What is a Gold Certificate?

20/06/2024Daniel Fisher

Free & fully insured UK Delivery. Learn more

Secure & flexible payments. Learn more

Buyback Guarantee Learn more

Gold certificates hold significance in the financial world as they have bridged the gap between the reassurance of holding something with intrinsic value and the convenience of representing the value of that item with a paper certificate. It could be argued that they symbolize the first ever paper money, before banknotes were issued.

We explore what gold certificates are, how they functioned, and their significance both historically and in modern times. We will also clarify the common confusion between gold certificates and bullion certificates, while discussing the relevance of gold certificates in today’s financial landscape.

A gold certificate is a type of paper currency that was once issued by governments, representing a claim to a specific amount of gold. These certificates were essentially promissory notes that could be exchanged for physical gold from the issuing authority. Unlike modern paper money, which is typically fiat currency backed by the issuing government’s credit, gold certificates were directly tied to gold reserves, giving them intrinsic value.

Gold certificates have an illustrious history, dating back to the 17th century. The first gold certificates were issued in the 1600s in London and Amsterdam by goldsmiths who acted as custodians for customer gold. Over time, the certificates began to exchange hands in return for goods or services rendered. This provided convenience whereby ownership of the gold could be traded without the need to physically move it. The new holder of the certificate simply became the owner of the gold. It wasn’t until the 19th and early 20th centuries that they gained significant prominence in the United States.

Key dates in the history of U.S. gold certificates include:

1600s: Issued by goldsmiths as evidence of title to wealthy customers who placed gold bullion into their safe-keeping.

1863: The U.S. government began issuing gold certificates to finance the Civil War.

1870s: Gold certificates became more widespread and were commonly used in everyday transactions.

1933: President Franklin D. Roosevelt signed Executive Order 6102, which required citizens to exchange their gold certificates and gold coins for U.S. dollars, effectively ending their use.

1964: The U.S. Treasury ceased redemption of gold certificates, further diminishing their role in the financial system.

In the modern world, it can be more common for people to refer to either certificates of authenticity or bullion certification when using the term ‘Gold Certificates’. This has grown out of the combined demise of the traditional gold certificate and the increase of retail ownership of gold bullion.

Understanding the difference between these two types of certificates is crucial, as it distinguishes between the role gold certificates played in historical financial systems compared to the modern use of bullion certificates for verifying gold bars.

The old documents issued to represent ownership of a certain amount of physical gold, is the official meaning of the phrase “Gold Certificate”, and the focus of this blog. Issued by governments, these certificates represented a claim to a certain amount of gold held by the issuing authority. They were used as currency and could be exchanged for physical gold.

These certificates accompany gold bars and provide detailed information about the bullion, such as purity, weight, manufacturer, and serial number. They certify the authenticity and specifics of the gold bar but are not used as a form of currency.

Gold bars by their very nature, are far less intricate than gold coins. Their simplicity therefore enables criminals to create fake copies far easier than trying to recreate the detail of bullion coins. Horror stories of gold bars filled with less valuable compounds such as tungsten, still scare the growing retail investor market. This dynamic has provided the catalyst for modern gold bars to be accompanied by certification to provide reassurance of the gold is real.

Minted gold bars tend to be issued in a plastic laminated case, containing certification printed on a card.

This type of assay card provides all the necessary details along with a signature from the chief assayer of the gold producer.

Combing the certificate within the encapsulated casing ensures that it’s never lost.

The more rustic finish of cast gold bars tends instead to be accompanied with loose paper certification, proving the same details.

In both instances, the gold bars are stamped with a serial number which matches that displayed on the certificate. In that way, mis-placing the loose certification isn’t integral to re-selling the gold.

Certification can also be issued by manufacturers of gold coins, although this tends to be exclusively for proof coins which are sold in expensive wooden boxes. Proof coins issued by mints such as the Royal Mint, command far higher prices than their investment-targeted bullion versions.

A certificate is a smart way for manufacturers to create the perception of added value with the inclusion of a certificate. They sometimes also record the specific production run number of that limited-issue coin when it forms part of a limited mintage.

Finally, some gold dealers can also sometimes issue a general certificate of authenticity when selling gold bars or coins, especially if they don’t possess a mint mark. These certificates may simply state that all items have been authenticated by the numismatic team. This is of less value than official manufacturer certificates and is commonly used to reassure nervous customers rather than act as an official guarantee.

Gold certificates were issued by governments, primarily during the 19th and early 20th centuries, as a way to streamline transactions involving gold. Here’s how the process worked:

The government or a central bank printed gold certificates, each representing a specific amount of gold. These certificates were distributed through banks and other financial institutions.

Every gold certificate was backed by an equivalent amount of physical gold held in reserve by the issuing authority. This meant that the holder of a gold certificate could theoretically exchange it for the corresponding amount of gold.

