The Different Types of Silver Investment

08/10/2018Daniel Fisher

Free & fully insured UK Delivery. Learn more

Secure & flexible payments. Learn more

Buyback Guarantee Learn more

Investment in silver can be lucrative, due to market expectations of steady price increases. The current spot price of silver has been around $16.58 per troy ounce. There are analysts who believe that this price could soon be at $20. Still, others are bullish on the precious metal, believing that it could hit a high of $130 over the longer term. It may be worthwhile to note that there was a silver rally a few years ago when the spot price touched $50 in 2011.

Although, that high was a response to investors hedging their risks in order to move their money out of the global capital markets, which were in turmoil at that point in time. Well, whether you’re bullish on silver or not, investments in precious metals provide balance and stability to an investment portfolio. There are many investment advisors who recommend an asset allocation of at least 7-15% in precious metals, in order to hedge risks and balance the portfolio.

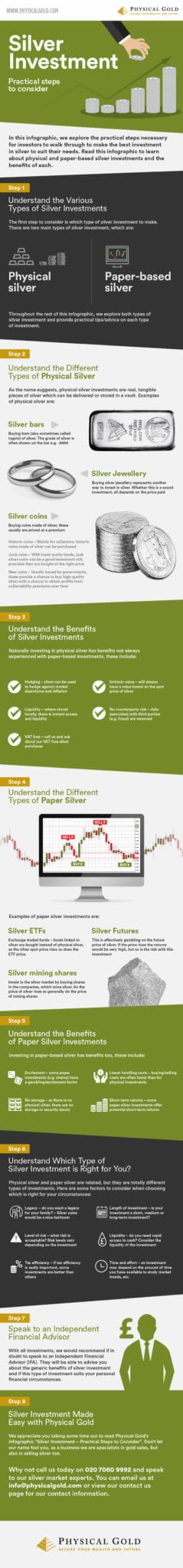

If you enjoy infographics, please read one we have published below relating to the silver investment. This is entitled “Silver investment – practical steps to consider” and covers a range of silver investment-related topics. These are also discussed in more detail directly below the infographic, so read this page to learn more about the different types of silver investment.

We appreciate the time you have taken to read the infographic and hope you enjoyed this appealing visual format. Please continue reading this page to learn more about silver investment strategies and approaches.

The excitement for silver investing is growing, with the number of silver enquiries we receive on a monthly basis quadrupling over the past 3 years. As its popularity and demand has increased, so has the various ways to invest. But with so much choice, which type of silver investment is the best?

On a simple level, types of silver investment can fall into two broad categories;

Silver Bars are a great way of saving for retirement

Let’s look at each one of those in turn;

As the name suggests, various physical silver investments are real, tangible pieces of silver which can be delivered or stored in a vault. One of the main advantages of physical silver investment is that there’s no counterparty risk involved. The silver has an intrinsic value according to its silver content so its value can never fall to zero. Access to the silver can be instantaneous if kept at home, so you’re not reliant on any third party transactions.

Download our FREE 7 step cheat sheet to successful Silver Investing here

One of the major motivations to own silver as an investment is to hedge against market downturns and paper asset collapses, like 2008’s credit crunch. It makes sense then that physical silver most appropriately negates the very paper risk you’re trying to avoid.

Government minted silver bullion coins (such as silver Britannias) are one of the most popular physical silver choices.

The quality of coins is predictable with a refined and practised manufacturing process. Just as importantly, the coins features are always stamped onto the coin, such as purity, year of issue and face value.

Uncirculated coins are in perfect condition and can be bought at relatively low premiums due to mass production. Limited issue coins are also available which command higher premiums and can rise in value quicker than standard issue coins.

Generally, the cost of silver coins is slightly higher than the equivalent weight in silver bars due to their added collectability and divisibility.

Silver Bullion coins offer a high degree of flexibility

How about pre-owned silver coins?

How about pre-owned silver coins?While a vast majority of our silver coins are brand new, every now and again we feature a ‘pre-owned product’ or ‘best value coin’. This will simply be coins we’ve bought back from one of our larger customers. If you see these coins on our site, snap them up if you’re seeking tax-efficient investment value. Coins may be slightly tarnished from coming into contact with the oxygen in the air, but this doesn’t impact our buy-back cost. The largest challenge is that most customers buy and hold silver coins for the long term, so pre-owned coins don’t appear often and usually get snapped up quickly.

