The World’s 5 Most Popular Bullion Coins

25/03/2025Daniel Fisher

Free & fully insured UK Delivery. Learn more

Secure & flexible payments. Learn more

Buyback Guarantee Learn more

Bullion coins are a popular choice for both investors and collectors, offering a combination of precious metal content, government backing, and global recognition. They’re mass-produced coins aimed at the gold and silver investment markets.

However, the most sought-after coins can vary significantly depending on the buyer’s location and investment goals. While some investors prioritize purity and liquidity, others focus on tax advantages or historical significance.

While a coin may represent great value in one part of the world, premiums may be far higher in other regions. If you’re looking to buy the best-recognised and most suitable bullion coin, ensure you buy the leading coin in your market location to suit your goals.

In this guide, we’ll explore five of the world’s most popular bullion coins and how their appeal differs across regions. Plus, we’ll specifically highlight the top choices for UK investors looking for the ultimate bullion coins for investment and tax-efficiency.

This was the coin that started it all. First minted in 1967 by the South African Mint, the Krugerrand was the world’s first modern gold bullion coin specifically designed for private investment. Named after Paul Kruger, the former South African president, and the country’s currency, the rand, it features his portrait on the obverse and a springbok antelope, a national symbol, on the reverse. The Krugerrand played a key role in making gold accessible to private investors, and its historical significance keeps it popular today.

The Krugerrand is a 22-karat (91.67%) gold coin, containing one full troy ounce of gold but alloyed with copper to improve durability. This copper content gives it a distinctive reddish hue and makes it more resistant to wear and scratches compared to softer 24-karat coins. Its durability makes it a practical choice for investors who anticipate frequent handling or trading. The choice of purity has paid dividends as the huge quantity of Krugerrands from the 1970s and 1980s remain in excellent condition and highly traded today.

As the first modern bullion coin, the Krugerrand enjoys global recognition and high liquidity. It is often one of the lowest-premium gold coins on the market, making it an attractive option for investors focused on acquiring gold at the best possible price. It can be argued that it’s the most globally recognised of all the 1-ounce bullion coins. The sheer number of coins on the secondary market ensures low premiums and highly efficient trading.

Unlike some government-issued bullion coins, the Krugerrand does not have an official face value, but its value is tied directly to the gold price, reinforcing its role as a pure investment vehicle.

Free ultimate guide for keen precious metals investor

The American Gold Eagle, first introduced in 1986, is one of the most recognizable gold bullion coins in the world. Its obverse features Augustus Saint-Gaudens’ iconic depiction of Lady Liberty, a design originally used on $20 gold coins from the early 20th century. The reverse showcases a bald eagle, symbolizing American strength and resilience. As the official gold bullion coin of the United States, it carries significant trust and prestige.

Unlike many modern bullion coins that are .999 or higher in purity, the Gold Eagle is struck in 22-karat gold (91.67% pure). It contains a full troy ounce of gold but is alloyed with copper and silver to increase durability. This makes it more resistant to scratches and wear compared to softer 24-karat coins, an appealing feature for investors who prefer physical handling of their assets. Many investors assume 22-karat bullion coins are inferior to 24-karat ones, but essentially, they both contain exactly 1 ounce of pure 24-karat gold.

The Gold Eagle can be perceived as the bullion guise of the US Dollar due to its universal recognition. It’s highly liquid and widely accepted worldwide, making it an excellent store of value. It is backed by the U.S. government and carries a face value (though its metal content is worth far more). Many investors appreciate its combination of durability, recognizable design, and legal tender status. Additionally, being exempt from IRS 1099-B reporting requirements for certain transactions adds to its appeal in the U.S. market.

The Canadian Maple Leaf, introduced by the Royal Canadian Mint in 1979, was one of the first modern bullion coins to offer .999 pure gold. By 1982, it was upgraded to an incredible .9999 (24-karat) purity, setting a new industry standard. This pioneering production has laid the foundation for the Maple’s reputation for minting excellence.

The coin features the iconic maple leaf on the reverse, a powerful national symbol of Canada, and a portrait of Queen Elizabeth II on the obverse. Its purity, security features, and government backing make it a favourite among investors worldwide.

The Gold Maple Leaf is struck in 99.99% pure gold, making it one of the purest bullion coins available. Unlike the American Gold Eagle, it does not contain additional alloys for durability, which gives it a distinctive bright gold lustre. However, this also means it is softer and more susceptible to scratches, so investors often handle it with extra care or store it in protective cases. The Royal Canadian Mint has also produced special .99999 “five nines” editions, further solidifying its reputation for high-purity gold.

The Gold Maple Leaf is highly valued for its purity, making it a top choice for investors who prefer 24-karat gold. It carries a legal tender face value (though its metal content is worth far more) and is backed by the Canadian government. The coin also boasts advanced security features, including micro-engraved radial lines and a laser-marked maple leaf, making it one of the most counterfeit-resistant bullion coins on the market. These factors, combined with its relatively low premiums over spot price, contribute to its widespread appeal.