The value of gold certificates was guaranteed by the government, which pledged to maintain sufficient gold reserves to cover all issued certificates. This backing provided assurance of the certificate’s value, much like the gold standard that underpinned many national currencies at the time.

Free ultimate guide for keen precious metals investor

Gold certificates were commonly used in everyday transactions during their peak usage periods. They played a crucial role in the financial systems of the past, combining the stability of gold with the practicality of paper currency and coins. This dual nature helped them gain widespread acceptance and facilitated smoother economic transactions during their time.

Here’s how they were integrated into daily life:

Gold certificates provided a more convenient way to carry and exchange value compared to physical gold. They were easier to transport, less risky in terms of theft, and simpler to use in transactions of various sizes.

Businesses, banks, and individuals accepted gold certificates just like they would accept regular paper money. The guarantee of gold backing made these certificates as trusted and reliable as physical gold or standard currency.

People used gold certificates for a range of everyday activities, from buying goods and services to paying debts. The certificates circulated alongside other forms of currency, offering a versatile option for those who preferred or needed a gold-backed medium of exchange.

Smaller denominated gold coin certificates were issued to enable smaller transactions

Gold certificates became an integral part of the United States financial system in the mid-19th century. The U.S. government began issuing gold certificates in 1863 as a means to finance the Civil War. These early certificates helped stabilize the economy by providing a reliable, gold-backed currency.

By the 1870s, gold certificates became more broadly circulated and accepted. They were used by both individuals and businesses for everyday transactions, trusted for their guaranteed value and convenience over carrying physical gold.

Banks and financial institutions in particular, favoured gold certificates to other forms of payment due to their secure backing. They were often used in large-scale transactions and as reserves within the banking system, providing liquidity and stability. By the early 20th century, they evolved further to be issued in various denominations to provide flexibility for smaller transactions.

However, as gold certificates became more widespread, so did the occurrence of forgeries and duplicates. Inaccurate administration of their issuance and redemption led to uncertainty whether each was actually backed by the correct amount of bullion.

The pivotal change came with the Gold Reserve Act of 1934, the conclusion of Roosevelt’s radical gold program. It transferred ownership of all gold and gold certificates to the U.S. Treasury, effectively prohibiting ownership of gold. Citizens were required to exchange them for other forms of currency, while the US Treasury and financial institutions were banned from redeeming Dollars for gold. This move was undertaken on the back of the Great Depression to prevent hoarding of gold.

1922 $100 gold coin certificate issued by the US Treasury

Gold certificates, while no longer in circulation, hold significant value for collectors due to their historical and monetary importance.

Historical gold certificates are prized by collectors for their historical significance, providing a glimpse into a bygone era of U.S. monetary history. They represent a time when currencies were backed by physical gold, granting insight into policy choices taken at the time to overcome economic woes.

Many gold certificates also feature intricate designs, unique serial numbers, and distinctive features that make them attractive to collectors. The artistry and craftsmanship of these certificates add to their appeal and contribute to premiums paying paid by enthusiasts. As gold certificates are no longer produced or used in transactions, they have become rare. This scarcity increases their value, especially for well-preserved examples in excellent condition.

For collectors, the ability to identify authentic specimens is no different with gold certificates as it is with rare coins or stamps. Here are some tips to help ensure you are acquiring genuine items:

Authentic gold certificates often have specific watermarks, distinctive paper quality, and unique ink patterns. Familiarize yourself with these features specific to the period and issuer.

Each gold certificate should have a unique serial number and signatures from authorized officials. Verify these details against known records to confirm authenticity.

Engage with numismatic experts or use reputable reference materials and catalogues to compare and validate gold certificates. Professional appraisals and certifications can also provide assurance of authenticity.

Be aware of common counterfeit techniques and reproductions. Educate yourself on the differences between genuine certificates and well-crafted fakes.

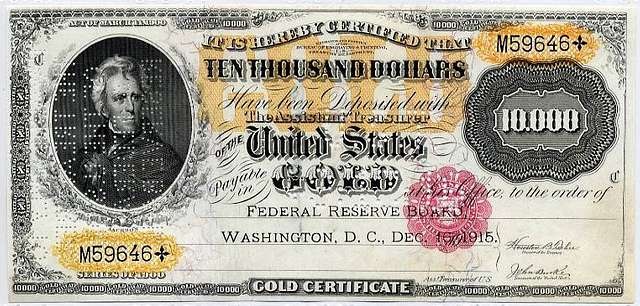

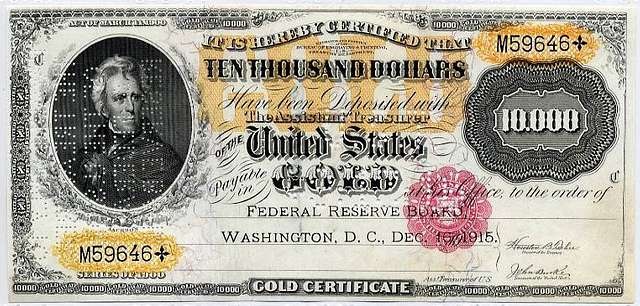

1900 $10,000 Gold Certificate

Gold’s history as a means of trade, value and investment has endured in one form or another over centuries. Its limited supply, role as a store of wealth, and widespread recognition has meant that communities around the globe will likely always buy gold.