Pre-owned silver coins can cut prices further

The short answer is no. We won’t sell pre-owned silver coins if they’re damaged. The term ‘junk silver’ tends to refer to coins produced mainly by the US (pre-1965) and the UK (pre-1946) such as Crowns. Often silver purity is also far lower than the 99.99% we are used to today in bullion coins. Junk silver is regarded as too good to qualify as scrap silver. We don’t sell junk silver as our focus is on silver investment. We feel that junk silver is a specialized market on its own which requires far more seasoned silver buyers than the average customer. Its lack of standardised quality and condition introduces unnecessary risks into silver investment which can be avoided with high purity silver coins.

Silver rounds are similar to Government produced

With silver’s low price, producing 1oz silver coins can lead to a relatively high production cost in percentage terms. In simple terms, a £1 cost of producing a 1oz gold coin may only be 0.1%, but the £1 cost of minting a 1oz silver coin is nearer 6%.

Silver bars though can be manufactured in far larger sizes, reducing the silver cost per gram and providing a convenient form of investment.

Weights can be denominated in both imperial and metric systems. Typically, the US sticks to the former, with Europe preferring the more modern grams and kilos. Sizes vary from diminutive 1oz bars, right up to 100 troy ounces, and from 100g through to 1kg and 5kg.

Like coins, silver bullion bars are well-regulated and standardised.

Silver bars are cheaper per gram than silver coins

One pitfall to avoid is simply buying the biggest bar possible for your money in a hope of reducing the silver price per gram as low as possible. While the largest bars are more cost-effective, it leaves the buyer with little room to manoeuvre. The investor is unable to liquidate small parts of their portfolio due to the inflexibility of the bars. The idea is to target the sweet spot between cost and liquidity. For that reason, it’s no surprise that 1kg bars are the most popular size.

Our Ultimate Insiders Guide to Silver Investment can be downloaded FREE here

“Silver investing in 2019 and beyond” a YouTube video from Physical Gold Ltd.

We exclusively sell silver bars at very competitive prices

At the moment the answer is no. Because there are no UK face value silver bars, they’re not CGT exempt. Maybe this is something for the future, especially with the popularity of the non-UK ’coin bars’. But this doesn’t mean you’ll be taxed on any profits. Each UK resident is permitted an annual CGT allowance, currently £11k, which grows each year. That means you can sell your silver bars and pay no tax on any profit up to that amount. Tax is only applied to profits above your allowance. Not only that, but your allowance resets each tax year. So, selling some silver before April 5th and some after will entitle you to £22k of tax-free profits!

At present, HMRC only permits gold bars to

UK Self Invested Personal Pensions (SIPP). Silver bullion isn’t currently accepted. However, with the Government continually seeking to encourage more of us to save for retirement, the list of permissible assets will be reviewed. With silver amongst the highest growing asset classes, it will no doubt make it onto their radar.

Obviously, silver jewellery can also provide a level of silver investment. For many years, precious metals lovers have been buying silver jewellery and benefitting from their value rising.

However, it’s important to understand that this is a very different challenge to investing in silver coins and bars.

The price of the item will also be significantly higher than the equivalent weight in silver coins or bars. That’s because jewellery is priced to reflect the design and beauty of the item. The problem is, this value is very much subjective. Only silver purity is standardised with silver jewellery. The rest is very much bespoke. This opens up the real possibility of paying over-the-odds for an item and just as importantly, not receiving your ‘perceived value’ when it comes to selling.

Certainly, as a silver investment, we stick to silver coins and bars. They provide a far more predictable, tax-efficient and cost-effective means of investing. However, don’t forget that jewellery should be worn and enjoyed, so it really can’t be compared like-for-like with silver bullion.

Silver can be enjoyed and used but is a less effective type of silver investment

Silver grain is small pieces of silver sold by weight. Premiums are low due to a lack of manufacturing cost, but it also reflects the fact that it doesn’t benefit from any of the tax efficiencies of coins and bars. The market for silver grain is also more focused on those wishing to use the grain to make jewellery, so liquidity for selling on your silver investment as grain is diminished.

Silver-backed assets and electronic silver investments have grown in variety over recent years, as more investors wish to actively trade the market. They provide lower cost ways of accessing the market as they avoid the cost of manufacture, delivery and storage.

However, the risks of these silver investments are different from owning physical silver.

Exchange traded funds (ETFs) can be linked to silver. Rather than take delivery of silver bullion, silver investors can buy units of the silver ETF. Participants can buy and sell at lower margins than with physical silver, but there will be brokerage fees to do so and annual management fees of the fund.

