic whereby high interest rates have curtailed house prices for the first time in years, while the gold price has continued showing strength as a safe haven during uncertain socio-economic conditions.

The high average house price of £287,546 makes direct purchase impossible for many everyday investors lacking such capital. Mortgages can help finance real estate investments, but lenders have tightened criteria dramatically in the last decade, requiring substantial deposits of 25-30%.

While the average house price hit its all-time high in November 2022 with £292,674 and has been slowly declining since then, this combination still makes accessing the property ladder a major hurdle for households.

However, you also need to consider costs such as estate agent fees, stamp duty or valuation of the property.

In contrast, gold has a very low entry point, starting from around £100 for an (admittedly tiny) coin or bar, making it far more accessible to the average investor. Improved distribution means physical gold coins and bars can be delivered in fractional amounts.

This affordability makes gold available across the wealth spectrum as a tangible asset. Gold provides a unique opportunity to begin investing from a small investment size.

Owning rental property provides potential for passive income from monthly rentals in cash. However, metrics suggest rental income growth is slowing. With inflationary pressures squeezing tenants’ ability to pay higher rents, prospects for ongoing passive income seem uncertain. Maintenance costs also erode return on investment over time for property investors.

While gold does not provide regular income like property, it has proven a fantastic vehicle for capital appreciation. Over the past decade, gold has delivered average annual gains of around 12% – over double what housing has achieved. This strong track record for growth makes gold highly appealing as a long-term investment for investors focused on maximum returns.

Liquidity depends heavily on housing market conditions. However, it also depends on other factors such as interest rates, credit availability, consumer confidence, and government policies. In key markets like London, inventory is taking longer to sell, indicating falling liquidity in property markets. But you need to keep in mind that the situation can be different in other parts of the UK.

Being part of fragile buyer chains further restricts the ability to exit positions quickly. This potential illiquidity can hamper real estate investors.

However, illiquidity can also create opportunities for investors who have access to capital and can take advantage of lower prices and higher yields in some markets.

You can also diversify your portfolio and reduce your exposure to illiquidity by investing in different regions, sectors, and asset classes.

In comparison, gold remains a highly liquid physical asset regardless of market conditions. Gold bullion can readily be sold back to dealers within days, providing excellent financial flexibility.

This easy convertibility to cash is a standout benefit versus relatively illiquid property assets. Gold provides peace of mind by acting as a form of cash during periods of market uncertainty.

When it comes to property investment, the tax landscape is a labyrinth you’ll need to navigate carefully. Let’s break it down:

The bottom line? The taxman is practically your silent partner in property investment, and he’s not the generous type.

Now, let’s pivot to gold. Ah, the lustrous, timeless metal that has been a symbol of wealth for centuries. But did you know it can also be a tax-efficient asset? Here’s how:

So, why is gold different when it comes to tax? It’s simple. The tax system is designed to favour certain types of investments, and gold ticks all those boxes. It’s like having a VIP pass to an exclusive tax-friendly club.

So, what’s the verdict? If you’re tired of navigating the complex tax maze that comes with property investment, it might be time to diversify your portfolio with some glittering gold. Not only will you benefit from its intrinsic value and capital appreciation, but you’ll also enjoy some serious tax perks.

With investment properties being occupied by tenants, wear and tear are inevitable. As a landlord, you’re obligated to provide upkeep and maintenance of the property for your tenants. Clearly, you have a vested interest in upholding your property’s condition, too.

The level of these ongoing costs will depend on how well your tenants look after the property, the age of the property and its value.

For larger property portfolios, it’s not uncommon for many properties to need work at once, leading to high running costs.

Paying a management fee for a company to help this process is common. Ongoing fees to manage tenants and rent are also applied if you’re unable to manage the process yourself. Finally, landlord insurance is required by law, further saddling the property investor with continuing costs.

We’ve already concluded that if you buy the right type of gold, like gold Sovereigns or gold Britannia coins for UK investors, then you’ll avoid incurring any ongoing tax costs. But the privilege of owning real physical gold coins is that they need to be looked after and protected, which can come at a cost.

The main ongoing fee for gold is insurance and storage. For modest amounts of gold, it’s possible to take delivery yourself, reducing ongoing fees to buying a home safe and adding the gold to your contents insurance.

But for larger investments, the peace of mind of professional vault storage is comforting. However, insured storage can cost up to 1% per year of the value of the gold, which will rise as the value of gold increases.

Use our automated portfolio builder to get suggestions based on various investment objectives.

Any factor detrimental to the economy, specifically the housing market, can be a huge boost to gold investment.