While gold certificates no longer serve as a medium of exchange, they continue to captivate the interest of collectors and financial analysts who speculate about the growing need to return to some form of gold standard.

In contrast, today’s gold investments offer various avenues for individuals to invest in and gain exposure to gold, highlighting the enduring allure of this precious metal.

While classic gold certificates are a relic of the past, modern gold investments draw lessons from their history to create a raft of new options. In particular, contemporary paper gold investments such as gold ETFs and gold futures owe much of their creation to the existence of gold certificates.

In the modern context, the concept of unallocated gold refers to gold held in bulk by a financial institution, with ownership shares allocated to different investors. Unlike historical gold certificates, which represented specific amounts of gold, unallocated gold shares are not tied to individual bars or coins, making them more like modern financial instruments such as gold ETFs. Fears of liquidity issues stem from this lack of explicit allocation, in a similar way to the doubt that grew with duplicate certificates of the past.

Today, a limited number of financial institutions and precious metals dealers issue a modern version of gold certificates. Modern gold certificates represent ownership of a specific amount of unallocated gold held by a financial institution. Unlike historical certificates, they are typically used for investment purposes rather than as currency. Investors buy and sell these certificates without physically handling the gold, benefiting from gold’s value while avoiding storage and security concerns. However, investors should note that that the value of their certificate could fall to zero if the company issuing them goes bankrupt.

Here’s a comparison between historical gold certificates and contemporary gold investment options:

While in circulation, traditional gold certificates represented a convenient way to own gold without having the hassle of physical possession. They could be traded with others and redeemed for physical gold. Their restrictions were perhaps their limited flexibility to use in everyday transactions, and increasingly the lack of faith that the correct amount of bullion actually existed. As such, this historical form of paper gold began to lose its prominence as doubt crept in.

Nowadays of course, original gold certificates are simply collectible items, valuable mainly to enthusiasts and historians, rather than as an investment vehicle. This reflects their lack of long-term stores of wealth, especially when so many holders were forced to relinquish them at a poor rate of exchange in 1934.

Gold Bullion

Investors can buy gold bars or coins, which provide direct ownership of physical gold. Bullion comes with certifications of purity, weight, and serial number, ensuring authenticity.

Gold ETFs (Exchange-Traded Funds)

These funds allow investors to gain exposure to gold prices without holding physical gold. They are traded on stock exchanges and backed by gold reserves.

Gold Futures and Options

These financial instruments allow investors to speculate on future gold prices. They provide leverage but come with higher risk.

Gold Mining Stocks

Investing in companies that mine gold offers exposure to gold prices, along with the potential for dividends and capital appreciation. This represents a relatively higher risk versus reward profile than direct gold ownership, as performance is closely linked to that of a single company.

A gold certificate is a document issued by a government or financial institution that represents ownership of a specific amount of gold held in reserve. It allows the holder to redeem the certificate for physical gold or its equivalent value in cash, offering a secure and convenient way to own and trade gold without physically handling it.

Gold certificates offer secure ownership of gold without the need to store physical metal. They are easy to handle, trade, and transport, providing liquidity and convenience. Additionally, gold certificates allow investors to own gold with reduced risks of theft or loss, while still benefiting from the value of the gold backing them.

Gold certificates can no longer be redeemed for gold but can be collected as historical items. While they are no longer used in transactions, they may still be exchanged at face value for U.S. currency. Collectors value them for their historical significance and rarity.

Images: Wikicommons, Picryl, Garystockbridge617, Picryl

Live Gold Spot Price in Sterling. Gold is one of the densest of all metals. It is a good conductor of heat and electricity. It is also soft and the most malleable and ductile of the elements; an ounce (31.1 grams; gold is weighed in troy ounces) can be beaten out to 187 square feet (about 17 square metres) in extremely thin sheets called gold leaf.

Live Silver Spot Price in Sterling. Silver (Ag), chemical element, a white lustrous metal valued for its decorative beauty and electrical conductivity. Silver is located in Group 11 (Ib) and Period 5 of the periodic table, between copper (Period 4) and gold (Period 6), and its physical and chemical properties are intermediate between those two metals.