Exploring the Variety: The Different Types of Silver Bars

14/12/2023Daniel Fisher

Free & fully insured UK Delivery. Learn more

Secure & flexible payments. Learn more

Buyback Guarantee Learn more

Owning physical silver bars can be a profitable and exciting investment. Recognized for their stability and tangible value, they’ve become a go-to for investors. But there is a huge array of different types of silver bars and making the right choice can influence your investment success.

This study aims to dissect the specifics of various silver bars, exploring their distinct characteristics, sizes, and manufacturing processes. Along the way, we’ll highlight the significance of certain features and how they can impact your investment. This practical exploration aims to shed light on the nuances that differentiate each type so you can optimize the benefits of buying silver bars.

Investors seeking to own physical silver can decide on the merits silver coins vs silver bars, or in fact choose to own both. In the realm of precious metal investments, silver bars hold an enduring and pragmatic appeal that transcends market trends. The popularity of specific silver coins can ebb and flow with fashion, but the desire for silver bullion has sustained for decades.

Understanding silver bars begins with recognizing their universal recognition as a store of value. These bars, typically rectangular and produced in various sizes and weights, offer investors a tangible and enduring asset. The best place to begin when understanding the varying types of silver bar is with the range of production methods.

In the following section, we’ll dissect the fundamental characteristics that make silver bars a staple in investment portfolios. From the standardized appearance of minted bars to the artisanal touch of hand-poured varieties, our exploration will shed light on the diversity within this straightforward yet versatile investment option.

Understanding the various production methods will explain not only the different aesthetics of silver bars, but can also impact the cost. Each method brings its own characteristics, contributing to the uniqueness of silver bars.

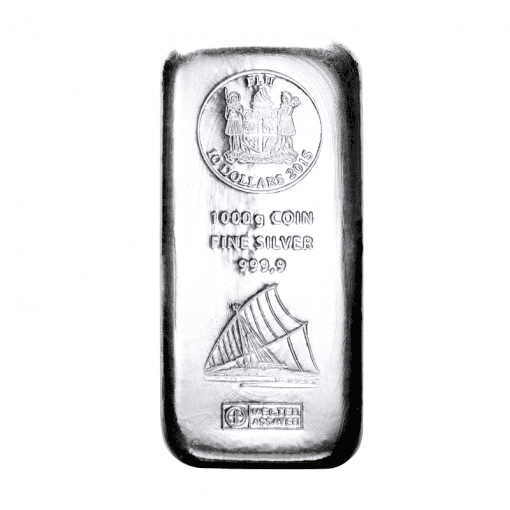

Among the diverse types of silver bars, cast silver bars stand out for their distinct manufacturing process and appearance. Cast bars are formed by melting silver and pouring it into molds, resulting in a rustic and irregular shape. Investors often appreciate the unique characteristics of cast bars, embracing their individuality. While cast bars may lack the precision of minted counterparts, their charm lies in the handcrafted feel, making them a noteworthy option for those seeking a more distinctive and raw aesthetic in their precious metal investments. Cast bars tend to dominate the sizes from 100g upwards where cost saving and the rustic finish appeal most.

Minted silver bars represent the epitome of precision and uniformity in the world of precious metal investments. Crafted with meticulous detail, minted bars undergo a highly controlled manufacturing process which is comparable to the production of silver bullion coins. This involves pressing silver blanks with engraved designs, resulting in a polished finish and standardized appearance. Investors often favor minted silver bars for their refined look, making them a popular choice for those who appreciate the sleek and consistent aesthetic that comes with precision minting.

They hold further aesthetic and practical appeal as minted bars tend to be sold in handy laminated wallets which provide the dual purpose of protecting the bar from damage and housing printed certification details. For this reason, they tend to be popular as gifts.

As an offshoot of cast silver bars, a less frequent and more artisan approach is hand-pouring. In a market dominated by precision, these silver bars offer a unique touch to precious metal investments. Crafted individually, they’re created by melting silver and pouring it into molds by hand. This hands-on process results in irregular shapes and a more organic appearance. Investors often find appeal in the distinctiveness of hand-poured bars, appreciating the craftsmanship that goes into each piece. For those seeking a more personalized and one-of-a-kind investment, hand-poured silver bars provide a tangible connection to the artistry behind their value.

Stamped silver bars are manufactured in a different way to minted bars. Rather than applying high pressure to the dies, stamped bars are created using a machine press. This difference enables cheaper production but compromise on the amount of detail and complexity possible in the artistic design.

