UK Gold Reserves

27/03/2024Daniel Fisher

Free & fully insured UK Delivery. Learn more

Secure & flexible payments. Learn more

Buyback Guarantee Learn more

Gold reserves are a critical component of a country’s economic foundation, often regarded as a symbol of financial strength and stability. Simply put, gold reserves refer to the amount of gold held by a nation’s central bank or government as part of its overall monetary reserves.

These reserves serve various purposes, including supporting the value of a country’s currency, providing liquidity during times of economic uncertainty, and serving as a hedge against inflation.

It’s important to distinguish gold reserves from the total amount of gold estimated to exist within a country’s borders. While a nation’s gold reserves represent the tangible assets held in vaults, the overall gold reserves do not necessarily reflect the entire gold wealth within a country’s territory. Gold reserves are specifically managed and controlled by the government or central bank and are often utilized to back the national currency or as a means of international trade.

The United Kingdom’s gold reserves stand at 310.29 tonnes as of 2024, representing a substantial portion of its monetary assets. This quantity of gold serves as a cornerstone of the UK’s economic stability, providing a tangible asset that bolsters confidence in its financial system.

The quantity of gold held by the United Kingdom underscores its position in the global economic landscape. With a sizeable reserve, the UK demonstrates its ability to weather economic uncertainties and maintain confidence in its currency.

The value of the UK’s gold reserves equates to around $20.734billion as at the beginning of 2024, which constitutes around 11% of the value of it’s total reserves, with the remainder consisting of foreign currency reserves.

Despite its status as the sixth-largest global economy by GDP, the UK’s gold reserves rank it 17th among nations worldwide. However, the UK’s total reserves (gold + currencies) of $178billion only ranks it 19th globally, despite its prominent economic position.

This ranking prompts a closer examination of the diverse approaches countries take in managing their monetary reserves. While some nations prioritize gold as a key asset, others may focus on different strategies for economic resilience.

While the UK holds only 11% of its reserves in gold, the top 4 countries by gold reserve, namely the US, Germany, Italy, and France, all allocate near to 70% of their total reserves in gold. The notable contrast to this weighting bias is China, who despite holding by far the largest total reserves by value, chooses to only retain 4% in gold.

This comparison highlights the nuanced nature of international finance and the multifaceted factors that contribute to a country’s financial standing. It also demonstrates the potential scope for China to increase its gold holdings.

Data from World Gold Council Feb 2024

The United Kingdom’s gold reserves are relatively low compared to many other nations with far smaller economies. But why is this and what are the consequences of a lower ratio of gold within its reserves.

Several factors contribute to the UK’s diminished gold reserves. One significant reason is the historical shift away from the gold standard, which tied currency values directly to gold reserves. Additionally, the UK has pursued diverse investment strategies, opting to hold assets beyond gold to maintain economic stability.

While low gold reserves may raise concerns for some, the economic implications are not necessarily negative. Instead, the UK’s approach reflects a broader strategy of diversification, wherein assets are spread across various investments to mitigate risks and maximize returns. This strategy allows the UK to adapt to changing economic conditions while maintaining a robust financial position.

The counter argument would focus on the growing threat to the value of currency reserves by inflation. A country’s reserves backed by fiat currency such as the US Dollar, are susceptible to devaluation, especially during periods of Quantitative Easing. Gold is acclaimed as the asset of choice for wealth preservation during inflationary times.

Clearly during gold bull runs, the UK’s lower reserves come under the most scrutiny and criticism. A diversified reserves approach proves most beneficial when the gold price stagnates or falls. With future markets difficult to predict, asset allocation enables a more varied stance which protects reserves when markets make unexpected turns.

The United Kingdom’s gold reserves are primarily stored within the secure vaults of the Bank of England. The current vaults were built during the 1930s and cover an area of more than 300,000 square feet.

Located in London, the Bank of England gold vault serves as the custodian for the majority of the UK’s gold reserves and also for other countries. In fact, the vault is second only to New York’s Federal Reserve as the largest depository of gold in the world, holding around one fifth of the globe’s gold.

These reserves are stored in highly secure underground vaults, providing maximum protection against theft or unauthorized access. The Bank of England implements stringent security measures to safeguard the UK’s gold reserves. These measures include state-of-the-art surveillance systems, access controls, and round-the-clock monitoring by trained security personnel. Additionally, the vaults themselves are constructed with reinforced materials to withstand external threats.

Gold Vault at the Bank of England. Image from www.bankofengland.co.uk

The type of gold held as the UK’s gold reserves consist primarily of bullion, which is gold bars or ingots. Predominantly the gold is in the form of 24-carat good delivery bars weighing around 12.5KG, equivalent to 400 ounces each. A small number of older 22-carat bars exist and even 900 gold purity. The purity of the gold bars held in reserves typically meets international standards, ensuring its authenticity and value as a monetary asset.

Additionally, the vault holds a small amount of historical coinage, such as sovereigns, but this is confined to holdings of 3rd parties including businesses.

