What is Investment Grade Gold?

06/12/2023Daniel Fisher

Free & fully insured UK Delivery. Learn more

Secure & flexible payments. Learn more

Buyback Guarantee Learn more

Before embarking on your gold investment journey, it’s important to understand that not all gold is the same.

In fact gold can vary dramatically by its form, its colour and its purity. Choosing the best type of gold for investing will be more cost effective, have tax advantages and be easy to sell.

Luckily, this category of gold is universally known as investment grade gold and sticking to it will ensure you’re on the right path.

Investment grade gold refers to physical gold products meeting minimum purity and weight standards established for common trading. The two explicit criteria are based on the form of gold and its purity level. To qualify, the product has to be either in the form of a gold bar or coin, while its purity must meet the minimum levels of 99.5% for bars and 90% for coins.

This includes popular bullion coins, bars, and rounds manufactured to qualify for investment portfolios under guidance from entities like LBMA and COMEX. Items classified as investment grade will not only satisfy minimum carat content but also typically adhere to specifically outlined weight standards.

This elevates marketability and liquidity since larger dealers, refineries and commodity exchanges recognize such pieces based on consistent specifications. Meeting established norms also provides assurances against counterfeits. While collectibles derive premiums from subjective appeal, uniform investment grade gold suits diversified portfolios where integrity, cost effectiveness and liquidity are desired.

The HM Revenue & Customs defines investment grade gold to be in the form of a bar, wafer or coin with a minimum purity of 995 thousandths for bars and 900/1000 for coins (minted after 1800). In short, Investment Grade Gold has to be either 22-karat gold coins and 24-karat gold bars.

Sales of investment grade gold in the UK have been exempt from VAT since 1st January 2000 to be consistent with tax treatment within the EU.

The terms gold bullion and investment-grade gold are commonly used interchangeably and assumed to be the same thing. Gold bullion refers to high purity gold solely produced for investment purposes and a store of value. Gold bullion is internationally classified as either gold bars of at least 99.5% purity or gold coins of at least 90% purity, who’s value is closely based on its weight only.

The main difference is that ‘gold bullion’ can become ambiguous in some circumstances, while the term ‘investment grade gold’ is more explicit as it has tax-free implications.

When focussing on gold bars, the two terms really have identical meaning. Bars, ingots and wafers will always contain at least the minimum required carat level and never trade at prices based on collectability or history. In reality, while tiny gold ingots weighing a gram or so are still classified as bullion, their relatively high production cost commands a vastly inflated price over its gold weight value.

Ambiguity and confusion can develop when considering gold coins. The term bullion is meant to refer to mass-produced gold coins minted by major global mints, aimed at the investment market. These guidelines line up when pondering well-known coins such as Krugerrands, Britannias, Maple Leafs and American Eagles.

But these same mints also produce coins which attract collectors due to a particular design, limited production run or commemoration. Their initial price may well meet the bullion criteria of being close to its intrinsic value. But in time the coins can trade at highly inflated and rising premiums in the subsequent secondary market, leading to purists arguing against their bullion tag. In contrast, any 22-carat or higher coin is classed as investment-grade regardless of its premium.

A prime example is the Royal Mint’s Queen’s Beasts series with some coins trading 50% higher than other 1oz gold coins. Similarly, while gold Sovereigns are undoubtedly referred to as bullion coins when first minted, many will argue that the history, scarcity and high value of older versions such as Victorian coins, are not.

Free ultimate guide for keen gold investors

The investment grade standard has created a number of advantages for investors and mints alike. Conformity to published standards raises marketability, buyer trustworthiness, value, and secondary market liquidity that personal collectibles lack.

Here are some of the key benefits of investment grade gold.

The globalised standardization of gold products aids tradability and buy/sell spreads compared to less common pieces. Reliable weights and purities enable certainty which in turn creates more cost-effective trading. Its easy to source investment grade bullion in a wide range of weights whenever buyers desire. Likewise, the consistent nature of the products enables swift selling when required, with a much deeper and dependable secondary market than collectibles.

Meeting a minimum fineness purity level provides integrity assurances and protects against counterfeit risks. I like to analogize with the process of buying a bottle of wine from the supermarket. You can choose a familiar brand and the alcohol content is clearly stated. Compare that to buying alcohol in the prohibition era; you never knew what you were drinking! This is particularly important with a high-value investment where mistakes can be costly.

Major vaults and accounts typically only allow investment grade bullion meeting certain standards. Storing a small number of valuable gold ornaments, expensive jewellery or collectible gold coins at home may be the acceptable norm. But investors of larger quantities of gold bars or coins will benefit from the security and peace of mind that professional vaulting offers.