Our automated portfolio creator will help you choose the ideal selection based on your budget and objectives.

Introduced in 1989 by the Austrian Mint, the Austrian Philharmonic is Europe’s best-selling gold bullion coin. It was created to celebrate Austria’s rich musical heritage, featuring a stunning design inspired by the world-famous Vienna Philharmonic Orchestra. The obverse displays the grand pipe organ from Vienna’s Musikverein concert hall, while the reverse showcases an ensemble of orchestral instruments. With its combination of beauty, purity, and strong liquidity, the Philharmonic is a top choice for European and global investors alike.

The Gold Philharmonic is minted in 99.99% pure gold (24-karat), making it one of the purest gold bullion coins available. Unlike 22-karat coins such as the Krugerrand or American Gold Eagle, the Philharmonic contains no additional metal alloys, giving it a rich, bright gold appearance. However, its softness makes it more prone to scratches, so careful handling and storage in protective cases are recommended.

The Gold Philharmonic is minted in 99.99% pure gold (24-karat), making it one of the purest gold bullion coins available. Unlike 22-karat coins such as the Krugerrand or American Gold Eagle, the Philharmonic contains no additional metal alloys, giving it a rich, bright gold appearance. However, its softness makes it more prone to scratches, so careful handling and storage in protective cases are recommended.

The Austrian Philharmonic is one of the most widely traded and recognized gold coins in Europe. It consistently ranks among the best-selling bullion coins globally, appealing to both investors and collectors. Its legal tender status in Austria and its availability in a variety of sizes make it an accessible option for different budgets. Additionally, the Philharmonic is the only major gold bullion coin denominated in euros, making it especially attractive to investors in the Eurozone.

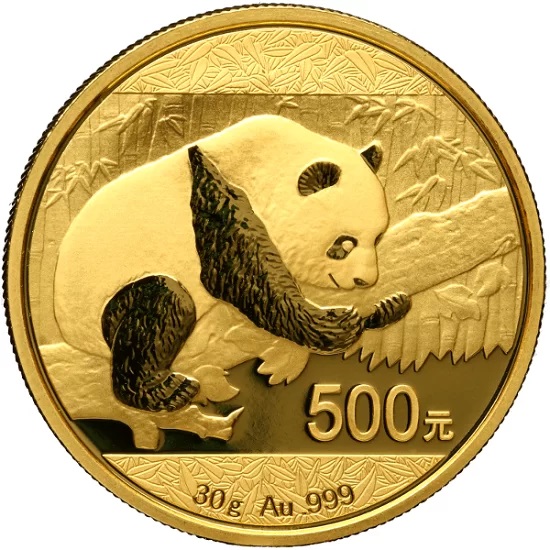

First issued in 1982 by the People’s Bank of China, the Chinese Gold Panda is one of the most distinctive gold bullion coins in the world. Unlike most bullion coins that maintain the same design each year, the Gold Panda features a new panda illustration annually (except for 2001 and 2002, which shared the same design). This unique aspect adds a collectible appeal, making it popular among both investors and numismatists. The obverse consistently depicts the Temple of Heaven in Beijing, symbolizing China’s rich history and cultural heritage.

The Chinese Gold Panda is minted in 99.9% pure gold (24-karat), making it one of the purer bullion coins available. In 2016, China transitioned the coin’s weight system from troy ounces to grams, making it unique among major gold bullion coins. This change aligns with the metric system widely used in China and many other parts of the world, further increasing its appeal in Asian markets. Whereas other 1 ounce bullion coins contain 31.103g of pure gold, the Panda contains 30 grams, making it simpler to calculate price per gram.

The Gold Panda offers a combination of investment value and collectible appeal. Its annually changing design makes it more desirable to collectors, potentially increasing its numismatic value over time. As a 24-karat gold coin, it is highly sought after by investors who prioritize purity. The coin’s official backing by the Chinese government and its strong demand in Asian markets also contribute to its liquidity and credibility.

Check out the latest prices

Clearly, an investor’s location and objectives can significantly skew which bullion coin is most appropriate for their needs. We specialize in helping UK buyers, so we thought we’d devote a whole section specifically to address the best bullion coins for UK investors.

One of the biggest factors influencing bullion coin popularity in the UK is tax efficiency. Buying and selling gold and silver for a profit can have tax implications. Read our handy Precious Metals tax guide. While all gold and silver coins of 22 karat are exempt from Value Added Tax (VAT), the same cannot be said of Capital Gains Tax (CGT).

However, British coins that are classed as legal tender, such as Gold & Silver Britannias and Sovereigns, are exempt from CGT. This makes them a particularly attractive option for UK investors compared to foreign bullion coins, which may be subject to taxation upon resale.

UK investors benefit from a highly developed bullion market where British coins are widely recognized and easy to trade. Coins like the Gold Britannia and Sovereign have a long history and strong domestic demand, ensuring they can be easily bought and sold at competitive prices.