Free ultimate guide for keen precious metals investor

The gold reserves held by the United Kingdom are considered national assets and are owned by the UK government. The management of these reserves falls under the responsibility of Her Majesty’s Treasury, which oversees the strategic decisions regarding the buying, selling, and storage of gold.

In addition to its domestic gold reserves, the United Kingdom also serves as a custodian for foreign countries’ gold holdings. The Bank of England, renowned for its secure vaults and reliable financial services, holds significant quantities of gold on behalf of other nations.

This arrangement provides foreign governments with a trusted location to store their gold reserves, benefiting from the Bank of England’s expertise in secure storage and management. The dynamics of foreign reserves held in the UK reflect the country’s role as a global financial centre and its reputation for reliability and stability in international finance.

The accumulation of gold reserves by the United Kingdom dates back centuries, with gold playing a pivotal role in the country’s monetary system. Historically, gold served as a standard for currency valuation and was closely tied to the British pound sterling.

The United Kingdom’s gold reserves have not always been held exclusively at the Bank of England’s vaults. While the Bank of England has long served as a key custodian for the country’s gold reserves, historical records indicate that the UK’s gold holdings were also stored in various other locations at different points in time.

However, in modern times, the Bank of England has emerged as the central institution entrusted with the storage and management of the majority of the UK’s gold reserves. Its vaults, renowned for their security and reliability, provide a secure location for storing the country’s monetary assets, including gold.

Over the years, various significant events have influenced not only the amount of gold held by the UK, but where it’s been stored. Notably “Operation Fish” involved the secret transfer of gold reserves during World War II to Canada, as the UK Government feared for the security of it’s reserves from the advancing Nazis.