As the world’s safe haven asset, economic and political instability, which can impact property investment negatively, will likely provide a magnet for investors to gold as a way of seeking protection. We’ve seen this switch into precious metals throughout the history of gold investment.

Bad news for UK property can also put Sterling under pressure as a currency. This indirectly boosts gold prices in the UK, as pricing originates in Dollars and is then converted into Sterling. So, a weak Pound increases the price of gold for UK investors.

The biggest overseas buyer of UK property in recent times has been the Chinese. They’ve not only been the catalyst for UK property price increases but almost single-handedly provided momentum to the global economy.

It’s not uncommon to hear that an entire block of new flats has been sold within weeks, mainly to the Chinese market.

But cracks have started to appear in the world’s second-biggest economy, forcing the Chinese central bank to devalue its currency on some occasions this year.

Stock markets have already reflected the growing concern and accepted that the Chinese bull run is possibly coming to an end.

If, as expected, Chinese demand for UK properties wanes, then we’re likely to see the heat from the market dissipate. China’s size (it contributes more than 13% of global GDP) means a shrinking economy will also impact every other region around the world – further curbing demand for UK buy-to-lets.

Equally, the wealthy Russian buyers have also held an obsession with buying UK properties over the past decade. With political tensions increasing with Russia, many are pulling out of the UK market, especially with visas harder to obtain. 1

However, the UK government has made it much more difficult for Russian buyers to succeed in the country’s market in reaction to the current events in Ukraine. In 2021, the government passed the National Security and Investment Act. It covers 17 sectors of the economy, and the UK can put a stop to any investments and transactions that could bring danger to the country. There are now even more hurdles for buyers who have been sanctioned.

With their focus on the high-end London market, it’s no surprise that this is now the region and sector that is most missing their enthusiasm and Rubles.

Supply and demand play a key role in both property and gold. With property investment, it’s reassuring that, here in the UK, we have the equation of an increasing population and very limited space to build new houses. This scarcity of available land not only drives up property values but also makes it a more stable investment in the long term. The demand for rental properties is also on the rise, providing property investors with a steady income stream. Similarly, gold’s demand continues to increase, whilst supply is extremely limited due to no major discoveries in the past 15 years. The finite nature of gold makes it a highly sought-after asset, especially during times of economic uncertainty. Additionally, gold is widely used in various industries, from electronics to medicine, further fueling its demand.

Whilst property supply may increase, the Government is also determined to hamper demand in a desperate attempt to prevent another financial crisis through stamp duty. This additional upfront tax burden may put off those looking to enter the market or those wishing to add to their current property investment portfolio.1

However, as of September 2022, the Government has reduced stamp duty rates on residential properties. They’ve increased the nil-rate band from £125,000 to £250,000.

This adjustment means that property purchases up to £250,000 will be exempt from stamp duty, and those investing in more expensive property will face lower stamp duty charges than before.

This modification is likely to positively impact first-time homebuyers, those looking to move homes and buy-to-let investors.

Banks are now increasingly tight-fisted when it comes to giving out generous mortgages on buy-to-let properties. Not only is it difficult to get a buy-to-let mortgage, but recent budgets have also witnessed reduced tax breaks for buy-to-let investors, making the asset class less attractive for investors.

Landlords also face higher capital gains tax rates when they sell their properties, as they are not eligible for the annual allowance of £6,000 or the reduced rate of 10% that applies to some other assets.

If that wasn’t enough, new legislation already passed will impact the income received for all UK buy-to-let investors.

Previously, investors were able to offset much of their rental income against their mortgage, meaning little or no income tax on the investment. However, this benefit is now being phased out, so anyone owning investment properties will face significant rises to their tax bill.

This will not only deter new investment into the market but may also see existing owners sell to avoid the tax hike.

As of July 2023, UK inflation, as measured by the Consumer Price Index (CPI) sat at an uncomfortably high 6.8%.

Despite falling from an incredible 26.7% in January 2023, this rate is still more than 300% above the Monetary Policy Committee’s (MPC) maximum target level.

This erosion of Sterling’s value acts as a significant motivation for investors to purchase gold as an inflation hedge.

The MPC’s response to the uncontrollable inflation levels has been to increase the bank rate fourteen times to the highest level for 16 years.

Hopes of an end to rate hikes have been tempered by suggestions of stubborn prices in various CPI elements. Even if rates only increase once or twice more, it’s unlikely they will come down again in the near future.

With a vast majority of property buyers requiring borrowing to purchase a property, this has severely impacted the cost of funding property investment.

For those seeking new investments into property, the current high monthly cost of a mortgage is ensuring that most plans don’t get off the ground, crimping much of the money coming into the property market.