ETFs don’t offer the comfort of owning the physical silver in your hand which could prove significant as many funds are leveraged with only a small percentage of actual physical silver bullion backing the investment amount.

Those concerned about the value of fiat paper currencies may be disappointed that they never own any actual silver bullion.

Buckle in, as this type of silver investment is only for the more sophisticated investor. For many, silver’s potential massive price gains are the main driving force, rather than market protection and insurance. Silver futures contracts provide a means for these people to speculate on the future price of silver.

While owning physical silver is about taking the risk away (and making great returns), investing in silver futures is certainly about taking the risk. But with great risk, comes great potential reward, and possibly in a short space of time.

A large amount of ‘silver futures’ can be bought at a relatively low initial cost. The buyer agrees to buy a fixed amount of silver on a set future date, but speculators never opt to actually receive silver bullion when the date arrives. Instead, they simply settle the difference either way on the future date, depending on which way the market has moved. This is known as paying the margin. The minimum and maximum trading amounts depend on which exchange is used, with the most popular being the Commodity Exchange of the New York Mercantile Exchange (COMEX).

The added flexibility to futures and options on silver is that the investor can make money on the silver price going down as well as up. By ‘going short’ on a future or option, the participant is hoping they can buy the silver back (or settle their margin) for a lower amount on the future date.

Electronic types of silver investment can be far riskier

While the leverage involved can magnify possible gains, it can also cause large losses. With many futures and options traders moving in and out of the market well before the ‘maturity’ of the future, it can be a rollercoaster ride. Speculation and volatility play a far greater role than investing in physical silver, with the real danger that you can lose your entire investment.

Obviously, the process of silver being discovered and mined can also provide investment opportunities. Investing in silver mining shares is a completely different opportunity and risk profile again. While the silver price does play a role, the value of the investment is more closely linked to the individual mining company.

Just like buying and selling any stocks, an investor can own a share in a silver mining company. Unlike investing in physical silver, no actual silver bullion is ever owned, instead, the buyer has a paper share. These shares are easily traded on the market and buy/sell margins are low.

These shares can outperform the silver price

if the particular company, you own a share of outperforms others. Equally, if the company has poor management, the investor could lose the entire investment if the mining company goes bankrupt. This can be a major factor when fixed costs such as oil rise but the silver price doesn’t. Profits become squeezed and sometimes mines temporarily close to save costs. Buying silver funds can reduce this dependence on one company by investing in a wider selection of mining corporations.

Each type of silver investment should be evaluated on its individual merits and how it best meets your objectives. We only focus on physical silver investments, as we’d prefer to be great at that than try to please everyone. Physical silver also sits most comfortably with our philosophy behind precious metals. We believe the very fact their physicality is rare, makes paper and electronic versions completely different assets altogether.

As a general guide, physical silver if bought in the right way (tax efficiently) best suits those seeking the ultimate reassurance of owning a physical asset, with no counterparty risks.

For those with sophisticated market experience and willing to adopt a higher risk to market timings by trading the market., then electronic silver proves popular.

So, assuming that you are a keen silver investor, the next step in order to invest in silver is to identify a reliable silver broker. Our niche is to offer tax-efficient methods of silver investment to our customers.

Physical Gold has historically been a highly reputed online broker and investment advisor of precious metals. We are registered with the British Numismatic Trade Association (BNTA) and abide by their strict code of conduct. Our customer offerings are second to none and all deals available through our website are extremely transparent and provide investors with great value for money. All our products come with a certificate of authenticity, as well as a buyback guarantee.

If you’ve decided which type of physical silver investment you’re after, simply open an account on our website, find the best deals on offer from the website and add these to your shopping cart.

Our team of investment advisors are ever ready to help you select the best silver buying option for you. Call us now on 020 7060 9992 or get in touch with our team online in order to discuss investment strategies, choice of product categories and the best product deals. We also sell a massive range of gold products too including gold bars and gold coins.

Image credits: Money Metals and Max Pixel

Live Gold Spot Price in Sterling. Gold is one of the densest of all metals. It is a good conductor of heat and electricity. It is also soft and the most malleable and ductile of the elements; an ounce (31.1 grams; gold is weighed in troy ounces) can be beaten out to 187 square feet (about 17 square metres) in extremely thin sheets called gold leaf.

Live Silver Spot Price in Sterling. Silver (Ag), chemical element, a white lustrous metal valued for its decorative beauty and electrical conductivity. Silver is located in Group 11 (Ib) and Period 5 of the periodic table, between copper (Period 4) and gold (Period 6), and its physical and chemical properties are intermediate between those two metals.