This balanced approach between cost and appearance appeals to a different buyer demographic than the more expensive and collectible minted silver bars. The process is most commonly used for silver bullion bars and bullion aimed at the wholesale market.

Free ultimate guide for keen precious metals investors

A silver good delivery bar is a large high purity cast silver bar weighing roughly 1,000 troy ounces (31 kg) that meets specific dimensional and silver purity requirements standardized by the London Bullion Market Association (LBMA). They serve as a tradable and transportable form of wholesale silver for large scale investors and market participants.

However, there is a degree of leeway in the accepted guidelines. To comply with the Good Delivery specification, the silver content of a standardised bar must be between 750 and 1100 troy ounces or around 23kg to 34kg.

A silver bar also must conform to specific dimensions to meet these internationally recognised standards. It must have a height of between 60mm and 100mm, a top surface length of 250mm to 350mm and a top surface width of 110mm to 150mm.

Silver ingots stacked for storage

Silver bars and silver ingots might sound identical; they’re made of the same material, so what’s the difference? In reality there are some key distinctions that you should learn if you want to buy or sell silver.

As you might imagine, the main struggle that comes when attempting to define what separates silver bars from silver ingots is down to the flexibility of the language and how the meanings of these words can vary from place to place.

In basic terms, a silver ingot is a non-specific amount of silver that has been shaped to make it easy to store, transport and process. Silver is not the only type of metal that comes in ingots; in fact most manufacturing processes that involve precious and non-precious metals will at some point involve ingots.

Ingots can be thought of as a blank slate; a convenient form in which silver and other metals can exist until they are needed. They might be melted down or machined to make something new. They might remain in their ingot form until a later date, or to act as a currency reserve in their own right.

This is where things get a little tougher because in some senses the words ‘bar’ and ‘ingot’ are effectively interchangeable when referring to silver gold bars. But for practical purposes, and for those who know a bit more about the industry, it’s sensible to define these terms as distinct from one another.

A silver bar is essentially a far more refined iteration of an ingot and needs to come with a serial number, assay stamp, fineness figure and year of manufacture all displayed on its surface.

When it comes to security and traceability, serialized silver bars dominate the silver bullion market. Each bar is assigned a unique identification number, providing a level of traceability that adds an extra layer of confidence for investors. This unique number can either be stamped onto the bar itself or printed on the laminated card accompanying minted bars. A vast majority of the silver bars offered by precious metals dealers will include a serial number so there’s no need to purchase one without.

Beyond serialization, these bars often come equipped with additional security features like holograms, QR codes or special markings. This not only safeguards against counterfeiting but also reinforces the integrity of the investment. With their generally simpler design than leading silver coins, silver bars are more vulnerable to counterfeiting due to the increased ease of copying. An increasing addition of security features aims to appeal to those who prioritize transparency, accountability, and providence in their precious metal holdings.

As investors navigate the diverse landscape of silver bars, certain key factors come into play, shaping the decision-making process. Size, weight, and personal investment goals are crucial considerations. The size of silver bars varies, accommodating different budgets and preferences. Weight determines the amount of silver in each bar, impacting overall investment value. Exploring these factors allows investors to tailor their choices to align with individual preferences, ensuring a well-informed and personalized approach to building a silver portfolio.

Some buyers choose silver bars solely based on their hobby for collecting different designs and brands. However, there are also small investors who like to combine the two pleasures of investment and accumulating varied and unique assets. While this isn’t possible with most investment types, buying physical silver bars enables this blend.

Some silver bars, particularly limited-edition versions or those with unique designs, possess this collectible appeal. Collectors are drawn to the rarity and exclusivity, viewing these bars as not just investments but artifacts with potential numismatic value. Understanding the collectible nature of certain silver bars adds an additional dimension for investors seeking both financial gain and a connection to the historical and artistic aspects of precious metals.

The versatility of silver bars extends to the choice investors have regarding size and weight. Whether you’re considering a more modest investment or aiming for substantial holdings, the diverse size options provide flexibility.

Silver bars come in various sizes, catering to a spectrum of preferences and budgets. Specialist retail-focussed dealers sell silver bars as small as 2.5 grams and costing less than £10, while huge 5 kilo cast silver bars are also readily available.