This in turn has started to lead to property values dropping as demand falls.

The days of easy money in the early 00s witnessed an epidemic of UK house buyers taking out interest-only mortgages.

The idea was that the borrower could invest money in the stock market for the duration of the mortgage term and witness growth, which out-paced the amount needed to pay off the loan’s notional amount. This would leave them with a bonus nest egg to do with what they liked.

But when stock markets failed to make the expected gains, many households fell short of the amount they required. The consequence was that the Financial Conduct Authority (FCA) applied pressure on lenders to stop giving these mortgages out anymore. Nowadays, interest-only mortgages are only really available on buy-to-let properties rather than main homes.

We’re here to provide as much or as little guidance as you need

We’re all enjoying our stocks going up in value in our pensions and ISAs. But all good things must come to an end. Analysing stock valuations over the past 150 years depicts bull runs lasting up to 6 years, immediately followed by a market correction.

The Dow Jones and FTSE indices are now enjoying their 9th year of rising prices, so the law of averages tells us that the downturn is overdue.

An analogy would be the city of San Francisco. History and science tell us that being located on the San Andreas fault guarantees future earthquakes.

With many of the current residents having enjoyed years without a major quake, it’s naïve to suggest it will never happen. It will happen, we just don’t know when.

What we do know is the longer it goes without a quake, the bigger the damage when it does occur. The same can be said of stocks.

Each day, we read about more major brands either shutting stores, making redundancies or even going into administration.

This isn’t just small independent shops in the high street, but major mega brands such as House of Fraser, BT, Sainsburys & Asda, Toys R Us and Maplin.

On an evolutionary note, commerce is changing at the fastest pace for a century, with online giants like Amazon squeezing profit from physical stores and automation replacing human jobs.

This will only continue with technology.

Many market experts predict a major stock market correction with the Fed Reserve starting to raise interest rates in the US.

Closer to home, wages are stagnant, and credit bubbles are almost at bursting point with car leasing and zero per cent credit card deals.

When stock markets tumble, every investor feels the pinch, jobs are lost, and day to day income is impacted. This takes any heat from the stock market as fewer borrowers can raise the funds to move house or pay high rent.

This is also the very time that institutional and savvy retail investors switch their attention to gold. As a safe haven, it tends to receive a significant injection of investment demand during such market downturns.

The great thing is that you don’t need to choose between property and physical gold investment. If you’re already a keen property investor, then it may be worth taking your first steps into gold investment to hedge your portfolio.

As we’ve seen, possible threats to one asset class can be a benefit to the other. That way, the two investment rules are met: property & gold are simple, tangible assets, and timing becomes less of an issue if you own both.

However, we all know that strong economic markets don’t last forever. That’s where owning some gold comes into play. Relying solely on property investment means the good years are great, but the bad years are catastrophic. Combining property and gold investment hedges the issue, so regardless of underlying conditions, you should still receive both income and portfolio growth.

If you have decided gold investment is for you, then look no further than Physical Gold. Why not call our experts on 020 7060 9992 today?

Honestly, there’s no one-size-fits-all answer. It really comes down to your specific goals and situation. Gold is great if you want an asset that’s liquid, low maintenance, and not tied to one location. Property can give you rental income plus appreciation but requires a bigger upfront investment and ongoing upkeep. My advice would be to consider your risk tolerance and diversify across both if possible. That’s worked well in my experience!

Gold can definitely be a smart investment. The key benefits are its inflation hedging abilities, portfolio diversification, and historically strong long-term returns. One downside is it doesn’t provide dividends, but I don’t solely invest for dividends. I look at gold as a way to offset risk and preserve wealth over time. It’s provided me peace of mind through volatile markets.

The appeal of gold during high inflation is that it holds its value better than normal currencies. When inflation kicks in, most money loses purchasing power. But gold has proven reliable at retaining its worth over decades and even centuries. As a limited resource, gold provides a solid store of value that isn’t eroded by inflation like cash savings might be. It’s served that role for people across history!

Live Gold Spot Price in Sterling. Gold is one of the densest of all metals. It is a good conductor of heat and electricity. It is also soft and the most malleable and ductile of the elements; an ounce (31.1 grams; gold is weighed in troy ounces) can be beaten out to 187 square feet (about 17 square metres) in extremely thin sheets called gold leaf.

Live Silver Spot Price in Sterling. Silver (Ag), chemical element, a white lustrous metal valued for its decorative beauty and electrical conductivity. Silver is located in Group 11 (Ib) and Period 5 of the periodic table, between copper (Period 4) and gold (Period 6), and its physical and chemical properties are intermediate between those two metals.