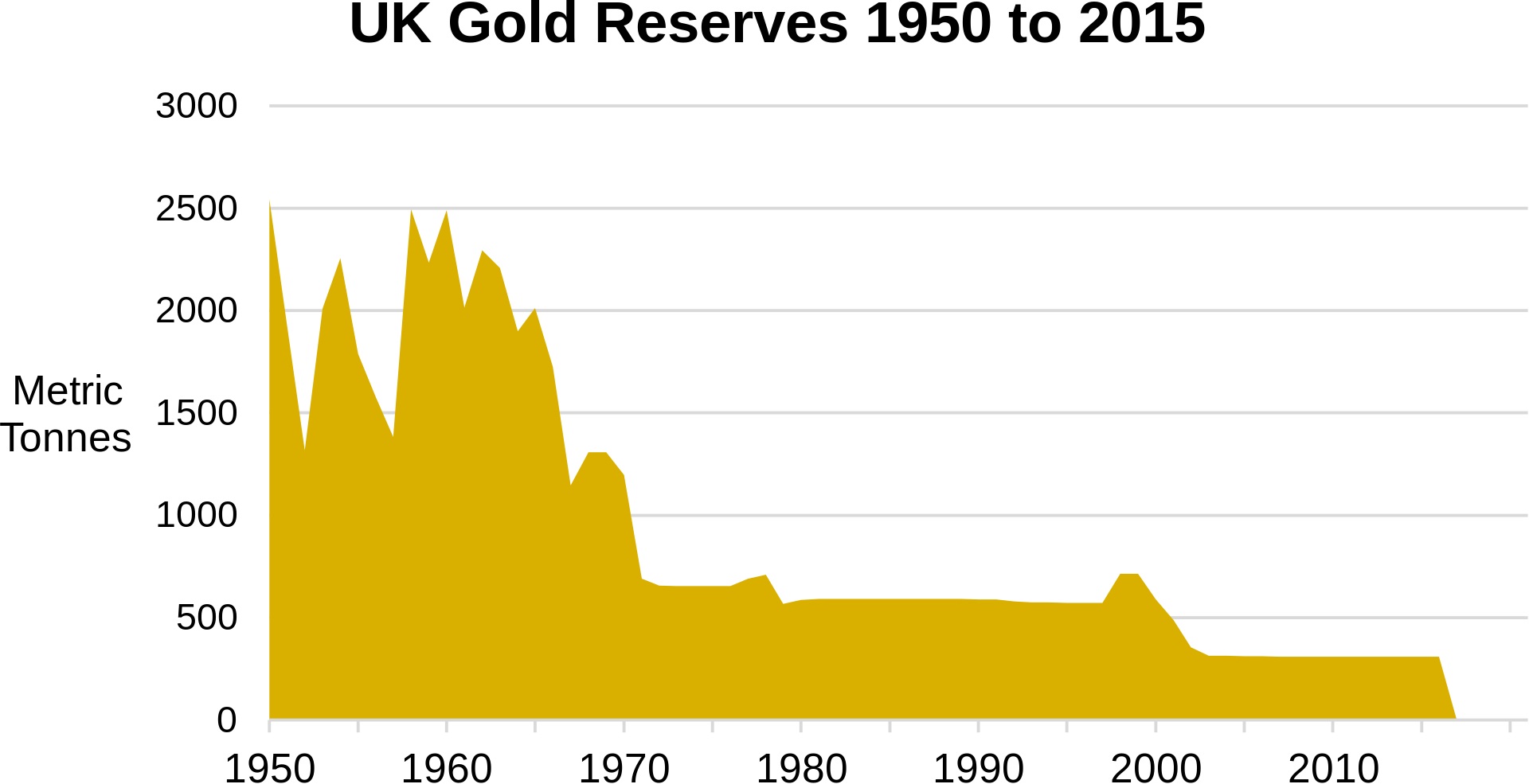

Data from https://en.wikipedia.org/wiki/Gold_reserves_of_the_United_Kingdom

While the UK’s reserves and that of many other Governments, are held at the Bank of England’s vaults, there are several other major facilities in the United Kingdom that serve as key storage locations for banks, precious metals dealers, businesses, and wealthy individuals.

It’s worth noting that while these facilities store multiple types of precious metals and valuables, the Bank of England primarily focusses on only storing gold, catering to central banks and governments.

While the UK accumulated gold during its British Empire heyday, it has also sold off large swathes of its gold reserves during certain periods. While most ask the question as a referral to the notorious gold sale by then-Chancellor Gordon Brown from 1999-2002, the UK has chosen to make significant sales on a number of occasions.

The UK’s decision to sell its gold reserves has been influenced by various economic and strategic factors. One primary motivation has been to manage and diversify the country’s financial assets in an ever-evolving global economy. Selling gold reserves can provide liquidity and capital that may be used for other purposes, such as supporting economic growth, reducing debt, or investing in alternative assets.

Additionally, changes in global economic conditions and market dynamics have played a role in shaping the UK’s decisions regarding its gold reserves. For example, during periods of economic uncertainty or currency volatility, selling gold reserves may be seen as a prudent measure to stabilize the economy or mitigate financial risks, even though downturns are usually when gold appreciates in value!

If a country’s reserves were compared to equity funds, holding 100% reserves as gold could in a way be compared to a tracker fund. The value of reserves will be exposed to the one factor it tracks, ie gold, with the hope of overall preservation over the long term. The UK’s more diversified approach would be more akin to a managed fund that aims to outperform the market. When it works, it looks great, but when it underperforms the base asset of gold, criticism grows.

The United Kingdom has undertaken several notable periods of gold reserve sales throughout its history. These sales often coincide with significant economic or geopolitical events, as well as shifts in monetary policy objectives.

Examples of key periods of gold reserve sales include:

1970s: During this decade, the UK sold a portion of its gold reserves as part of efforts to manage economic challenges, including inflation and balance of payments deficits. In particular, funds were raised to prop up the value of Sterling, which had been devalued in 1967.

1999-2002: The UK conducted a series of gold reserve sales during this period, claiming it to be part of a broader strategy to diversify its assets and optimize the composition of its reserves. Chancellor Gordon Brown halved the UK’s gold reserves over 3 years, using it to reduce national debt and reinvest into other assets including Dollars, Euro, and Yen.

However, these sales attracted attention and debate within the financial community, with many questioning the timing and implications of the transactions. This period known as ‘Brown’s Bottom’ was poorly timed when using hindsight to analyse the price of gold. After an initial 10% drop on the news of his planned sale, gold then went on an extended bull run, appreciating significantly in value.

No, the UK is not considered rich in gold reserves. While it once held significant reserves, subsequent sales and limited domestic production have diminished its holdings compared to other countries.

Yes, the UK still holds gold reserves of more than 310 tonnes, primarily stored in the Bank of England’s vaults. However, the quantity is relatively low compared to historical levels and those of other nations.

The decision to sell a significant portion of the UK’s gold reserves was made by then-Chancellor of the Exchequer, Gordon Brown, between 1999 and 2002, when he offloaded around half of total reserves to reduce national debt.

Yes, gold can be found in some rivers and streams across the UK. While not as abundant as in other regions, recreational gold panning is practiced by enthusiasts in areas such as Scotland and Wales.

Gordon Brown’s gold sales, conducted between 1999 and 2002, were criticized for occurring at historically low prices. The exact amount received varies, but estimates suggest around $275-$300 per ounce, significantly below current market prices.

Yes, individuals can engage in gold panning and small-scale mining activities in certain areas of the UK with the appropriate permits and permissions. However, commercial-scale gold mining is not prevalent due to limited reserves and regulatory restrictions.

Live Gold Spot Price in Sterling. Gold is one of the densest of all metals. It is a good conductor of heat and electricity. It is also soft and the most malleable and ductile of the elements; an ounce (31.1 grams; gold is weighed in troy ounces) can be beaten out to 187 square feet (about 17 square metres) in extremely thin sheets called gold leaf.

Live Silver Spot Price in Sterling. Silver (Ag), chemical element, a white lustrous metal valued for its decorative beauty and electrical conductivity. Silver is located in Group 11 (Ib) and Period 5 of the periodic table, between copper (Period 4) and gold (Period 6), and its physical and chemical properties are intermediate between those two metals.