Which is the Better Investment, Gold or Platinum?

23/10/2023Daniel Fisher

Free & fully insured UK Delivery. Learn more

Secure & flexible payments. Learn more

Buyback Guarantee Learn more

Platinum is over 30 times rarer than gold in the earth’s crust and offers unique properties, yet it currently sells for around $600 less per ounce. Given platinum’s prestige as a precious metal and its lower price point, some UK investors consider it an intriguing investment opportunity compared to gold.

However, gold still enjoys greater liquidity, popularity and regulated markets globally. Whether platinum or gold is the better investment depends on comparing factors like current pricing, historical performance, market supply and demand, risks and benefits.

Silver is far cheaper than gold and offers precious metal investors an easy entry into the market. However, in recent years, the popularity of platinum has risen. Several jewellery brands manufacture platinum pendants and rings. Many people love the mirror-like finish of platinum and its colour. So, does it make sense to invest in Platinum?

This guide provides an in-depth look at platinum vs. gold for UK investors. It compares the two precious metals across a variety of metrics to help British investors make the most informed decisions for their individual portfolios and investment goals.

Platinum is a white metal that can be found naturally on our planet. It is rarer than gold, and its value and demand have appreciated over the years. Platinum has certain characteristics that are different from gold. The white metal is heavier and harder than gold. Since it is less malleable than gold, it can be used in a pure form when manufacturing bars, coins, or jewellery. Today, platinum is around half the price of gold.

Gold does not have this property. When gold objects are handled roughly, they get damaged and scratched. Due to their hardness, platinum objects are virtually scratch-resistant but may develop small bumps and ridges. This ridging of platinum is natural, and many people believe that it lends an antique look to platinum products.

Gold is a precious yellow metal that humans have valued for thousands of years. Its dense, durable, conductive, and not reactive properties make it useful across a wide range of applications.

While gold can be found in some rivers and mines, the cost of extracting it is generally high. Gold’s rarity and beauty make it valuable, with a long history of being made into coins, jewellery and other artefacts. Many cultures and investors have placed great worth in gold due to its longevity and universal appeal.

Gold is also an effective store of value not tied to any government, acting as a hedge against inflation and currency devaluation. Central banks hold gold reserves to diversify holdings away from currencies and stabilise balance sheets.

In investment portfolios, gold provides an alternative to stocks, bonds and real estate that can balance risk during times of economic turbulence. Gold bars, bullion coins and exchange-traded funds allow individual investors to conveniently add exposure to gold prices.

Gold’s unique properties, limited supply, diverse applications and perception as a lasting asset class make it a popular investment commodity worldwide. Understanding gold’s background helps contextualise its enduring value.