Being minted in Wales means that new coins are almost always available with no wait, unlike some global bullion coins which may sometimes take longer to obtain due to overseas transport. Only in times of intense demand, such as during the COVID crisis, were the Royal Mint unable to keep up with demand, leading to supply delays. British coins’ global recognition also makes them liquid assets in international markets.

The Sovereign coin has a 200-year history, creating a very deep and liquid secondary market. Selling Sovereigns is incredibly easy and the sheer variety of versions on the market means historical coins can be picked up for collectible enthusiasts. There are less second hand Britannias on the market as they were only launched in 1987.

Compared to some foreign bullion coins, British options often come with lower premiums over the spot price of gold. This is particularly true for Gold Britannias and Sovereigns, which are produced in large quantities and readily available. Pre-owned Britannias and Sovereigns can be picked up for even lower prices, under the guise of ‘best value’ coins.

Investors looking to acquire gold in smaller increments can opt for fractional Britannais and Sovereigns, making UK gold coin ownership accessible for all. Premiums can jump up significantly for smaller Britannias and half Sovereigns, but this isn’t dissimilar to fractional global coins.

The right bullion coin for you depends on your investment objectives. If your primary goal is wealth preservation, you may want to focus on well-known, highly liquid coins with low premiums, such as the Gold Britannia or American Gold Eagle. On the other hand, if you have an interest in collectability and potential numismatic appreciation, coins like the Chinese Gold Panda, with its annually changing design, or the Queen’s & Tudor Beasts series may be more appealing.

Tax efficiency can significantly impact your investment returns. UK investors, for example, benefit from Capital Gains Tax (CGT) exemptions on legal tender coins like Gold Britannias and Sovereigns. In contrast, investors in North America might prioritize American Gold Eagles or Canadian Maple Leafs, which offer tax advantages in their respective countries. Always consider the tax implications of bullion purchases based on your location before making a decision.

Different investors have different preferences when it comes to gold purity. Some prefer .9999 fine gold coins like the Canadian Maple Leaf and Austrian Philharmonic for their high gold content. Others opt for 22-karat coins like the Krugerrand and Sovereign, which are more durable due to their copper or silver alloy. If you anticipate handling your coins frequently, a 22-karat coin might be more practical, whereas those looking for maximum gold content may lean towards 24-karat options.

Highly recognized coins tend to be easier to sell at competitive prices. The American Gold Eagle, Canadian Maple Leaf, and Gold Britannia are among the most liquid coins globally. If you’re investing in silver, the Silver Britannia is an excellent choice for UK investors due to its CGT exemption, while the Silver Maple Leaf and American Silver Eagle are strong contenders in North America.

Gold and silver bullion coins come in a variety of sizes, allowing investors to enter the market at different price points. If you’re looking for a cost-effective way to invest in gold, fractional coins like Sovereigns or 1/10 oz Gold Britannias provide flexibility. For larger investments, full-ounce coins typically offer lower premiums per gram of gold.

Gold Britannias and Sovereigns are the best choices for UK investors because they are exempt from Capital Gains Tax (CGT) and VAT, making them more tax-efficient than foreign bullion coins. Silver Britannias also offer CGT exemption, making them a popular silver investment.

It depends on your preference. 24-karat coins (like the Maple Leaf and Philharmonic) have a higher gold content but are softer and more prone to scratches. 22-karat coins (like the Krugerrand and Gold Eagle) contain small amounts of copper or silver, making them more durable for handling and trading.

Some coins, like the Chinese Gold Panda, feature new designs each year to appeal to collectors, potentially increasing their numismatic value. Others, like the Queen’s & Tudor Beasts Series, offer a limited run with different designs to maintain investor interest.

Consider factors like tax efficiency (based on your location), liquidity, gold purity, durability, and premiums. If you’re in the UK, Britannias and Sovereigns are tax-efficient. If you prefer pure gold, look at 24-karat options like the Maple Leaf. If you want low premiums, the Krugerrand is a strong choice.

The easiest bullion coins to sell are those with high global recognition and liquidity, such as the American Gold Eagle, Canadian Maple Leaf, South African Krugerrand, Austrian Philharmonic, Sovereigns, and Britannia. These coins are widely accepted by dealers, have strong market demand, and typically offer low buy-sell spreads.

Live Gold Spot Price in Sterling. Gold is one of the densest of all metals. It is a good conductor of heat and electricity. It is also soft and the most malleable and ductile of the elements; an ounce (31.1 grams; gold is weighed in troy ounces) can be beaten out to 187 square feet (about 17 square metres) in extremely thin sheets called gold leaf.

Live Silver Spot Price in Sterling. Silver (Ag), chemical element, a white lustrous metal valued for its decorative beauty and electrical conductivity. Silver is located in Group 11 (Ib) and Period 5 of the periodic table, between copper (Period 4) and gold (Period 6), and its physical and chemical properties are intermediate between those two metals.