Central banks with significant gold reserves also exclusively use investment grade gold bullion. Leading storage vaults offer a system of ‘Good delivery bars’ whereby institutions can buy and sell without the need or cost to physically move the bullion.

Any gold classified as investment grade is VAT-exempt to purchase within the UK and European Union. Saving 20% in the UK and EU is a great incentive, especially when engaging in an investment. VAT is still added to any gold purchase that doesn’t qualify as investment grade, applying to assets such as jewellery and lower grade coins. No such exemption currently exists for silver bullion, whether investment grade or otherwise.

For active and experienced commodity traders, uniform specifications allow exploiting tiny pricing differences between exchange-approved products. Their homogenous nature makes comparisons and opportunities possible to eagle-eyed traders. They operate on the opposite end of the scale to dealers of gold collectibles who try to spot value amongst incredibly varied products.

Established investment grade products facilitate allocating gold across pensions, funds, and ETFs as alternative assets. The tight regulation of such financial instruments requires certainty that assets are consistent and meet minimum quality levels. The standardized nature of investment grade gold ideally lends itself to this role. In the UK, pension investors seeking to add tangible products to their Self Invested Personal Pension (SIPP) are permitted to purchase gold bullion bars of at least 995 parts gold.

Keeping tabs on the value of your investment is far simpler due to the guaranteed authenticity, standard weights and purities. This can help when accurate valuation is needed for insurance purposes or financial planning. Less generic gold items are far more difficult to evaluate and quickly realise a sale at an optimum price. Jewellery’s value is very subjective and can go out of fashion, vastly impacting its value while holding the asset.

We know our customers want the most suitable gold products for an effective investment. For that reason, we simply don’t sell any gold below investment grade. You can rest assured that all items for sale on our website qualify for the sought-after standard.

We can provide guidance to select which gold bars or coins would meet your objectives optimally. You can purchase investment grade gold from PhysicalGold.com in three different ways;

If you’re unsure which is best for you, we can discuss the merits of each. Our friendly and knowledgeable team can be reached on 020 7060 9992.

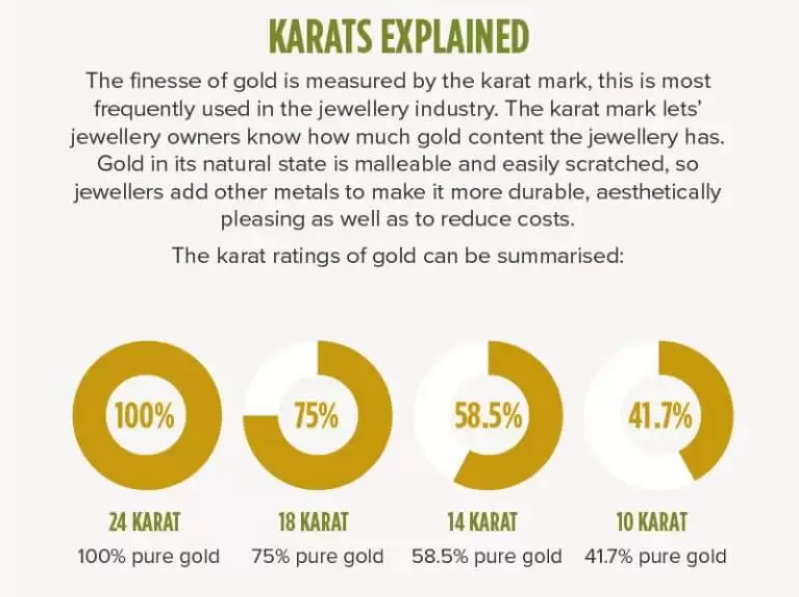

Jewellery is not classed as investment grade, primarily as it fails to meet the criteria of being in the form of a coin or bar. Most jewellery also fails the other pre-requisite of being at least 22-carat in purity, as a majority of is made from either 18-carat or 9-carat gold.

Investment grade gold coins are those specifically minted from gold of at least 90% purity and can be in any condition. This is different from graded coins which have been independently evaluated for their level of appearance and wear.

Live Gold Spot Price in Sterling. Gold is one of the densest of all metals. It is a good conductor of heat and electricity. It is also soft and the most malleable and ductile of the elements; an ounce (31.1 grams; gold is weighed in troy ounces) can be beaten out to 187 square feet (about 17 square metres) in extremely thin sheets called gold leaf.

Live Silver Spot Price in Sterling. Silver (Ag), chemical element, a white lustrous metal valued for its decorative beauty and electrical conductivity. Silver is located in Group 11 (Ib) and Period 5 of the periodic table, between copper (Period 4) and gold (Period 6), and its physical and chemical properties are intermediate between those two metals.