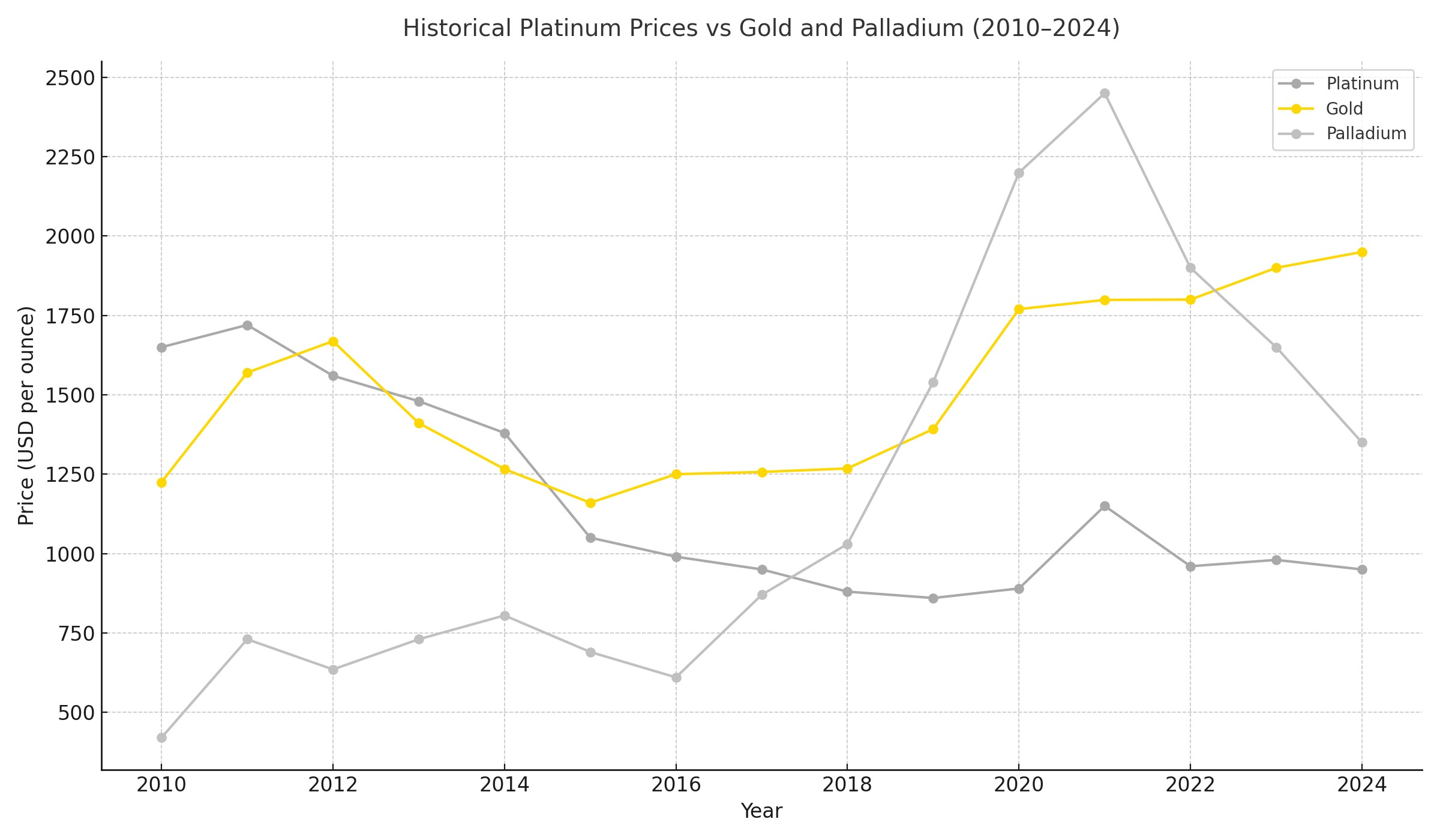

Gold has historically maintained higher prices and market value when directly comparing gold and platinum as investment assets. However, platinum has sometimes traded at a premium to gold during periods of constrained supply.

While both metals demonstrate long-term appreciation, platinum tends to be more volatile and sensitive to economic cycles and industrial demand. Gold benefits from greater liquidity, stability and established regulated markets.

The choice of gold coins and bars far outweighs the very limited variety of platinum investment products on the market.

Evaluating their relative historical performance, current pricing dynamics and market factors allows investors to determine which may better fit their portfolio strategies and risk tolerance.

Gold prices have historically traded higher than platinum in nominal terms, with gold having a much larger market capitalisation globally. However, platinum has exceeded gold’s value at times during supply shortages.

While both metals have shown long-term appreciation above inflation, platinum tends to be more volatile, with prices fluctuating in a wider annual range.

Platinum is also more sensitive to economic cycles, while gold sees greater demand as a safe haven asset during recessions. Ultimately, gold benefits from higher liquidity and more established, regulated markets for trading.

Looking back over the past century, platinum historically traded at a premium to gold for most years until 2015. Platinum reached a high of over 2X the price of gold in 2008 when supply shortages drove up values.

In other periods of economic instability, like the 1970s oil crisis, platinum and gold prices rose together as safe-haven assets.

