The Top 10 Gold Producing Countries

30/11/2017Daniel Fisher

Free & fully insured UK Delivery. Learn more

Secure & flexible payments. Learn more

Buyback Guarantee Learn more

Gold is mined in countries all over the world, but which countries currently produce the largest amount? Here are the top ten biggest producers of gold, ranked by the amount they produce each year in metric tons.

Dominating the list of biggest gold producers in the world is China, with 455 Metric Tons of gold produced last year. This is the tenth year that they have been top of this list, however, the amount of mineable gold in China is said to be declining. Are China exhausting their gold reserves? With only 2000 MT of mineable gold left, they could potentially run out within the next 4-5 years. It would be interesting to see how the gold market was to react should China’s gold output begin to drop.

With 270 MT of gold produced last year, Australia comes second on the

Russia plans on producing 400 MT of gold a year BY 2030. They currently have 8000 MT of gold reserves, the second largest in the world. With a country the size of Russia, there is little doubt that there is plenty more gold left to mine. Estimates predict that Russia have a minimum of 20 years of mining left.

Production of gold in the US hit 209 MT last year, this is down from the previous year (214 MT) The decline in production, like Australia is also due to the sale of mines and mine closures in Nevada.

Vintage gold mine cart

Canada has seen a rise of 17 MT in 2016, up from the previous year. With the expansion of Canadian gold mines and the development of two brand new Nunavut mines in 2019, their gold output is set to rise. Canadian gold reserves are set to last for at least 14 years at the current rate of mining.

Peru also saw a rise in gold production during 2016 with a 4 MT increase on the previous year. Peru is ranked in the top three countries in the world in terms of Copper, Silver, Zinc and Tin production. Their economy is driven by mining. As the 6th largest miner of gold their reserves (2400 MT) are set to run out by 2033.

Since the 1980’s South Africa’s gold reserves have dropped significantly, from the world’s biggest gold producer in 2007 to where they stand now, as only the 7th largest in the world. South Africa currently have the 3rd largest gold reserve in the world and at their current rate of mining, they still have another 42 years of production left.

Maturing gold mines and production challenges have severely affected Mexico’s gold operations in recent times. Mexico’s gold reserves currently stand at 1400 MT and if they carry on mining at this rate, they are set to run out of gold in approximately 11 years.

With a decline of 2 MT in gold output last year, Uzbekistan produced less gold in 2016 than the year previously. The country mined a total of 100 MT during 2016 and have a reserve of 1700 MT, which is 1300 less than Indonesia, positioned at number 10 on this list. Uzbekistan has an estimated 17 years of mining left in them.

Indonesia has increased its production of gold by 3 MT on last year, which ties them with Uzbekistan in terms of total gold produced. One factor that could potentially affect this year’s out- put however, is the long-running dispute between the owner of the Grasberg mine, Indonesia’s largest gold mine and the Indonesian government.

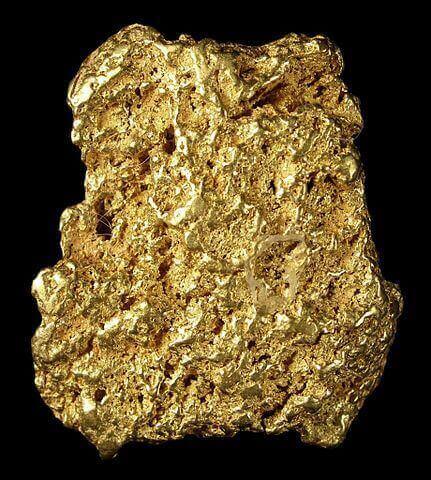

Raw, unprocessed gold

Other nations such as Brazil, Papua New Guinea, Ghana, Columbia and Kazakhstan also contribute to the global output of Gold. The companies that produce the most gold include: Barrick Gold, Newmont Mining, AngloGold Ashanti, Goldcorp and Kinross Gold.

As gold reserves decline, the gold market

will be forced to adapt as it becomes more expensive for mines to continue exploring for new gold. A need for costly new equipment and materials adding to the expense. Failure to adapt has already led to South Africa falling from its spot as the largest producer of gold in the world to only 7th in just over a decade. With the increased risk of mining gold, mining companies are forced to try and raise their profit margins in order to offset the risk. Currently the world has an estimated gold reserve of 57,000 MT. With 3,100 MT mined in 2016 mineable gold could potentially run out in the next 18-20 years, should no new sources be discovered.

Also read our related article “The top 10 silver producing countries today” and our Infographic “Where in the world is the gold?”

Physical Gold is a UK dealer of Gold and Silver and offers products including Pension Gold, Tax Free Gold and Silver Coins. As a trusted dealer we will advise you on all the options available to you and your investment will also come with a high-level security storage service along with insurance provided by Lloyds of London. Expand your portfolio today. Call for expert advice on 02070 609 992 or email info@www.physicalgold.com.

Live Gold Spot Price in Sterling. Gold is one of the densest of all metals. It is a good conductor of heat and electricity. It is also soft and the most malleable and ductile of the elements; an ounce (31.1 grams; gold is weighed in troy ounces) can be beaten out to 187 square feet (about 17 square metres) in extremely thin sheets called gold leaf.

Live Silver Spot Price in Sterling. Silver (Ag), chemical element, a white lustrous metal valued for its decorative beauty and electrical conductivity. Silver is located in Group 11 (Ib) and Period 5 of the periodic table, between copper (Period 4) and gold (Period 6), and its physical and chemical properties are intermediate between those two metals.