The comparative affordability of silver versus gold, enables silver bars to be acquired by those with very modest budgets, whereas gold’s value can mean even the smallest bars are inaccessible. The tiny silver bars which are usually minted and beautifully presented become ideal gift choices. But for those buying silver bars purely for investment, the larger size cast bars from around 1 kilo in weight, offer far lower premiums and better value.

Size and weight also need to be considered due to the practicality of storage. While the smallest bars may fit snuggly into a wallet, the larger sizes will require careful safe-keeping planning as they can take up significant space. If you’re looking to pick up your silver bars from a dealer, don’t forget to ponder the logistics of transporting them home. While £50,000 can buy a carriable 1 kilo gold bar, the same budget can acquire thirteen silver bars, each weight 5 kilos!

Acquiring the most suitable type of silver bars is only one part of the equation. The other crucial component which will impact your investing success is the premium you pay. Selecting the most appropriate types of bars for your specific needs requires an understanding of the nuances of premiums and pricing.

Premiums refer to the additional cost above the intrinsic value of the silver. Minted bars, for example, may carry higher premiums due to their precision and aesthetic appeal, while the lower production cost of cast bars is passed onto consumers.

By far the most significant factor influencing a silver bar’s premium is its silver weight. Premiums can be as low as 10-15% for bars weighing 5KG, while the most diminutive silver bars command mark ups of more than 300%, a massive difference in the value of the silver bars.

Even silver bars produced and finished in the same way and providing identical quantities and purity of silver, can be priced at different premiums. This is due to the impact of various brands. High end brands such as Pamp Suisse and Johnson Matthey charge dealers higher prices for their bars which is then passed onto end buyers. Meanwhile other brands position themselves at the budget end of the scale to target those desiring value. It’s important to buy bars manufactured by known refineries to ensure liquidity when selling. An ideal balance between market reputation and value is a mid-range brand such as Metalor.

Considering premiums alongside overall pricing helps investors strike a balance between cost and collectibility. Exploring the nuances of premiums and pricing ensures that investors make choices aligned with their budgetary constraints and investment objectives.

As with any investment decision, the best starting point is to decide on your investment objectives. This will then provide guidance as to which factors are the most important when deciding on the ideal type of silver bar.

It’s evident that these tangible assets offer investors more than just financial value. Considerations from the craftsmanship of cast and hand-poured bars to the precision of minted and stamped varieties, present an array of choices. Size, weight, collectibility, and pricing all contribute to the complexity of decision-making.

In conclusion, understanding these intricate differences allows investors to navigate the silver bar landscape with clarity, making choices that align with their financial goals and preferences. Whether seeking the raw aesthetic of cast bars or the refined look of minted ones, each silver bar type brings a unique dimension to the table, creating a nuanced and personalized approach to precious metal investments.

We’re here to provide as much or as little guidance as you need on your silver bar investment journey. Browse and buy from the various silver bars we offer below or contact us if you’d prefer advice.

Our team can help you make the best choices to suit your objectives. Either call 020 7060 9992 or get in touch via our callback service.

Cast silver bars are crafted through a traditional method, resulting in a rustic appearance. Investors may find them appealing for their uniqueness and potential cost advantages. Their finish looks more natural than the processed look of minted silver bars.

Minted silver bars are precisely manufactured, offering a polished finish and standardized appearance. They are favored by those who appreciate a more refined and uniform look in their investments.

Hand-poured silver bars are individually crafted, showcasing an artisanal touch with irregularities. Collectors often find them attractive for their unique, one-of-a-kind appearance.

Stamped silver bars feature intricate designs, logos, or patterns. They are chosen by investors who value the aesthetic appeal of their precious metal holdings.

Serialized silver bars come with unique identification numbers, providing traceability. Security features like holograms enhance the overall security, making them preferred by cautious investors.

Live Gold Spot Price in Sterling. Gold is one of the densest of all metals. It is a good conductor of heat and electricity. It is also soft and the most malleable and ductile of the elements; an ounce (31.1 grams; gold is weighed in troy ounces) can be beaten out to 187 square feet (about 17 square metres) in extremely thin sheets called gold leaf.

Live Silver Spot Price in Sterling. Silver (Ag), chemical element, a white lustrous metal valued for its decorative beauty and electrical conductivity. Silver is located in Group 11 (Ib) and Period 5 of the periodic table, between copper (Period 4) and gold (Period 6), and its physical and chemical properties are intermediate between those two metals.