But platinum declined more severely than gold during recessions when industrial activity slowed. Gold has generally retained its value more consistently through changing economic cycles.

The price differential between platinum and gold has widened considerably in recent years. As of the Q4 of 2023, platinum trades at around £734.35 per ounce, while gold sells for approximately £1,532.28.

This represents one of the largest discounts for platinum relative to gold in decades. Some analysts speculate platinum is undervalued presently based on its historical price ratio to gold. However, economic uncertainty has buoyed gold prices while platinum has struggled with reduced industrial demand.

To make sure that you’re making the right investment decision, remember to keep an eye on the price of platinum and gold and any forecasts that could have an impact on your choice. Comparing current pricing provides insight into their potential value.

A key benefit of platinum is that it trades at a lower nominal price per ounce than gold, making it potentially more affordable for retail investors. Platinum also has some industrial uses, like catalytic converters, that may drive demand.

However, platinum comes with higher price volatility risk, as its value is more dependent on economic cycles. Platinum is also not as widely traded or regulated, leading to higher bid-ask spreads and accessibility challenges for investors.

Gold is seen as a stable, safe haven asset that retains its value well through stock market volatility and economic downturns. Gold has stood the test of time over centuries and enjoys strong cultural allure globally.

However, some caution gold may be overvalued presently after its bull run over the last decade. Gold does not provide dividend yields, so its value stems entirely from price appreciation.

Use our automated portfolio builder to get suggestions based on various investment objectives.

Both platinum and gold can serve as effective portfolio diversifiers for UK investors when allocated appropriately based on individual risk profiles and goals.

Many experts recommend keeping gold exposure between 5-10% of total assets. Adding physical gold coins or physical bullion provides tangibility, while gold funds offer more liquidity. Gold’s role is primarily long-term capital preservation and stability.

Platinum warrants a smaller portfolio allocation, around 1-5%, due to its higher volatility. Platinum bullion coins and bars can provide concentrated exposure. Platinum mining stocks may also give investors calibrated leverage to platinum prices. The white metal acts more as a return enhancer than an anchor.

Balancing both metals allows for benefiting from platinum’s growth upside while still maintaining gold’s stabilising influence during market downturns. Properly diversifying into both hard assets ensures participation in their respective demand drivers.

Physical Gold is one of the most reputed precious metal dealers in the UK. We can advise you on which precious metal to invest in, and offer a wide range of investment gold opportunities on our site. Get in touch with us at (020) 7060 9992 or contact us online.

When weighing platinum and gold for investment purposes, several key questions often arise. This FAQ guide provides concise answers to some of the most common inquiries.

No definitive answer states one metal is always “better” than the other for all investors. Gold offers stability and history, while platinum provides higher potential growth. The better investment depends on an investor’s specific goals and risk tolerance. Holding both metals provides optimal diversification.

Historically, platinum has traded at higher prices than gold for most of the last century until 2015. Platinum also has an intrinsic value advantage from its rarity and multitude of industrial applications. However, platinum’s smaller market makes gold more consistently valued and liquid.

Gold holds a special universal allure built over thousands of years that platinum cannot match. Central banks and retail investors alike gravitate toward gold’s historical significance and reputation as a lasting store of value. Platinum also has higher price volatility that deters some conservative investors despite its upside potential.

Live Gold Spot Price in Sterling. Gold is one of the densest of all metals. It is a good conductor of heat and electricity. It is also soft and the most malleable and ductile of the elements; an ounce (31.1 grams; gold is weighed in troy ounces) can be beaten out to 187 square feet (about 17 square metres) in extremely thin sheets called gold leaf.

Live Silver Spot Price in Sterling. Silver (Ag), chemical element, a white lustrous metal valued for its decorative beauty and electrical conductivity. Silver is located in Group 11 (Ib) and Period 5 of the periodic table, between copper (Period 4) and gold (Period 6), and its physical and chemical properties are intermediate between those two metals.